TIDMPMO

RNS Number : 9343F

Premier Oil PLC

26 February 2015

Press Release

Annual Results for the year ended 31 December 2014

Tony Durrant, Chief Executive, commented:

"Despite the challenging macroeconomic circumstances, the group

delivered record production and operating cashflow in 2014. In

2015, we will continue to optimise our stable production base, push

forward with approved developments and anticipate adding to our

substantial resource base with targeted exploration. This can be

achieved while re-setting the cost base to a new low oil price

environment. These actions will position Premier as a well-financed

low cost producer with significant undeveloped resources and

acquisition capacity, highly leveraged to a future recovery in oil

prices."

2014 highlights

-- Strong operating cash flow of US$924.3 million (2013:

US$802.5 million), up 15 per cent

-- Revenue of US$1.6 billion (2013: US$1.5 billion); loss after

tax of US$210.3 million (2013: profit after tax of US$234.0

million), reflecting non-cash post-tax impairments of US$327.8

million due to lower near term oil price assumptions

-- Record production of 63.6 kboepd (2013: 58.2 kboepd), up 9.3

per cent and above upper end of market guidance

-- Key milestones reached on development projects: government

approval of the Catcher project received, installation of the Solan

facilities achieved, FEED completed on the Vette field and a lower

capex solution for the Sea Lion project selected

-- Exploration successes included a 100 mmboe oil and

liquids-rich gas discovery at Kuda/Singa Laut in Indonesia

-- Continued portfolio rationalisation with approximately US$190

million of non-core asset sales announced of which Scott area and

Luno II disposals completed during the year

-- Dividend suspended for full year 2014

Financial position and outlook

-- Significant liquidity with cash and undrawn facilities of US$1.9 billion

-- Sustainable operating cost of less than US$20/boe

-- Favourable, low cost debt structure; renewal of main bank

facility completed on improved terms and increased to US$2.5

billion

-- Significant cost reductions budgeted for 2015 via sustainable

savings in operating costs, reduced G&A spend, and re-phasing

of capex

Mike Welton, Chairman Tony Durrant, Chief Executive

26 February 2015

ENQUIRIES

Premier Oil plc Tel: 020 7730 1111

Tony Durrant

Richard Rose

Bell Pottinger Tel: 020 3772 2500

Gavin Davis

Henry Lerwill

A presentation to analysts and investors will be held at 9.00am

today at the offices of Premier Oil's Falkland Islands Business

Unit, 157-197 Buckingham Palace Road, London SW1W 9SP. A live

webcast of this presentation will be available via Premier's

website at www.premier-oil.com.

Disclaimer

This results announcement contains certain forward-looking

statements that are subject to the usual risk factors and

uncertainties associated with the oil and gas exploration and

production business. Whilst the group believes the expectations

reflected herein to be reasonable in light of the information

available to it at this time, the actual outcome may be materially

different owing to factors beyond the group's control or otherwise

within the group's control but where, for example, the group

decides on a change of plan or strategy. Accordingly, no reliance

may be placed on the figures contained in such forward-looking

statements.

CHAIRMAN'S STATEMENT

The industry context

From a macro perspective, 2014 was a year of two halves: oil

prices remained steady above US$100 per barrel (bbl) in the first

half, as they have done broadly for the last four years, before

falling significantly, to close the year at less than US$60/bbl.

The fall was driven by strong global supply, particularly the

growth in unconventional resources in North America.

One direct consequence of lower oil prices is a fall in the cost

of services to the industry and this is already evident across the

supply chain. The fall in prices should also lead to a supply

correction as more marginal projects are cancelled and free cash

flow for near-term investment across the industry is reduced.

However, it will take time for oil prices to reach a mid-cycle

equilibrium and, as a company, we must and we are taking steps to

ensure we are well positioned to withstand a prolonged period of

weak commodity prices.

The sector has seen these price cycles before and few believe

that the oil price will not eventually recover from current levels.

This view is supported by the forward curve which shows rising oil

prices. We are highly leveraged to such a recovery with a low cost,

stable production base and an improving portfolio mix. Beyond this

year, we have little committed expenditure. Our unsanctioned

projects, however, offer future growth at a lower cost base.

Premier's performance

Premier delivered a strong operational performance in 2014. We

achieved a record annual average production rate of 63.6 thousand

barrels of oil equivalent per day (kboepd), exceeding our

expectations due to significantly improved uptime across the

majority of our assets. This performance was delivered despite the

continuing supply disruptions at Huntington (due to circumstances

outside the joint venture's control) and is testament to the hard

work and successful efforts of our operated production teams.

We continue to progress our pipeline of development projects and

were delighted to achieve new production from two operated fields

in Asia over the course of the year. In the UK North Sea,

installation of the facilities at our Solan development West of

Shetland was completed in September and while it is disappointing

that commissioning has progressed slowly during the winter and

costs have increased on the project, the Solan field will be a

material contributor to Premier's cash flows once on-stream.

Significant progress was also made on our other operated North

Sea projects, namely Catcher which received development sanction

and Vette in Norway where front-end engineering and design (FEED)

work was completed, while the scope and size of the initial phase

of the Sea Lion development in the Falkland Islands has been

scaled-back. This project is now much more manageable for a company

of Premier's size in the current environment and the focus in 2015

will be on progressing the project to the point of investment

decision.

Our exploration team continued to bring new, material projects

into the portfolio with notable success at Kuda/Singa Laut on the

Tuna Block in the Natuna Sea, Indonesia. This oil and liquids-rich

gas discovery is strategically located in a core area for Premier

and appraisal activity is planned for 2016.

A key tenet of our strategy is to realise value from our

non-core assets and to reallocate our financial and human resources

to our key projects. This continued in 2014 with the announced sale

of undeveloped resources in Indonesia and Norway and the disposal

of our non-operated stake in the Scott area in the UK North Sea. In

total, these asset sales will raise around US$190 million in

disposal proceeds.

During the year, we enhanced the group's financial liquidity

position with the successful refinancing of our principal debt

facility on improved terms. Our long-term, unsecured debt structure

and supportive banking relationships leave us well placed, although

we will need to continue to manage our covenant headroom if current

oil prices persist.

Health, safety and environmental matters continue to be of

paramount importance to us and, while cost cutting is clearly a

focus in the current climate, we will not compromise on the

integrity and safety of our operations. Our safety performance in

2014 saw a substantial reduction in our TRIR (Total Recordable

Injury Rate) which reached a five year low of 1.48 per million man

hours. Our production operations management systems at Balmoral in

the UK, and at Anoa and Gajah Baru in Indonesia, retained their

OHSAS 18001 and ISO 14001 certifications, as did our worldwide

Drilling Management Systems. We are particularly proud of our track

record on our operated Anoa platform in Indonesia which, by

year-end 2014, had reached 1.6 million man hours without a lost

time injury.

Despite our much improved occupational health and safety

performance in 2014, I regret to report two fatalities in South

East Asia: one contractor fatality as a result of an offshore

vessel collision and a third party fatality as a result of a road

traffic accident. No blame was attached to Premier in either case

but we have taken steps to reduce the risk of these incidents

recurring. We are all saddened by the tragic outcomes for the

families involved.

Our annual reporting on corporate responsibility performance is

aligned with IPIECA Guidance and the Global Reporting Initiative's

Sustainability Reporting. We are also a long-standing member of the

FTSE4Good Index and the UN Global Compact and in 2014 were accepted

as a member of the Corporate Pillar of the Voluntary Principles on

Security and Human Rights. We remain committed to protecting our

people, our assets, our environment and our reputation by

maintaining the highest possible standards.

Future plans

In 2015 a key priority is to progress our sanctioned projects -

Solan and Catcher - through the execution phases and to deliver

safely the major four well exploration campaign on our Falkland

Islands acreage. Financially, we will minimise our cost base and

tailor our capital allocation to ensure that we are well positioned

through the current commodity price cycle.

Our substantial 2015 hedging programme has ensured that our

near-term cash flows are well protected and our debt position of

US$2.1 billion at year-end is manageable at this point in our

investment cycle. We are also taking further steps to dispose of,

or monetise, assets to reduce our debt position. We have

significant liquidity if the weak macro environment offers new

opportunities, as it has done in the past, although management

remain focused on ensuring that debt levels are kept under

control.

Board changes

I was pleased to announce that Tony Durrant, our former Finance

Director, accepted the role of Chief Executive during the year

replacing Simon Lockett. During Tony's tenure as Finance Director,

the company has maintained excellent relationships with our capital

providers and the Board believes he has all the right qualities to

take the company forward in the next stage of its evolution. We

also welcomed Richard Rose onto the Board as the new Finance

Director, bringing with him a broad range of experience from

accounting, industry and capital markets. I would like to pay

tribute to Simon Lockett who guided the company through a

substantial growth period and who ensured a smooth transition to

the new management team.

Andrew Lodge, our Exploration Director, has indicated that he

will retire effective 30 June this year and will therefore not seek

re-election as a board director at our forthcoming AGM. A new head

of exploration will be appointed in due course. Stephen Huddle, who

has been General Counsel and Company Secretary for 14 years, will

also retire on 31 May. Rachel Benjamin, currently Deputy Company

Secretary, will become Company Secretary on Stephen's

retirement.

We wish all our leavers well in their future endeavours. These

changes, together with other senior management changes, refresh the

leadership of the company and, in addition, will contribute to a

reduced cost base as we adapt to a new oil price environment.

Shareholder returns and share price performance

As we have stated in the past, our goal remains to deliver

consistent, measurable capital growth to our shareholders. Implied

within this strategy is a commitment to return cash to our

shareholders via distributions, after balancing the capital needs

of the business, when the performance of the company has not been

materially reflected in the share price.

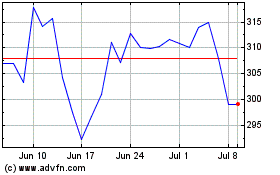

Over the course of 2014, our share price fell by 47 per cent,

although this was not out of line with the rest of the sector which

also suffered with the fall in commodity prices. During the year,

we paid a dividend of 5 pence per share and returned a further

US$93 million of capital to shareholders through a share buyback

programme. This was in acknowledgment of the significant gap

between our share price and underlying net asset value. It also

reflected surplus cash flow generated by our production base in the

first half of the year, above the level expected using our

long-term oil price planning assumption.

As we enter 2015 with a significantly lower oil price than in

recent years, the Board believes it is not prudent to propose a

dividend payment for the full year or, as previously announced, to

continue with the share buyback programme. Our focus in the

near-term is on preserving cash, maintaining access to liquidity

and reducing gearing levels while continuing to invest in our

sanctioned development projects. We would expect to revisit our

decisions around shareholder distributions should the oil price

recover above our long term planning assumption.

On behalf of the Board as well as myself, I would like once

again to express my appreciation for the hard work and effort put

into the business by Premier's staff. Their continued dedication

and enthusiasm in what are trying times for the industry should see

us well placed amongst our peers to prosper in the future.

Mike Welton

Chairman

CHIEF EXECUTIVE'S REVIEW

We are all only too aware of the sharp fall in the oil price

that occurred in the second half of 2014 after several years of oil

price stability at historically high levels. While it is not clear

at this stage when the oil price will find a floor, or how long it

may take to recover, it offers the industry the chance to re-set

its cost base and will present new opportunities for the

better-funded companies in the sector.

For our part, we have been quick to respond to the falling oil

price and, by the end of 2014, we had already taken steps to reduce

significantly the costs of running our business without

compromising the safety or performance of our operations. We will

continue to look to cut or defer our expenditure to ensure that we

are able to manage the business successfully through a potentially

prolonged period of low oil prices.

Despite the backdrop of falling oil prices in the second half of

the year, Premier remained focused on operational delivery and

achieving the near-term priorities that we set ourselves. In this

respect, 2014 was a strong year for us.

Beating our production guidance

2014 saw Premier deliver record production of 63.6 kboepd, above

the upper end of market guidance, assisted by improved operating

efficiency across the majority of the group's assets.

Production (kboepd) Working interest Entitlement

---------------------

2014 2013 2014 2013

--------------------- --------- -------- ------ ------

Indonesia 14.4 13.7 10.3 8.8

Pakistan* 12.9 15.5 12.9 15.3

UK 19.4 14.9 19.4 14.9

Vietnam 16.9 14.1 15.2 13.4

Total 63.6 58.2 57.8 52.4

--------------------- --------- -------- ------ ------

*Includes Mauritania

Significantly higher production in the UK was driven by improved

uptime from our operated B Block assets, flush production from the

redevelopment of the Kyle field and increased contributions from

the Huntington and Rochelle fields. Frustratingly, Huntington

continued to disappoint in 2014 as it suffered from poor uptime,

primarily due to restrictions on gas export from the field imposed

by the CATS pipeline operator BP.

In Asia, our operated Chim Sáo asset in Vietnam performed well,

benefitting from a series of projects we had undertaken aimed at

maximising operating efficiency. As a result, record production

rates were achieved. Singapore demand for our Indonesian gas

remained strong and our operated Natuna Sea Block A again captured

a market share well in excess of its contractual share.

Deliverability from the block was increased with first gas from

Naga in November, while Pelikan is planned to be on-stream in the

first quarter of 2015. As well as backfilling our gas contracts

into Singapore which generate long-term, stable cash flows for the

group, the additional deliverability will enable us to exploit any

contractual supply shortfall or short-term strengthening of

Singapore demand for our gas.

As at 31 December 2014 proven and probable (2P) reserves, on a

working interest basis, were 243 million barrels of oil equivalent

(mmboe) (2013: 259 mmboe) with the impact of production and

disposals on our reserve base partially offset by the booking of

the Vette field as 2P reserves. This, together with the discovery

at Kuda/Singa Laut in Indonesia, means that we have ended the year

with 2P reserves and 2C contingent resources of 794 mmboe, in line

with the previous year.

Proven and probable 2P reserves and

2P reserves 2C contingent resources

(mmboe) (mmboe)

-------------------------- -------------------- -------------------------

1 January 2014 259 794

Production (23) (23)

Net additions, revisions 22 50

Disposals (15) (27)

31 December 2014 243 794

-------------------------- -------------------- -------------------------

Progressing our developments - deliver Solan, sanction Catcher

and right-size Sea Lion

Installation of the facilities on the Premier-operated Solan

field West of Shetlands at the end of the summer was a significant

milestone on the project, only two and a half years after receiving

government approval. However, the subsequent commissioning

programme has taken longer than anticipated due to poor weather

conditions and low productivity over the winter period. As a

result, costs have increased and first oil is now expected to be

later than the previous guidance of the second quarter although we

continue to target plateau rates of production from the field of

20-25 thousand barrels of oil per day (kbopd) (gross) by

year-end.

Our operated Catcher project received government approval in

June and is now into the execution phase. Construction of the FPSO

hull started in January 2015 and the project continues to progress

on schedule and to budget. Once on-stream, both the Solan and

Catcher projects will contribute materially to our cash flows,

given our tax advantaged position in the UK.

Turning to our operated pre-sanction projects, FEED work on the

Vette FPSO development in Norway was successfully completed during

2014 and we were in a position to submit development approval

documentation to the government early in 2015. However, following

the sharp reduction in the oil price, we have chosen to defer the

final investment decision until the end of 2015, enabling us to

re-engage with the supply chain with the aim of negotiating lower

costs for the project. Given the falling oil price and our desire

to maintain a strong funding position, we decided to opt for a

lower capex solution for our Sea Lion development, which will now

utilise a leased FPSO. We plan to progress the project to sanction

over the course of 2015 which we anticipate will allow us to secure

further cost reductions. It remains our intention to seek a partner

ahead of final investment decision.

Exploration discoveries

In 2014, Premier delivered a notable exploration success, with

the 100 mmboe oil and liquids- rich gas discovery at Kuda/Singa

Laut on the Tuna Block in Indonesia. While we have deferred

appraisal of this discovery to 2016, this project will likely play

an important role in the long-term future of Premier's Indonesian

business. We also enjoyed exploration success in Pakistan with the

K-36 exploration well which discovered gas in a separate step-out

compartment. The well was successfully tied in to production in

April 2014. During the year, unsuccessful wells were drilled on

other acreage offshore Mauritania, Indonesia and onshore Pakistan

and, subsequent to year-end, onshore Kenya.

A successful disposal programme

During 2014, we announced approximately US$190 million of

non-core asset sales which have all subsequently completed. Of

particular note was the sale of the high cost Scott area for US$130

million which, as well as reducing the group's operating costs, has

significantly decreased our future abandonment liabilities.

Further disposals are planned. Notably, our partner in the Solan

field is in discussions with banks about refinancing a portion of

our loan to them, while discussions with third parties over selling

a royalty interest over the Solan field's cash flows are on-going.

In addition, we have received a number of enquiries about our Sea

Lion development since rescaling the project in November and active

discussions with potential partners continue.

Financial performance and liquidity

The Group is reporting a loss after tax of US$ 210.3 million in

2014 (2013: US$234.0 million profit after tax) largely as a result

of impairment charges of US$327.8 million (post-tax) on the

carrying value of several of our oil and gas assets. These were due

to the impact of the lower near-term oil price assumptions used in

balance sheet tests at the year-end and should not detract from the

record operating cash flows generated during 2014 of US$924.3

million (2013: US$802.5 million).

The collapse in the oil price has served to highlight the

importance of maintaining a strong funding position and a

conservative financing approach. To protect our investment

programme in 2015 we have hedged approximately 50 per cent of our

liquids entitlement production at an average price of just under

US$98/bbl. In July, our finance team did an excellent job of taking

advantage of a relatively strong bank market to refinance and

increase our principal bank facility on improved terms with

extended maturities. As a result, we do not have any significant

debt maturities until late 2017. It is also reassuring that all of

our facilities are on a corporate unsecured basis and are not

subject to any reserve base redeterminations. Consequently, we have

ample liquidity with US$1.9 billion of cash and undrawn facilities

as at year-end, although we recognise the need to manage our

covenant headroom in the near-term.

2015 is anticipated to be a significantly lower capex year. This

coupled with our hedging programme, planned cost reductions and

further potential disposals means that we are well placed to meet

the challenges presented by the current oil price environment.

Tony Durrant

Chief Executive

BUSINESS UNIT REVIEWS

THE FALKLAND ISLANDS

In November, Premier opted to progress a smaller, scaled-back

Sea Lion development scheme in order to reduce the capex required

prior to first cash flows from the field. The initial phase of

development aims to recover 160 million barrels (mmbbls) of oil

from the north east part of the field for less than US$2 billion of

pre-first oil capex.

Final preparations for the four well exploration campaign are

under way with the first well, Zebedee, expected to spud in early

March. The outcome of this campaign, which has the potential to

more than double the discovered resource in the North Falklands

Basin, will determine the shape of subsequent development phases in

the area.

Development

Good progress was made in planning the Sea Lion development

scheme utilising a Tension Leg Platform (TLP) during 2014. However,

the oil price environment and Premier's commitment to maintaining a

strong financial position caused the Group to re-examine the scheme

with a view to reducing capex. As a result, in November, Premier

opted to progress a smaller initial development of just the north

east part of the Sea Lion field with a single subsea drill centre,

utilising a leased FPSO.

It is anticipated that this smaller scheme will recover around

160 mmbbls of oil over 15 years from 14 wells. Total capital

expenditure prior to first oil was expected to be less than US$2

billion in November when first estimated. Premier plans to take

advantage of weaker market conditions in the second half of the

year to capture lower costs for the project.

Work has commenced on assessing the FPSO design options for the

first phase of the development. The existing TLP topsides design

and equipment lists are being modified for use with a smaller

capacity FPSO and the conclusions of various metocean studies are

being fed into the FPSO design process. A project sanction for the

first phase of development is targeted for the first half of 2016,

although the exact timing of this will ultimately depend upon the

contracting strategy employed for the FPSO. Sanction of the project

will depend on the cost reductions that are achieved and the oil

price outlook at that time.

Rockhopper will fund their share of the pre-sanction costs and a

letter of agreement has been concluded such that the remaining

development carry will be split equally between the initial

development and the next phase (US$337 million to each). A

guarantee fee mechanism which applies to capex guarantees given by

Premier in respect of the development has been extended to include

the FPSO lease.

While it is likely that Premier would be able to fund a project

of this size from existing facilities and cash flows, the company

will continue to seek a partner for the Sea Lion development. Plans

for subsequent phases of development, which could involve either

further FPSOs or a TLP, will target a further 235 mmbbls of

existing discovered resources plus any new discoveries arising from

the 2015 exploration programme.

Exploration

Preparations for the multi-operator exploration drilling

campaign, due to commence in the first quarter of 2015 are well

under way. In June a rig contract and a rig sharing agreement were

signed and all major service contracts have now been awarded. A

temporary dock facility located in Stanley Harbour has been built

and has received the first two coasters of supplies for the

upcoming programme. The rig departed West Africa at the end of

January and is expected to arrive in the Falkland Islands by the

end of February.

The exploration drilling programme will consist of at least four

wells targeting multiple stacked fans in Licences PL004 and PL032.

The sequence of the wells is expected to be Zebedee, Isobel Deep,

Jayne East and Chatham/West Sea Lion. The rig will drill for

another operator between the Isobel Deep and Jayne East wells.

INDONESIA

2014 saw strong production and cash flows from Premier's

operated Natuna Sea Block A, which increased its market share of

the GSA1 contract and achieved record production rates.

Deliverability from Natuna Sea Block A was further enhanced with

first gas from the Naga field in November. Premier also enjoyed

exploration success in Indonesia with a significant oil and

liquids-rich gas discovery on the operated Tuna Block further

strengthening the portfolio and providing the group with future

growth opportunities.

Production and development

Net production from Indonesia in 2014 on a working interest

basis was 14.4 kboepd (2013: 13.7 kboepd), up 5 per cent on the

prior year. This was driven by a strong operational performance

from the Anoa field on the Premier-operated Natuna Sea Block A, our

key asset in Indonesia. The Anoa field delivered 141 billion

British thermal units per day (BBtud) during 2014, capturing 44.6

per cent (2013: 39.9 per cent) of GSA1 deliveries into Singapore,

against a contractual share of 39.4 per cent. Natuna Sea Block A's

contractual share for 2015 has been increased to 39.9 per cent.

Gross liquids production from the Anoa field averaged 1.5 kbopd

(2013: 1.7 kbopd).

Sales from the Gajah Baru field to Singapore under GSA2 averaged

79 BBtud (2013: 82 BBtud). In addition, gas sales of up to 40 BBtud

from the Gajah Baru field to the Indonesian market commenced under

a Domestic Swap Agreement (DSA) in July. Gas delivered under the

DSA replaces gas previously contracted to Batam Island, Indonesia,

from the Natuna Sea Block A under GSA3 and GSA4. DSA deliveries are

expected to continue until the domestic pipelines are constructed

and the GSA3 and GSA4 contracts commence.

In total, 242 BBtud (gross) (2013: 208 BBtud) was sold from

Natuna Sea Block A during 2014 with record peak production rates of

391 BBtud achieved. High deliverability from Premier's Anoa and

Gajah Baru fields gives Premier the flexibility to meet peak

customer demand and to capitalise upon other suppliers' maintenance

and unplanned downtime. Looking to 2015, Premier plans to continue

to optimise its production from Natuna Sea Block A and to

renegotiate supplier contracts to take advantage of the expected

price reductions in oil field services in order to maintain its

competitive low operating cost base.

Good progress was made during 2014 on our new Natuna Sea Block A

developments, Naga and Pelikan. Following the successful completion

of the offshore installation in 2013, hook up and commissioning of

the Pelikan and Naga well head platforms was completed in April

2014. The Hakuryu rig commenced development drilling at the Naga

field in July with first gas achieved on budget in November. The

three development wells at the Pelikan field were completed in

early 2015 and the field is expected on-stream at the end of the

first quarter.

Natuna Sea Block A's deliverability continues to exceed its

contractual commitments. As a result, Premier is well placed to

increase its market share should its partners not meet their

contractual commitments under GSA1 as well as to increase its

supply of gas into Singapore should demand strengthen.

Elsewhere on Natuna Sea Block A, it is anticipated that the 2012

Anoa Deep gas discovery well will be tied into the Anoa production

facilities in 2015 to support GSA1 deliveries. Premier is also

progressing FEED for the Bison and Iguana projects as single well

subsea tie-backs to Pelikan while concept select for the Gajah

Puteri field is underway.

Premier successfully divested its 41.67 per cent non-operated

interest in Block A Aceh onshore Indonesia for US$40 million in

2014. Government approvals for the sale were received at the end of

2014 with completion achieved in January 2015.

Exploration and appraisal

Premier drilled three exploration wells in Indonesia during

2014: the Kuda Laut-1 and Singa Laut-1 wells on the

Premier-operated Tuna Block and the Ratu Gajah-1 well on the

Premier-operated Natuna Sea Block A.

The Kuda Laut-1 well, which targeted Miocene sands within a

four-way dip closed structure, and the Singa Laut-1 side track,

which targeted the Oligocene sequence in the adjoining three- way

dip closure, discovered in excess of 100 mmboe. Gas gradients have

been measured and liquids-rich gas samples were recovered

suggesting that the discovery has a high natural liquid content.

Planning for a 2016 appraisal campaign is now under way. Premier

has 65 per cent equity in the block and will assess the appropriate

working interest level to hold as appraisal advances.

Premier also drilled the Ratu Gajah-1 well on Natuna Sea Block A

during 2014. While the well flowed gas to surface during testing,

less sandstone reservoir than expected was encountered and the

discovery is sub-commercial. The results of this well, however,

have been integrated into the group's broader understanding of the

Lama play and thicker sands have been identified at the basin

margin. The next well in our portfolio to test the Lama play will

be the appraisal of the Anoa Deep discovery, which is scheduled for

the second quarter of 2015.

NORWAY

Following concept select in February, Premier successfully

completed FEED on the Vette development and progressed the project

to the point of sanction. However, Premier has agreed with the

Norwegian Petroleum Directorate to defer the submission of the Plan

for Development and Operation (PDO) to enable Premier to re-engage

with the supply chain to capture lower costs. Premier successfully

concluded the sale of its interest in Luno II in 2014 while

preparations for our first test of the emerging Mandal High play

are well advanced with the Myrhauk well expected to spud

mid-2015.

Development

Premier acquired operatorship of the Bream development, now

known as Vette, in 2013. Since then, significant progress has been

made in commercialising the field and, at the end of 2014, Premier

booked the reserves for the development.

The development will focus on recovering 40 mmbbls of reserves

from the field using four producers and two injectors tied back to

a FPSO. The Mackerel discovery in the adjacent PL406 licence will

be incorporated into a possible second phase of development.

FEED engineering work and supply chain engagement on the

development concept for Vette was completed and the project was

brought to sanction decision by the end of 2014. As part of that

process, Premier also continued with the development of its

organisation in Norway in preparation for development operator

status and successfully completed a number of audits undertaken by

the Petroleum Safety Authority.

In light of the sharp fall in the oil price in the second half

of 2014, Premier agreed with the Norwegian Petroleum Directorate to

defer the submission of the PDO by a year. Premier will use the

intervening period to re-engage with the supply chain to negotiate

better rates which are more reflective of the current climate.

Assuming that appropriate cost savings are achieved, Premier will

consider making a final investment decision at the end of 2015

targeting first oil in 2019.

Work continued during 2014 on the non-operated Frøy field to

identify a viable development concept. Following acquisition and

interpretation of new seismic data, a reassessment of subsurface

resources was completed in 2014 and screening of development

concepts is under way, including both standalone options as well as

a tie-back solution to nearby infrastructure.

Exploration

Premier continued to high grade its Norwegian exploration

portfolio during 2014. This included the profitable sale of the

Group's non-operated interest in PL359, which included the Luno II

discovery, to Lundin Petroleum for a consideration of US$17.5

million. In addition, following technical evaluations, Premier

relinquished a number of its exploration licences in Norway.

Premier's immediate exploration focus in Norway is on the

Myrhauk well which is expected to spud mid-2015 and will be the

company's first test of the emerging Mandal High play. Premier has

built an extensive acreage position over the Mandal High, both

organically and through acquisition, and has identified significant

follow on potential to the Myrhauk well in the success case.

Premier was successful in the APA 2014 Licensing Round with the

award of a 20 per cent non-operated interest in PL782S which is

located in the Norwegian North Sea and will be operated by

ConocoPhillips. There are no firm well commitments with the

award.

PAKISTAN

2014 saw another strong performance from Premier's Pakistan

business unit. Production from our six non-operated onshore

Pakistan gas fields exceeded expectations and exploration success

was achieved with the Kadanwari K-36 well.

Production and development

Average production in Pakistan during 2014 was 12.4 kboepd (net

to Premier), around 16 per cent lower than in 2013 (14.9 kboepd).

This reflects natural decline in the Bhit, Qadirpur and Zamzama gas

fields only partially offset by higher production from the

Kadanwari and Badhra fields.

The Kadanwari gas field, in which Premier has a 15.8 per cent

non-operated interest, performed strongly in 2014 and delivered

production of 3.2 kboepd (net to Premier) (2013: 2.9 kboepd), a new

record for the field. This was driven by new production from the

K-33 and K-35 wells which came on-stream in December 2013 and

February 2014 respectively, and the successful exploration well

K-36, which was tied in to production in April 2014.

Average production from the Bhit and Badhra gas fields in 2014

was 3.0 kboepd (net to Premier) (2013: 3.3 kboepd). Higher

production was achieved from the Badhra gas field which benefitted

from two new wells being brought on-stream in the first quarter of

2014. An additional two development wells were tied in at Badhra at

the end of the year partially offsetting natural decline from

existing wells. Good progress has also been made on the compressor

reconfiguration project at Bhit, which was initiated in the first

half of 2014, to improve ultimate recovery by around 54 billion

cubic feet (bcf) (gross). Five of the 10 compressors have been

commissioned and the project is on track to complete in April

2015.

Production from the Qadirpur gas field averaged 3.2 kboepd

(2013: 3.6 kboepd). Production fell over the year, in part due to

natural decline in the field, but also due to an unplanned shutdown

at the power plants into which gas is delivered.

Production from the Zamzama field was lower in 2014 averaging

3.1 kboepd (2013: 5.1 kboepd). This marked decrease in production

was due to faster declining reservoir pressures than initially

anticipated and Premier has updated its remaining reserves estimate

for the field accordingly. However, this decline was partially

mitigated by intervention work carried out at the Zam-4 production

well in May and the re-start of gas production from the Zam-8 well

in October. The joint venture is also considering further infill

drilling and additional wellhead compression to mitigate the

natural decline seen in the existing wells.

First gas was achieved from the Zarghun South gas field in

August and the field is currently producing at around 13 million

standard cubic feet per day (mmscfd) (gross). All costs pertaining

to Premier's 3.75 per cent working interest in the field continue

to be carried by the operator.

Exploration and appraisal

Premier drilled the successful K-36 exploration well on

Kadanwari in Pakistan in the first half of 2014. The well

discovered gas in a separate step-out compartment and was tied-in

to the Kadanwari facilities during April 2014.

MAURITANIA

Production and development

Production from the Chinguetti field averaged 447 bopd (2013:

507 bopd) net to Premier during the year. The fall in production

was driven by natural decline from the existing wells as well as a

shutdown of the facilities in January for a mooring chain

replacement. The FPSO contract has now been extended to December

2017.

Elsewhere in Mauritania, Premier relinquished its non-operated

interest in PSC-A, which contains the Banda gas development and

PSC-B, which contains the Tiof and Tevet discoveries.

Exploration and appraisal

The Tapendar-1 exploration well was drilled on PSC C-10 in the

first half of 2014 and was plugged and abandoned as a dry hole.

Subsequently, the joint venture partners agreed to exit the licence

on 30 November 2014.

UNITED KINGDOM

Higher UK production, driven by improved operating efficiency at

B Block, increased contributions from Huntington and Rochelle and

flush production from Kyle, resulted in a strong rise in UK cash

flows in 2014, despite the sharp fall in the oil price in the

second half of the year. Key milestones were reached on Premier's

operated Solan and Catcher projects. In addition, the sale of the

high cost Scott area assets for US$130 million was successfully

completed in December.

Production

In 2014, UK production averaged 19.4 kboepd, an increase of 30.3

per cent on the corresponding period (2013: 14.9 kboepd).

Production from the Premier-operated Balmoral area exceeded

expectations, averaging 3.2 kboepd during 2014 (2013: 2.5 kboepd),

as the asset benefitted from improved operating efficiency and the

reinstatement of five wells, four at the end of 2013 and one in

2014. Production from the non-operated Wytch Farm asset was also

strong, averaging 5.6 kboepd (2013: 5.5 kboepd) again driven by

high operating efficiency as well as a successful programme of

infill drilling which saw four new wells brought on-stream in the

first half of 2014.

Production from Scott, Telford and Rochelle averaged 3.8 kboepd,

broadly in line with expectations. While production from the fields

was impacted by several unplanned shutdowns, reservoir productivity

was strong when unconstrained by facilities, with Rochelle, for

example, achieving rates of up to 100 mmscfd (gross). In December

Premier successfully completed the sale of the Scott area assets

for a consideration of US$130 million. As part of the transaction,

all associated decommissioning costs liabilities were transferred

to the buyer.

Average production from the non-operated Huntington field was

5.7 kboepd (2013: 3.5 kboepd). Although the Group benefitted from a

full year of production from the asset, production performance from

the field was significantly below expectations due to lower

operating efficiency as a result of downtime on the production

facilities and restrictions on exporting the gas through the CATS

pipeline system. Most recently, production from the field has been

restricted while repairs are undertaken to a topsides valve on the

CATS riser platform which failed to re-start in early December

following a planned outage. The field is now expected to restart

production in mid-March.

Since December 2011, the non-operated Kyle field underwent

redevelopment following storm damage to the Banff FPSO to which the

field ties back. That work was successfully completed in 2014 and

Kyle was brought back on-stream in July. The field benefited from

early flush production with peak rates in excess of 7 kbopd

(gross). While flush production has continued into 2015 with the

field currently averaging around 5 kbopd, this is expected to

decline during the year.

Developments

Further progress was made on the Premier-operated Solan project

West of Shetland during 2014. The onshore construction of the

subsea oil storage tank jacket and topsides were completed and the

facilities were successfully installed at the end of the summer

using the Heerema Thialf heavy lift vessel. The first producer and

injector wells also successfully completed in September with good

flow rates achieved.

Commissioning commenced in November with the arrival of the Safe

Scandinavia flotel which is able to accommodate up to 400 people.

This programme, however, has taken longer than anticipated due to

poor weather conditions and low productivity over the winter

period. Whilst productivity has improved in recent weeks,

additional accommodation modules will be required to achieve

habitation on the platform. Further flotel slots have been

identified whilst conversion of the drilling rig contracted to

arrive in April is also being considered. As a result, first oil

will be later than the previous guidance of the second quarter of

2015 and Premier will provide further updates to the market as the

work progresses. Premier continues to target plateau production

rates from the field of 20-25 kbopd (gross) by year-end.

Cash spend to 31 December 2014 stood at US$1.4 billion. Premier

agreed to extend its loan to Chrysaor to ensure the project remains

fully funded to first oil. In return, Premier will take 100 per

cent of the project's cash flow (after certain deductions) until

the loan and interest has been repaid. As at 31 December, the loan

and interest outstanding stood at US$547 million. However, Premier

continues to work with Chrysaor and potential providers of debt

finance on a partial sale or refinancing of the Chrysaor loan.

The Premier-operated Catcher area project is progressing on

budget and on schedule. The development achieved partner approval

and government sanction in 2014 and the project is now well into

the execution phase. Engineering procurement and construction of

key subsea equipment, including the drilling templates, gas export

line, pipeline manifolds and subsea trees and control systems is

under way. Fabrication of the FPSO hull has also commenced, with

the first steel cut in Japan in early January 2015.

Offshore construction activity is planned to commence in

mid-2015 with the installation of the subsea facilities, including

the gas export line and drilling templates. Preparations for

development drilling with the Ensco-100 jack up rig are well

advanced and the campaign is on track to commence mid-year.

Exploration

Premier's UK North Sea exploration efforts are focused on near

field exploration opportunities close to its existing developments

and production. In particular, preparation is under way to drill an

exploration well at the Laverda prospect to the north of the

Catcher area hub in 2016.

Work also continues on the Bagpuss and Blofeld heavy oil

prospects, located on the Halibut Horst, a well-defined basement

high within the Moray Firth. The joint venture partners are

targeting the first half of 2016 for the drilling of the Bagpuss

well.

2014 saw Premier continue to high grade and rationalise its UK

North Sea exploration portfolio with a number of licences either

relinquished or sold over the course of the year.

VIETNAM

The Premier-operated Chim Sáo field out-performed expectations

in 2014 as we continued to maximise production delivery and to

improve the reliability of the facilities. The subsea tie-back of

the Dua field was completed successfully in July, extending plateau

production and the field life of Chim Sáo.

Production and development

In 2014, production from Block 12W, which contains the Chim Sáo

and Dua fields, exceeded expectations averaging 16.9 kboepd (13.7

kbpd of oil and 15.4 mmscfd of gas) net to Premier, up 19.9 per

cent on 2013.

During 2014, Premier completed significant upgrades to the Chim

Sáo FPSO aimed at maximising production deliverability and

operating efficiency. This included upgrades to the boilers and gas

compressors as well as the installation of an additional diesel

generator to improve the reliability of power generation. Premier

also increased the offshore workforce at Chim Sáo substantially to

support this improvement programme. As a result, operating

efficiency from the Chim Sáo facility increased to 88 per cent

during 2014, up 14 per cent on 2013. Record production rates of

19.2 kboepd (net) were achieved in November and December and the

field is currently producing over 20 kboepd (net).

The three well subsea tie-back of the Dua oil field to the Chim

Sáo facilities was completed, with first oil from the field

achieved in July 2014. Following the completion of the Dua drilling

programme, the West Telesto rig drilled two furtherwater injector

wells at Chim Sáo to provide pressure support to the field's oil

production. This, together with new production from Dua, will

extend plateau production and the field life of Chim Sáo.

In January 2015, Premier surpassed the milestone of 30 mmbbls

(gross) of production from Chim Sáo. This strong performance from

Block 12W has generated significant cash flows for the group and

the costs incurred to bring both Chim Sáo and Dua on-stream have

now been fully recovered.

NEW COUNTRY ENTRY - EXPLORATION

In addition to exploring in our existing core areas, Premier

looks to build business units in new countries via an

exploration-led entry strategy. The focus is on emergent plays

that, with exploration success, have the ability to develop into

new business units in the 2018 to 2025 time frame. In these new

countries Premier has a strict disciplined approach to investment

ensuring that cost exposure in the exploration phase is minimised

and only the best opportunities are matured to drill-ready status.

At year-end, Premier had established such exploration positions in

Brazil, Iraq, Kenya and the Western Sahara (SADR).

Premier entered Brazil in late 2013 securing three licenses in

the under-explored offshore regions of the proven Foz Do Amazonas

and Ceara Basins. In 2014 a small representative office was

established and new 3D seismic data was acquired over Premier's Foz

Do Amazonas Basin acreage. The full processed products are expected

to be available in the first half of 2015. Acquisition of new 3D

data over the Ceara Basin acreage is expected to commence in July

2015. The earliest exploration well on Premier's acreage in Brazil

will not be until 2017.

Premier holds a 30 per cent non-operated interest in Block 12,

onshore Iraq, in the under-explored western part of one of the

world's most prolific oil basins. At year-end a 3D seismic survey

acquisition programme was 75 per cent complete and it is

anticipated that processed products will be available in the third

quarter of 2015. There is one commitment well on this licence which

is planned to be drilled in late 2016 or early 2017.

Premier entered Kenya in 2012, and following the withdrawal from

our offshore acreage in 2014, the company focussed on one onshore

licence (Block 2B). This licence covers a Tertiary sub-basin within

the Anza Graben and was assessed as a potential look-a-like to the

successful plays drilled recently both in Uganda and further west

in Kenya. The first well on the block (Badada-1), drilled in early

2015, did not find hydrocarbons. Premier has no further commitments

in Kenya beyond the drilling of this well.

Offshore SADR, Premier holds 45,000 square kilometres (net) of

acreage across five licences. At present, all SADR licences are in

abeyance pending the country's admission to the UN.

Premier maintains two small new venture groups, one in London

and one in Singapore, tasked with evaluating exploration-led entry

options in new countries. Any new entry will be dependent on the

quality of the opportunity and its ability to create value at our

conservative oil price assumptions at the time.

FINANCIAL REVIEW

Economic background

After three and a half years in which the price of oil averaged

above US$100/bbl, crude oil experienced a sharp fall in the second

half of 2014. The average for 2014 was US$98.9/bbl against

US$108.7/bbl for the prior year. In the first half of 2014 the

Brent oil price ranged between US$104/bbl and US$115/bbl, before

falling below US$55/bbl by the end of the year.

Premier's portfolio of crudes traded at a weighted average of

US$2.0/bbl premium to Brent (2013: US$2.6/bbl), as we continued to

realise favourable prices, particularly for our Chim Sáo crude.

Premier's average realisations for the year were US$98.2/bbl (2013:

US$109.0/bbl) after taking into account timings of actual liftings

and export duties paid in Vietnam. Post hedging, realised prices

increased to US$101.0/bbl (2013: US$109.1/bbl).

Average gas prices for the group were US$8.4 per thousand

standard cubic feet (mscf) (2013: US$8.3/mscf). Gas prices in

Singapore, linked to high sulphur fuel oil (HSFO) pricing and in

turn, therefore, linked to crude oil pricing, averaged US$16.8/mscf

(2013: US$17.1/mscf). The average price for Pakistan gas (where

only a portion of the contract formulae is linked to energy prices)

was US$4.6/mscf (2013: US$4.4/mscf).

Effect of steep decline of the oil price

The fall in both spot and forward oil prices has inevitably had

an impact on our reported financial results in respect of the

carrying value of certain of our oil and gas assets. An impairment

charge has been booked in the income statement relating to several

of our fields in the UK North Sea, Indonesia, Vietnam and

Mauritania. The total amount for the impairment (pre-tax) is

US$784.4 million (US$327.8 million, post-tax). Impairment charges

for the year, relating to UK fields, amounted to US$732.3 million

(pre-tax) (2013: US$178.7 million), and were recognised for the

Solan, Balmoral area and Huntington fields, while the remaining

impairment charge of US$52.1 million was recognised in respect of

the Chim Sao field in Vietnam, the Chinguetti field in Mauritania

and the Kakap field in Indonesia. The principal cause of the

impairment charge is a reduction in the short to medium-term oil

price assumption used in estimating the future discounted cash

flows for each field. In addition to the impact of the reduced oil

price assumptions, a review of the expected decommissioning costs

for the Balmoral area in the first half of 2014 has also driven

part of the impairment charge, whilst the Solan impairment has in

part been caused by an increase in the costs incurred to date and

expected costs to completion.

Income statement

Production in 2014 averaged 63.6 kboepd (2013: 58.2 kboepd) up 9

per cent on a working interest basis. On an entitlement basis,

which under the terms of our Production Sharing Contracts (PSCs)

allows for additional government take at higher oil prices,

production was 57.7 kboepd (2013: 52.4 kboepd). Working interest

gas production averaged 177 mmscfd (2013: 174 mmscfd) or

approximately 49 per cent of total production. The increase in the

group's production can be partially attributed to an increase in

operating efficiency across a number of assets in the portfolio.

The group's operating efficiency was 84 per cent in 2014 (2013: 75

per cent).

Total sales revenue from all operations reached a new record

level of US$1.6 billion (2013: US$1.5 billion), due to higher

production partially offset by lower average oil prices. Cost of

sales, excluding impairment charges, were US$986.6 million (2013:

US$856.1 million). Operating costs were stable at US$436.1 million

(2013: US$418.9 million). Unit operating costs were US$18.5 per

barrel of oil equivalent (boe) (2013: US$19.7/boe), lower than the

prior year due to higher production, improved operating efficiency

across several of the company's assets and one-off insurance claims

received in the year. Underlying unit amortisation rose to

US$19.9/boe (2013: US$17.7/boe) mainly reflecting higher production

from fields in the UK and Vietnam, carrying a higher amortisation

charge per boe compared to the group average.

Exploration expense and pre-licence expenditure costs amounted

to US$58.5 million (2013: US$106.2 million) and US$25.3 million

(2013: US$30.1 million) respectively. This includes the write-offs

relating to Block L10B in Kenya and the Ratu Gajah well in

Indonesia, exiting our exploration licences in Mauritania and the

relinquishment of various exploration licences in the UK as part of

Premier's portfolio management programme. Net administrative costs

were US$25.4 million (2013: US$20.2 million).

Operating loss was US$248.1 million (2013: operating profit of

US$352.0 million), mainly attributable to the impairment charges

described above. Finance costs and other charges, net of interest

revenue and other gains, were US$137.1 million (2013: US$65.4

million). The interest revenue from the loan to our partner on the

Solan field development has increased to US$36.8 million (2013:

US$6.3 million), however we have recognised a provision of US$61.2

million against this long-term receivable, reflecting a reduction

in the total returns expected on the Solan field in a lower oil

price environment. The charge for the unwinding of the discounted

decommissioning provision increased to US$46.9 million (2013:

US$36.4 million) reflecting increased provisions for future

decommissioning as industry cost estimates rise.

Pre-tax losses were US$384.0 million (2013: pre-tax profits

US$285.4 million). The group tax credit for 2014 is US$173.7

million (2013: tax charge of US$51.4 million), an effective tax

rate of 45.2 per cent of the pre-tax loss. The group's theoretical

tax rate is close to 50 per cent, which includes a higher taxation

rate in the UK being offset by lower rates in Vietnam and Pakistan.

The 2014 group tax credit arises as a result of a deferred tax

credit in the UK, mainly arising from the tax effect of the

impairment charges recognised in the year and recognition of the UK

Small Fields allowance for the Catcher field. The group has an

estimated US$2.7 billion of carried forward UK corporation tax

allowances and losses, the majority of which are forecast to be

utilised against UK ring fence profits over time, and are therefore

reflected in the deferred tax asset position at the year-end. The

group did not pay any corporation tax or supplementary charge in

the UK in 2014 due to these brought forward losses.

Loss after tax is US$210.3 million (2013: profit after tax

US$234.0 million) resulting in a basic earnings per share of a loss

of 40.3 cents (2013: profit 44.7 cents).

Dividend and buyback

During 2014, Premier purchased 18.4 million shares at a volume

weighted average price of 302.0 pence and paid a dividend of 5

pence per share. In December, a decision was taken by the Board to

postpone the buyback programme pending a recovery in the oil price.

The Board has also decided to suspend the dividend and therefore no

dividend is proposed.

Cash flow

Cash flow from operating activities was US$924.3 million (2013:

US$802.5 million) after accounting for tax payments of US$208.5

million (2013: US$228.3 million). Cash movements in working capital

have improved to US$74.7 million (2013: US$1.3 million).

Capital expenditure in 2014 totalled US$1,195.5 million (2013:

US$878.0 million).

Capital expenditure (US$ million) 2014 2013

=================================== ======== ======

Fields/development projects 887.5 603.7

Exploration and evaluation 294.1 260.5

Other 13.9 13.8

Total 1,195.5 878.0

=================================== ======== ======

The principal development projects were the Solan and Catcher

fields in the UK, and the Dua field in Vietnam. In addition,

US$318.4 million (2013: US$185.9 million) funding support was

provided to our partner in the Solan project.

Exploration and evaluation spend includes costs principally

related to the exploration drilling and pre-development activities

in Norway, Indonesia, the Falkland Islands and Kenya.

Disposals and asset held for sale

During the first half of 2014, Premier announced the proposed

sale of the non-operated Scott area assets in the UK North Sea for

US$130 million, the sale of Block A Aceh onshore Indonesia for

US$40 million, and the sale of PL359, which contains the Luno II

discovery offshore Norway, for US$17.5 million prior to working

capital adjustments. The Scott area assets and Luno II transactions

were completed during the second half of 2014, whilst a US$76.9

million loss has been recognised as the anticipated loss on the

sale of Block A Aceh, which was completed in January 2015. These

disposals, combined with the write off of deferred consideration of

US$7.0 million held for the Block 07/08 disposal in 2013, resulted

in a gain on disposal of non-current assets of US$2.7 million

(2013: US$3.6 million).

Balance sheet position

Net debt at 31 December 2014 amounted to US$2,122.2 million

(2013: US$1,452.9 million), with cash resources of US$291.8 million

(2013: US$448.9 million).

Net debt (US$ million) 2014 2013

=========================== ========== ==========

Cash and cash equivalents 291.8 448.9

Convertible bonds ^ (228.5) (224.2)

Other debt*^ (2,185.5) (1,677.6)

Total net debt (2,122.2) (1,452.9)

=========================== ========== ==========

* Other debt includes EUR120.0 million of long-term senior

notes, which are valued at year-end US$1.13:EUR spot rate. These

will be redeemed at an average of US$1.39:EUR due to cross currency

swap arrangements. It also includes GBP250.0 million of UK retail

bond and long-term bank financing which are valued at year-end

US$1.56:GBP spot rate. These will be redeemed at an average of

US$1.64:GBP due to cross currency swap arrangements.

^ The carrying amounts of the convertible bonds and the other

long-term debt on the balance sheet are stated net of the

unamortised portion of the issue costs of US$0.4 million (2013:

US$0.6 million) and debt arrangement fees of US$27.4 million (2013:

US$12.2 million) respectively.

Long-term borrowings consist of convertible bonds, UK retail

bonds, senior loan notes and bank debt. Premier took advantage of

the strength of the banking markets in the first half of 2014 to

refinance its principal US$1.2 billion facility with a new,

increased facility of US$2.5 billion on improved terms with

extended maturity to July 2019. The group repaid a US$300 million

term loan in January 2015 which was due to mature in April

2015.

Premier does not have any significant debt maturities until late

2017 and all debt is unsecured. As at 31 December, cash and undrawn

facilities stood at US$1.9 billion.

Financial risk management

Commodity prices

The Board's commodity pricing and hedging policy continues to be

to lock in oil and gas prices for a proportion of expected future

production at a level which ensures that investment programmes for

sanctioned projects are adequately funded. Where investment

requirements are well covered by cash flows without hedging, it is

recognised that there may be an advantage, in periods of strong

commodity prices, in locking in a portion of forward production at

favourable prices on a rolling forward 12-18 month basis.

At year-end, 5.4 mmbbls of Dated Brent oil were hedged through

forward sales for 2015 at an average price of US$98.3/bbl. This

volume represents approximately 50 per cent of the group's expected

liquids entitlement production in 2015. 84,000 metric tonnes (mt)

of HSFO, which drives our gas contract pricing in Singapore, has

been sold forward for 2015 at an average price of US$614.4/mt.

These hedges cover approximately 13 per cent of our expected

Indonesian gas entitlement production for 2015.

The year-end fair value on the commodity was US$250.1 million

(2013: loss US$24.2 million), which is expected to be released to

the income statement during 2015 as the related barrels are

lifted.

During 2014, forward oil sales of 5.6 mmbbls, and forward fuel

oil sales of 222,000 mt expired resulting in a net credit of

US$45.9 million (2013: US$0.8 million) which has been included

within sales revenue for the year.

Foreign exchange

Premier's functional and reporting currency is US dollars.

Exchange rate exposures relate only to local currency receipts, and

expenditures within individual business units. Local currency needs

are acquired on a short-term basis. At the year-end, the group

recorded a mark-to-market loss of US$6.0 million on its outstanding

foreign exchange contracts (2013: gain of US$13.1 million). The

group currently has GBP150.0 million retail bonds, EUR120.0 million

long-term senior loan notes and GBP100.0 million term loan in

issuance which have been hedged under cross currency swaps in US

dollars at average fixed rates of US$1.64:GBP and US$1.34:EUR.

Interest rates

The group has various financing instruments including senior

loan notes, convertible bonds, UK retail bonds, term loans and

revolving credit facilities. As at year-end, 56 per cent of total

borrowings is fixed or has been fixed using the interest rate swap

markets. On average, the cost of drawn funds for the year was 4.4

per cent. Mark-to-market credits on interest rate swaps amounted to

US$6.8 million (2013: credit of US$6.4 million), which are recorded

as movements in other comprehensive income.

Cash balances are invested in short-term bank deposits and AAA

rated liquidity funds, subject to Board approved limits and with a

view to spreading counterparty risks.

Insurance

The group undertakes a significant insurance programme to reduce

the potential impact of physical risks associated with its

exploration, development and production activities. Business

interruption cover is purchased for a proportion of the cash flow

from producing fields for a maximum period of 18 months. During

2014, claims amounting to US$20.5 million were agreed in relation

to property damage and business interruption on Chim Sao gas export

pipeline damage in 2013.

Going concern

The group monitors its funding position and its liquidity risk

throughout the year to ensure it has access to sufficient funds to

meet forecast cash requirements. Cash forecasts are regularly

produced based on, inter alia, the group's latest life of field

production and expenditure forecasts, management's best estimate of

future commodity prices (based on recent forward curves, adjusted

for the group's hedging programme) and the group's borrowing

facilities. Sensitivities are run to reflect different scenarios

including, but not limited to, changes in oil and gas production

rates, possible reductions in commodity prices and delays or cost

overruns on major development projects. This is done to identify

risks to liquidity and covenant compliance and enable management to

formulate appropriate and timely mitigation strategies.

Due to the current weakness in oil and gas prices, the directors

have reduced planned development and exploration expenditure for

2015, are implementing a series of cost saving initiatives to

reduce both operating costs and G&A spend and have identified a

range of portfolio management opportunities to monetise certain of

the group's current development and exploration assets and to

source additional sources of financing.

At year-end, the group had significant headroom on its borrowing

facilities and related financial covenants. The group's forecasts

and projections, which take into account the actions described in

the preceding paragraph, also indicate that the company will be

able to operate within the requirements of its existing borrowing

facilities for 12 months from the date of approval of the Annual

Report and Accounts. However, if there were further sustained falls

in the oil price or if certain of the identified portfolio

management opportunities are delayed or cancelled, whilst forecasts

indicate that the group's liquidity will remain strong, it is

possible that management will need to request a temporary amendment

to the terms of one of its financial covenants. If the group's

ongoing forecasts were to suggest that this would be required,

management would take appropriate action with the support of its

long-term banking relationships well in advance of such

requirement, and management have no reason to believe that such

support would not be forthcoming. The directors therefore continue

to adopt the going concern basis in preparing the financial

statements.

Business risks

Premier's business may be impacted by various risks leading to

failure to achieve strategic targets for growth, loss of financial

standing, cash flow and earnings, and reputation. Not all of these

risks are wholly within the company's control and the company may

be affected by risks which are not yet manifest or reasonably

foreseeable.

Effective risk management is critical to achieving our strategic

objectives and protecting our personnel, assets, the communities

where we operate and with whom we interact and our reputation.

Premier therefore has a comprehensive approach to risk

management.

A critical part of the risk management process is to assess the

impact and likelihood of risks occurring so that appropriate

mitigation plans can be developed and implemented. Risk severity

matrices are developed across Premier's business to facilitate

assessment of risk. The specific risks identified by project and

asset teams, business units and corporate functions are

consolidated and amalgamated to provide an oversight of key risk

factors at each level, from operations through business unit

management to the Executive Committee and the Board.

For all the known risks facing the business, Premier attempts to

minimise the likelihood and mitigate the impact. According to the

nature of the risk, Premier may elect to take or tolerate risk,

treat risk with controls and mitigating actions, transfer risk to

third parties, or terminate risk by ceasing particular activities

or operations. Premier has a zero tolerance to financial fraud or

ethics non-compliance, and ensures that HSES risks are managed to

levels that are as low as reasonably practicable, whilst managing

exploration and development risks on a portfolio basis.

The group has identified its principal risks for the next 12

months as being:

-- Health, safety, environment and security (HSES);

-- Production and development delivery;

-- Commodity price volatility;

-- Exploration success and reserves addition;

-- Host government - political and fiscal risks;

-- Organisational capability;

-- Joint venture partner alignment; and

-- Financial discipline and governance.

Further information detailing the way in which these risks are

mitigated is provided on the company's website

(www.premier-oil.com).

CONSOLIDATED INCOME STATEMENT

For the year ended 31 December 2014

2014 2013

$ million $ million

--------------------------------------------- ---------- ------------

Sales revenues 1,629.4 1,501.0

Other operating income - 38.7

Cost of sales (986.6) (856.1)

Impairment charge on oil and gas properties (784.4) (178.7)

Exploration expense (58.5) (106.2)

Pre-licence exploration costs (25.3) (30.1)

Profit on disposal of non-current assets 2.7 3.6

General and administration costs (25.4) (20.2)

--------------------------------------------- ---------- ------------

Operating (loss)/profit (248.1) 352.0

--------------------------------------------- ---------- ------------

Share of profit in associate 1.9 -

Interest revenue, finance and other gains 58.5 33.0

Finance costs, other finance expenses

and losses (196.3) (98.4)

Loss on commodity derivative financial

instruments - (1.2)

--------------------------------------------- ---------- ------------

(Loss)/profit before tax (384.0) 285.4

Tax 173.7 (51.4)

--------------------------------------------- ---------- ------------

(Loss)/profit after tax (210.3) 234.0

--------------------------------------------- ---------- ------------

Earnings per share (cents):

Basic (40.3) 44.2

Diluted (40.3) 43.2

--------------------------------------------- ---------- ------------

The results relate entirely to continuing operations.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2014

2014 2013

$ million $ million

------------------------------------------------------- ---------- ----------

(Loss)/profit for the year (210.3) 234.0

------------------------------------------------------- ---------- ----------

Cash flow hedges on commodity swaps:

Gains/(losses) arising during the year 296.1 (25.0)

Less: reclassification adjustments for

losses in the year (46.0) 0.8

---------- ----------

250.1 (24.2)

Tax relating to components of other comprehensive

income 139.0 13.9

Cash flow hedges on interest rate and

foreign exchange swaps 15.5 (0.8)

Exchange differences on translation of

foreign operations (48.3) (17.5)

Actuarial (losses)/gains on long-term

employee benefit plans (0.2) (6.5)

------------------------------------------------------- ---------- ----------

Other comprehensive income/(expense) 78.1 (35.1)

------------------------------------------------------- ---------- ----------

Total comprehensive (expense)/income for

the year (132.2) 198.9

------------------------------------------------------- ---------- ----------

All comprehensive income is attributable to the equity holders

of the parent.

CONSOLIDATED BALANCE SHEET

As at 31 December 2014

2014 2013

$ million $ million

-------------------------------------------- ---------- ----------

Non-current assets:

Intangible exploration and evaluation

assets 825.7 701.0

Property, plant and equipment 2,430.0 2,885.9

Goodwill 240.8 240.8

Investment in associate 7.6 6.2

Long-term employee benefit plan surplus 0.8 1.0

Long-term receivables 494.1 198.1

Deferred tax assets 971.7 762.4

-------------------------------------------- ---------- ----------

4,970.7 4,795.4

-------------------------------------------- ---------- ----------

Current assets:

Inventories 26.1 49.5

Trade and other receivables 411.0 421.8

Tax recoverable 57.9 82.4

Derivative financial instruments 273.4 15.9

Cash and cash equivalents 291.8 448.9

Assets held for sale 56.7 -

-------------------------------------------- ---------- ----------

1,116.9 1,018.5

-------------------------------------------- ---------- ----------

Total assets 6,087.6 5,813.9

-------------------------------------------- ---------- ----------

Current liabilities:

Trade and other payables (544.5) (512.4)

Current tax payable (84.2) (92.0)

Provisions (14.1) (13.1)

Derivative financial instruments (48.1) (38.3)

Short-term debt (300.0) -

Liabilities directly associated with asset (1.8) -

held for sale

(992.7) (655.8)

-------------------------------------------- ---------- ----------