TIDMPMO

RNS Number : 9622V

Premier Oil PLC

03 February 2017

This announcement has been determined to contain inside

information

PREMIER OIL PLC

("Premier" or "the Group")

Announcement of the proposed refinancing

3 February 2017

Premier is pleased to announce:

- Agreement of representatives of its Private Lenders to a long

form term sheet, subject to credit approvals

- Agreement of revised key terms between Premier and

representatives of its convertible bondholders, subject to

agreement by the Private Lenders

- Proposed amended terms to its retail bonds

Refinancing overview

The refinancing will provide a solid foundation for Premier to

deliver its strategic plans through:

- Preserving the Group's debt facilities

- Resetting financial covenant headroom

- Extending Premier's debt maturities to 2021 and beyond

In return, the lenders will receive a revised security and

covenant package, enhanced economics and certain governance

controls.

The long form term sheet will now be circulated to the lenders

under the company's RCF, term loan, Schuldschein and US Private

Placement notes (Private Lenders) for formal credit committee

approval, with lock-up agreements requested by the end of February.

Revised financing documentation will now be finalised with

completion of the refinancing currently anticipated by the end of

May 2017.

Revised funding structure allows for debt reduction and

growth

Year-to-date Premier's production has averaged around 80 kboepd.

A significant step up in production is expected once Catcher is

on-stream later this year, materially enhancing the Group's cash

flows. The Group will prioritise these cash flows towards reducing

its absolute debt levels and leverage ratio to 3x EBITDA. At the

same time, Premier and its lenders envisage that the Group will

selectively seek to invest in its unsanctioned projects, at the

appropriate equity levels, with due regard to the commodity price

environment.

With rising production and 700 mmboe of discovered but

undeveloped reserves and resources, Premier has considerable

portfolio optionality. Unsanctioned projects include infill

drilling programmes, incremental developments and new projects such

as Tolmount, Tuna and Sea Lion. Premier also has the potential for

material value creation through its exploration acreage, including

in Mexico, with drilling expected to commence in Q2.

Tony Durrant, CEO, commented

"The agreement of the long form term sheet with representatives

of our Private Lenders marks a significant milestone for Premier.

We are grateful for our lenders' continued support, which reflects

the high quality nature of our asset base, the strong recent

operating performance and our plans to deliver value for all of our

stakeholders."

Enquiries

Premier Oil plc Tel: 020 7730 1111

Tony Durrant (CEO), Richard

Rose (Finance Director)

Bell Pottinger Tel: 020 3772 2500

Lorna Cobbett, Henry Lerwill

Key terms of the refinancing

The RCF, term loan, US Private Placement notes (USPP) and

Schuldschein notes

Proposed amendments have been agreed with the Coordinating

Committee of the RCF Group and representatives of the other Private

Lenders as follows:

- Confirmation of total existing facilities of US$3.9bn with undrawn capacity preserved

- Alignment of final maturity dates to 31 May 2021

- Amendment of Premier's financial covenants, currently anticipated to be

-- Net debt to EBITDA cover ratio reset to 7.5x until end 2017

reducing to 5.0x at the end of 2018, before returning to 3.0x in

2019

-- Interest cover ratio reduced to 1.85x before increasing to 3.0x in 2019

-- Covenant net debt (which includes issued letters of credit)

to be less than US$2.95bn by end 2018

- Enhanced economics to lenders, including

-- A margin uplift of 1.5% over existing pricing with an

additional 1.0% for the Schuldschein lenders for conversion of

their existing bilateral facilities into an English law syndicated

facility

-- Amendment fees of 1.0% with an additional 0.5% for the Schuldschein lenders

-- Equity warrants representing up to 90 million new shares,

being 15% of Premier's issued shares (enlarged for the potential

new issue) at a price of 42.75 pence per share, equivalent to 7.6%

dilution based on the latest closing share price. The warrants will

have a five-year term. Alternatively, lenders will have the option

to take up synthetic warrants in the form of a deferred fee of

comparable value to the equity warrants. Take up of the synthetic

warrants will reduce the number of underlying new shares to be

issued under the equity warrants

-- Crystallisation of the make-whole on the USPP to be

calculated at the completion date of the refinancing

- A security package which provides priority over unsecured

creditors; in addition a portion of the RCF and certain other debt

obligations of up to US$800m will receive super senior status

- Certain governance controls including

-- Annual approval of Premier's overall capex and exploration budgets

-- Final sanction of significant new projects

-- Certain approval rights in respect of acquisitions and disposals

The retail bonds

Substantially the same economic terms are being offered to the

retail bondholders as to the Private Lenders. The key terms

proposed are:

- Maturity date extended by six months to 31 May 2021

- Enhanced economics comprising an interest rate uplift of

1.50%, amendment fees of 1.0% and pro rata participation in the

warrant offering as above

- Participation in the security package which gives priority

over unsecured creditors, ranking alongside the private debt

facilities (with senior status)

Positive feedback has been received from a number of significant

retail bondholders who have been consulted on these terms. A

prospectus will be issued for retail bondholders to elect between

equity warrants and synthetic warrants.

Convertible bonds

Premier has agreed key amended terms with certain significant

bondholders and advisers to an ad hoc committee of the convertible

bondholders. Full details of these terms will be circulated to the

wider convertible group. The amended terms remain subject to review

and agreement by the Private Lenders and their representatives.

Implementation of the proposed refinancing

Premier plans to enter into lock up agreements in relation to

the long form term sheet with Private Lenders by the end of

February. Revised refinancing and implementation documents will now

be finalised with completion for the refinancing anticipated by the

end of May 2017.

The proposed RCF, term loan and USPP amendments will be effected

through a Scottish scheme of arrangement of each of Premier and

Premier Oil UK Limited (the Schemes), which must be approved by a

majority in number and 75% in value of Scheme creditors attending

and voting at the meetings (the Scheme Meetings).

Schuldschein lenders and the convertible bondholders will each

consent to the terms of the refinancing outside of the Scheme

process.

The refinancing will require shareholder approval in respect of

the potential issue of the warrant shares and shares that could be

issued as a result of the change to the convertible bond conversion

price. That approval will be sought at a general meeting.

Forward Looking Statements

Certain statements in this announcement are forward looking

statements. These forward looking statements can be identified by

the use of forward looking terminology including the terms

"believes", "expects", "estimates", "anticipates", "intends",

"may", "will" or "should" or in each case, their negative, or other

variations or comparable terminology. These forward looking

statements reflect Premier's current expectations concerning future

events. They involve various risks, uncertainties and other factors

which may cause the actual results, performance or achievements of

the Group, third parties or the industry to be materially different

from any future results, performance or achievements expressed or

implied by such forward looking statements. Such risks,

uncertainties and other factors include, amongst other things,

general economic and business conditions, industry trends,

competition, changes in regulation, currency fluctuations, the

Group's ability to recover its reserves or develop new reserves and

to implement expansion plans and achieve cost reductions and

efficiency measures, changes in business strategy or development

and political and economic uncertainty. There can be no assurance

that the results and events contemplated by these forward looking

statements will in fact occur.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCQXLBBDLFEBBF

(END) Dow Jones Newswires

February 03, 2017 02:00 ET (07:00 GMT)

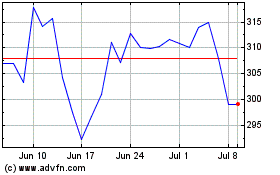

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Harbour Energy (LSE:HBR)

Historical Stock Chart

From Apr 2023 to Apr 2024