TIDMPFD TIDMIRSH

RNS Number : 8011E

Premier Foods plc

21 July 2016

Premier Foods plc (the "Company" or the "Group")

Trading update for the 13 weeks ended 2 July 2016

-- Q1 Group sales up +1.9%; Branded sales up +0.8%

-- Fourth consecutive quarter of sales growth

-- Expectations for Full Year remain unchanged

Gavin Darby, Chief Executive Officer

"We are very pleased by the further improvement in our sales

performance, which demonstrates four consecutive quarters of growth

and continued momentum in the business. Our category strategy of

investing behind our brands continues to deliver results, despite

the wider deflationary grocery market in the UK. While the economic

environment is more uncertain following the EU referendum outcome,

our immediate financial exposure is expected to be limited. Given

our strong brands and UK manufacturing cost base, we believe we

remain well placed to make progress and our expectations for the

full year remain unchanged."

Q1 Sales % change Grocery Sweet Group

Treats

Branded 0.9% 0.5% 0.8%

Non-branded 9.0% 11.9% 9.8%

-------- -------- ------

Total 1.9% 2.0% 1.9%

Trading update

The Group delivered sales growth of 1.9% in the first thirteen

weeks of the 2016/17 financial year, with Branded sales up 0.8% and

Non-branded sales ahead 9.8%. On a divisional basis, sales grew by

1.9% in Grocery and sales in Sweet Treats increased by 2.0%.

In the Grocery business Bisto continued its strong momentum from

the prior year into the first quarter, while Loyd Grossman sauces

also performed well as its premium pouches range and Bolognese

sauces continued to prove very popular with consumers.

Ambrosia returned to growth in the quarter, following the

launches of the new Deluxe custard range and Frozen custard

ice-cream. Additionally, the brand benefitted from TV advertising

in the period with the 'Taste of Happy' campaign and the deluxe

range performing particularly well. Ambrosia's performance in the

first quarter this year further demonstrates that the Group's

strategy of investing behind its brands can be effectively applied

across its portfolio. In the second half of the year, the Group is

planning to make a significant investment in its Batchelors range,

with new products High Veg pots, High Protein Pots and Soup Dippers

launched to market. This new range of products are aligned to

current consumer trends and have been well received by retail

customers.

Non-branded sales in the Grocery business increased 9.0%

benefitting in particular from increased sales at Knighton

Foods.

Sweet Treats continued to benefit from strong Cadbury cake

performances, reflecting continued growth of new products such as

Cadbury Amaze Bites while also seeing strong sales from the core

Cadbury cake range. Non-branded Sweet Treats grew by 11.9% due to

contract wins in both major retailers and the discounters' channel,

while Mr Kipling sales were lower as a result of higher promotional

activity in the prior year period. The Cake-On-The-Go range of twin

pack Mr Kipling and Cadbury cakes designed for the convenience

market is building distribution and seven different formats are now

available in market. The launch of the Mr Kipling Cup Cake range

exclusively in one major retailer is also performing well.

International sales grew approximately 5% in the quarter due to

a strong performance in Australia and the business unit has now

delivered growth for seven successive quarters. Additionally, good

progress is being made in delivering against the strategic

initiative of extending the Group's cake brands in the USA and

Middle East.

Work streams established for the co-operation agreement with

Nissin are now well underway, with collaboration on both sides

building well commercially and operationally. The Group expects to

be able to deliver tangible initiatives from these work streams in

2017.

As previously announced, the Group expects to invest between

GBP42-44m in consumer marketing in the current financial year, with

nine of its brands planned to benefit from TV advertising in the

year. This represents a significant increase on the GBP36m invested

in the prior year and marks the third successive year of increased

consumer marketing investment.

One of the key roles of the Group's supply chain is to deliver

efficiencies which can then be re-invested in consumer marketing.

Efficiency programmes including streamlining the supply chain's

management teams, delivering line efficiency improvements and

optimisation of its logistics operations are all well on track.

The Group recognises the broader macroeconomic uncertainty

created by the UK electorate voting to the leave the European

Union. In overall terms, the FY16/17 financial impact to the Group

of the UK voting to leave the EU is expected to be low. The Group's

main direct foreign currency exposure is with respect to Euros of

which it is a net purchaser of approximately EUR50m per annum,

however it is substantially hedged against the Euro for the

remainder of FY16/17. One of the Group's strategic initiatives is

to deliver international sales growth sourced from its UK

manufacturing cost base and this is expected to be significantly

supported by the recent devaluation of Sterling. While financial

market movements will affect the net pensions' position, certain

hedging instruments are in place and additionally, the Group's

pension deficit contribution payments are fixed through to the end

of 2019.

Outlook

As outlined at its recent Investor and Analyst visit to its

Lifton Desserts centre of excellence, the Group's focus on

innovation and brand investment is delivering demonstrable results,

with more exciting initiatives to come. Having delivered four

successive quarters of sales growth, the Group considers it is well

placed to make progress and its sales, profit and Net debt

expectations for the year remain unchanged.

Ends

For further information, please contact:

Institutional investors and analysts:

Alastair Murray, Chief Financial +44 (0) 1727 815

Officer 850

Richard Godden, Head of Investor +44 (0) 1727 815

Relations 850

Media enquiries:

Richard Johnson, Corporate Affairs +44 (0) 1727 815

Director 850

+44 (0) 1727 815

Marisa Fitch, Head of External Affairs 850

Maitland

+44 (0) 20 7379

Kate O'Neill 5151

Tom Eckersley

Conference Call

A conference call for investors and analysts will take place on

21 July 2016 at 9.30am, details of which are outlined below. A

replay of the conference call will be available on the Company's

website later in the day.

http://www.premierfoods.co.uk/investors/results-centre

Telephone number: +44 1452 555566

Telephone number

(UK Toll free) 0800 694 0257

Conference ID: 49360726

Notes to editors:

1. All sales data is for the thirteen weeks to 2 July 2016 or 4

July 2015 as appropriate.

2. FY15/16 Q1 sales are stated on a pro forma basis and are

re-stated as if the Company owned the recently acquired Knighton

Foods for the comparative period.

3. Q1 sales segmental disclosure:

Q1 Sales (GBPm) FY16/17 FY15/16 % Change

Q1 Q1

Grocery

Branded 111.1 110.1 0.9%

Non-branded 17.5 16.1 9.0%

-------- -------- ---------

Total 128.6 126.2 1.9%

Sweet Treats

Branded 40.2 40.0 0.5%

Non-branded 6.7 6.0 11.9%

-------- -------- ---------

Total 46.9 46.0 2.0%

-------- -------- ---------

Group

Branded 151.2 150.1 0.8%

Non-branded 24.3 22.1 9.8%

-------- -------- ---------

Total 175.5 172.2 1.9%

-------- -------- ---------

Certain statements in this Trading Update are forward looking

statements. By their nature, forward looking statements involve a

number of risks, uncertainties or assumptions that could cause

actual results or events to differ materially from those expressed

or implied by those statements. Forward looking statements

regarding past trends or activities should not be taken as

representation that such trends or activities will continue in the

future. Accordingly, undue reliance should not be placed on forward

looking statements.

A Premier Foods image gallery is available using the following

link:

http://www.premierfoods.co.uk/media/image-gallery

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLLFFADFIIFIR

(END) Dow Jones Newswires

July 21, 2016 02:00 ET (06:00 GMT)

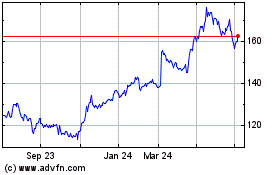

Premier Foods (LSE:PFD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Premier Foods (LSE:PFD)

Historical Stock Chart

From Apr 2023 to Apr 2024