TIDMPFD

RNS Number : 8317T

Premier Foods plc

23 July 2015

Premier Foods plc (the "Company" or the "Group")

Trading update for the 13 weeks ended 4 July 2015

-- Q1 Branded sales down (1.4%); Group sales down (1.6%) reflecting earlier Easter

-- Market share gains in Cake, Ambient Desserts and Flavourings & Seasonings

-- Sweet Treats delivering increased volumes and sales following recent brand investment

-- Grocery brands demonstrating encouraging volume trends

-- Expectations for Full Year remain unchanged

Gavin Darby, Chief Executive Officer

"We are encouraged by the continued good volume and value

response of our brands in those areas where we have focused our

investment, although Branded sales in the quarter were impacted by

the earlier timing of Easter. While the business environment

remains challenging, our expectations for the year, including a

significant reduction in Net debt, remain unchanged."

Q1 Sales Grocery Sweet Group

Treats

% change

Branded (2.0%) 0.1% (1.4%)

Non-branded (9.8%) 11.1% (3.1%)

-------- -------- -------

Total (2.7%) 1.4% (1.6%)

Trading update

The Group's sales in the first thirteen weeks of the year were

GBP166.2m, with branded sales (1.4%) lower and total sales down

(1.6%). The Group's branded sales mix was slightly higher at 90.3%,

while gross margins in the quarter were in line with the prior

year. Non-branded sales were GBP0.5m lower with a strong

performance in Sweets Treats offset by declines in Grocery.

The slightly lower branded sales performance in the quarter was

affected by the timing of Easter this year, which impacted both the

Cake and Flavourings & Seasonings categories. This Easter

effect is equivalent to approximately 1 1/2 % of branded sales, and

therefore taking this into account, branded sales would have

otherwise delivered a broadly flat result in the quarter. Aside

from this effect, the Sweet Treats business has continued to enjoy

the benefits of renewed focus and marketing investment, delivering

both volume and value share growth and is expected to benefit from

new product launches over the coming months. In the Grocery

business, Bisto and Oxo sales performed well, while Loyd Grossman

sales were held back due to re-phasing of our annual promotional

plan.

In aggregate, the Company's market share was broadly flat across

its categories in the quarter, with gains in Cake, Flavourings

& Seasonings and Ambient Desserts offset by weaker performances

in Cooking Sauces and Light Meals. These trends are in line with

management expectations and reflect relative levels of marketing

and innovation investment by the Company in the respective

categories over the last twelve months.

Building on the Company's recent new product development

launches using gel pot technology, Oxo Stock Pots, a premium

gel-based stock product will be launched into market shortly. Other

products launched in the quarter which align to consumer trends of

premiumisation and foodieness include Loyd Grossman Pan Melts and

Sharwood's Stir Fry Melts. The Company is also launching a number

of exciting new Cadbury products into market this year. A range of

ambient desserts have just been introduced which are performing

ahead of expectations, and these will be followed by Cadbury Hot

Cakes and Cadbury Amaze Bites products which have received a very

encouraging response from our major customers. These launches will

be supported by television advertising with eight of the Company's

brands planned to benefit from such investment in this financial

year.

The Company's expectations for Net debt for the Full Year remain

unchanged. The Company recently reduced the size of its Debtors

securitisation facility from GBP120m to GBP80m, reflecting a

smaller debtor's book following the completion of the Hovis joint

venture transaction in 2014. The interest rate and maturity of the

facility are unchanged and the new GBP80m facility remains adequate

for the Company's requirements; as at 4 April 2015, GBP19.7m of the

facility was drawn.

Outlook

The Company's commitment to brand investment continues, with

consumer marketing expenditure planned to increase materially in

2015/16. While we expect the trading environment to remain

challenging, our expectations for the year, which include a

significant reduction in Net debt, are unchanged.

Ends

For further information, please contact:

Institutional investors and analysts:

Alastair Murray, Chief

Financial Officer +44 (0) 1727 815 850

Richard Godden, Head of

Investor Relations +44 (0) 1727 815 850

Media enquiries:

Richard Johnson, Group

Corporate Affairs Director +44 (0) 1727 815 850

Maitland +44 (0) 20 7379 5151

Greg Lawless

Tom Eckersley

Conference Call

A conference call for investors and analysts will take place on

23 July 2015 at 9.00am, details of which are outlined below. A

replay of the conference call will be available on the Company's

website later in the day.

http://www.premierfoods.co.uk/investors/results-centre

Telephone number: +44 20 7192 8000

Telephone number (UK Toll

free) 0800 376 7922

Conference ID: 83829272

Notes to editors:

1. All sales data is for the thirteen weeks to 4 July 2015 or 5

July 2014 as appropriate.

2. Q1 sales segmental disclosure:

Q1 Sales (GBPm) FY16 Q1 FY15 Q1 % Change

Grocery

Branded 110.1 112.4 (2.0%)

Non-branded 10.2 11.3 (9.8%)

-------- -------- ---------

Total 120.3 123.7 (2.7%)

Sweet Treats

Branded 40.0 39.9 0.1%

Non-branded 6.0 5.4 11.1%

-------- -------- ---------

Total 46.0 45.3 1.4%

-------- -------- ---------

Group

Branded 150.1 152.3 (1.4%)

Non-branded 16.2 16.7 (3.1%)

-------- -------- ---------

Total 166.3 169.0 (1.6%)

-------- -------- ---------

3. Gavin Darby, Chief Executive Officer, will make a short

presentation at the Company's Annual General Meeting, today, 23

July 2015. Included in this presentation are the following market

data statistics, sourced by IRI for 26 weeks ended 27 June

2015.

Category Volume Sales Share

growth

Flavourings & +2.2% - - -

Seasonings

Bisto +2.2% +1% +4% +0.4ppt

Oxo +2.2% +2% +2% +0.0ppt

Cake +2.1% - - -

Mr. Kipling +2.1% +13% +6% +0.7ppt

Cadbury +2.1% +19% +11% +0.6ppt

Certain statements in this Trading Update are forward looking

statements. By their nature, forward looking statements involve a

number of risks, uncertainties or assumptions that could cause

actual results or events to differ materially from those expressed

or implied by those statements. Forward looking statements

regarding past trends or activities should not be taken as

representation that such trends or activities will continue in the

future. Accordingly, undue reliance should not be placed on forward

looking statements.

A Premier Foods image gallery is available using the following

link:

http://www.premierfoods.co.uk/media/image-gallery

This information is provided by RNS

The company news service from the London Stock Exchange

END

TSTLFFILDDIFFIE

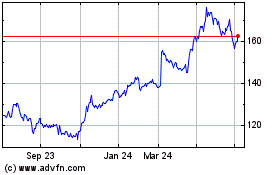

Premier Foods (LSE:PFD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Premier Foods (LSE:PFD)

Historical Stock Chart

From Apr 2023 to Apr 2024