Premier Foods plc Issuance of senior secured floating rate notes (1729H)

June 05 2017 - 9:02AM

UK Regulatory

TIDMPFD TIDMIRSH

RNS Number : 1729H

Premier Foods plc

05 June 2017

Premier Foods Plc

5 June 2017

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA, NEW

ZEALAND, JAPAN OR ANY OTHER JURISDICTION IN WHICH THE PUBLICATION,

DISTRIBUTION OR RELEASE WOULD BE UNLAWFUL. OTHER RESTRICTIONS ARE

APPLICABLE. PLEASE SEE THE IMPORTANT NOTICE AT THE END OF THE PRESS

RELEASE.

Premier Foods plc

ISSUANCE BY PREMIER FOODS FINANCE PLC

OF GBP210,000,000 SENIOR SECURED FLOATING RATE NOTES

Further to the announcement on 16 May 2017 of a proposed bond

issue and the announcement on 18 May 2017 of the pricing of the

offering by Premier Foods Finance plc (the "Issuer") of

GBP210,000,000 senior secured floating rate notes due 15 July 2022,

at three-month GBP LIBOR (floor: 0%) plus 500 bps, reset quarterly

(the "Notes"), Premier Foods plc ("Premier Foods") announced today

the closing of the offering of the Notes by the Issuer and the

receipt of proceeds thereof.

The gross proceeds of the offering will be used, together with

cash on hand, (i) to redeem GBP175,000,000 in aggregate principal

amount of the Issuer's senior secured floating rate notes due 2020

(the "2020 Notes"), (ii) to prepay outstanding indebtedness under

Premier Foods' revolving credit facility of up to GBP35,000,000 and

reduce the maximum capacity available under such facility by

GBP35,000,000, and (iii) to pay certain administrative costs,

expenses and fees in connection with the offering.

With the successful closing of this offering, the Issuer has

raised funds sufficient to redeem the outstanding 2020 Notes. As

such, the Refinancing Condition (as stated in the notice of

redemption with respect to the 2020 Notes issued on 16 May 2017)

has been satisfied, and the redemption of the 2020 Notes will occur

on 15 June 2017 as previously described in such notice.

For further information, please contact:

Institutional investors and analysts:

Alastair Murray, Chief Financial +44 (0) 1727 815

Officer 850

Richard Godden, Head of Investor +44 (0) 1727 815

Relations 850

Media enquiries:

Marisa Fitch, Head of External +44 (0) 1727 815

Affairs 850

Maitland +44 (0) 20 7379

Kate O'Neill 5151

THIS ANNOUNCEMENT IS FOR INFORMATIONAL PURPOSES ONLY AND DOES

NOT CONSTITUTE A PROSPECTUS OR ANY OFFER OF SECURITIES FOR SALE OR

A SOLICITATION OF AN OFFER TO PURCHASE ANY SECURITIES IN THE UNITED

STATES (AS DEFINED IN THE U.S. SECURITIES ACT OF 1933, AS AMENDED

(the "SECURITIES ACT")), OR IN ANY OTHER JURISDICTION.

Any securities referred to in this announcement have not been

and will not be registered under the Securities Act, or with any

securities regulatory authority of any state or other jurisdiction

of the United States, and may not be offered, sold, resold,

pledged, taken up, delivered, distributed or transferred, directly

or indirectly, into or within the United States except pursuant to

an exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and in compliance

with any applicable securities laws of any state or other

jurisdiction of the United States. No public offering of any

securities is being made in the United States.

This announcement may contain "forward-looking statements" that

are based on estimates and assumptions and are subject to risks and

uncertainties. Forward-looking statements are all statements other

than statements of historical fact or statements in the present

tense, and can be identified by words such as "targets", "aims",

"aspires", "assumes", "believes", "estimates", "anticipates",

"expects", "intends", "hopes", "may", "would", "should", "could",

"will", "plans", "predicts" and "potential", as well as the

negatives of these terms and other words of similar meaning. Any

forward-looking statements in this announcement are made based upon

Premier Foods' estimates, expectations and beliefs concerning

future events affecting the Group and subject to a number of known

and unknown risks and uncertainties. Such forward-looking

statements are based on numerous assumptions regarding the Group's

present and future business strategies and the environment in which

it will operate, which may prove not to be accurate. Premier Foods

cautions that these forward-looking statements are not guarantees

and that actual results could differ materially from those

expressed or implied in these forward-looking statements. Undue

reliance should, therefore, not be placed on such forward-looking

statements. Any forward-looking statements contained in this

announcement apply only as at the date of this announcement and are

not intended to give any assurance as to future results. Premier

Foods will update this announcement as required by applicable law,

including the Prospectus Rules, the Listing Rules, the Disclosure

and Transparency Rules, London Stock Exchange and any other

applicable law or regulations, but otherwise expressly disclaims

any obligation or undertaking to update or revise any

forward-looking statement, whether as a result of new information,

future developments or otherwise.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSSUFEIFWSEIM

(END) Dow Jones Newswires

June 05, 2017 09:02 ET (13:02 GMT)

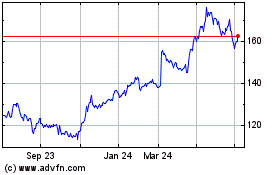

Premier Foods (LSE:PFD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Premier Foods (LSE:PFD)

Historical Stock Chart

From Apr 2023 to Apr 2024