Praxair Holds Merger Discussions With Germany's Linde

August 15 2016 - 8:02PM

Dow Jones News

By Eyk Henning and Dana Mattioli

Praxair Inc. is in discussions to combine with Germany's Linde

AG, people familiar with the matter said, in a deal that would

create the world's largest industrial-gas supplier and continue a

wave of consolidation in the industry.

Details of the talks couldn't be learned, and one person

cautioned they are fragile and could fall apart. If there is an

agreement, there is also no guarantee antitrust regulators would

approve it. A deal would combine companies each worth about $30

billion and rank as one of the largest tie-ups in a strong year for

mergers.

The news comes less than three months after two major rivals of

the companies combined, setting off another possible wave of

consolidation in an industry hit by declining energy prices and

sluggish economic growth. Air Liquide SA in May bought Airgas Inc.

for about $10 billion, enabling the French company to reclaim the

No. 1 spot among makers of gases used in manufacturing, food

production, health care and the like, with annual revenue of more

than $23 billion.

Munich-based Linde, which makes industrial and medical gases and

builds plants for chemical producers and others, had taken the No.

1 position from Air Liquide with its $14 billion takeover of the

U.K.'s BOC PLC in 2006. A combined Linde and Praxair would again

leapfrog Air Liquide, creating a company with more than $30 billion

in revenue -- before any divestitures.

But in the wake of the Airgas deal, some analysts questioned

whether antitrust regulators would allow another large takeover in

the industry.

What is now called Praxair was once part of Linde. Founded as

its American arm in 1907 and then known as Linde Air Products Co.,

the company developed so rapidly that by World War I it was bigger

than the German parent, according to Linde's website. In the early

part of last century, Linde Air Products was acquired by Union

Carbide Corp., which spun the company off in 1992 and named it

Praxair. Union Carbide is now part of Dow Chemical Co.

Based in Danbury, Conn., Praxair has 26,000 employees in more

than 50 countries and was the first company in the U.S. to produce

oxygen using a cryogenic process, according to its website.

The company in late July reported revenue in the first half of

the year slipped by nearly 6% to $5.17 billion, due mainly to

adverse currency moves. It also issued a downbeat outlook, warning

about the effects of economic sluggishness. Its shares, like those

of Linde, have significantly underperformed the S&P 500 in the

past five years.

Linde's revenue and operating profit in the first six months of

the year were also weighed down by currency shifts as well as weak

oil prices, which resulted in sluggish demand from energy companies

at its engineering unit. Linde's overall revenue fell by about 5%

to EUR8.56 billion ($9.57 billion) in the period.

Meanwhile, Air Liquide fell short of analysts' estimates in the

first half as the company was similarly weighed down by its

engineering division.

Should a deal between Praxair and Linde come to fruition, it

would continue a strong run for the mergers-and-acquisitions

market. The dollar volume of deals is down 22% from last year's

record level, but it still stands at more than $2 trillion,

according to Dealogic, which is strong by historic standards, as

low interest rates, sluggish economic growth and tie-ups by rivals

provide strong incentives for companies to merge.

Write to Eyk Henning at eyk.henning@wsj.com and Dana Mattioli at

dana.mattioli@wsj.com

(END) Dow Jones Newswires

August 15, 2016 19:47 ET (23:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

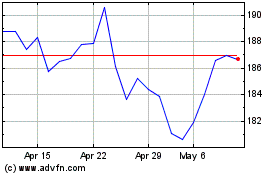

Air Liquide (EU:AI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air Liquide (EU:AI)

Historical Stock Chart

From Apr 2023 to Apr 2024