Praxair Holds Merger Discussions With Germany's Linde

August 15 2016 - 6:46PM

Dow Jones News

By Eyk Henning and Dana Mattioli

Praxair Inc. is in discussions to combine with Germany's Linde

AG, people familiar with the matter said, in a major deal that

would create the world's largest industrial-gas supplier and

continue a wave of consolidation in the industry.

Details of the talks couldn't be learned, and one person

cautioned they are fragile and could fall apart. If there is an

agreement, there is also no guarantee antitrust regulators would

approve it. A deal would combine companies each worth about $30

billion and rank as one of the largest tie-ups in a strong year for

mergers.

The news comes less than three months after two major rivals of

the companies combined, setting off another possible wave of

consolidation in an industry hit by declining energy prices and

sluggish economic growth. Air Liquide SA in May bought Airgas Inc.

for about $10 billion, enabling the French company to reclaim the

number one spot among makers of gases used in manufacturing, food

production, health care and the like, with annual revenue of more

than $23 billion.

Munich-based Linde, which makes industrial and medical gases and

builds plants for chemical producers and others, had taken the No.

1 position from Air Liquide with its $14 billion takeover of the

UK's BOC PLC in 2006. A combined Linde and Praxair would again

leapfrog Air Liquide, creating a company with more than $30 billion

in revenue.

But in the wake of the Airgas deal, some analysts questioned

whether antitrust regulators would allow yet another large takeover

in the industry.

Write to Eyk Henning at eyk.henning@wsj.com and Dana Mattioli at

dana.mattioli@wsj.com

(END) Dow Jones Newswires

August 15, 2016 18:31 ET (22:31 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

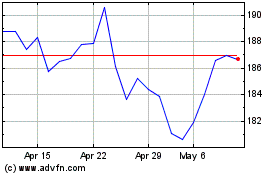

Air Liquide (EU:AI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air Liquide (EU:AI)

Historical Stock Chart

From Apr 2023 to Apr 2024