Pound Up As 'In' Camp Widens Lead; BoE Sees Pickup In Inflation

May 24 2016 - 3:15AM

RTTF2

The pound drifted higher against its key counterparts in

European trading on Tuesday, as latest poll results showed surging

support for the U.K.'s membership in the European Union and as the

Bank of England estimates the U.K. inflation to rise gradually this

year.

The latest ORB Telegraph poll showed the supporters for remain

camp surged to 55 percent, a 13-point lead over the 'Leave'

campaign, whose campaigners stood just 42 percent.

The poll found older voters and Conservative supporters, who

relied on Brexit, have turned to the pro-EU campaign.

In its annual report, the BoE concluded that the UK inflation is

likely to rise gradually through 2016, while the Brexit could slow

growth and weaken the currency exchange rate.

Speaking before the Treasury Select Committee, the BoE governor

Mark Carney said that the monetary policy committee is united about

the assessment on material negative impact on U.K. economy, if

Britain votes to leave the EU.

The BoE chief indicated that the U.K. interest rate may probably

rise, if Britain remains in the EU, contrary to the Brexit vote

that reduces chance of a rate rise.

In economic front, figures from the Office for National

Statistics showed that the U.K. budget deficit narrowed less than

expected in April.

Public sector net borrowing excluding public sector banks

decreased GBP 0.3 billion from last year to GBP 7.2 billion in

April. It was forecast to fall to GBP 6.4 billion.

The pound was trading mixed in Asian deals. While the currency

rose against the yen and the franc, it held steady against the euro

and the greenback.

The pound appreciated to 0.7644 against the euro, its strongest

since February 4, and a 1.3 percent rise from Monday's closing

value of 0.7746. The pound is seen finding resistance around the

0.75 mark.

Survey from the Centre for European Economic Research or ZEW

showed that Germany's economic sentiment weakened for the first

time in three months, defying expectations for improvement as

financial experts do not expect the strong performance of the

economy in the first quarter to continue.

The ZEW Indicator of Economic Sentiment for Germany dropped to

6.4 from 11.2 in April. Economists had forecast a score of 12.

The pound spiked up to a 5-day high of 1.4622 against the

dollar, up from yesterday's closing quote of 1.4483. If the

pound-dollar extends rise, 1.48 is likely seen as its next

resistance level.

The pound firmed to 1.4508 against the franc, a level unseen

since February 4. This marks a 1.3 percent gain from an early 6-day

low of 1.4317. Continuation of the pound's uptrend may see it

challenging resistance around the 1.47 region.

Data from the Federal Customs Administration showed that

Switzerland's trade surplus increased in April as exports recovered

amid a fall in imports.

The trade surplus increased to CHF 2.5 billion in April from CHF

2.2 billion in March.

Reversing from an early low of 158.10 against the Japanese yen,

the pound rose to a 4-day high of 160.31. Continuation of the

pound's uptrend may see it challenging resistance around the 162.5

region.

Looking ahead, U.S. new home sales data for April and U.S.

Richmond Fed manufacturing index for May are set to be published in

the New York session.

At 9:00 am ET, the euro area finance ministers are scheduled to

meet in Brussels.

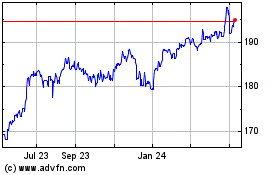

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024