Pound Rises Amid Risk Appetite

August 05 2015 - 5:34AM

RTTF2

The British pound strengthened against the other major

currencies in the early European session on Wednesday amid risk

appetite, as European shares rose tracking the gains from Asian

trading on the back of some upbeat reading on China's services

sector.

The U.K.'s FTSE 100 index is currently up 0.21 percent or 13.76

points at 6,700, France's CAC 40 index is down 0.86 percent or

43.95 points at 5,156 and Germany's DAX is down 0.92 percent or

105.02 points at 11,561.

Data from Caixin showed that the services sector in China

continued to expand in July, and at an accelerated pace, with a PMI

score of 53.8. That's up from 51.8 in June, and it moves further

above the boom-or-bust level of 50 that separates expansion from

contraction.

Investors await Friday's U.S. jobs report for more clues about

the timing of rate hike after hawkish comments from a Fed official

on interest-rate increases.

Federal Reserve Bank of Atlanta President Dennis Lockhart

expressed his support for raising rates in September.

In an interview with The Wall Street Journal, Lockhart told that

it would take "a significant deterioration in the economic picture"

to persuade the Fed not to raise rates in September. He also said

that only a "significant deterioration" in economic momentum could

convince him to wait longer.

The currency showed mixed reaction to the U.K. PMI report. While

the U.S. dollar, the yen and the Swiss franc changed little, it

rose against the euro.

Data from Markit Economics showed that the U.K. services sector

growth slowed more than expected in July. Still the survey signaled

strong growth in the dominant services sector moving into the

second half of 2015.

The Markit/Chartered Institute of Procurement & Supply

Purchasing Managers' Index fell to 57.4 in July, from 58.5 in June.

It was forecast to drop marginally to 58 in July.

In other economic news, the National Institute of Economic and

Social Research said that the U.K. economy is set to see a

reasonable pace of growth in the second half of the year driven by

consumption and business investment. The growth outlook for 2015

was retained at 2.5 percent. The think tank said growth will remain

close to this rate throughout the forecast period.

In the Asian trading today, the pound held steady against its

major rivals.

In the European trading now, the pound rose to nearly a 7-month

high of 1.5282 against the Swiss franc, more than a 2-week high of

0.6964 against the euro and a 2-day high of 194.09 against the yen,

from early lows of 1.5189, 0.6997 and 193.19, respectively. If the

pound extends its uptrend, it is likely to find resistance around

1.58 against the franc, 0.68 against the euro and 195.00 against

the yen.

Against the U.S. dollar, the pound advanced to 1.5605 from an

early 9-day low of 1.5525. The pound may test resistance around the

1.58 area.

Looking ahead, U.S. private sector jobs data for July, trade

balance for June, U.S. services PMI for July and Canada trade data

for June are slated for release in the New York session.

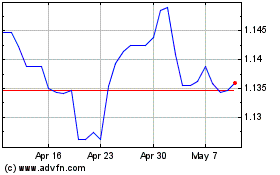

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024