Pound Rises Ahead Of U.K. General Election

April 27 2015 - 4:08AM

RTTF2

The British pound strengthened against most major currencies in

the Asian session on Monday, as some hedge funds bet on a risk-free

election and government, as the general election draws closer.

Several hedge funds bet that the aftermath of the May 7 election

result would be risk-free for the Sterling, even if it delivers a

hung parliament with an unstable coalition government.

Polls also show a 'hung parliament' in which no single party

commands a majority is likely.

Traders also focus on next week's election campaigns.

Sentiment also improved, as the minutes of Bank of England's

latest recent monetary policy meeting hinted at a

sooner-than-expected rate hike.

Meanwhile, Asian stock markets are mostly in positive territory,

as higher commodity prices lifted resource stocks. Investors also

focused on corporate earnings.

Last Friday, the Pound showed mixed trading against its major

rivals. While the Pound rose against the U.S. dollar and the Yen,

it held steady against the Swiss franc. Against the euro, the Pound

fell.

In the Asian trading today, the pound rose to nearly a 2-month

high of 1.5189 against the U.S. dollar, from an early low of

1.5141. If the pound extends its uptrend, it is likely to find

resistance around the 1.54 area.

Against the Swiss franc, the pound advanced to a 4-day high of

1.4515 from Friday's closing value of 1.4478. The next possible

upside target for the pound is seen at 1.51 level.

The pound edged up to 180.73 against the yen, from last week's

closing value of 180.59. At Friday's close, the pound was trading

at 184.25 against the yen. The pound is likely to find resistance

around 184.00 region.

Looking ahead, Markit's flash U.S. PMI for March is slated for

release in the New York session.

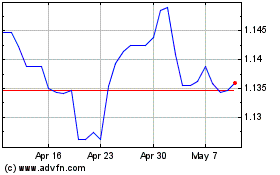

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024