Pound In Positive Territory As Chancellor Ups 2016 GDP Outlook

November 25 2015 - 4:36AM

RTTF2

The pound was higher against its major rivals in early New York

deals on Wednesday, after U.K. Chancellor of the Exchequer George

Osborne lifted economic growth forecast for next year, while saying

that Britain has seen the fastest growth among the G-7 nations

since 2010.

Speaking to lawmakers in the House of Commons, Osborne argued

that the economic growth had not been driven by an irresponsible

banking boom, like in the last decade. "We're determined that this

will be an economic recovery for all, felt in all parts of our

nation," he claimed.

The Office for Budget Responsibility left its economic growth

forecast unchanged at 2.4 percent for 2015. It raised its outlook

for 2016 to 2.4 percent, from its July predictions of 2.3 percent

growth.

However, Britain's budget deficit forecast has been widened to

3.9 percent of gross domestic product this year from 3.7 percent

seen in July.

In other economic news, U.K. mortgage approvals increased in

October and gross mortgage lending reached a seven year high,

according to a report from the British Bankers' Association.

The number of mortgages approved in October rose to 45,437 from

44,825 in September. It was also below the expected level of

44,500.

The currency has been higher against most major rivals in

European deals, amid a rise in European stocks.

Reversing from an early low of 1.5056 against the greenback, the

pound rebounded to 1.5124. On the upside, the pound is likely to

find resistance around the 1.52 mark.

Data from the Commerce Department showed that new orders for

U.S. manufactured durable goods increased by much more than

expected in the month of October.

The durable goods orders jumped by 3.0 percent in October after

falling by a revised 0.8 percent in September.

The pound, having declined to 1.5308 against the Swiss franc at

2:45 am ET, edged up to 1.5420. The next resistance for the pound

may possibly be found around the 1.55 level.

Figures from the UBS bank showed that Switzerland's consumption

increased slightly in October, driven by better retail trade

prospects along with brighter consumer confidence.

The consumption indicator rose to 1.60 in October from 1.56 in

the previous month, which was revised down from 1.65.

The pound reached as high as 0.7016 against the euro, following

a decline to 0.7080 at 2:55 am ET. The pound is seen finding

resistance near the 0.69 zone.

Financial market risks stemming from emerging markets,

especially China, are rising, while the limited direct exposure of

the euro area banks to these markets reduces the impact, the

European Central Bank said in a report.

"Occasional bouts of financial market volatility suggest that

vulnerabilities stemming from emerging markets are increasing. Of

particular concern is the outlook for China, given its growing role

in the world economy," the ECB said in its latest bi-annual

Financial Stability Review.

The pound climbed to 185.24 against its Japanese counterpart, up

from 184.73 hit late New York Tuesday. If the pound extends rise,

it may locate resistance around the 186.5 area.

Bank of Japan policymaker Sayuri Shirai said core inflation is

likely to rise to the 2 percent target by around spring 2017, a

delay of about a quarter from the official projection.

Core inflation will accelerate and reach about 1.7-1.8 percent,

or rise closer to around 2 percent from the January to March 2017

to the April-June quarter, Shirai said.

Looking ahead, U.S. new home sales data for October, University

of Michigan's final consumer sentiment index for November and U.S.

crude oil inventories data are set to be published shortly.

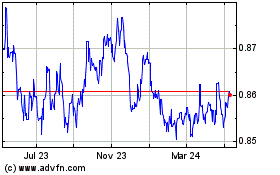

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

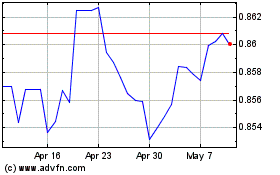

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024