Pound Higher As European Shares Advance

February 10 2016 - 1:38AM

RTTF2

The pound was trading in a positive territory in European

trading on Wednesday, as European shares rose on the back of

positive corporate earnings and M&A activity.

Investors also cheered the rebound in oil, after news that Iran

is ready to talk with Saudi Arabia over the current conditions in

international oil markets.

Focus also shift towards semi-annual testimony from the Federal

Reserve Chair Janet Yellen later today, which could shed more light

on the Fed's policy outlook.

Deteriorating global outlook and volatility in financial markets

since December have arose speculation that Yellen may concede about

her change in plan to hike rate four times this year.

Data from the Office for National Statistics showed that British

industrial production declined at a faster pace in December.

Industrial production fell 1.1 percent month-on-month, faster

than November's 0.8 percent drop. Economists had forecast output to

remain flat in December. This was the second consecutive fall in

production.

Manufacturing output dropped at a pace of 0.2 percent,

confounding expectations for a 0.1 percent rise. In November,

output had fallen 0.3 percent.

The pound held steady against most majors in Asian deals.

In European trading now, the pound climbed to a 2-day high of

1.4535 against the greenback, off its early low of 1.4435. At

Tuesday's close, the pair was valued at 1.4467. The pound is seen

finding resistance around the 1.48 zone.

Reversing from an early low of 165.28 against the yen, the pound

firmed to a 2-day high of 167.28. On the upside, 168.00 is possibly

seen as its next resistance level.

Data from the Bank of Japan showed that Japan's producer prices

fell 0.9 percent on month in January.

That missed forecasts for a decline of 0.7 percent following the

0.4 percent contraction in December.

The pound advanced to 0.7745 against the European currency,

following a decline to 0.7819 at 8:30 pm ET. The pair was worth

0.7800 when it ended yesterday's trading. The next possible

resistance for the pound may be located around the 0.76 mark.

The pound appreciated to 1.4162 against the Swiss franc, up by

0.84 percent from its early low of 1.4044. The pound is poised to

target resistance around the 1.44 area.

Looking ahead, the NIESR U.K. GDP estimate for January and U.S.

Federal budget statement for January are due to be released in the

New York session.

At 9:00 am ET, European Central Bank Board member Peter Praet

will deliver keynote speech at the "Lender of Last Resort: An

International perspective" conference organized by Harvard

University in Washington.

At 1:30 pm ET, Federal Reserve Bank of San Francisco President

John Williams is scheduled to speak before the 2016 National

Interagency Community Reinvestment Conference, "Pathways to

Economic Opportunity," in Los Angeles.

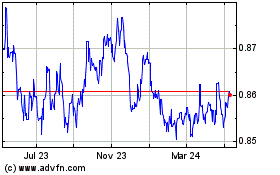

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

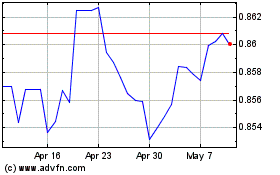

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024