Pound Falls Amid Risk Aversion

February 08 2016 - 12:03AM

RTTF2

The British pound weakened against the other major currencies in

the early European session on Monday amid risk aversion, as

investors focus on the Federal Reserve's next interest rate hike

path.

The U.K.'s FTSE 100 index is currently down 1.02 percent or

59.58 points at 5,788, France's CAC 40 index is down 1.72 percent

or 72.30 points at 4,128 and Germany's DAX is down 1.65 percent or

153.25 points at 9,134.

Federal Reserve Chair Janet Yellen will be on Capitol Hill for

two days of testimony as investors anxiously await further clues on

the next interest rate hike.

The latest jobs report painted a murky picture of the U.S.

economy, with a slowdown in the pace of hiring but a decrease in

the overall rate of unemployment and better-than-expected wage

growth.

In the Asian session today, the pound rose against its major

rivals.

In the early European trading, the pound fell to 0.7711 against

the euro and 169.52 against the yen, from early 4-day highs of

0.7661 and 170.63, respectively. If the pound extends its

downtrend, it is likely to find support around 0.78 against the

euro and 164.00 against the yen.

Against the U.S. dollar and the Swiss franc, the pound dropped

to 1.4484 and 1.4378 from early highs of 1.4547 and 1.4449,

respectively. The pound may test support near 1.42 against the

greenback and 1.41 against the franc.

Looking ahead, Canada housing starts for January and building

permits for December and U.S. labor market conditions index for

January are set to be published in the New York session.

At 12:05 pm ET, Bank of Canada Deputy Governor Timothy Lane will

deliver a speech titled "Monetary Policy and Financial

Stability—Using the Right Tools" at the HEC Montreal.

Chinese banks will be closed in observance of the Spring

Festival holiday.

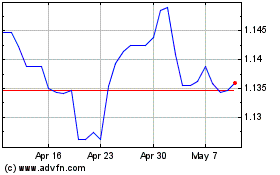

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024