Pound Falls Amid Risk Aversion, Weaker-than-expected Retail Sales

June 15 2017 - 1:31AM

RTTF2

The pound declined against its major counterparts in the early

European session on Thursday, amid risk aversion after the hawkish

Fed statement and news of U.S. President Donald Trump being

investigated for obstruction of justice in Russia probe, as well as

on weaker than expected domestic retail sales data.

The Federal Reserve raised its key interest rate by 25 basis

points and unveiled additional plans to tighten monetary policy

despite growing concerns over weak inflation.

The U.S. central bank also said it would start "gradual"

shrinking of its $4.5 trillion balance sheet this year, provided

that the economy evolves broadly as anticipated.

The Washington Post reported that U.S. President Donald Trump is

being investigated by special counsel Robert Mueller for possible

obstruction of justice.

Investigators are also looking for any evidence of possible

financial crimes among Trump associates, the report showed.

Figures from the Office for National Statistics showed that UK

retail sales declined more than expected in May.

Retail sales volume including auto fuel declined 1.2 percent

month-on-month in May, reversing a 2.5 percent rise in April. Sales

were forecast to drop 0.8 percent.

The Bank of England meets today for monetary policy meeting, but

no changes to policy are expected after Prime Minister Theresa May

lost the Conservative parliamentary majority at the June 8 general

election.

The pound has been trading lower against most major rivals in

the Asian session.

The pound edged down to 139.19 against the yen, compared to

139.70 hit late New York Wednesday. The pound is seen finding

support around the 138.00 region.

The pound that closed Wednesday's trading at 1.2751 against the

greenback slipped to a 2-day low of 1.2697. The next possible

support for the pound-greenback pair is seen around the 1.26

level.

Reversing from an early high of 0.8781 against the euro, the

pound eased to 0.8804. If the pound extends slide, 0.89 is likely

seen as its next support level.

The pound, having advanced to 1.2393 against the Swiss franc at

7:15 pm ET, reversed direction and dropped to 1.2359. Continuation

of the pound's downtrend may see it challenging support around the

1.22 mark.

The Swiss National Bank maintained its expansionary monetary

policy and reaffirmed its stance to remain active in the foreign

exchange market to prevent the franc from appreciating.

The interest rate on sight deposits at the central bank was kept

unchanged at -0.75 percent and the target range for the three-month

Libor was retained between -1.25 percent and -0.25 percent.

Looking ahead, U.S. weekly jobless claims for the week ended

June 10, NAHB housing market index for June, import price index and

industrial production for May, as well as Canada manufacturing

sales for April are set for release in the New York session.

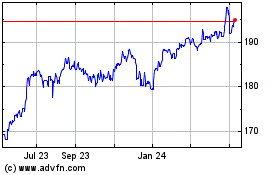

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs Yen (FX:GBPJPY)

Forex Chart

From Apr 2023 to Apr 2024