Pound Extends Rise On Strong U.K. GDP Data

July 28 2015 - 5:45AM

RTTF2

The British pound continued to be strong against the other major

currencies in the early European session on Tuesday, after data

showed that U.K. economy expanded at a faster pace in the second

quarter largely driven by an improvement in services output.

Data from the Office for National Statistics showed that U.K.

gross domestic product grew 0.7 percent sequentially, in line with

forecast, following a 0.4 percent rise in the first quarter.

Services expanded 0.7 percent and production increased 1 percent.

While construction growth showed flat growth, agriculture

contracted 0.7 percent.

GDP was 2.6 percent higher in the second quarter compared with

the same quarter a year ago. Annual figure also matched

expectations.

Another report from ONS said the latest index of services

suggested that output increased by 0.3 percent in May from April,

when it climbed 0.2 percent. The monthly growth rate came in line

with expectations. On a yearly basis, services output advanced 2.7

percent.

The focus also remains on the two-day U.S. Federal Reserve

meeting that begins later in the day. Analysts do not expect the

Fed to raise interest rates before September but traders will be

scrutinizing the statement for any hints about the timing of the

first rate hike.

Meanwhile, the European stocks traded higher, lifted by company

earnings results and M&A activities. The investors watch the

Chinese stocks, as the stock market turmoil in China caused ripple

effects across global equity and commodity markets on Monday.

Chinese shares wavered between gains and losses today as

authorities scrambled once again to stave off a full-blown market

collapse.

The People's Bank of China said on Tuesday it would inject 50

billion yuan ($8.05 billion) into the money markets via open-market

operations in its biggest liquidity injection since July 7. The

central bank also hinted at further monetary easing using "various

monetary tools" to help ease fears about the impact of stock market

volatility on the broader economy.

The currency traded higher in the Asian trading.

In the early European trading now, the pound rose to a 6-day

high of 1.5032 against the Swiss franc and a 5-day high of 192.59

against the yen, from early lows of 1.4946 and 191.44,

respectively. If the pound extends its uptrend, it is likely to

find resistance around 1.52 against the franc and 194.50 against

the yen.

Against the U.S. dollar and the euro, the pound advanced to

1.5586 and 0.7096 from early lows of 1.5527 and 0.7129,

respectively. The pound may test resistance around 1.56 against the

greenback and 0.69 against the euro.

Looking ahead, Canada industrial product and raw materials price

indices for June and U.S. S&P/Case-Shiller home price index for

May, Markit's preliminary U.S. service sector PMI report for July

and U.S. consumer confidence for July are slated for release in the

New York session.

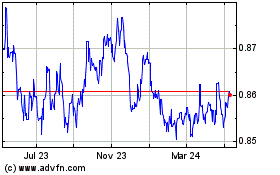

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

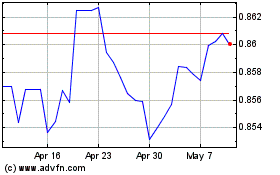

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024