Pound Declines As U.K. Services PMI Falls Unexpectedly

March 04 2015 - 5:10AM

RTTF2

The British pound weakened against the other major currencies in

the early European session on Wednesday, after U.K. service sector

expansion slowed unexpectedly in February.

Data from Markit showed that the Markit/Chartered Institute of

Purchasing and Supply Purchasing Managers' Index for the service

sector decreased to 56.7 in February from 57.2 in January. The

score was forecast to rise to 57.5.

This marked the twenty-sixth month of expansion.

The European Central Bank policy makers are due to meet in

Cyprus for a 2-day monetary policy meeting on Thursday. Traders

focus on the commencement of the bank's quantitative easing

program. The bank will provide further details on its 1 trillion

euro ($1.118 trillion) government bond-buying program, which begins

this month.

In the Asian session, the Pound held steady against the other

major currencies.

In the European trading today, the pound fell to 1.5325 against

the U.S. dollar for the first time since February 17, from an early

high of 1.5371. If the pound extends its downtrend, it is likely to

find support around the 1.51 area.

Against the yen, the pound dropped to a 9-day low of 183.36 from

an early high of 183.98. On the downside, 180.01 is seen as the

next support level for the pound.

The pound fell slightly to 1.4770 against the Swiss franc, from

an early more than a 1-1/2-month high of 1.4794. The pound may test

support near the 1.40 area.

Against the euro, the pound fell slightly to 0.7254 from an

early more than 7-year high of 0.7235. The pound is likely to find

support near the 0.75 region.

Looking ahead, Markit's U.S. PMI, ISM U.S. non-manufacturing PMI

and private sector employment report - all for February are slated

for release in the New York session.

At 9:00 am ET, U.S. Federal Reserve Bank of Chicago President

Charles Evans will deliver a speech about the economic outlook and

monetary policy at the Lake Forest-Lake Bluff Rotary Club 2015

Economic Breakfast in Lake Forest.

Around 45 minutes later, Bank of England's Deputy Governor

Andrew Bailey is expected to speak on currency at Treasury

Committee Hearing, U.K.

The Bank of Canada will announce its interest rate decision at

10:00 am ET. Economists expect the bank to retain interest rates

unchanged at 0.75 percent.

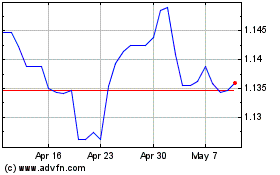

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024