As filed with the Securities and Exchange Commission on December 11, 2015

Registration No. 333-201881

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 2 to

FORM S-1 ON FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PANGAEA LOGISTICS SOLUTIONS LTD.

(Exact name of registrant as specified in its charter)

|

| | | | |

Bermuda

(State or other jurisdiction of

incorporation or organization) | | 4412

(Primary Standard Industrial

Classification Code Number) | | Not Applicable

(I.R.S. Employer

Identification Number) |

Pangaea Logistics Solutions Ltd.

109 Long Wharf

Newport, Rhode Island 02840

(401) 846-7790

(Address, including Zip Code, and Telephone Number, including Area Code, of Registrant’s Principal Executive Offices)

Anthony Laura

Trudy Coleman

Pangaea Logistics Solutions Ltd.

109 Long Wharf

Newport, Rhode Island 02840

(401) 846-7790

(Name, Address, including Zip Code, and Telephone Number, including Area Code, of Agent for Service)

Copies to:

Kirk A. Radke, Esq.

Willkie Farr & Gallagher LLP

787 7th Avenue

New York, NY 10019-6099

Telephone: (212) 728-8996

Telecopy: (212) 728-9996

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date hereof.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box: o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box: o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box: o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer o | Accelerated filer o | Non-accelerated filer o

(Do not check if a

smaller reporting company) | Smaller reporting company x |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On February 2, 2015, Pangaea Logistics Solutions Ltd. (the “Company”) filed a registration statement with the Securities and Exchange Commission (the “SEC”) on Form S-1 (Registration No. 333-201881), which was amended by Pre-Effective Amendment No. 1 filed with the SEC on March 11, 2015 and Pre-Effective Amendment No. 2 filed with the SEC on July 2, 2015 (as amended, the “Form S-1”). The Form S-1 was declared effective by the SEC on July 22, 2015 and registers for resale by the selling stockholders named in the prospectus up to 291,953 shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”).

The Company is filing this Post-Effective Amendment No. 2 to convert the Form S-1 into a registration statement on Form S-3, and it contains an updated prospectus relating to the offering and sale of the shares of Common Stock that were registered for resale on the Form S-1. All applicable registration and filing fees payable in connection with the registration of the shares of Common Stock covered by the registration statement were paid by the Company at the time of the initial filing of the Form S-1.

The information in this prospectus is not complete and may be changed. We and the Selling Shareholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED December 11, 2015

PRELIMINARY PROSPECTUS

291,953 Common Shares

Pangaea Logistics Solutions Ltd.

This Prospectus relates to the offer and sale of: (i) up to 29,441 shares of our common stock by Dinan & Company, LLC (“Dinan”) which Dinan received from us pursuant to a Letter Agreement, dated as of October 1, 2014; (ii) up to 176,644 shares of our common stock by EarlyBirdCapital, Inc. (“EBC”) which EBC received from us pursuant to a Letter Agreement, dated as of October 1, 2014; and (iii) up to 85,868 shares of our common stock by Jefferies LLC (“Jefferies”), which Jefferies received from us in connection with providing services to the Company in connection with its merger with Quartet Merger Corp. (“Quartet”), collectively, (the “Selling Shareholders"). The registration of the offer and sale of securities covered by this prospectus does not necessarily mean that any of the securities will be offered or sold by the Selling Shareholders.

We will not receive any cash proceeds from the selling shareholders from the offer and sale of the common shares described in this registration statement. The common shares issued to Dinan, EBC and Jefferies were issued in lieu of cash fees payable to each such party in connection with the merger of the Company and Quartet that was consummated on October 1, 2014.

The selling shareholders may offer the securities from time to time directly or through underwriters, broker-dealers or agents and in one or more public or private transactions and at fixed prices, prevailing market prices, at prices related to prevailing market prices or at negotiated prices. If these securities are sold through underwriters, broker-dealers or agents, the selling shareholders will be responsible for underwriting discounts or commissions or agents’ commissions. See the sections entitled “Plan of Distribution” and “About this Prospectus” for more information.

Our common stock is currently quoted on the Nasdaq Capital Market (“Nasdaq”) under the symbol “PANL”. The closing price of our common stock on December 10, 2015 was $2.74 per share.

Investing in our common stock involves risk. See “Risk Factors” beginning on page 9 of this Prospectus to read about factors you should consider before investing in our common shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this Prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is December 11, 2015

This prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process. Under this shelf registration process, the selling stockholders named in this prospectus or any supplement to this prospectus may, from time to time, offer and sell the common stock described in this prospectus in one or more offerings. This prospectus generally describes Pangaea Logistics Solutions Ltd. and the common stock that our selling stockholders may offer. We may file a prospectus supplement that contains specific information about the terms of a particular offering of common stock by the selling stockholders. We may also authorize one or more free writing prospectuses to be provided to you that may contain material information relating to these offerings. We may also add or update in aprospectus supplement (and in any related free writing prospectus that we may authorize to be provided to you) any of the information contained in this prospectus or in the documents that we have incorporated by reference into this prospectus. We urge you to carefully read this prospectus, any applicable prospectus supplement, and any related free writing prospectus, together with the information incorporated by reference in the foregoing, before buying any of the common stock being offered by a selling shareholder.

You should rely only on the information contained in this prospectus, any prospectus supplement, and the documents we have incorporated by reference. We have not authorized any dealer, salesperson, or other person to provide you with additional or different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus and any prospectus supplement are not an offer to sell or the solicitation of an offer to buy any securities other than the securities to which they relate and are not an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make an offer or solicitation in that jurisdiction. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus, or that the information contained in any document incorporated by reference is accurate as of any date other than the date of the document incorporated by reference, regardless of the time of delivery of this prospectus or any sale of a security. Our business, financial condition, results of operations, and prospects may have changed since then.

This prospectus contains summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed as exhibits to the registration statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where You Can Find Additional Information.”

Unless otherwise indicated, all references in this prospectus to “Pangaea,” the “Company,” “we,” “our,” “us” and like terms refer collectively to Pangaea Logistics Solutions Ltd. and its consolidated subsidiaries.

TABLE OF CONTENTS

We have not authorized any dealer, salesperson or other person to give any information or represent anything not contained in this prospectus. You should not rely on any unauthorized information. This prospectus does not offer to sell or buy any shares in any jurisdiction in which it is unlawful. The information in this prospectus is current as of the date on the cover. You should rely only on the information contained or incorporated by reference in this prospectus.

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus or incorporated by reference into this prospectus from our Annual Report on Form 10-K for the year ended December 31, 2014 and our other filings with the SEC listed in the section of this prospectus entitled "Incorporation of Documents By Reference." This summary does not contain all of the information that you should consider before investing in our common shares. You should read this entire prospectus, including the section entitled “Risk Factors,” and our financial statements and the notes thereto in our most recent Annual Report on Form 10-Q or Quarterly Report on Form 10-Q, which are incorporated by reference herein, before making an investment decision.

Overview

On April 30, 2014, the Company (formerly known as “Quartet Holdco Ltd.”) entered into an Agreement and Plan of Reorganization (the “Merger Agreement”) with Quartet, Quartet Merger Sub Ltd. (“Merger Sub”), Bulk Partners (Bermuda), Ltd. (at the time, Pangaea Logistics Solutions Ltd., now known as “Bulk Partners” or “Former Pangaea”), and the security holders of Bulk Partners (“Former Pangaea Holders”), which contemplated (i) Quartet merging with and into the Company, with the Company surviving such merger as the publicly-traded entity and (ii) Merger Sub merging with and into Bulk Partners with Bulk Partners surviving such merger as a wholly-owned subsidiary of the Company (collectively, the “Mergers”). On September 26, 2014, Bulk Partners’ Board of Directors, acting by unanimous written consent, approved the Merger Agreement and the Mergers. On September 29, 2014, Quartet held a special meeting in lieu of annual meeting of stockholders, at which the Quartet stockholders considered and adopted, among other matters, the Merger Agreement and the Mergers. On October 1, 2014, the parties consummated the Mergers.

This Prospectus relates to the offer and sale of: (i) up to 29,441 shares of our common stock by Dinan & Company, LLC (“Dinan”) which Dinan received from us pursuant to a Letter Agreement, dated as of October 1, 2014; (ii) up to 176,644 shares of our common stock by EarlyBirdCapital, Inc. (“EBC”) which EBC received from us pursuant to a Letter Agreement, dated as of October 1, 2014; and (iii) up to 85,868 shares of our common stock by Jefferies LLC (“Jefferies”), which Jefferies received from us in connection with providing services to the Company in connection with its merger with Quartet Merger Corp. (“Quartet”), collectively, (the “Selling Shareholders).” The registration of the offer and sale of securities covered by this prospectus does not necessarily mean that any of the securities will be offered or sold by the selling shareholders.

We will not receive any cash proceeds from the Selling Shareholders from the offer and sale of the common shares described in this registration statement. The common shares issued to Dinan, EBC and Jefferies were issued in lieu of cash fees payable to each such party in connection with the merger of the Company and Quartet that was consummated on October 1, 2014.

Pangaea is a growth-oriented global logistics company that utilizes its logistics experience and assets to service a broad base of industrial customers who require the transportation of a wide variety of drybulk cargoes, including grains, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite and limestone.

Pangaea derives its revenue from (i) contracts of affreightment (“COAs”), which are contracts to transport multiple shipments of cargo during the term of the contract between specified load and discharge ports, at a fixed or variable price per metric ton of cargo, (ii) voyage charters, under which a vessel carries a shipment of cargo for a customer on a specified route for a fixed price per metric ton of cargo, and (iii) time charters, during which the vessel is dedicated solely to the charterer for the term of the agreement. A majority of Pangaea’s revenue is from COA’s and voyage charters, as Pangaea’s focus is on transporting cargo for its customers. Pangaea’s COAs typically extend for a period of one to five years, although some extend for longer periods. A time charter may vary from a single trip to longer-term charters, whenever Pangaea deems such use to be in its commercial interest. The length of a voyage depends on the number of load and discharge ports, the time spent in such ports and the distance between the ports. Pangaea attempts, through selecting COAs and voyage contracts on what would normally be backhaul or “ballast” legs, to enhance vessel utilization and its profitability because these contracts and charters position vessels at or near loading areas where spot cargoes are typically obtained. This reduces ballast time and expense as a percentage of the vessel’s total revenue and increases expected earnings for the vessel.

Pangaea utilizes its logistics expertise to service a broad base of industrial customers who require the transportation of a wide variety of drybulk cargoes, including grains, pig iron, hot briquetted iron, bauxite, alumina, cement clinker, dolomite and limestone. Pangaea addresses the transportation needs of its customers by undertaking a comprehensive set of services and activities, including cargo loading, cargo discharge, vessel chartering, voyage planning, and technical vessel management. In particular, Pangaea has historically focused on providing such services for backhaul routes. In addition, Pangaea has developed

customized shipping routes, which Pangaea believes create value for its customers and its shareholders by both reducing the time and cost of transportation between ports and increasing cargo carried per voyage. For example, in 2010, Pangaea was the first non-Russian vessel operator to carry drybulk cargoes from Europe to Asia via the Northern Sea Route. Similarly, in 2013, Pangaea was the first vessel operator to carry drybulk cargo from the West Coast of Canada to Europe via the Northwest Passage. Pangaea is the leading transporter of bauxite from Jamaica to the United States, carrying on average more than 3.5 million tons per year. Pangaea believes that its experience in carrying a wide range of cargoes, pioneering new routes, and serving less common ports increases its opportunities to secure higher margins than in more commoditized cargoes and routes. Pangaea believes that providing such specialized drybulk transportation logistics services together with its long-term commercial and contractual relationships makes Pangaea less vulnerable to industrial and economic cycles as compared to other bulk-shipping operators. Finally, Pangaea believes that it can create value by serving and focusing on customer needs rather than depending on its correct anticipation of future charter rates.

Pangaea uses a mix of owned and chartered-in vessels to transport more than 19.5 million dwt of cargo to more than 190 ports around the world, averaging over 48 vessels in service daily during 2014. The majority of its fleet is chartered-in on short-term charters of less than 9 months. Pangaea believes that these shorter-term charters afford it more flexibility to match its variable costs to its customers’ service requirements, allowing it to respond to changes in market demand and limiting its exposure to changes in prevailing charter rates. In addition to its chartered-in fleet, Pangaea has interests in 13 vessels and has placed orders for the construction of three additional vessels; all at prices that Pangaea believes will permit it to operate profitably through a range of cargo rate environments. These vessels are and will be used to serve its customers’ cargo transportation needs. Included in the vessels currently owned or on order are six Ice-Class 1A Panamax vessels that are currently the only drybulk vessels of their size rated to operate on the Northern Sea Route and the severe ice conditions of the Baltics in winter. Pangaea believes that a combination of owned and chartered-in vessels help it to more efficiently match its customer demand than it could with an entirely owned fleet or an entirely chartered-in fleet. Pangaea sold its oldest vessel, the m/v Bulk Discovery, on August 17, 2015.

Technical management of two of the Company’s Ice-Class 1A vessels is provided by a third-party technical manager with extensive expertise managing this type of vessel and with ice pilotage. The technical management of the remainder of the Company’s owned fleet is performed in-house. The Company believes its in-house management provides exceptional service and pricing, reduces time out of service, and best enhances the service value of these vessels. The technical management for the Company’s chartered-in vessels is performed by each respective ship owner.

Active risk management is an important part of its business model. Pangaea believes its active risk management allows it to reduce the sensitivity of its earnings to market fluctuations and helps it to secure its long-term profitability. Pangaea manages its market risk primarily through chartering in vessels for periods of less than nine months. Pangaea further manages its market exposure through a portfolio approach based upon owned vessels, chartered-in vessels, COAs, voyage charters, and time charters. Pangaea tries to identify routes and ports for efficient bunkering to minimize its fuel expense. Pangaea also seeks to hedge a portion of its exposure to changes in the price of marine fuels, or bunkers, uses forward freight agreements to protect against changes in charter rates and has entered into interest rate swap agreements to fix a portion of its interest rate exposure.

Corporate and Other Information

Pangaea is a holding company incorporated under the laws of Bermuda as an exempted company on April 29, 2014 in connection with the Mergers. Bulk Partners, which following the Mergers is wholly owned by Pangaea, is also a holding company that was incorporated under the laws of Bermuda as an exempted company on June 17, 2008, the subsidiaries of which provide seaborne drybulk transportation services. Pangaea owns its vessels through separate wholly-owned subsidiaries and through joint venture entities, which Pangaea consolidates as variable interest entities, incorporated in Bermuda and Denmark. Furthermore, certain of its wholly-owned subsidiaries that are organized in Bermuda, British Virgin Islands, Panama, and Delaware provide it with office space, vessel management services and administrative support.

Pangaea’s principal executive headquarters is located at 109 Long Wharf, Newport, Rhode Island 02840, and its phone number at that address is (401) 846-7790. Pangaea also has offices in Copenhagen, Denmark, Athens, Greece, Rio de Janeiro, Brazil and Singapore. Pangaea’s corporate website address is http://www.pangaeals.com. The information contained on or accessible from its corporate website is not part of this prospectus.

RISK FACTORS

An investment in our securities involves a high degree of risk. Before making a decision to invest in our securities, you should consider carefully in their entirety the risk factors in the section entitled "Risk Factors" in our most recent Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q filed subsequent to such Annual Report on Form 10-K, which are incorporated by reference into this prospectus and any prospectus supplement, as the same may be amended, supplemented, or superseded from time to time by our filings under the Securities Exchange Act of 1934, as amended, or the Exchange Act. This Post Effective Amendment No. 2 to this Form S-1 also contains forward-looking statements and estimates that involve risks and uncertainties. In connection with such forward looking statements, you should also carefully review the cautionary statements referred to under “Forward Looking Statements.” Our actual results could differ materially from those anticipated in the forward-looking statements as a result of these risks and risks not known to us or that we currently believe are immaterial.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference contain "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, included in this prospectus and the documents incorporated by reference that are predictive in nature, that depend upon or refer to future events or conditions, or that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” “projects,” “forecasts,” “may,” “should” and similar expressions are forward-looking statements.

All statements in this prospectus that are not statements of either historical or current facts are forward-looking statements. Forward-looking statements include, but are not limited to, such matters as:

|

| | |

| • | our future operating or financial results; |

| • | our ability to charter-in vessels and to enter into COAs, voyage charters, time charters and forward freight agreements and the performance of our counterparties in such contracts; |

| • | our financial condition and liquidity, including our ability to obtain financing in the future to fund capital expenditures, acquisitions and other general corporate activities; |

| • | our expectations of the availability of vessels to purchase, the time it may take to construct new vessels, and vessels’ useful lives; |

| • | competition in the drybulk shipping industry; |

| • | our business strategy and expected capital spending or operating expenses, including drydocking and insurance costs; |

| • | global and regional economic and political conditions, including piracy; and |

| • | statements about shipping market trends, including charter rates and factors affecting supply and demand. |

Many of these statements are based on our assumptions about factors that are beyond our ability to control or predict and are subject to risks and uncertainties that are described in the section of this prospectus entitled “Risk Factors” and elsewhere in this prospectus. Any of these factors or a combination of these factors could materially affect our future results of operations and the ultimate accuracy of the forward-looking statements. Factors that might cause future results to differ include, but are not limited to, the following:

|

| | |

| • | changes in governmental rules and regulations or actions taken by regulatory authorities; |

| • | changes in economic and competitive conditions affecting our business, including market fluctuations in charter rates and charterers’ abilities to perform under existing time charters; |

| • | potential liability from future litigation and potential costs due to environmental damage and vessel collisions; |

| • | the length and number of off-hire periods; and |

| • | other factors discussed under the “Risk Factors” section of this prospectus. |

You should not place undue reliance on forward-looking statements contained in this prospectus because they are statements about events that are not certain to occur as described or at all. All forward-looking statements in this prospectus are qualified in their entirety by the cautionary statements contained in this prospectus. These forward-looking statements are not guarantees of our future performance, and actual results and future developments may vary materially from those projected in the forward-looking statements.

Except to the extent required by applicable law or regulation, we undertake no obligation to release publicly any revisions to these forward-looking statements to reflect events or circumstances after the date of this prospectus or to reflect the occurrence of unanticipated event.

USE OF PROCEEDS

We will not receive any cash proceeds from the selling shareholders’ sale of common shares covered by this Prospectus.

DETERMINATION OF OFFERING PRICE

The offering price of the securities offered by the selling shareholders will be determined by the prevailing market price for the common shares at the time of sale or negotiated transactions.

DESCRIPTION OF SHARE CAPITAL

The following is a description of the material terms of our common shares and includes a summary of specified provisions of our bye-laws. This description is qualified by reference to our bye-laws, which are incorporated herein by reference.

General

Our constitutional documents provide for the issuance of 100,000,000 common shares, par value $.0001, and 1,000,000 preferred shares, par value $.0001.

Common Shares

The holders of our common shares will be entitled to one vote for each share held of record on all matters to be voted on by shareholders.

There is no cumulative voting with respect to the election of directors, with the result that the holders of more than 50% of the shares that vote for the election of directors can elect all of the directors. Directors are elected to a staggered board, which may discourage, delay or prevent a change in control of the Company.

Holders of our common shares will not have any conversion, preemptive or other subscription rights and there are no sinking fund or redemption provisions applicable to the common shares.

As of September 30, 2015, we have approximately 416 holders of our common shares.

Preferred Shares

The Company’s memorandum of association and amended and restated bye-laws authorized the issuance of 1,000,000 blank check preferred shares with such designations, rights and preferences as may be determined from time to time by the Board. Accordingly, the Board is empowered, without shareholder approval, to issue preferred shares with dividend, liquidation, conversion, voting or other rights which could adversely affect the voting power or other rights of the holders of common shares. In addition, the preferred shares could be utilized as a method of discouraging, delaying or preventing a change in control of the Company.

Dividends

It is the present intention of the Board to pay an annual cash dividend of $0.10 per share. Notwithstanding the foregoing, the payment of dividends is entirely within the discretion of the Board and is contingent upon our revenues and earnings, if any, capital requirements and general financial condition subsequent. Under Bermuda law, the board of directors has no discretion to declare or pay a dividend if there are reasonable grounds for believing that the Company is, or would after the payment be, unable to pay its liabilities as they become due or the realizable value of the Company’s assets would thereby be less than its liabilities.

Transfer Agent

Our transfer agent for our common shares is Continental Stock Transfer & Trust Company, 17 Battery Place, New York, New York 10004.

Market Listing

Our common shares are listed on Nasdaq under the symbol “PANL”.

Market Information

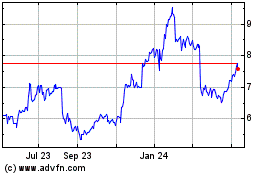

The following table sets forth the high and low sales prices for our common shares for the periods indicated since our common shares began public trading (as PANL) on October 3, 2014.

|

| | | | |

| High | Low |

2015 | | |

Third Quarter | 3.68 |

| 2.72 |

|

Second Quarter | 3.77 |

| 2.22 |

|

First Quarter | 4.70 |

| 2.70 |

|

| | |

2014 | | |

Fourth Quarter | 10.09 |

| 4.51 |

|

Comparison Between Bermuda and United States

The Company is an exempted company organized under the Bermuda Companies Act. The Bermuda Companies Act differs in some material respects from laws generally applicable to United States companies and their stockholders. However, a general permission issued by the Bermuda Monetary Authority results in the Company’s common shares being freely transferable among persons who are residents and non-residents of Bermuda. Each shareholder, whether a resident or non-resident of Bermuda, is entitled to one vote for each share of stock held by the shareholder.

Taxes

There is no Bermuda income or profits tax, withholding tax, capital gains tax, capital transfer tax, estate duty or inheritance tax payable by us or by our shareholders in respect of our shares. We have obtained an assurance from the Minister of Finance of Bermuda under the Exempted Undertakings Protection Act 1966, as amended, that in the event any legislation is enacted in Bermuda imposing any tax computed on profits or income, or computed on any capital asset, gain or appreciation or any tax in the nature of estate duty or inheritance tax, such tax shall not, until March 31, 2035, be applicable to it, to any of its operations or to its shares, debentures or other obligations except insofar as such tax applies to persons ordinarily resident in Bermuda or is payable by us in respect of real property owned or leased by us in Bermuda.

There is no reciprocal tax treaty between Bermuda and the United States that affects the Company or its shareholders.

SELLING SHAREHOLDERS

We are registering the offer and sale of common shares in order to permit the Selling Shareholders to offer the common shares detailed herein for resale from time to time. None of the selling shareholders or any of their affiliates has held a position or office, or had any other material relationship, with us within the past three years.

The following table sets forth information with respect to the Selling Shareholders and the number of common shares beneficially owned by each Selling Shareholder that may be offered for sale under this prospectus. The percentage of common shares beneficially owned before the offering is based on 35,937,169 aggregate common shares outstanding as of December 10, 2015. In addition, a Selling Shareholder may have sold, transferred or otherwise disposed of all or a portion of that shareholder’s common shares since the date on which they provided information for this table. We are relying on the selling shareholders to notify us of any changes in their beneficial ownership after the date they originally provided this information.

|

| | | | | | | | | | | | |

Name of Selling

Shareholder | | Common Shares

Beneficially Owned (1) | | | Percentage of

Common Shares

Beneficially Owned | | | Maximum Common

Shares that may be

sold in the Offering | |

EBC | | | 176,664 | | | | 0.49% | | | | 176,664 | |

Jefferies | | | 85,868 | | | | 0.24% | | | | 85,868 | |

Dinan | | | 29,441 | | | | 0.08% | | | | 29,441 | |

_______________________

(1) The beneficial ownership of the common shares by the Selling Shareholders set forth in the table is determined in accordance with Rule 13d-3 under the Exchange Act, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rule, beneficial ownership includes any common shares as to which the Selling Shareholder has sole or shared voting power or investment power and also any common shares that the Selling Shareholder has the right to acquire within 60 days. The percentage of beneficial ownership is calculated based on 35,937,169 outstanding common shares, which does not take into account the shares that may be issued to the Former Pangaea Holders upon achievement of certain net income targets. Unless otherwise indicated, we believe that all persons named in the table have sole voting and investment power with respect to all common shares beneficially owned by them.

PLAN OF DISTRIBUTION

We are registering the offer and sale of common shares covered by this prospectus to permit Selling Shareholders to conduct public secondary trading of these common shares from time to time after the date of this prospectus. We will not receive any of the proceeds of the sale of the common shares offered by this prospectus. The aggregate proceeds to the Selling Shareholders from the sale of the common shares will be the purchase price of the common shares less any discounts and commissions. A Selling Shareholder reserves the right to accept and, together with their agents, to reject, any proposed purchases of common shares to be made directly or through agents.

The common shares offered by this prospectus may be sold from time to time to purchasers:

|

| | |

| • | directly by the Selling Shareholders and their successors, which include their donees, pledgees or transferees or their successors-in-interest, or |

| • | through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, commissions or agent’s commissions from the Selling Shareholders or the purchasers of the common shares. These discounts, concessions or commissions may be in excess of those customary in the types of transactions involved. |

Each of the Selling Shareholders and any underwriters, broker-dealers or agents who participate in the sale or distribution of the common shares may be deemed to be “underwriters” within the meaning of the Securities Act. Each of the Selling Shareholders identified in the Selling Shareholders table above is affiliated with a registered broker-dealer and as such may be deemed to be an underwriter with respect to securities sold by such Selling Shareholders pursuant to this prospectus. As a result, any profits on the sale of the common shares by such Selling Shareholders and any discounts, commissions or agent’s commissions or concessions received by any such broker-dealer or agents may be deemed to be underwriting discounts and commissions under the Securities Act. Selling Shareholders who are deemed to be “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to prospectus delivery requirements of the Securities Act. Underwriters are subject to certain statutory liabilities, including, but not limited to, Sections 11, 12 and 17 of the Securities Act. The common shares may be sold by the Selling Shareholders, pursuant to Rule 415 of the Securities Act, in one or more transactions at prevailing market prices at the time of such sale.

The common shares may be sold by the Selling Shareholders in one or more transactions at:

|

| | |

| • | fixed prices; |

| • | prevailing market prices at the time of sale; |

| • | prices related to such prevailing market prices; |

| • | varying prices determined at the time of sale; or |

| • | negotiated prices. |

These sales may be effected in one or more transactions:

|

| | |

| • | on any national securities exchange or quotation on which the common shares may be listed or quoted at the time of the sale; |

| • | in the over-the-counter market; |

| • | in transactions other than on such exchanges or services or in the over-the-counter market; |

| • | through the writing of options, whether such options are listed on an options exchange or otherwise; |

| • | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| • | block trades in which the broker-dealer will attempt to sell the common shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| • | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| • | an exchange distribution in accordance with the rules of the applicable exchange; |

| • | privately negotiated transactions; |

| • | through the settlement of short sales; |

| • | sales pursuant to Rule 144 or Rule 144A; |

| • | broker-dealers may agree with the Selling Shareholder to sell a specified number of common shares at a stipulated price per share; |

| • | through any combination of the foregoing; or |

| • | any other method permitted pursuant to applicable law. |

These transactions may include block transactions or crosses. Crosses are transactions in which the same broker acts as an agent on both sides of the trade.

In connection with the sales of the common shares, the Selling Shareholders may enter into hedging transactions with broker-dealers or other financial institutions which in turn may:

|

| | |

| • | engage in short sales of the common shares in the course of hedging their positions; |

| • | sell the common shares short and deliver the common shares to close out short positions; |

| • | loan or pledge the common shares to broker-dealers or other financial institutions that in turn may sell the common shares; |

| • | enter into option or other transactions with broker-dealers or other financial institutions that require the delivery to the broker-dealer or other financial institution of the common shares, which the broker-dealer or other financial institution may resell under the prospectus; or |

| • | enter into transactions in which a broker-dealer makes purchases as a principal for resale for its own account or through other types of transactions. |

The common shares may be offered to the public either through underwriting syndicates represented by one or more managing underwriters or directly by one or more of such firms. The obligations of underwriters or dealers to purchase the common shares offered will be subject to certain conditions precedent and the terms of any agreement entered into with the underwriters. Any public offering price and any discount or concession allowed or reallowed or paid by underwriters or dealers to other dealers may be changed from time to time.

To our knowledge, there are currently no plans, arrangements or understandings between any Selling Shareholders and any underwriter, broker-dealer or agent regarding the sale of the common shares by the Selling Shareholders.

In order to comply with the securities laws of certain states, if applicable, the common shares may be sold only through registered or licensed brokers or dealers. In addition, in certain states, the common shares may not be sold unless they have been registered or qualified for sale in the state or an exemption from the registration or qualification requirement is available and complied with. Brokers, dealers, underwriters, or agents participating in the distribution of the common shares as agents may receive compensation in the form of commissions, discounts, or concessions from the selling stockholder and/or purchasers of the common shares for whom the broker-dealers may act as agent. The compensation paid to a particular broker-dealer may be less than or in excess of customary commissions.

None of the Company or any of the Selling Shareholders can presently estimate the amount of compensation that any agent will receive. We know of no existing arrangements between the Selling Shareholders, any other stockholder, broker, dealer, underwriter, or agent relating to the sale or distribution of the common shares offered by this Prospectus. At the time a particular offer of shares is made, a Prospectus supplement, if required, will be distributed that will set forth the names of any agents, underwriters, or dealers and any compensation from the Selling Stockholder, and any other required information.

Our common stock is listed on the Nasdaq Capital Market under the symbol “PANL.”

We will pay all of the expenses incident to the registration, offering, and sale of the common shares to the public other than commissions or discounts of underwriters, broker-dealers, or agents.

There can be no assurance that any Selling Shareholder will sell any or all of the common shares under this prospectus. Further, we cannot determine whether any such Selling Shareholder will transfer, devise or gift the common shares by other means not described in this prospectus. In addition, any common shares covered by this prospectus that qualify for sale under Rule 144 of the Securities Act may be sold under Rule 144 rather than under this prospectus. The common shares covered by this prospectus may also be sold to non-U.S. persons outside the U.S. in accordance with Regulation S under the Securities Act rather than under this prospectus. The common shares may be sold in some states only through registered or licensed brokers or dealers. In addition, in some states the common shares may not be sold unless they have been registered or qualified for sale or an exemption from registration or qualification is available and complied with.

The Selling Shareholders and any other person participating in the sale of the common shares will be subject to the Exchange Act. The Exchange Act rules include, without limitation, Regulation M. While the Selling Shareholders are engaged in a distribution of the common shares included in this Prospectus, they are required to comply with Regulation M promulgated under the Exchange Act, and are aware of their compliance obligations pursuant to Regulation M. With certain exceptions, Regulation M precludes the Selling Shareholders, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of the distribution until the entire distribution is complete.

Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the common shares offered pursuant to this Prospectus. This offering will terminate on the date that all shares offered by this Prospectus have been sold by the Selling Shareholders or may be resold by the Selling Shareholders without restriction under Rule 144(b)(1)(i) under the Securities Act.

LEGAL MATTERS

Appleby (Bermuda) Limited, which has acted as our counsel in connection with this offering, will pass upon the validity of the shares of common stock being offered by this prospectus.

EXPERTS

The audited financial statements of the Company appearing in the Company's Annual Report on Form 10-K for the years ended December 31, 2014 and 2013, have been audited by Grant Thornton LLP, independent registered public accountants, as set forth in their report thereon, included therein, and incorporated herein by reference. Such financial statements are incorporated herein by reference in reliance upon such reports given on the authority of said firm as experts in accounting and auditing.

The audited financial statements of Nordic Bulk Holding ApS, not separately presented in the Company's Annual Report on Form 10-K for the years ended December 31, 2014 and 2013, have been audited by PricewaterhouseCoopers Statsautoriseret Revisionspartnerselskab, an independent registered public accounting firm, as set forth in their report thereon, included therein, and incorporated herein by reference. The audited financial statements of Bulk Partners (Bermuda) Ltd, to the extent they relate to Nordic Bulk Holding ApS, have been so included in reliance on the report of such independent registered public accounting firm given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We have filed with the SEC a Post-Effective Amendment No. 2 to Form S-1 on Form S-3 under the Securities Act with respect to the shares of common stock offered by this prospectus. This prospectus, which constitutes a part of the registration statement, does not contain all of the information set forth in the registration statement, some of which is contained in exhibits to the registration statement as permitted by the rules and regulations of the SEC. For further information with respect to us and our common stock, we refer you to the registration statement, including the exhibits filed as a part of the registration statement. Statements contained in this prospectus concerning the contents of any contract or any other document are not necessarily complete. If a contract or document has been filed as an exhibit to the registration statement, please see the copy of the contract or document that has been filed. Each statement in this prospectus relating to a contract or document filed as an exhibit is qualified in all respects by the filed exhibit. You may read and copy reports, proxy statements and other information filed by us with the SEC at the SEC public reference room located at 100 F Street, N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You may also obtain copies of the materials described above at prescribed rates by writing to the Securities and Exchange Commission, Public Reference Section, 100 F Street, N.E., Washington, D.C. 20549. You may access information on the Company at the SEC web site containing reports, proxy statements and other information at: http://www.sec.gov.

We are subject to the informational and reporting requirements of the Securities Exchange Act of 1934, as amended, and have filed and will file annual, quarterly and current reports, proxy statements and other information with the SEC. These periodic reports, proxy statements and other information will be available for inspection and copying at the SEC's public reference facilities and the website of the SEC referred to above. We also maintain a website at www.pangaeals.com. You may access these materials free of charge as soon as is reasonably practicably after they are electronically filed with, or furnished to, the SEC. Information contained on our website is not a part of this prospectus and the inclusion of our website address in this prospectus is an inactive textual reference only.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus certain information that we have filed with the SEC, which means that we can disclose important information to you without actually including the specific information in this prospectus by referring you to those documents. The information incorporated by reference is an important part of this prospectus. You should not assume that the information in this prospectus is current as of any date other than the date of this prospectus, and you should not assume that the information contained in a document incorporated by reference is accurate as of any date other than the date of such document (or, with respect to particular information contained in such document, as of any date other than the date set forth within such document as the date as of which such particular information is provided). We incorporate by reference into this prospectus (i) the documents listed below, (ii) any future filings we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act following the date of this prospectus and prior to the termination of the offering covered by this prospectus and any prospectus supplement, and (iii) filings we make with the SEC under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act after the date of the registration statement of which this prospectus is a part and prior to the effectiveness of such registration statement, in each case, other than information furnished to the SEC (including, but not limited to, information furnished under Items 2.02 or 7.01 of Form 8-K and any corresponding information furnished with respect to such Items under Item 9.01 or as an exhibit) and which is not deemed filed under the Exchange Act:

|

| | | |

| • | | our Annual Report on Form 10-K for the fiscal year ended December 31, 2014, filed with the SEC on March 31, 2015; |

| • | | our Quarterly Reports on Form 10-Q for the periods ended March 31, 2015, June 30, 2015 and September 30, 2015 filed with the SEC on May 15, 2015, August 13, 2015 and November 12, 2015, respectively; |

| • | | our Definitive Proxy Statement on Schedule 14A, filed with the SEC on August 21, 2015; |

| • | | our Current Reports on Form 8-K, filed with the SEC on March 31, 2015, May 15, 2015, June 9, 2015, June 26, 2015, July 2, 2015, July 6, 2015, August 14, 2015, August 19, 2015, August 31, 2015, September 23, 2015, October 16, 2015 and November 12, 2015. |

Any statement contained in this prospectus or in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded to the extent that a statement contained in any subsequently filed document which is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

We will provide without charge to each person, including any beneficial owner, to whom this prospectus is delivered, upon written or oral request, a copy of any document incorporated by reference in this prospectus. Requests for such documents should be directed to:

Pangaea Logistics Solutions Ltd.

109 Long Wharf

Newport, Rhode Island 02840

(401) 846-7790

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth an itemized statement of the amounts of all expenses payable by us in connection with the registration of the common stock offered hereby. With the exception of the Registration Fee, the amounts set forth below are estimates.

|

| | | |

SEC Registration Fee (1) | $ | 117.72 |

|

Legal Fees and Expenses | | 5,000 |

|

Accounting Fees and Expenses | | 9,000 |

|

Miscellaneous | | — |

|

Total | | 14,117.72 |

|

(1) Previously paid.

Item 15. Indemnification of Directors and Officers.

Section 98 of the Companies Act provides generally that a Bermuda company may indemnify its directors, officers and auditors against any liability which by virtue of any rule of law would otherwise be imposed on them in respect of any negligence, default, breach of duty or breach of trust, except in cases where such liability arises from fraud or dishonesty of which such director, officer or auditor may be guilty in relation to the company. Section 98 further provides that a Bermuda company may in its bye-laws or in any contract or arrangement between the company and any officer, or any person employed by the company as auditor, exempt such officer or person from, or indemnify him in respect of , any loss arising or liability attaching to him by virtue of any rule of law in respect of any negligence, default, breach of duty or breach of trust of which the officer or person may be guilty in relation to the company or any subsidiary thereof.

We have adopted provisions in our bye-laws that provide that we shall indemnify our officers and directors in respect of their actions and omissions, except in respect of their fraud or dishonesty. Our bye-laws provide that the shareholders waive all claims or rights of action that they might have, individually or in right of the company, against any of the company’s directors or officers for any act or failure to act in the performance of such director’s or officer’s duties, except in respect of any fraud or dishonesty of such director or officer. Section 98A of the Companies Act permits us to purchase and maintain insurance for the benefit of any officer or director in respect of any loss or liability attaching to him in respect of any negligence, default, breach of duty or breach of trust, whether or not we may otherwise indemnify such officer or director.

Insurance. We maintain directors’ and officers’ liability insurance, which covers directors and officers of our Company against certain claims or liabilities arising out of the performance of their duties.

Indemnification Agreements. We intend to enter into agreements to indemnify our directors and officers. These agreements will provide for indemnification of our directors and officers to the fullest extent permitted by applicable Bermuda law against all expenses, including attorneys’ fees, judgments, fines and settlement amounts incurred by any such person in actions or proceedings, including actions by us or in our right, arising out of such person’s services as our director or officer, any of our subsidiaries or any other company or enterprise to which the person provided services at our Company’s request.

Item 16. Exhibits and Financial Statement Schedules

(a) See the Exhibit Index immediately following the signature page hereto, which is incorporated by reference as if fully set forth herein.

Item 17. Undertakings

The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933, as amended;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

Provided, however, that subparagraphs (1)(i), (1)(ii), and (1)(iii) above do not apply if information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus related, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report pursuant to section 13(a) or section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been

settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

(6) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities:

| |

| The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser: |

| |

| (i) Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424 (§230.424 of this chapter); |

| |

| (ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant; |

| |

| (iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and |

| |

| (iv) Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

(7) The undersigned registrant hereby undertakes to deliver or cause to be delivered with the prospectus, to each person to whom the prospectus is sent or given, the latest annual report to security holders that is incorporated by reference in the prospectus and furnished pursuant to and meeting the requirements of Rule 14a-3 or Rule 14c-3 under the Securities Exchange Act of 1934; and, where interim financial information required to be presented by Article 3 of Regulation S-X are not set forth in the prospectus, to deliver, or cause to be delivered to each person to whom the prospectus is sent or given, the latest quarterly report that is specifically incorporated by reference in the prospectus to provide such interim financial information.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant has duly caused this Post-Effective Amendment No. 2 to the Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Newport, Rhode Island on December 11, 2015.

|

| | |

Pangaea Logistics Solutions Ltd. |

| |

By: | | /s/ Edward Coll |

Name: | | Edward Coll |

Title: | | Chairman of the Board and Chief Executive Officer |

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons in the capacitites and on the dates indicated.

Signature Title Date

/s/ Edward Coll Chairman of the Board and Chief

Edward Coll Executive Officer December 11, 2015

/s/ Carl Claus Boggild President (Brazil) and Director December 11, 2015

Carl Claus Boggild

/s/ Anthony Laura Chief Financial Officer and Director December 11, 2015

Anthony Laura

/s/ Peter M. Yu Director December 11, 2015

Peter M. Yu

/s/ Paul Hong Director December 11, 2015

Paul Hong

/s/ Richard T. du Moulin Director December 11, 2015

Richard T. du Moulin

/s/ Mark L. Filanowski Director December 11, 2015

Mark L. Filanowski

/s/ Eric S. Rosenfeld Director December 11, 2015

Eric S. Rosenfeld

/s/ David D. Sgro Director December 11, 2015

David D. Sgro

EXHIBIT INDEX

|

| | | | | |

Exhibit no. | Description | Incorporated By Reference | Filed herewith |

| | Form | Date | Exhibit | |

2.1 | Agreement and Plan of Reorganization, dated as of April 30, 2014, by and among Quartet Merger Corp., Quartet Holdco Ltd., Quartet Merger Sub Ltd., Pangaea Logistics Solutions, Ltd., and the securityholders of Pangaea Logistics Solutions, Ltd. | S-1 | 02/04/15 | | |

3.1 | Certificate of Incorporation of the Company, as amended | S-1 | 02/04/15 | | |

3.2 | Bye-laws of Company | S-1 | 02/04/15 | | |

5.1 | Opinion of Appleby | | | | X |

8.1 | Tax Opinion of Appleby | | | | X |

10.1 | Form of Escrow Agreement among Quartet Holdco Ltd., the Representative (as described in the Agreement and Plan of Reorganization), the securityholders of Pangaea Logistics Solutions, Ltd., and Continental Stock Transfer & Trust Company, as Escrow Agent. | S-1 | 02/04/15 | | |

10.2 | Form of Registration Rights Agreement between Quartet Holdco Ltd. and certain holders identified therein. | S-1 | 02/04/15 | | |

10.3 | Form of Lock-Up Agreement. | S-1 | 02/04/15 | | |

10.4 | $1.048 Million Secured Construction Loan Agreement | S-1 | 02/04/15 | | |

10.5 | $9.12 Million Secured Term Loan | S-1 | 02/04/15 | | |

10.6 | $4.55 Million Secured Term Loan | S-1 | 02/04/15 | | |

10.7 | $40.0 Million Secured Loan Facility | S-1 | 02/04/15 | | |

10.8 | $8.52 Million Term Loan | S-1 | 02/04/15 | | |

10.9 | $5.685 Million Secured Loan Facility | S-1 | 02/04/15 | | |

10.1 | Post-Delivery Facility | S-1 | 02/04/15 | | |

10.11 | $10.0 Million Loan from Shareholder | S-1 | 02/04/15 | | |

10.12 | January 10, 2013 Related Party Loan with ASO 2020 Maritime S.A. | S-1 | 02/04/15 | | |

10.13 | March 18, 2013 Related Party Loan with ASO 2020 Maritime S.A. | S-1 | 02/04/15 | | |

10.14 | June 18, 2013 Related Party Loan with ASO 2020 Maritime S.A. | S-1 | 02/04/15 | | |

10.15 | Related Party Loan with ST Shipping and Transport Pte. Ltd. | S-1 | 02/04/15 | | |

10.16 | $5.0 million Loan Agreement from Bulk Partners (Bermuda) Ltd. to Nordic Bulk Carriers AS | S-1 | 02/04/15 | | |

10.17 | $13.0 Million Term Loan | S-1 | 02/04/15 | | |

10.18 | Nordic Bulk Holding Company Ltd. Shareholders Agreement | S-1 | 02/04/15 | | |

10.19 | Nordic Bulk Ventures Holding Company Shareholders Agreement | S-1 | 02/04/15 | | |

10.25 | Loan Agreement (Revolving Line of Credit) by and between Phoenix Bulk Carriers (US) LLC and Rockland Trust Company | S-4 | 05/13/14 | | |

10.26 | Pangaea Logistics Solutions Ltd. 2014 Share Incentive Plan (as amended and restated by the Board of Directors on August 7, 2015) | S-1/A | 09/16/15 | | |

10.27 | Bulk Nordic Odin Ltd., Bulk Nordic Olympic Ltd., Bulk Nordic Odyssey Ltd., Bulk Nordic Orion Ltd. and Bulk Nordic Oshima Ltd. Amended and Restated Loan Agreement | 10-Q | 11/13/15 | | |

|

| | | | | |

16.1 | Letter from PricewaterhouseCoopers Statsautoriseret Revisionspartnerselskab to the Securities and Exchange Committee | S-1/A | 07/02/15 | | |

23.1 | Consent of Grant Thornton LLP. | | | | X |

23.2 | Consent of PricewaterhouseCoopers Statsautoriseret Revisionspartnerselskab. | | | | X |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

Exhibit 5.1

|

| |

Pangaea Logistics Solutions Ltd. | Email jbodi@applebyglobal.com |

Cumberland House | |

9th Floor | Direct Dial 1 441 298 3240 |

1 Victoria Street | |

Hamilton HM11, Bermuda | Your Ref |

| |

| Appleby Ref 428932.0001 |

| |

| December 11, 2015 |

|

| | | | |

| | Dear Sirs |

Bermuda Office | | Pangaea Logistics Solutions Ltd. (the "Company") |

Appleby (Bermuda) | | | | |

Limited Canon's Court 22 Victoria Street PO Box HM 1179 Hamilton HM EX Bermuda Tel +1 441 295 2244 Fax +1 441 292 8666 applebyglobal.com | | We have acted as legal counsel in Bermuda to the Company and this opinion as to Bermuda law is addressed to you in connection with the filing by the Company with the U.S. Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended, of Post-Effective Amendment No. 2 to Form S-1 on Form S-3 (File No. 333-201881)(the “Registration Statement”), as thereafter amended or supplemented, in relation to the registration of up to 291,953 common shares, par value USD 0.0001 each (the “Common Shares”) to be issued pursuant to the Prospectus constituting part of the Registration Statement. For the purposes of this opinion we have examined and relied upon the Registration Statement together with such other documentation as we have considered requisite to this opinion (“Documents”). Unless otherwise defined herein, capitalised terms have the meanings assigned to them in the Registration Statement. |

| | Assumptions |

| | In stating our opinion we have assumed: |

| | 1 | | the authenticity, accuracy and completeness of all Documents and other documentation examined by us submitted to us as originals and the conformity to authentic original documents of all Documents and other such documentation submitted to us as certified, conformed, notarised, faxed or photostatic copies; |

| | 2 | | that each of the Documents and other such documentation which was received by electronic means is complete, intact and in conformity with the transmission as sent; |

|

|

Appleby (Bermuda) Limited (the Legal Practice) is a limited liability company incorporated in Bermuda and approved and recognised under the Bermuda Bar (Professional Companies) Rules 2009. "Partner" is a title referring to a director, shareholder or an employee of the Legal Practice. A list of such persons can be obtained from your relationship partner. |

Bermuda British Virgin Islands Cayman Islands Guernsey Hong Kong Isle of Man Jersey London Mauritius Seychelles Shanghai Zurich

|

| |

3 | the genuineness of all signatures on the Documents; and |

|

| |

4 | that any representation, warranty or statement of fact or law, other than as to the laws of Bermuda, made in any of the Documents is true, accurate and complete. |

Opinion

Based upon and subject to the foregoing and subject to the reservations set out below and to any matters not disclosed to us, we are of the opinion that the Common Shares will, upon payment for and delivery of such shares as contemplated by the Registration Statement be duly authorised and validly issued, fully paid and non-assessable.

Reservations

We have the following reservations:

|

| |

5 | We express no opinion as to any law other than Bermuda law and none of the opinions expressed herein relates to compliance with or matters governed by the laws of any jurisdiction except Bermuda. This opinion is limited to Bermuda law as applied by the courts of Bermuda at the date hereof. |

|

| |

6 | Where an obligation is to be performed in a jurisdiction other than Bermuda, the courts of Bermuda may refuse to enforce it to the extent that such performance would be illegal under the laws of, or contrary to public policy of, such other jurisdiction. |

Disclosure

This opinion is given in connection with filing of the Registration Statement with the Commission and not for any other purpose except as may be required by law or regulatory authority. We consent to the filing of this opinion as an exhibit to the Registration Statement of the Company. Further, this opinion speaks as of its date and is strictly limited to the matters stated herein and we assume no obligation to review or update this opinion if applicable law or the existing facts or circumstances should change.

This opinion is governed by and is to be construed in accordance with Bermuda law. It is given on the basis that it will not give rise to any legal proceedings with respect thereto in any jurisdiction other than Bermuda.

Yours faithfully

/s/ Appleby (Bermuda) Limited

Appleby (Bermuda) Limited

Bermuda British Virgin Islands Cayman Islands Guernsey Hong Kong Isle of Man Jersey London Mauritius Seychelles Shanghai Zurich

SCHEDULE

| |

1. | Copies of the Certificate of Incorporation on Change of Name, Certificate of Incorporation, Certificate of Merger, Amended and Restated Memorandum of Association (Memorandum of Association) and Bye-Laws adopted for the Company (collectively referred to as the Constitutional Documents). |

| |

2. | Copy of the unanimous written resolutions of the Directors effective April 29, 2014, April 30, 2014 and 26 September 2014 (the “Resolutions”). |

| |

3. | A copy of the notice to the public dated 1 June 2005 as issued by the Bermuda Monetary Authority under the Exchange Control Act 1972 and the Exchange Control Regulations 1973 (the “Notice”). |

| |

4. | A PDF copy of the Registration Statement. |

Bermuda British Virgin Islands Cayman Islands Guernsey Hong Kong Isle of Man Jersey London Mauritius Seychelles Shanghai Zurich

Exhibit 8.1

|

| |

Pangaea Logistics Solutions Ltd. | Email jbodi@applebyglobal.com |

109 Long Wharf, 2nd Floor | |

Newport, RI 02840 | Direct Dial 1 441 298 3240 |

| |

| Appleby Ref 428932.0001/JB |

| |

| |

| December 11, 2015 |

|

| | | | |

| | Dear Sirs |

Bermuda Office | | Pangaea Logistics Solutions Ltd. (the "Company") |

Appleby (Bermuda) | | | | |

Limited Canon's Court 22 Victoria Street PO Box HM 1179 Hamilton HM EX Bermuda Tel +1 441 295 2244 Fax +1 441 292 8666 applebyglobal.com | | This opinion as to Bermuda law is addressed to you in connection with the filing of the Post-Effective Amendment No. 2 to the Form S-1 (File No. 333-201881) (the "Registration Statement") as filed publicly with the U.S. Securities and Exchange Commission (the "Commission") on 16 November 2015, as thereafter amended or supplemented. For the purposes of this opinion we have examined and relied upon the Registration Statement together with such other documentation as we have considered requisite to this opinion ("Documents"). Unless otherwise defined herein, capitalised terms have the meanings assigned to them in the Registration Statement.

|

| | Assumptions |

| | In stating our opinion we have assumed: |

| | 1 | | the authenticity, accuracy and completeness of all Documents and other documentation examined by us submitted to us as originals and the conformity to authentic original documents of all Documents and other such documentation submitted to us as certified, conformed, notarised, faxed or photostatic copies; |

| | 2 | | that each of the Documents and other such documentation which was received by electronic means is complete, intact and in conformity with the transmission as sent; |

| | 3 | | the genuineness of all signatures on the Documents; |

| | 4 | | the authority, capacity and power of each of the persons signing the Documents; and |

| | 5 | | that any factual statement made in any of the Documents are true, accurate and complete. |

|

|

Appleby (Bermuda) Limited (the Legal Practice) is a limited liability company incorporated in Bermuda and approved and recognised under the Bermuda Bar (Professional Companies) Rules 2009. "Partner" is a title referring to a director, shareholder or an employee of the Legal Practice. A list of such persons can be obtained from your relationship partner. |

Bermuda British Virgin Islands Cayman Islands Guernsey Hong Kong Isle of Man Jersey London Mauritius Seychelles Shanghai Zurich

Opinion

Based upon and subject to the foregoing and subject to the reservations set out below and to any matters not disclosed to us, we confirm that the statements in the Registration Statement under the heading Information with Respect to the Registrant - Tax Considerations - Bermuda Tax Considerations, insofar as such information describes the provisions of the tax laws of Bermuda, constitute our opinion as to such laws.

Reservations

We have the following reservations:

|

| | |

6 |