Table of Contents

As filed with the Securities and Exchange Commission on June 29, 2015.

Registration No. 333- 193861

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 1 to

FORM S-1 on FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

VERICEL CORPORATION

(Exact name of registrant as specified in its charter)

|

Michigan |

|

94-3096597 |

|

(State or other jurisdiction of |

|

(I.R.S. Employer Identification |

|

incorporation or organization) |

|

Number) |

64 Sidney Street

Cambridge, Massachusetts 02139

(Address of principal executive offices)

(617) 588-5555

(Registrant’s telephone number, including area code)

Dominick C. Colangelo

President and Chief Executive Officer

Vericel Corporation

64 Sidney Street

Cambridge, Massachusetts 02139

(617) 588-5555

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copy to:

Mitchell S. Bloom, Esq.

Ryan S. Sansom, Esq.

Goodwin Procter LLP

Exchange Place

Boston, Massachusetts 02109

(617) 570-1000

Approximate date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If the only securities being registered on this form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box: x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o |

Accelerated filer o |

Non-accelerated filer o

(Do not check if a smaller reporting company) |

Smaller reporting

company x |

This filing constitutes a Post-Effective Amendment to the Registration Statement on Form S-1 (File No. 333- 193861), which was declared effective on April 3, 2014. The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

EXPLANATORY NOTE

On February 10, 2014, the registrant filed a registration statement with the Securities and Exchange Commission (the “SEC”) on Form S-1 (Registration No. 333-193861), which was amended by Pre-Effective Amendment No. 1 to Form S-1 filed with the SEC on March 26, 2014, and declared effective by the SEC on April 3, 2014 (as amended, the “Form S-1”), to register for resale, by the selling shareholder named in the prospectus, shares of the registrant’s common stock, having no par value.

This Post-Effective Amendment No.1 to Form S-1 on Form S-3 is being filed by the registrant to convert the Form S-1 into a registration statement on Form S-3, and contains an updated prospectus relating to the offering and sale of certain shares that were registered for resale on the Form S-1.

All filing fees payable in connection with the registration of the shares of the common stock covered by the Form S-1 were paid by the registrant at the time of the initial filing of the Form S-1.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 29, 2015.

PROSPECTUS

1,748,063 Shares of Common Stock

This prospectus relates to the resale, from time to time, of up to 1,748,063 shares of our common stock by Lincoln Park Capital Fund, LLC. Lincoln Park Capital Fund, LLC is sometimes referred to in this prospectus as “selling shareholder” or “Lincoln Park”. The shares of common stock being offered by Lincoln Park are issuable pursuant to a Purchase Agreement we entered into with Lincoln Park on January 21, 2014, which we refer to in this prospectus as the Purchase Agreement. See the section of this prospectus entitled “The Lincoln Park Transaction” for a description of the Purchase Agreement and the section entitled “Selling Shareholder” for additional information about Lincoln Park. Such registration does not mean that Lincoln Park will actually offer or sell any of these shares. We will not receive any proceeds from the sales of shares of our common stock by Lincoln Park; however, we may receive further proceeds of up to $11,345,362 under the Purchase Agreement.

Lincoln Park is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended. Lincoln Park may offer the shares pursuant to this prospectus for resale in a number of different ways through public or private placement transactions and at varying prices. The prices at which Lincoln Park may sell the shares will be determined by the prevailing market price for the shares or in privately negotiated transactions. See “Plan of Distribution” for additional information.

You should read this document and any prospectus supplement or amendment carefully before you invest in our securities.

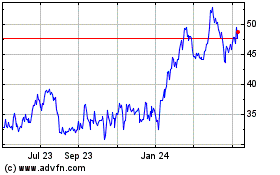

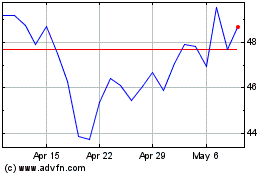

Our common stock is listed on the NASDAQ Capital Market under the symbol “VCEL.” On June 25, 2015, the closing price for our common stock, as reported on the NASDAQ Capital Market, was $3.63 per share. Our principal executive offices are located at 64 Sidney Street, Cambridge, Massachusetts, 02139.

Investing in our securities involves a high degree of risk. You should review carefully the risks and uncertainties described under the heading “Risk Factors” contained in this prospectus beginning on page 7 and any applicable prospectus supplement, and under similar headings in the other documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this Prospectus is , 2015.

Table of Contents

ABOUT THIS PROSPECTUS

You may rely only on the information provided or incorporated by reference in this prospectus and the documents incorporated herein and therein by reference, or in a prospectus supplement or amendment thereto. We have not and Lincoln Park has not authorized anyone to provide you with information different from that contained in or incorporated by reference into this prospectus. We and the underwriters are offering to sell, and seeking offers to buy, common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus, any free writing prospectus, or document incorporated by reference is accurate only as of its date, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Information contained on our website is not part of this prospectus. You should read this prospectus together with additional information described under the heading “Where You Can Find More Information” below. In various places in this prospectus, we refer you to sections for additional information by indicating the caption heading of the other sections. All cross-references in this prospectus are to captions contained in this prospectus, unless otherwise indicated.

For investors outside the United States: We have not and Lincoln Park has not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the shares of common stock and the distribution of this prospectus outside the United States.

1

Table of Contents

PROSPECTUS SUMMARY

The following summary highlights information contained elsewhere in this prospectus. It may not contain all of the information that is important to you. You should read the entire prospectus carefully, especially the discussion regarding the risks of investing in our securities under the heading “Risk Factors,” before investing in our securities. All references to “Company,” “we,” “our” or “us” refer solely to Vericel Corporation and its subsidiaries and not to the persons who manage us or sit on our Board of Directors.

Our Company

Overview

Vericel Corporation is a leader in developing patient-specific expanded cellular therapies for use in the treatment of patients with severe diseases and conditions. We market two autologous cell therapy products in the United States: Carticel® (autologous cultured chondrocytes), an autologous chondrocyte implant for the treatment of cartilage defects in the knee, and Epicel® (cultured epidermal autografts), a permanent skin replacement for the treatment of patients with deep-dermal or full-thickness burns comprising greater than or equal to 30% of total body surface area. We are also developing MACI™, a third-generation autologous chondrocyte implant for the treatment of cartilage defects in the knee, and ixmyelocel-T, a patient-specific multicellular therapy for the treatment of advanced heart failure due to ischemic dilated cardiomyopathy.

Acquisition of Sanofi’s CTRM Business

On May 30, 2014, we completed the acquisition of the Cell Therapy and Regenerative Medicine (CTRM) business of Sanofi, a French société anonyme (Sanofi), certain assets, including all of the outstanding equity interests of Genzyme Biosurgery ApS (Genzyme Denmark or the Danish subsidiary) (now known as Vericel Denmark ApS), a wholly-owned subsidiary of Sanofi and over 250 patents and patent applications of Sanofi and certain of its subsidiaries and assumed certain liabilities for purposes of acquiring a portion of the CTRM business, which researches, develops, manufactures, markets and sells Carticel, MACI and Epicel (the CTRM Transaction). In consideration for the acquisition of the CTRM business, we paid a total purchase price of approximately $6.5 million, as follows: (a) $4 million was paid in cash on the closing date of the CTRM Transaction, and (b) a $2.5 million promissory note which was paid on July 30, 2014.

Manufacturing

We acquired two cell-manufacturing facilities as part of the acquisition of the CTRM business in Cambridge, Massachusetts and Copenhagen, Denmark. The Cambridge facility, which is approved by the U.S. Food and Drug Administration (FDA), is used for U.S. manufacturing and distribution of Carticel, Epicel manufacturing and also manufactured MACI for the SUMMIT study conducted for approval in Europe. The Copenhagen manufacturing facility, which was approved by the Danish Medicines Agency (DKMA), was responsible for MACI manufacturing and distribution in Europe. As part of a June 2014 restructuring, we discontinued MACI manufacturing at the Copenhagen manufacturing facility. Going forward, we expect that any clinical and commercial production of MACI will occur at our Cambridge facility.

We also operate a centralized cell manufacturing facility in Ann Arbor, Michigan. The facility supports the current ixCELL-DCM clinical trial being conducted in the United States and Canada and we believe we have sufficient capacity, with minor modifications, to supply our early commercialization requirements.

Product Portfolio

Our approved and marketed products were acquired through the CTRM Transaction and include three approved autologous cell therapy products, each of which are further described below: Carticel (autologous cultured chondrocytes), a first-generation product for autologous chondrocyte implantation (ACI) currently marketed in the U.S., MACI (matrix-applied characterized autologous cultured chondrocytes), a third-generation ACI product, and Epicel (cultured epidermal autografts), a permanent skin replacement for full thickness burns greater than or equal to 30% of total body surface area. Our product candidate portfolio also includes ixmyelocel-T, a patient-specific multicellular therapy currently in development for the treatment of advanced heart failure due to ischemic dilated cardiomyopathy (DCM).

2

Table of Contents

Carticel

Carticel, a first-generation ACI product for the treatment and repair of cartilage defects in the knee, is the first and only FDA-approved autologous cartilage repair product. Carticel is indicated for the repair of symptomatic cartilage defects of the femoral condyle (medial, lateral or trochlea) caused by acute or repetitive trauma, in patients who have had an inadequate response to a prior arthroscopic or other surgical repair procedure such as debridement, microfracture, drilling/abrasion arthroplasty, or osteochondral allograft/autograft. Carticel received a Biologics License Application (BLA) approval in 1997 and is currently marketed in the U.S. It is generally used on patients with larger lesions (greater than 3 cm2).

In the U.S., we focus net sales of Carticel on the sports-injury-targeted orthopedic physician target audience, which is very concentrated, with 60% of the current Carticel business originating from 25% of this audience, or approximately 110 physicians. We currently have a 21-person field force calling on this sports-injury targeted orthopedic physician audience.

Epicel

Epicel is a permanent skin replacement for full thickness burns greater than or equal to 30% of total body surface area (TBSA). Epicel is regulated by the Center for Biologics Evaluation and Research (CBER) under medical device authorities, and is currently the only FDA-approved autologous epidermal product available for large total surface area burns. Epicel was designed as a Humanitarian Use Device (HUD) in 1998 and a Humanitarian Device Exemption (HDE) application for the product was submitted in 1999. HUDs are devices that are intended for diseases or conditions that affect or are manifested in fewer than 4,000 individuals annually in the United States. Currently, approximately less than 100 patients are treated with Epicel in the U.S. each year.

Under the HDE approval of 2007, Epicel cannot be sold for an amount that exceeds the cost of research and development, fabrication and distribution. However, pursuant to the Pediatric Medical Device Safety and Improvement Act of 2007 and the FDA Safety and Innovation Act of 2012 (FDASIA), a HUD can be sold for profit if certain conditions are met. Under current law as amended by FDASIA, an HDE holder can make a profit on its HUD after receiving HDE approval if the device is intended for the treatment or diagnosis of a disease or condition that occurs in pediatric patients or in a pediatric subpopulation, and such device is labeled for use in pediatric patients or in a pediatric subpopulation in which the disease or condition occurs; or is intended for the treatment or diagnosis of a disease or condition that does not occur in pediatric patients or that occurs in pediatric patients in such numbers that the development of the device for such patients is impossible, highly impracticable, or unsafe. If the FDA makes a determination that a HUD meets the eligibility criteria, the HUD is permitted to be sold for profit after receiving HDE approval as long as the number of devices distributed in any calendar year does not exceed the Annual Distribution Number (ADN) for the device. The ADN is determined by FDA when it approves the original HDE application, or when the agency approves an HDE supplement for an HDE approved before the enactment of FDASIA, if the HDE holder seeks a determination for the HUD in an HDE supplement based upon the profit-making eligibility criteria, and FDA determines that the HUD meets the eligibility criteria.

We are currently investigating Epicel’s eligibility for an exemption from the profit prohibition and have requested a pre-submission meeting with the FDA to discuss the process and required data for submitting an HDE supplement to obtain an exemption from the profit prohibition. Epicel is currently being sold at a price that reflects the cost of research and development, fabrication and distribution.

Also, up until July 2014, we had one sales representative selling Epicel and two partially dedicated Medical Scientific Liaisons supporting Epicel inquiries. We currently have a 4-person field force.

MACI

MACI is a third-generation ACI product for the treatment of focal chondral cartilage defects in the knee. MACI received marketing authorization in Europe in July 2013 by meeting the requirements of the Advanced Therapy and Medicinal Product (ATMP) guidelines. MACI has been commercially available in the EU since 1998. As part of the June 2014 restructuring we temporarily suspended sales of MACI in August 2014, primarily due to low utilization and an unfavorable pricing environment. We believe that MACI has significant revenue potential in the U.S. The timing and strategy for and a possible reintroduction in select EU countries have not yet been determined. In June of 2015, we announced plans to submit a BLA to the FDA by the end of this year for MACI, for the treatment of cartilage defects in the knee.

3

Table of Contents

MACI was obtained by Sanofi by acquiring Verigen AG (Verigen) in 2005. As part of Sanofi’s acquisition of Verigen, Sanofi agreed to make cash payments to Verigen upon the achievement of developmental milestones relating to regulatory and commercialization of MACI in the United States. In connection with our acquisition of the CTRM business, we agreed that if we further developed MACI in the U.S., we would be obligated to pay these milestone payments. During the third quarter of 2014, at the request of the Company, Sanofi entered into a settlement agreement with the former shareholders of Verigen whereby these shareholders agreed to discharge all obligations related to these MACI milestone payments in exchange for a one-time cash payment of €2.5 million (approximately $3.2 million). We paid this amount in full in October 2014.

Ixmyelocel-T

Our preapproval stage portfolio also includes ixmyelocel-T, a unique patient-specific multicellular therapy derived from an adult patient’s own bone marrow which utilizes our proprietary, highly automated and scalable manufacturing system. Our proprietary cell manufacturing process significantly expands the mesenchymal stromal cells (MSCS) and M2-like anti-inflammatory macrophages in the patient’s bone marrow mononuclear cells while retaining many of the hematopoietic cells. These cell types are known to regulate the immune response and play a key role in tissue repair and regeneration by resolving pathologic inflammation, promoting angiogenesis, and remodeling ischemic tissue. The novelty and advantage of using ixmyelocel-T is the expansion of a unique combination of cell populations, including MSCS and M2-like macrophages, which secrete a distinct combination of angiogenic and regenerative factors, and possess the ability to remain anti-inflammatory in the face of inflammatory challenge.

Our lead clinical development program for ixmyelocel-T is focused on severe, chronic ischemic cardiovascular diseases. We are currently conducting the Phase 2b ixCELL-DCM study, which is a randomized, double-blind, placebo-controlled clinical trial for patients with advanced heart failure due to ischemic DCM. Ixmyelocel-T has been granted a U.S. Orphan Drug designation by the FDA for the treatment of DCM. We also have an ongoing ixmyelocel-T clinical program for the treatment of craniofacial reconstruction and have conducted clinical studies for the treatment of critical limb ischemia.

The ongoing Phase 2b ixCELL-DCM clinical study has treated 114 patients at 28 sites in the U.S. and Canada. Patients will be followed for 12 months for the primary efficacy endpoint of major adverse cardiovascular events, defined as all-cause deaths, all-cause hospitalizations, and unplanned outpatient or emergency department visits for IV treatment of acute worsening heart failure. Secondary endpoints include clinical, functional, structural, symptomatic, quality of life, and biomarker measures at 3, 6 and 9 months. Patients will be followed for an additional 12 months for safety. We completed enrollment of the ixCELL-DCM study in January 2015, and expect to have top-line efficacy results around the end of the first quarter of 2016.

Company Information

We were incorporated under the laws of the State of Michigan on March 24, 1989. Our principal executive offices are located at 64 Sidney Street, Cambridge, Massachusetts, 02139 and our telephone number is (617) 588-5555. Our website address is www.vcel.com. The reference to our website is intended to be an inactive textual reference and, except for the documents incorporated by reference as noted below, the information on, or accessible through, our website is not part of this prospectus.

4

Table of Contents

The Offering

On January 21, 2014, we entered into a Purchase Agreement and a Registration Rights Agreement (the Registration Rights Agreement) with Lincoln Park, pursuant to which Lincoln Park agreed to purchase from us up to $15,000,000 in shares of our common stock, subject to certain limitations from time to time over a 30-month period commencing on the date of effectiveness of the registration statement on Form S-1 (Registration No. 333-193861), which provides for the resale of such shares pursuant to the Registration Rights Agreement. The shares issuable to Lincoln Park under the Purchase Agreement are being offered pursuant to this prospectus.

As of June 15, 2015, we have issued shares of common stock to Lincoln Park under the Purchase Agreement as follows:

(1) 48,063 shares of our common stock to Lincoln Park pursuant to the terms of the terms of the Purchase Agreement as consideration for its commitment to purchase additional shares of our common stock under the Purchase Agreement; and

(2) 887,436 shares of our common stock to Lincoln Park purchased pursuant to the terms of the Purchase Agreement.

Accordingly, we may sell up to $11,345,362 over the remaining approximately 13-month period. We may, from time to time and at our sole discretion, direct Lincoln Park to purchase up to $11,345,362 worth of shares of our common stock. By means of a Regular Purchase, so long as at least one business day has passed since the most recent purchase, we may direct Lincoln Park to purchase up to 50,000 shares of our common stock at the Regular Purchase Price, increasing to amounts up to 100,000 shares of our common stock depending upon the closing sale price of our common stock. Additionally, we may direct Lincoln Park to purchase additional amounts as Accelerated Purchases if on the date of a Regular Purchase the closing sale price of our common stock equals or exceeds $3.00.

There is no upper limit on the price per share that Lincoln Park must pay for our common stock under the Purchase Agreement, but in no event will shares be sold to Lincoln Park under a Regular Purchase on a day our closing price is less than the minimum floor price of $2.50 per share.

As consideration for Lincoln Park’s commitment to purchase our common stock pursuant to the Purchase Agreement, we issued to Lincoln Park 48,063 shares of our common stock (or the Initial Commitment Shares) on January 21, 2014 as consideration for its commitment to purchase shares pursuant to the Purchase Agreement. In the event the initial registration statement is insufficient to cover all of the shares issuable under the Purchase Agreement and we file a new registration statement to cover any remaining shares not covered by the initial registration statement, we will issue to Lincoln Park an additional 48,063 shares (or the Additional Commitment Shares).

The proceeds received by us under the Purchase Agreement are expected to be used for working capital and general corporate purposes as described further in this prospectus.

The Purchase Agreement limits our sales of shares of common stock to Lincoln Park to the maximum number of shares of our common stock that we may issue without breaching our obligations under applicable rules of the NASDAQ Capital Market (approximately 1,148,843 shares, or 19.99% of our total outstanding common stock as of the date of the Purchase Agreement, which we refer to as the 19.99% shareholder approval limitation) or obtaining shareholder approval under such rules, unless the average price of all applicable sales of common stock exceed a “Base Price” (or $4.13, representing our closing consolidated bid price on January 17, 2014, plus an incremental amount to account for the issuance of commitment shares) such that the sales to Lincoln Park are considered to be at least “at market” under applicable NASDAQ rules.

As a result, although the Purchase Agreement provides that we may sell up to $15,000,000 in shares of our common stock to Lincoln Park, only 1,748,063 shares are being offered under this prospectus, which includes the shares already sold to Lincoln Park as described above. This aggregate number of shares may or may not cover all of such shares to be purchased by and issued to Lincoln Park under the Purchase Agreement, depending on the purchase price per share. In the event the initial registration statement is insufficient to cover all of the shares issuable under the Purchase Agreement, we may elect to file a new registration statement so as to cover all of the shares potentially issuable.

As of June 15, 2015, there were 23,785,653 shares of our common stock issued and outstanding, of which 23,732,291 shares were held by non-affiliates. If all of the 1,748,063 shares offered by Lincoln Park under this prospectus were issued and outstanding

5

Table of Contents

as of the date hereof, such shares would represent approximately 7.35% of the total common stock outstanding and approximately 7.37% of the total number of outstanding shares held by non-affiliates.

The actual number of shares to be purchased by Lincoln Park under the Purchase Agreement is variable, depending on the market price of our common stock at the time of each sale. Accordingly, we cannot predict the actual total number of shares to be issued to Lincoln Park. This prospectus covers 1,748,063 shares of common stock. As of the date hereof, we do not currently have any plans or intent to issue to Lincoln Park any shares pursuant to the Purchase Agreement beyond the 1,748,063 shares offered hereby. However, if we elect to issue and sell to Lincoln Park pursuant to the Purchase Agreement more than the 1,748,063 shares offered under this prospectus, which we have the right but not the obligation to do, up to the $15,000,000 maximum in shares of our common stock, we would first be required to register for resale under the Securities Act any additional shares we may elect to sell to Lincoln Park before we can sell such additional shares, which could cause additional substantial dilution to our shareholders. The number of shares issued pursuant to the Purchase Agreement and ultimately offered for resale by Lincoln Park depends on the number of shares purchased by Lincoln Park under the Purchase Agreement.

There are substantial risks to our shareholders as a result of the sale and issuance of common stock to Lincoln Park under the Purchase Agreement. These risks include substantial dilution, significant declines in our stock price and our inability to draw sufficient funds when needed. See “Risk Factors.” Issuance of our common stock to Lincoln Park under the Purchase Agreement will not affect the rights or privileges of our existing shareholders, except that the economic and voting interests of our existing shareholders will be diluted as a result of any such issuance. Although the number of shares of common stock that our existing shareholders own will not decrease, the shares owned by our existing shareholders will represent a smaller percentage of our total outstanding shares after any such issuance to Lincoln Park.

|

Issuer |

Vericel Corporation |

|

|

|

|

Common stock offered by selling shareholder |

Up to 1,748,063 shares of common stock consisting of :

· 935,499 shares already issued to Lincoln Park and

· 812,564 shares we may sell to Lincoln Park under the Purchase Agreement. |

|

|

|

|

Common stock outstanding before this offering |

23,785,653 shares of common stock, which amount includes 935,499 shares of common stock already sold to Lincoln Park as described herein. |

|

|

|

|

Common stock to be outstanding after this offering |

24,598,217 shares of common stock, which amount assumes sale of the remaining 812,564 available under the terms of the Purchase Agreement. |

|

|

|

|

Use of Proceeds |

We will not receive any proceeds from the sales of shares of our common stock by Lincoln Park; however, we may receive total proceeds of up to $15,000,000 under the Purchase Agreement for the sale of such shares to Lincoln Park, of which we have received $3,654,638 as of June 15, 2015. See “Use of Proceeds” for a more complete description of our intended use of the net proceeds from this offering. |

|

|

|

|

Risk Factors |

You should carefully read “Risk Factors” in this prospectus for a discussion of factors that you should consider before deciding to invest in our common stock. |

|

|

|

|

NASDAQ Capital Market symbol |

VCEL |

6

Table of Contents

RISK FACTORS

An investment in our securities involves a high degree of risk. Prior to making a decision about investing in our securities, you should carefully consider all of the information appearing or incorporated by reference in this prospectus. You should also consider the risks, uncertainties and assumptions discussed under Item 1A, “Risk Factors,” in our Annual Report on Form 10-K for the year ended December 31, 2014 and any updates described in our subsequent Quarterly Reports on Form 10-Q, each of which is incorporated herein by reference, and may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future and any prospectus supplement related to a particular offering. The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. The occurrence of any of these known or unknown risks might cause you to lose all or part of your investment in the offered securities. The discussion of risks includes or refers to forward-looking statements; you should read the explanation of the qualifications and limitations on such forward-looking statements discussed elsewhere in this prospectus.

7

Table of Contents

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, including the documents that we incorporate by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act) and Section 21E of the Securities Exchange Act of 1934, as amended (Exchange Act). Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but are not always, made through the use of words or phrases such as “anticipates,” “estimates,” “plans,” “projects,” “trends,” “opportunity,” “comfortable,” “current,” “intention,” “position,” “assume,” “potential,” “outlook,” “remain,” “continue,” “maintain,” “sustain,” “seek,” “achieve,” “continuing,” “ongoing,” “expects,” “believe,” “intend” and similar words or phrases, or future or conditional verbs such as “will,” “would,” “should,” “could,” “may,” or similar expressions. Accordingly, these statements involve estimates, assumptions and uncertainties which could cause actual results to differ materially from those expressed in them. Any forward-looking statements are qualified in their entirety by reference to the factors discussed throughout this report, and in particular those factors referenced in the section “Risk Factors.”

Because the factors referred to in the preceding paragraph could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements we make, you should not place undue reliance on any such forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding:

· potential strategic collaborations with others;

· future capital needs and financing sources;

· adequacy of existing capital to support operations for a specified time;

· product development and marketing plan;

· features and successes of our cellular therapies;

· manufacturing and facility capabilities;

· regulatory developments in the United States and foreign countries;

· the timing or likelihood of regulatory filings and approvals;

· clinical trial plans and anticipated results, including the publication thereof;

· anticipation of future losses;

· replacement of manufacturing sources;

· integration of the CTRM business and assets;

· commercialization plans;

· revenue expectations and operating results; or

· other risks and uncertainties, including those listed under the caption “Risk Factors.”

Given these uncertainties, you should not place undue reliance on these forward-looking statements. You should read this prospectus, any supplements to this prospectus and the documents that we reference in this prospectus with the understanding that our actual future results may be materially different from what we expect. Except as required by law, we do not undertake any obligation

8

Table of Contents

to update or revise any forward-looking statements contained in this prospectus or any supplement to this prospectus, whether as a result of new information, future events or otherwise.

9

Table of Contents

HOW WE INTEND TO USE THE PROCEEDS

We will not receive any proceeds from the sales of shares of our common stock by Lincoln Park; however, we may receive additional proceeds of up to $11,345,362 under the Purchase Agreement over the remaining approximately 13-month period following the date of this registration statement of which this prospectus is a part assuming that we sell all of the shares available thereunder and excluding the cost of the shares issued to Lincoln Park for its commitment. However, there can be no assurance we will sell any or all of the shares to Lincoln Park or that they will resell such shares offered hereby.

Unless otherwise provided in a supplement or amendment to this prospectus, we intend to use any net proceeds from this offering, together with other available funds, for operating costs, including continuing to conduct our clinical development programs and pursuing commercialization of our products and product candidates, capital expenditures and working capital needs and for other general corporate purposes.

We have not specifically identified the precise amounts we will spend on each of these areas or the timing of these expenditures. The amounts actually expended for each purpose may vary significantly depending upon numerous factors, including the amount and timing of the proceeds from this offering, progress with clinical product development and other cell therapy application programs. In addition, expenditures may also depend on the establishment of new collaborative arrangements with other companies, the availability of other financing, and other factors.

We will be required to raise substantial additional capital to continue to fund the clinical development of our cell therapy applications. We may raise additional capital through additional public or private financings, as well as collaborative relationships, incurring debt and other available sources. Please see the discussion of the risks associated with our liquidity in the section “Risk Factors.”

10

Table of Contents

DETERMINATION OF OFFERING PRICE

The selling shareholder may offer and sell the shares of common stock covered by this prospectus at prevailing market prices or privately negotiated prices. See “Plan of Distribution.”

11

Table of Contents

THE LINCOLN PARK TRANSACTION

General

On January 21, 2014, we entered into the Purchase Agreement and the Registration Rights Agreement with Lincoln Park. Pursuant to the terms of the Purchase Agreement, Lincoln Park agreed to purchase from us up to $15,000,000 in shares of our common stock, subject to certain limitations. Under the terms of the Purchase Agreement, we may, from time to time and at our sole discretion during the 13-month period commencing on the date of this registration statement of which this prospectus is a part, subject to the conditions of the Purchase Agreement, direct Lincoln Park to purchase shares of our common stock up to an additional aggregate amount of $11,345,362. The amount we receive and the per share purchase price depends on whether the purchase is a Regular Purchase or an Accelerated Purchase. An aggregate of 1,748,063 shares issuable to Lincoln Park under the Purchase Agreement are being offered pursuant to this prospectus, which includes the shares already sold to Lincoln Park, as described herein. The proceeds received by us under the Purchase Agreement are expected to be used for clinical development costs and general corporate purposes as described further in this prospectus.

As of June 15, 2015, we have issued shares of common stock to Lincoln Park under the Purchase Agreement as follows:

(3) 48,063 shares of our common stock to Lincoln Park pursuant to the terms of the terms of the Purchase Agreement as consideration for its commitment to purchase additional shares of our common stock under the Purchase Agreement; and

(4) 887,436 shares of our common stock to Lincoln Park purchased pursuant to the terms of the Purchase Agreement.

Accordingly, we may sell up to $11,345,362 over the remaining approximately 13-month period.

Pursuant to the terms of the Registration Rights Agreement, we have filed with the SEC the registration statement that includes this prospectus to register for resale under the Securities Act shares of common stock that may be issued and sold to Lincoln Park under the Purchase Agreement. Although the Purchase Agreement provides that we may sell up to a total of $15,000,000 in shares of our common stock to Lincoln Park, only 1,748,063 shares are being offered under this prospectus, which includes the shares already sold to Lincoln Park described above.

We cannot predict the actual total number of shares to be issued to Lincoln Park. The aggregate number of shares offered under this prospectus may or may not cover all of such shares to be purchased by and issued to Lincoln Park under the $15,000,000 Purchase Agreement, depending on the purchase price per share. In the event the initial registration statement is insufficient to cover all of the shares issuable under the Purchase Agreement, we may elect to file a new registration statement so as to cover all of the shares potentially issuable. As of the date hereof, we do not currently have any plans or intent to issue to Lincoln Park any shares pursuant to the Purchase Agreement beyond the 1,748,063 shares offered hereby. If we elect to issue and sell to Lincoln Park pursuant to the Purchase Agreement more than the 1,748,063 shares offered under this prospectus, up to the $15,000,000 maximum, we would first be required to register for resale under the Securities Act such additional shares, which could cause substantial additional dilution to our stockholders.

Purchase of Shares under the Purchase Agreement

By means of a Regular Purchase, so long as at least one business day has passed since the most recent purchase, we may direct Lincoln Park to purchase up to 50,000 shares of our common stock at the Regular Purchase Price, increasing to amounts up to 100,000 shares of our common stock depending upon the closing sale price of our common stock. The Regular Purchase Price is the lower of:

· the lowest sale price for our common stock reported on the NASDAQ Capital Market on the purchase date of such shares, or

· the arithmetic average of the three lowest closing sale prices for our common stock during the 10 consecutive business days immediately preceding the purchase date of such shares.

Additionally, we may direct Lincoln Park to purchase additional amounts as Accelerated Purchases if on the date of a Regular Purchase the closing sale price of our common stock equals or exceeds $3.00. In such event, we may direct Lincoln Park to

12

Table of Contents

purchase on the following day, as an Accelerated Purchase and at the Accelerated Purchase Price, up to the lesser of: (i) three times the number of shares for a Regular Purchase, or (ii) up to 30% of the following day’s volume.

The Accelerated Purchase Price is the lower of:

· 97% of the volume weighted average price during (i) the entire trading day on the purchase date, if the volume of shares of our common stock traded on the purchase date has not exceeded a volume maximum calculated in accordance with the Purchase Agreement, or (ii) the portion of the trading day on the purchase date (calculated starting at the beginning of normal trading hours) until such time at which the volume of shares of our common stock traded has exceeded such volume maximum, or

· the closing sale price of our common stock on the purchase date.

There is no upper limit on the price per share that Lincoln Park must pay for our common stock under the Purchase Agreement, but in no event will shares be sold to Lincoln Park under a Regular Purchase on a day our closing price is less than the minimum floor price of $2.50 per share. The Regular Purchase Price and the Accelerated Purchase Price will be equitably adjusted for any reorganization, recapitalization, non-cash dividend, stock split or other similar transaction occurring during the business days used to compute the Regular Purchase Price or Accelerated Purchase Price.

The Purchase Agreement limits our sales of shares of common stock to Lincoln Park to the maximum number of shares of our common stock that we may issue without breaching our obligations under applicable rules of the NASDAQ Capital Market (approximately 1,148,843 shares, or 19.99% of our total outstanding common stock as of the date of the Purchase Agreement) or obtaining shareholder approval under such rules, unless the average price of all applicable sales of common stock exceed a “Base Price” (or $4.13, representing our closing consolidated bid price on January 17, 2014, plus an incremental amount to account for the issuance of commitment shares) such that the sales to Lincoln Park are considered to be at least “at market” under applicable NASDAQ rules.

Other than as set forth above, there are no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any sales of our common stock to Lincoln Park. Generally, each time we direct Lincoln Park, subject to the terms of the Purchase Agreement, Lincoln Park will be obligated to purchase such amounts as directed by us. Lincoln Park does not have the right to require us to sell any shares of common stock to them under the Purchase Agreement. We have no obligation to sell any shares under the Purchase Agreement and the actual proceeds that we receive from sales to Lincoln Park could be substantially less than the maximum $15,000,000.

Commitment Shares

As consideration for Lincoln Park’s commitment to purchase our common stock pursuant to the Purchase Agreement, we previously issued to Lincoln Park 48,063 shares as Initial Commitment Shares. Lincoln Park may not assign or transfer its rights and obligations under the Purchase Agreement. In the event the initial registration statement is insufficient to cover all of the shares issuable under the Purchase Agreement and we file a new registration statement to cover any remaining shares not covered by the initial registration statement, we will issue to Lincoln Park 48,063 shares (or the Additional Commitment Shares) as additional consideration.

Effect of Performance of the Purchase Agreement on Our Shareholders

All shares of common stock that are covered by this prospectus are expected to be freely tradable. It is anticipated that shares registered in this offering will be sold over a period of up to 13 months from the date of this prospectus. The sale by Lincoln Park of a significant amount of shares registered in this offering at any given time could cause the market price of our common stock to decline and to be highly volatile. Lincoln Park may ultimately acquire all, some or none of the shares of common stock not yet issued but registered in this offering. After it has acquired such shares, it may sell all, some or none of such shares. Therefore, sales to Lincoln Park by us under the Purchase Agreement may result in substantial dilution to the interests of other holders of our common stock. However, we have the right to control the timing and amount of any sales of our shares to Lincoln Park and the Purchase Agreement may be terminated by us at any time at our discretion without any cost to us.

13

Table of Contents

As of June 15, 2015, there were 23,785,653 shares of our common stock issued and outstanding, of which 23,732,291 shares were held by non-affiliates. If all of the 1,748,063 shares offered by Lincoln Park under this prospectus were issued and outstanding as of the date hereof (without taking into account the 19.99% shareholder approval limitation), such shares would represent approximately 7.35% of the total common stock outstanding and approximately 7.37% of the total number of outstanding shares held by non-affiliates.

The number of shares ultimately offered for resale by Lincoln Park will be dependent upon the number of shares we sell to Lincoln Park under the Purchase Agreement. The following table shows the amount of proceeds we would receive from Lincoln Park from the sale of shares pursuant to the Purchase Agreement (without accounting for certain fees and expenses), to the extent covered by this prospectus, based on varying assumed average purchase prices:

|

Assumed Average

Purchase Price |

|

Number of Registered

Shares to be Issued if

Full Purchase (1)(4) |

|

Percentage of Outstanding

Shares After Giving Effect

to the Issuance to

Lincoln Park (2)(4) |

|

Proceeds from the Sale of

Shares to Lincoln Park

Under the Purchase

Agreement |

|

|

$ |

2.50 |

(3) |

1,700,000 |

|

6.91 |

% |

$ |

4,250,000 |

|

|

$ |

3.50 |

|

1,700,000 |

|

6.91 |

% |

$ |

5,950,000 |

|

|

$ |

4.50 |

|

1,700,000 |

|

6.91 |

% |

$ |

7,650,000 |

|

|

$ |

5.50 |

|

1,700,000 |

|

6.91 |

% |

$ |

9,350,000 |

|

|

$ |

6.50 |

|

1,700,000 |

|

6.91 |

% |

$ |

11,050,000 |

|

|

$ |

7.50 |

|

1,700,000 |

|

6.91 |

% |

$ |

12,750,000 |

|

(1) Excludes the 48,063 shares issued as Commitment Shares. Although the Purchase Agreement provides that we may sell up to $15,000,000 in shares of our common stock to Lincoln Park, we are only registering 1,748,063 shares to be purchased thereunder, which includes the shares already sold to Lincoln Park as described herein and may or may not cover all of such shares purchased by them under the Purchase Agreement, depending on the purchase price per share. As a result, we have included in this column only those shares which are registered in this offering.

(2) The denominator is based on 24,598,217 shares outstanding as of June 15, 2015, adjusted to include the 48,063 shares issued as Initial Commitment Shares, and the number of shares set forth in the adjacent column which we would have sold to Lincoln Park. The numerator is based on the number of shares issuable under the Purchase Agreement at the corresponding assumed purchase price set forth in the adjacent column.

(3) Under the Purchase Agreement, we may not sell any shares to Lincoln Park in the event the purchase price of such shares is below $2.50.

(4) If we seek to issue shares, including shares from other transactions but not included in this offering that may be aggregated with this transaction under the applicable rules of the NASDAQ Capital Market, in excess of 1,748,063 or 19.99% of the total common stock outstanding as of the date of the Purchase Agreement, we may be required to seek shareholder approval in order to be in compliance with the NASDAQ Capital Market rules.

There are substantial risks to our shareholders as a result of the sale and issuance of common stock to Lincoln Park under the Purchase Agreement. These risks include substantial dilution and declines in our stock price. See “Risk Factors.” Issuances of our common stock to Lincoln Park under the Purchase Agreement will not affect the rights or privileges of our existing shareholders, except that the economic and voting interests of our existing shareholders will be diluted as a result of any such issuance. Although the number of shares of common stock that our existing shareholders own will not decrease, the shares owned by our existing shareholders will represent a smaller percentage of our total outstanding shares after any such issuance to Lincoln Park.

Representations and Warranties; Indemnification

The Purchase Agreement includes customary representations and warranties by us to Lincoln Park. In addition, we have agreed to customary indemnification of Lincoln Park in connection with the Purchase Agreement.

14

Table of Contents

Events of Default

Pursuant to the Purchase Agreement, we cannot sell any shares of common stock to Lincoln Park if an event of default has occurred. Lincoln Park does not have the right to terminate the Purchase Agreement upon any of the events of default set forth below. The following events constitute events of default under the Purchase Agreement, all of which are outside the control of Lincoln Park:

· the effectiveness of the registration statement, of which this prospectus is a part, lapses for any reason (including, without limitation, the issuance of a stop order), or this prospectus is unavailable for sale by us or the resale by Lincoln Park of our common stock offered hereby, and such lapse or unavailability continues for a period of ten consecutive business days or for more than an aggregate of thirty business days in any 365-day period;

· suspension by our principal market of our common stock from trading for a period of one business day;

· the delisting of our common stock from the NASDAQ Capital Market, provided our common stock is not immediately thereafter trading on the New York Stock Exchange, NYSE MKT, the NASDAQ Global Market, the NASDAQ Global Select Market, the NYSE ARCA or the OTC Bulletin Board (or nationally recognized successor thereto);

· the transfer agent’s failure for three business days to issue to Lincoln Park shares of our common stock which Lincoln Park is entitled to receive under the Purchase Agreement;

· any breach of the representations or warranties or covenants contained in the Purchase Agreement or any related agreements which has a material adverse effect on us, only if breach continues for a period of at least five business days;

· any participation in insolvency or bankruptcy proceedings by or against us, which is not discharged within 90 days;

· our common stock is not eligible to be transferred electronically; or

· if we reach the share limit to the extent applicable under the NASDAQ Capital Market rules, and we have not obtained any necessary shareholder approval.

Termination of the Purchase Agreement; No Assignment

We have the unconditional right at any time under the Purchase Agreement for any reason to give notice to Lincoln Park terminating the Purchase Agreement without any cost to us.

No Short-Selling or Hedging by Lincoln Park

Lincoln Park has agreed that any time prior to the termination of the Purchase Agreement neither it nor any of its affiliates shall engage in or enter into, directly or indirectly, any short-sale of our common stock or any hedging transaction that establishes a net short position in our common stock.

15

Table of Contents

SELLING SHAREHOLDER

This prospectus relates to the possible resale by the selling shareholder, Lincoln Park, of shares of common stock that have been or may be issued to Lincoln Park pursuant to the Purchase Agreement. We are filing the registration statement of which this prospectus forms a part pursuant to the provisions of the Registration Rights Agreement, which we entered into with Lincoln Park on January 21, 2014 concurrently with our execution of the Purchase Agreement, in which we agreed to provide certain registration rights with respect to sales by Lincoln Park of the shares of our common stock that have been or may be issued to Lincoln Park under the Purchase Agreement.

Lincoln Park, as the selling shareholder, may, from time to time, offer and sell pursuant to this prospectus any or all of the shares that we have sold or may sell to Lincoln Park under the Purchase Agreement. The selling shareholder may sell some, all or none of its shares. We do not know how long the selling shareholder will hold the shares before selling them, and we currently have no agreements, arrangements or understandings with the selling shareholder regarding the sale of any of the shares.

The following table presents information regarding the selling shareholder and the shares that it may offer and sell from time to time under this prospectus. The table is prepared based on information supplied to us by the selling shareholder, and reflects its holdings as of June 15, 2015. Neither Lincoln Park nor any of its affiliates has held a position or office, or had any other material relationship, with us or any of our predecessors or affiliates. As used in this prospectus, the term “selling shareholder” means Lincoln Park. Beneficial ownership is determined in accordance with Rule 13d-3(d) promulgated by the SEC under the Exchange Act. The percentage of shares beneficially owned prior to the offering is based on 23,785,653 shares of our common stock actually outstanding as of June 15, 2015.

|

Selling Shareholder |

|

Shares Beneficially

Owned Before

this Offering |

|

Percentage of

Outstanding

Shares Beneficially

Owned

Before this

Offering |

|

Shares to be Sold in

this Offering Assuming

The Company

issues the Maximum

Number of Shares

Under the Purchase

Agreement |

|

Percentage of

Outstanding

Shares Beneficially

Owned After

this Offering |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lincoln Park Capital Fund, LLC (1) |

|

935,499 |

(2) |

3.93 |

%(3) |

1,748,063 |

(4) |

7.35 |

% |

(1) Josh Scheinfeld and Jonathan Cope, the Managing Members of Lincoln Park Capital, LLC, are deemed to be beneficial owners of all of the shares of common stock owned by Lincoln Park Capital Fund, LLC. Messrs. Cope and Scheinfeld have shared voting and investment power over the shares being offered under the prospectus filed with the SEC in connection with the transactions contemplated under the Purchase Agreement. Lincoln Park Capital, LLC is not a licensed broker dealer or an affiliate of a licensed broker dealer.

(2) Represents 48,063 shares of our common stock issued to Lincoln Park on January 21, 2014 as a commitment fee for its commitment to purchase additional shares of our common stock under the Purchase Agreement and additional issuance of 887,436 shares of our common stock as of June 15, 2015 for a total of 935,499 shares of common stock. See the description under the heading “The Lincoln Park Transaction” for more information about the Purchase Agreement.

(3) Based on 23,785,653 outstanding shares of our common stock as of June 15, 2015, which includes 48,063 shares of our common stock issued to Lincoln Park on January 21, 2014 as a commitment fee for its commitment to purchase additional shares of our common stock under the Purchase Agreement and additional issuance of 887,436 shares of our common stock as of June 15, 2015

16

Table of Contents

for a total of 935,499 shares of common stock. Although we may at our discretion elect to issue to Lincoln Park up to an aggregate amount of $11,345,362 of our common stock under the Purchase Agreement as of June 15, 2014, other than the shares described in the immediately preceding sentence, such shares are not included in determining the percentage of shares beneficially owned before this offering.

(4) Assumes issuance of the maximum 1,748,063 shares being registered hereby, which includes the shares already sold to Lincoln Park as described herein.

17

Table of Contents

PLAN OF DISTRIBUTION

The common stock offered by this prospectus is being offered by Lincoln Park, the selling shareholder. The common stock may be sold or distributed from time to time by the selling shareholder directly to one or more purchasers or through brokers, dealers, or underwriters who may act solely as agents at market prices prevailing at the time of sale, at prices related to the prevailing market prices, at negotiated prices, or at fixed prices, which may be changed. The sale of the common stock offered by this prospectus may be effected in one or more of the following methods:

· ordinary brokers’ transactions;

· transactions involving cross or block trades;

· through brokers, dealers, or underwriters who may act solely as agents;

· “at the market” into an existing market for the common stock;

· in other ways not involving market makers or established business markets, including direct sales to purchasers or sales effected through agents;

· in privately negotiated transactions; or

· any combination of the foregoing.

In order to comply with the securities laws of certain states, if applicable, the shares may be sold only through registered or licensed brokers or dealers. In addition, in certain states, the shares may not be sold unless they have been registered or qualified for sale in the state or an exemption from the registration or qualification requirement is available and complied with.

Brokers, dealers, underwriters, or agents participating in the distribution of the shares as agents may receive compensation in the form of commissions, discounts, or concessions from the selling shareholder and/or purchasers of the common stock for whom the broker-dealers may act as agent. The compensation paid to a particular broker-dealer may be less than or in excess of customary commissions.

Lincoln Park is an “underwriter” within the meaning of the Securities Act.

Neither we nor Lincoln Park can presently estimate the amount of compensation that any agent will receive. We know of no existing arrangements between Lincoln Park, any other shareholder, broker, dealer, underwriter, or agent relating to the sale or distribution of the shares offered by this prospectus. At the time a particular offer of shares is made, a prospectus supplement, if required, will be distributed that will set forth the names of any agents, underwriters, or dealers and any compensation from the selling shareholder, and any other required information.

We will pay all of the expenses incident to the registration, offering, and sale of the shares to the public other than commissions or discounts of underwriters, broker-dealers, or agents. We have also agreed to indemnify Lincoln Park and related persons against specified liabilities, including liabilities under the Securities Act.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers, and controlling persons, we have been advised that in the opinion of the SEC this indemnification is against public policy as expressed in the Securities Act and is therefore, unenforceable.

Lincoln Park and its affiliates have agreed not to engage in any direct or indirect short selling or hedging of our common stock during the term of the Purchase Agreement.

We have advised Lincoln Park that while it is engaged in a distribution of the shares included in this prospectus it is required to comply with Regulation M promulgated under the Securities Exchange Act of 1934, as amended. With certain exceptions, Regulation M precludes the selling shareholder, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the

18

Table of Contents

subject of the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability of the shares offered hereby this prospectus.

This offering will terminate on the date that all shares offered by this prospectus have been sold by Lincoln Park.

Our common stock is listed on the NASDAQ Capital Market under the symbol “VCEL.”

19

Table of Contents

CERTAIN PROVISIONS OF MICHIGAN LAW AND OF OUR CHARTER AND

BYLAWS; TRANSFER AGENT AND REGISTRAR

We are subject to certain anti-takeover provisions of the Michigan Business Corporation Act (MBCA) that could delay or make more difficult a merger or tender offer involving us. Chapter 7A of the MBCA prevents, in general, an “interested shareholder” (defined generally as a person owning 10% or more of a corporation’s outstanding voting shares) from engaging in a “business combination” (as defined therein) with a Michigan corporation unless: (a) the board of directors issues an advisory statement, holders of 90% of the shares of each class of stock entitled to vote approve the transaction, and holders of two-thirds of the “disinterested” shares of each class of stock approve the transaction; (b) the interested shareholder has been an interested shareholder for at least five years and has not acquired beneficial ownership of any additional shares of the corporation subsequent to the transaction which resulted in such shareholder being classified as an interested shareholder, and meets certain requirements, including provisions relating to the fairness of the price and the form of consideration paid; or (c) the board of directors, by resolution, exempts a particular interested shareholder from these provisions prior to the interested shareholder becoming an interested shareholder. The MBCA also contains certain other provisions that could have anti-takeover effects.

Our Charter does not provide shareholders with the right to act without a meeting and does not provide for cumulative voting in the election of directors. The amendment of any of these provisions would require approval by holders of at least a majority of the shares of our outstanding common stock.

These and other provisions of our Charter or Bylaws, as well as our Rights Agreement described below under “Description of Securities,” could have the effect of deterring certain takeovers or delaying or preventing certain changes in control or changes in our management, including transactions in which shareholders might otherwise receive a premium for their shares over then-current market prices.

20

Table of Contents

DESCRIPTION OF SECURITIES

The following briefly summarizes the general terms and provisions of our shares of common stock and preferred stock. You should read the provisions of our articles of incorporation, as amended (Charter), our amended and restated bylaws (Bylaws) and other relevant instruments and agreements relating to our securities before you make an investment decision with respect to our shares of common and preferred stock. The following description of our common and preferred stock and certain provisions of our Charter, and our amended and restated Bylaws, is a summary and is qualified in its entirety by the provisions of our Charter and Bylaws.

Our authorized capital stock consists of 75,000,000 shares of common stock, no par value per share, and 5,000,000 shares of preferred stock, no par value per share. Please see “Certain Provisions of Michigan Law and of Our Charter and Bylaws” for a description of those provisions in our Charter and Bylaws that would have an effect of delaying, deferring or preventing a change in control of the Company and that would operate only with respect to an extraordinary corporate transaction involving us or our subsidiaries.

Common Stock

Holders of our common stock are entitled to one vote for each share held of record on all matters submitted to a vote of shareholders. We do not have a classified Board and shareholders do not have cumulative voting rights. Holders of common stock have no preemptive, redemption or conversion rights and are not subject to future calls or assessments. No sinking fund provisions apply to our common stock. All outstanding shares are fully-paid and non-assessable. In the event of our liquidation, dissolution or winding up, holders of common stock are entitled to share ratably in assets available for distribution, subject to any prior distribution rights of any preferred stock then outstanding. Holders of common stock are entitled to receive proportionately any such dividends declared by our Board, out of legally available funds for dividends, subject to any preferences that may be applicable to any shares of preferred stock that may be outstanding at that time. The rights, preferences and privileges of holders of common stock are set forth in our Charter, which may be amended by the holders of a majority of the outstanding shares of common stock.

Preferred Stock

Our Board may issue preferred stock in one or more series without shareholder approval. Our Board may determine the rights, preferences, privileges and restrictions, including voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences, of each series of preferred stock. The issuance of preferred stock, while providing desirable flexibility in connection with possible acquisitions and other corporate purposes, could make it more difficult for a third party to acquire, or could discourage a third party from acquiring, a majority of our outstanding voting stock. The rights of holders of our common stock described above, will be subject to, and may be adversely affected by, the rights of any preferred stock that we may designate and issue in the future.

Shareholder Rights Agreement - Series A Junior Participating Cumulative Preferred Stock

On August 11, 2011, our Board adopted a shareholder rights agreement (Rights Agreement), the purpose of which is, among other things, to enhance the Board’s ability to protect shareholder interests and to ensure that shareholders receive fair treatment in the event any coercive takeover attempt of the Company is made in the future. The Rights Agreement could make it more difficult for a third-party to acquire, or could discourage a third party from acquiring, us or a large block of our common stock.

The following summary description of the Rights Agreement should be read in conjunction with the Rights Agreement, which was filed with the SEC as an exhibit to a Registration Statement on Form 8-A on August 12, 2011 and amended in March 2012 to allow Eastern Capital to acquire beneficial ownership of up to 49.9% of the Company’s outstanding securities without being deemed an “acquiring person” for purposes of our Rights Agreement.

In connection with the adoption of the Rights Agreement, the Board declared a dividend distribution of one preferred stock purchase right (Right) for each outstanding share of common stock to shareholders of record as of the close of business on August 15, 2011. In addition, one Right will automatically attach to each share of common stock issued between August 15, 2011 and the

21

Table of Contents

distribution date. As a result of the October 2013 reverse stock split, the number of Rights associated with each share of common stock was automatically proportionately adjusted so that (i) twenty rights were then associated with each outstanding share of common stock and (ii) so long as the Rights are attached to the common stock, twenty rights shall be deemed to be delivered for each share of common stock issued or transferred by the Company in the future. The Rights currently are not exercisable and are attached to and trade with the outstanding shares of common stock. Under the Rights Agreement, the Rights become exercisable if a person or group becomes an “acquiring person” by acquiring 15% or more of the outstanding shares of common stock or if a person or group commences a tender offer that would result in that person owning 15% or more of the common stock. If a person or group becomes an “acquiring person,” each holder of a Right (other than the acquiring person and its affiliates, associates and transferees) would be entitled to purchase, at the then-current exercise price, such number of shares of our preferred stock which are equivalent to shares of common stock having a value of twice the exercise price of the Right. If we are is acquired in a merger or other business combination transaction after any such event, each holder of a Right would then be entitled to purchase, at the then-current exercise price, shares of the acquiring company’s common stock having a value of twice the exercise price of the Right.

Each share of preferred stock is entitled to payment of a quarterly dividend, an increased vote multiple, and a liquidation preference. In addition, each share of preferred stock is granted the exclusive right to vote for two additional members of the Board whose positions are created upon the vesting of such rights upon holders of preferred stock. Once purchased, said shares are not redeemable by the Company.

The Rights may be redeemed in whole, but not in part, at a price of $0.001 per Right (payable in cash, common stock or other consideration deemed appropriate by the Board) by the Board only until the earlier of (i) the time at which any person becomes an “acquiring person” or (ii) the expiration date of the Rights Agreement. Immediately upon the action of the Board ordering redemption of the Rights, the Right will terminate and thereafter the only right of the holders of Rights will be to receive the redemption price. The Rights will expire at the close of business on August 15, 2021, unless previously redeemed or exchanged by us as described above.

Series B Convertible Preferred Stock

On March 9, 2012, we completed the sale of 12,308 shares of Series B-1 Non-Voting Convertible Preferred Stock (Series B-1 preferred stock) at an offering price of $3,250 per share. In addition to the Series B-1 preferred stock, which was issued at the closing, we also authorized Series B-2 Voting Convertible preferred Stock (Series B-2 preferred stock). The Series B-1 preferred stock and Series B-2 preferred stock collectively are referred to as the Series B preferred stock. The Series B preferred stock is convertible, at the option of the holder thereof at any time after the five year anniversary of the closing of the offering, into shares of common stock at a conversion price of $3.25 per share of common stock, at a conversion ratio of one share of preferred stock for fifty shares of common stock. At any time after the five year anniversary of issuance, we may elect to convert any or all outstanding shares of Series B preferred stock into shares of common stock, subject to certain limitations. Dividends on the Series B preferred stock will be cumulative and compound daily, at a rate of 11.5% per annum, payable upon conversion, liquidation, redemption or other similar events, and payable in cash or Series B-1 preferred stock until the five year anniversary of issuance. As of March 31, 2015, there are approximately 259,534 accumulated but undeclared Series B-1 dividend shares. Unless prohibited by Michigan law governing distributions to shareholders, the Series B-1 preferred stock shall be redeemable at the option of holder of the Series B-1 preferred stock commencing at any time after the five year anniversary of issuance, liquidation, winding up, dissolution or other similar events, subject to certain terms and limitations.

On August 12, 2013, we amended the Series B preferred stock agreement to remove the cash redemption provision, modify the liquidation preferences for the Series B-2 preferred stock and to increase the redemption price for the Series B-1 preferred stock. The redemption price, prior to the five year anniversary, is now equal to $7,430 multiplied by the number of Series B-1 preferred shares redeemed minus our closing stock price multiplied by the number of common shares into which the outstanding Series B-2 preferred stock are convertible. The redemption price, after the five year anniversary, is the amount equal to the greater of the Series B offering price plus accrued dividends or the conversion value in common stock. As a result of the amendment to the agreement, the total amount of $38.4 million Series B preferred stock has been reclassified from mezzanine into shareholders’ equity (deficit).

Transfer Agent

The transfer agent of our common stock is Continental Stock Transfer & Trust Company.

22

Table of Contents

LEGAL MATTERS

Certain legal matters, including the legality of the securities offered, will be passed upon for us by Dykema Gossett PLLC, Bloomfield Hills, Michigan, acting as special counsel to the Company. In connection with the offering, other legal matters will be passed upon for us by Goodwin Procter LLP, Boston, Massachusetts.

EXPERTS

The consolidated financial statements incorporated in this Prospectus by reference to the Annual Report on Form 10-K for the year ended December 31, 2014, as well as the audited special purpose combined financial statements of the Cell Therapy and Regenerative Medicine Business, a product portfolio of Sanofi, included as Exhibit 99.1 to Vericel Corporation’s Current Report on Form 8-K, as amended, dated June 29, 2015, have been so incorporated in reliance on the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION