TIDMPRV

RNS Number : 7916M

Porvair PLC

25 January 2016

For immediate release 25 January 2016

Porvair PLC

Results for the year ended 30 November 2015

Record profits before tax and strong cash generation

Porvair plc ("Porvair" or "the Group"), the specialist

filtration and environmental technology group, today announces its

results for the year ended 30 November 2015.

Highlights

Strong financial performance:

-- Profit before tax up 9% to a record GBP9.2 million (2014: GBP8.4 million).

-- Basic earnings per share up 8% to 15.5 pence (2014: 14.4 pence).

-- Strong cash generation: net cash doubled to GBP10.7 million

at 30 November 2015 (2014: GBP5.3 million).

-- Underlying revenue(1) growth of 7%.

o As previously announced, large project revenue was GBP14.0

million lower in 2015 so total reported revenue is 8% lower at

GBP95.8 million (2014: GBP104.0 million).

-- Final dividend of 2.2 pence per share (2014: 2.0 pence per

share) recommended, an increase of 10%.

Metals Filtration:

-- Revenue up 3% to a record GBP31.0 million (2014: GBP30.1

million). 4% lower in constant currency.

-- Acquisition of Fiber Ceramics to enhance offering in steel filtration.

-- Production of a new aluminium filter started in Porvair's expanded facility in China.

Microfiltration:

-- 9% underlying revenue(1) growth and record operating profit.

-- Revenue was GBP64.8 million (2014: GBP73.9 million).

-- Building and commissioning work for the large projects is going well.

-- Seal Analytical had a record year.

Outlook:

-- Healthy order position going into 2016.

-- Further capital investment planned to allow for further organic growth.

-- TEM acquired in December 2015 to expand into specialist filtration in microelectronics.

Commenting on the outlook, Ben Stocks, Chief Executive,

said:

"2015 finished with a strong final quarter and healthy order

books. Over the last two years significant investments have been

made in capacity with new production lines being brought into

operation. A promising new product development pipeline offers

plenty of opportunity for organic growth. The two recent

acquisitions should start to contribute in 2016. The Group is in a

strong financial position and a good start has been made to the

year."

Note (1) Underlying revenue: Revenue excluding the impact of

four specific large projects, as previously announced and

reported.

For further information please contact:

Porvair plc 020 7466 today

5000

Ben Stocks, Chief Executive 01553 765 thereafter

500

Chris Tyler, Group Finance

Director

020 7466

Buchanan Communications 5000

Charles Ryland / Steph

Watson

An analyst briefing will take place at 9:30 a.m. on Monday 25

January at Buchanan. An audio webcast and a copy of the

presentation will be available at www.porvair.com on the day.

Operating review

Overview of 2015

2015 2014 2013

GBPm GBPm GBPm

Revenue 95.8 104.0 84.3

------ ------ ------

Profit before tax 9.2 8.4 7.6

------ ------ ------

Earnings per share 15.5p 14.4p 12.3p

------ ------ ------

Cash generated from operations 13.3 14.2 12.3

------ ------ ------

Net cash 10.7 5.3 0.6

------ ------ ------

2015 was a strong year for the Group and positive progress was

achieved. Profit before tax in the year ended 30 November 2015 was

up 9% to a record GBP9.2 million (2014: GBP8.4 million). Earnings

per share grew 8% to 15.5 pence (2014: 14.4 pence). Cash generation

was again strong, enabling the Group to invest GBP3.8 million in

capital expenditure and finish the year with GBP10.7 million of net

cash.

As anticipated in previous statements, revenue at GBP95.8

million (2014: GBP104.0 million) was 8% lower due to revenue from

large projects dropping by GBP14.0 million compared with the

previous year. Underlying revenue growth was 7%.

Demand for gasification spares, bioscience materials, aluminium

filters and water analysis consumables continued to grow, driven by

the new product introductions, new installations and account wins

of recent years. With 48% of our products manufactured in the USA,

this was balanced by the negative commercial effects of a strong US

dollar.

2015 was another year of capital investment for organic growth

with facility expansion and production equipment upgrades in the

UK, USA and China. In recent years, seven of our ten manufacturing

plants have been extended and upgraded. 2016 will see a

continuation of this programme.

Shortly after the year end we acquired the business and trading

assets of TEM Filter Company ("TEM"), a filter business serving the

microelectronics industry. It offers the Group entry into a niche

market where technical specifications are challenging and quality

requirements high. TEM offers a well-designed product range and an

experienced distribution network. Porvair can bring a broader range

of filtration media, wider sales reach, and funds for investment.

Plans to expand the range, develop new products and widen the

distribution network will roll out through 2016.

Over the last five years the Group has delivered revenue growth

of 50% (9% CAGR) and cash from operations of GBP57.0 million. Over

the same period, GBP21.8 million has been invested in capital

expenditure and acquisitions and net debt of GBP9.7 million has

moved into a net cash position of GBP10.7 million. In 2015, the

Group's after tax operating profit return on operating capital was

49% (2014: 47%).

Looking ahead, an exciting range of organic growth and capital

projects are underway and the benefits of integrating Fiber

Ceramics and TEM will start to flow through. Order books at the

start of 2016 were healthy.

Strategic statement

Porvair's strategy has remained consistent for a number of

years. It is to generate shareholder value through the development

of specialist filtration and environmental technology businesses,

both organically and by acquisition. Such businesses have certain

key characteristics in common:

-- specialist design or engineering skills are required;

-- product use and replacement is mandated by regulation,

quality accreditation or a maintenance cycle; and

-- products are often designed into a specification and will typically have long life cycles.

Over the last five years this strategy has worked for the Group,

which moves into 2016 in a position of financial strength, able to

invest in both organic and acquired growth as appropriate.

Business model outline

Our customers require filtration or emission control products

that perform to a given specification; for a minimum amount of

time; often with prescribed physical attributes such as size or

weight. We win business by offering the best technical solutions

for these requirements at an acceptable commercial cost. Filtration

expertise is applicable across all markets with new products

generally being adaptations of existing designs. Experience in

particular markets or applications is valuable in building customer

confidence. Domain knowledge is important, as is deciding where to

direct resources.

This leads us to:

1. Focus on end-markets where we see long term growth potential.

2. Look for applications where product use is mandated and

replacement demand is therefore regular.

3. Make new product development a core business activity.

4. Establish geographic presence where end-markets require.

5. Invest in both organic and acquired growth.

Therefore:

-- We focus on four end-markets: aviation; energy and

industrial; environmental laboratories; and molten metals. All have

clear structural growth drivers.

-- Our products are specialist in nature and typically protect

costly or complex downstream systems. As a result they are replaced

regularly. A high proportion of our annual revenue is from repeat

orders.

-- We encourage new product development in order to generate

growth rates in excess of the underlying market. Where possible we

build robust intellectual property around our product developments.

About 30% of our revenue is derived from patent protected

products.

-- Our geographic presence follows the markets we serve. 47% of

revenue is in the Americas, where aviation and metals filtration

are strong. 22% of revenue is in Asia, where sales into water

analysis markets are growing and the demand for gasification plants

is strongest.

-- We aim to meet dividend and investment needs from free cash

flow and modest borrowing facilities. In recent years we have

expanded manufacturing capacity in the UK, Germany, US and China

and made several small acquisitions. All investments are subject to

a careful investment hurdle rate analysis based on strategic and

financial priorities.

Operating structure

-- The Group has two divisions. The Microfiltration division

serves the aviation, environmental laboratory and energy/industrial

markets. The Metals Filtration division focuses on filtration of

molten metals, principally aluminium.

-- The Group has plants in the US, UK, Germany and China. 48% of

revenue is manufactured in the US, 42% in the UK, 8% in Germany and

2% in China.

Investment and future development

2015 was a year of continued investment with capital expenditure

of GBP3.8 million.

(MORE TO FOLLOW) Dow Jones Newswires

January 25, 2016 02:00 ET (07:00 GMT)

-- In the UK, the Microfiltration facility at New Milton moved

into a larger site to increase capacity for aviation and industrial

filtration growth. Further investment in production capacity at our

UK sites is planned for 2016.

-- In the US, the manufacturing footprint in Maine was expanded,

with further investments in production equipment to follow in 2016.

We are in the process of fitting out a new facility in Virginia

which will open in early 2016.

-- A second factory in China, sited alongside the one opened in

2013, was built, fitted out and commissioned. Further investments

on this site are planned for 2016.

-- The gasification projects are going well. The first of these

to reach the commissioning stage is in South Korea, and early

indications of its start-up are promising. In India investments are

planned in service and maintenance equipment to support the

filtration systems that are due for commissioning towards the end

of 2016. We continue to work on other such projects.

-- Investments in the Metals Filtration plant in North Carolina

have focussed on productivity, new product development and the

integration of Fiber Ceramics, acquired earlier in the year.

-- Following the acquisition of TEM in early December 2015,

investments are planned in sales and marketing, product development

and production equipment upgrades.

New product development remains core to Porvair's strategy, with

investments in range extensions and product differentiation being

the driving force behind our plans for organic growth:

-- Adoption of our proprietary aluminium lithium filter increased during the year.

-- We will launch a patented aluminium filter formulation in our Chinese operation.

-- We are evaluating a new formulation for the filtration of steel.

-- In Bioscience we have almost finished the development of our

DNA filtration product range and will be seeking commercial

partners in 2016.

-- Seal Analytical will bring two new platforms to market in the course of the year.

-- A host of new products will be launched in the

microelectronics filtration market as we combine the expertise we

have in Maine with the newly acquired TEM in Idaho.

Divisional review

Metals Filtration

2015 2014 2013

GBPm GBPm GBPm

Revenue 31.0 30.1 28.5

----- ----- -----

Operating profit 2.4 2.6 2.4

----- ----- -----

Revenue from the Metals Filtration division was at a record

GBP31.0 million, although this benefited from currency movements.

At constant currency, revenue fell by 4%. Foundry filtration in the

US agricultural sector held back sales by around 2%, whilst the

prior year was boosted by a one-off aluminium equipment order to

Nanshan that accounted for a further 3% of sales.

Additional costs associated with the start-up in China and the

lower constant currency revenue led to a small drop in operating

profit.

41% of this division's sales were exported from the US, and

given the strength of the US dollar the Board was pleased with this

performance overall. Market conditions were not straightforward and

these results show a certain resilience, driven by continued market

share wins from our range of patented and differentiated products,

mainly:

-- Selee CSX(TM) for aluminium cast house filtration. This

product has a unique environmental footprint in being free of

phosphates and ceramic fibres.

-- Selee IC(TM) for gray and ductile iron filtration. This range

is sold principally in the US and offers excellent filtration

efficiency.

-- Selee SA(TM) for the filtration of nickel-cobalt alloys. This

niche application requires exceptional filtration performance and

uses a highly proprietary additive manufacturing technique.

We are increasingly asked to run competitive trials by customers

to demonstrate environmental or filtration performance in the

field. Again this year we have performed well, notably in aluminium

where our products clearly out-perform the competition. Over recent

years, while metal quality requirements in the market have

increased, customers have often cut back on their technical

overheads. In response, we have launched Selee Metallurgical

Services, a business unit that offers confidential technical

support and advice to aluminium cast houses, investment casters and

foundries. Backed by excellent laboratory resources and extensive

metallurgical experience, Selee Metallurgical Services has been

busy from its inception.

Two events dominated the year in this division: the acquisition

of Fiber Ceramics and the commissioning of a new line in China.

Fiber Ceramics has now been moved into the main plant in

Hendersonville and has made a modest contribution to results in the

year. The product line was acquired mainly for its technical

capability, and we expect to take advantage of a shorter production

cycle and stronger formulation for steel filtration in 2016.

Significant management and engineering resource was directed to

commissioning the new aluminium filtration line in China, which

started production in November. Good quality filters are now being

made, using a new proprietary formulation that we expect to be

attractive in this market. Customer trials are underway and thus

far have gone well. Current market conditions in China are not

easy; but the market opportunity is substantial; we have an

excellent differentiated product; and our cost base is competitive.

We expect the Chinese operation to grow in 2016.

Microfiltration

2015 2014 2013

GBPm GBPm GBPm

Revenue 64.8 73.9 55.8

----- ----- -----

Operating profit 9.7 8.7 8.6

----- ----- -----

Revenue in the Microfiltration division was 12% lower, with

revenue from large projects GBP14.0 million less than in the prior

year, as expected. Allowing for this, underlying revenue growth was

9%. Operating profits grew 11% to a record GBP9.7 million.

The underlying performance of the division was just above its

five year average of 8% revenue growth with gasification spares, US

general industrial and bioscience filtration all performing well.

Aviation had a quieter year, but our exposure to the newer Boeing

and Airbus airframes means we expect a return to growth in 2016. As

our reputation in the industry grows we are approached from time to

time to manufacture products for other filter companies. This is a

growing part of our industrial portfolio.

The UK based filtration facilities in this division were the

proud recipients of a Queens Award for export in 2015, which

recognised their work in aerospace and industrial filtration growth

since 2012.

The large projects are progressing well. The installation in

South Korea is complete and commissioning is underway. The project

in India is much larger and will be built through 2016.

Manufacturing for the project in China started during 2015 and

shipment will commence in the first quarter of 2016. Shipments to

the UK nuclear project are underway. Orders for filter spares for

the commissioning process were received early in the year and

shipped on time. We are developing a service and maintenance

capability for the Indian installation, which due to its size will

require constant cleaning and filter replacement. We expect final

contract negotiations for this to be complete in the first half of

2016.

As discussed in previous statements, the Group has adopted long

term contract accounting for these large contracts. Revenue is

recognised through the manufacturing and shipping phase of each

project, leading to the unusually high revenue of GBP19.5 million

reported in 2014. Revenue in 2015 was GBP5.5 million. There is

expected to be further revenue in 2016 and 2017. Allowance is made

for potential future costs arising during the commissioning and

warranty stages of the projects. Profits are therefore recognised

over the life of the projects, which are likely to run into 2017

and 2018.

Seal Analytical posted a record result with revenue growing by

4% in constant currency. Seal is a market leading supplier of

equipment and consumables for the detection of inorganic

contamination in water. This well defined niche market grows as

water quality standards improve and we have again been successful

in exporting to China. Seal has a good track record of product

development, and places particular emphasis on technical training

of its skilled workforce. These initiatives are showing through in

results. Seal's five year CAGR revenue growth is 7%. Another new

analysis platform was introduced during the year, and a further two

are planned for 2016.

Dividends

The Board re-affirms its preference for a progressive dividend

and recommends an improved final dividend of 2.2 pence per share

(2014: 2.0 pence), making the full year dividend 3.5 pence per

share (2014: 3.2 pence), an increase of 9%.

Staff

Porvair has doubled in size over the last six years, a testament

to our staff and their commitment. In 2016 we welcome those who

have joined us from Fiber Ceramics and TEM. The Board recognises

that the Group's success is due to the skills and hard work of its

staff, to whom we offer our thanks.

Current trading and outlook

2015 finished with a strong final quarter and healthy order

books. Over the last two years significant investments have been

made in capacity with new production lines being brought into

operation. A promising new product development pipeline offers

plenty of opportunity for organic growth. The two recent

acquisitions should start to contribute in 2016. The Group is in a

strong financial position and a good start has been made to the

year.

Ben Stocks

Group Chief Executive

22 January 2016

Financial review

(MORE TO FOLLOW) Dow Jones Newswires

January 25, 2016 02:00 ET (07:00 GMT)

Group operating performance

2015 2014 2013

GBPm GBPm GBPm

Revenue 95.8 104.0 84.3

----- ------ -----

Operating profit 9.8 9.2 8.4

----- ------ -----

Profit before tax 9.2 8.4 7.6

----- ------ -----

2015 2014 2013

GBPm GBPm GBPm

Underlying revenue 90.3 84.5 78.3

Large projects revenue (Microfiltration) 5.5 19.5 6.0

----- ------ -----

Revenue 95.8 104.0 84.3

----- ------ -----

Underlying revenue, which excludes the impact of large

contracts, grew 7% (4% at constant currencies). Reported revenue

fell by 8% as a result of large contract revenue in Microfiltration

being GBP14.0 million lower than 2014. Operating profit was up 6%

and profit before tax grew 9%. Operating profit margins were 10.2%

(2014: 8.9%), the improvement resulting from the phasing of profits

on the large contracts and an improvement in the underlying margin

in the Microfiltration division.

The operating performance of the Microfiltration and Metals

Filtration divisions are described in detail in the Operating

Review and below. The operating loss associated with the Other

Unallocated segment was GBP2.4 million (2014: GBP2.1 million),

which mainly comprises Group corporate expenditure such as head

office and Board costs, new business development and general

financial costs.

The operating profit includes amortisation charges on intangible

assets arising on acquisition of GBP0.2 million (2014: GBP0.2

million), a credit of GBP0.1 million (2014: credit of GBP0.3

million) arising on the reassessment of acquisition consideration,

acquisition expenses of GBP0.1 million (2014: GBPnil) and share

based payment charges of GBP0.5 million (2014: GBP0.5 million).

Impact of exchange rate movements on performance

The international nature of the Group's business means that

relative movements in exchange rates can have a significant impact

on reported performance. The average rate used for translating the

results of US operations into Sterling was US$1.53:GBP1 (2014:

US$1.65:GBP1) and the Group's Euro denominated operations were

translated at EUR1.37:GBP1 (2014: EUR1.24:GBP1). The stronger

dollar offset by the weaker Euro improved revenue growth by 2% and

operating profit growth by 2% on translating the Group's foreign

subsidiaries compared with 2014.

The Group sold its UK business' 2015 US dollar receipts during

the financial year and achieved an average rate of US$1.54:GBP1

(2014: US$1.57:GBP1).

At 30 November 2015 the Group has US$8.8 million of outstanding

forward foreign exchange contracts taken out to translate the

future revenue on the Group's underlying dollar revenue generated

by the UK operations and on the Group's large contracts. The Group

has applied hedge accounting to US$4.0 million of these

transactions. The reduction in the value of the hedge in the year

of GBP0.2 million (2014: gain of GBP0.9 million) is shown in the

consolidated statement of comprehensive income.

Finance costs

Net interest payable reduced to GBP0.6 million (2014: GBP0.8

million). Included within interest payable are finance costs in

relation to the defined benefit pension scheme, which were GBP0.4

million (2014: GBP0.5 million) in the year. Other net interest

payable reduced as a result of lower gross borrowings in the year.

The Group suffers non-utilisation fees on its unused borrowing

facilities at a rate of half the margin on the facility.

Consequently, the interest payments have not fallen in line with

the elimination of gross borrowings.

Interest cover was 16 times (2014: 12 times); excluding the

impact of the pension finance charge the interest cover is 61 times

(2014: 30 times).

Tax

The Group tax charge was GBP2.2 million (2014: GBP2.1 million).

This is an effective rate of 24% (2014: 25%), which is higher than

the UK standard corporate tax rate of 20.3% (2014: 21.7%). Tax in

the UK was reduced by the benefit of tax relief on the exercise of

share options but the rates of tax are higher on profits made in

Germany and the US. The tax charge comprises current tax of GBP2.3

million (2014: GBP2.1 million) and a deferred tax credit of GBP0.1

million (2014: GBPnil).

The Group carries a deferred tax asset of GBP2.5 million (2014:

GBP3.2 million) and a deferred tax liability of GBP1.5 million

(2014: GBP1.5 million). The deferred tax asset relates principally

to the deficit on the pension fund and share-based payments. The

deferred tax liability relates to accelerated capital allowances,

capitalised development costs and other timing differences, arising

in the US.

Total equity

Total equity at 30 November 2015 was GBP59.1 million (2014:

GBP52.1 million), an increase of 13% over the prior year. Increases

in total equity arose from profit after tax of GBP7.3 million

(2014: GBP6.4 million), after adding back the charge for employee

share option schemes net of tax of GBP0.3 million (2014: GBPnil);

exchange gains on translation of GBP0.9 million (2014: GBP1.1

million); actuarial gains of GBP0.4 million (2014: loss of GBP1.1

million); and GBPnil (2014: GBP0.2 million) arising on the issue of

shares on share option exercises. Dividends paid of GBP1.5 million

(2014: GBP1.3 million); and a reduction of GBP0.1 million (2014:

gain of GBP0.9 million) in the value of hedge accounting

instruments reduced total equity.

Return on capital employed

The increase in the profits of the Group compared with lower

capital employed led to an increase in the return on capital

employed to 16% (2014: 15%). Excluding the impact of goodwill and

the net pension liability, the return on operating capital employed

increased to 49% (2014: 47%).

Cash flow

The table below summarises the key elements of the cash flow for

the year:

2015 2014

GBPm GBPm

Operating cash flow before working

capital 12.5 11.9

Working capital movement 0.8 2.2

------ ------

Cash generated from operating activities 13.3 14.1

Interest (0.2) (0.3)

Tax (1.8) (2.2)

Capital expenditure net of disposals (3.3) (5.1)

------ ------

8.0 6.5

Acquisitions (1.1) (0.7)

Dividends (1.5) (1.3)

Share issue proceeds - 0.2

------ ------

Net cash increase in the year 5.4 4.7

Net cash at 1 December 5.3 0.6

------ ------

Net cash at 30 November 10.7 5.3

------ ------

Net working capital reduced by GBP0.8 million (2014: GBP2.2

million). Cash was received from large contracts in excess of the

revenue recognised in the year ended 30 November 2015, mainly as a

result of the collection in 2015 of a receivable outstanding at the

end of 2014 of GBP2.6 million. Inventories in Microfiltration and

the China plant of Metals Filtration increased to support growth

and payables at the year end were lower than the prior year.

Net interest paid represents the bank interest and

non-utilisation fees charged in the year. It reduced as bank

borrowings fell in the year.

Tax payments in the year are lower than the current tax charge

as a result of recoveries in relation to prior years.

GBP0.8 million was paid in deferred consideration for

acquisitions completed in 2012 and 2013 and GBP0.3 million was paid

in relation to an acquisition in 2015. A maximum of a further

GBP0.1 million is payable in 2016.

Construction contracts and performance bonds

The income statement impact of the large contracts is described

in the Divisional Review above. At 30 November 2015, the Group had

no amounts due from contract customers and amounts due to contract

customers of GBP7.7 million, representing the amount by which cash

received at 30 November 2015 exceeds revenue recognised to date on

these large contracts.

The contract customers generally provide advance payments to

fund the initial stages of the contracts and the Group provides

advance payment bonds to the customer as security. The bonds are

cancellable after up to six months following the shipment of goods.

At 30 November 2015 the Group held US$3.7 million (GBP2.5 million)

of advanced payments against future shipments and there were US$5.3

million (GBP3.5 million) of advance payment bonds outstanding.

The contract customers also generally require performance bonds

to cover risks arising during the contract warranty periods. At 30

November 2015 the Group had US$9.7 million (GBP6.5 million) of

performance bonds outstanding.

Capital expenditure

Capital expenditure was GBP3.3 million (2014: GBP5.1 million)

net of GBP0.5 million disposal proceeds. The principal investments

in 2015 related to the completion of a new plant in New Milton, UK,

which was fully operational in February; completion of the

extension to the plant in Caribou, Maine, which was opened in May;

and a new cast shop filtration line in China, which began

production in November.

Looking forward to 2016 the Board is planning further

investments: facilities in the US; gasification service and

maintenance in India; and upgraded production capability in the UK,

US and China. Capital expenditure in 2016 is expected to be up to

GBP5.0 million.

Pension schemes

(MORE TO FOLLOW) Dow Jones Newswires

January 25, 2016 02:00 ET (07:00 GMT)

The Group continues to support its defined benefit pension

scheme in the UK, which is closed to new members, and to provide

access to defined contribution schemes for its US employees and

other UK employees.

The Group total pension cost was GBP2.2 million (2014: GBP2.2

million). GBP1.8 million (2014: GBP1.7 million) was recorded as an

operating cost: GBP1.2 million (2014: GBP1.2 million) related to

funding defined contributions schemes; and GBP0.6 million (2014:

GBP0.5 million) related to the charge for the Group's defined

benefit scheme. GBP0.4 million (2014: GBP0.5 million) was charged

as a finance cost in relation to the defined benefit scheme.

The Group's net retirement benefit obligation was GBP12.0

million (2014: GBP12.8 million). The contributions paid to the

defined benefit scheme in the UK were GBP1.0 million (2014: GBP0.9

million). The service cost, administrative expenses and finance

cost were GBP1.0 million (2014: GBP1.0 million) and the actuarial

gain in the year was GBP0.8 million (2014: loss of GBP0.9 million).

All of the assumptions adopted were broadly in line with the

previous year.

The defined benefit scheme had 48 (2014: 53) active members, 271

(2014: 281) deferred members and 249 (2014: 271) pensioners at 30

November 2015. The life expectancy of members of the scheme

reaching age 65 at 30 November 2015 is assumed to be 21.6 years

(2014: 21.6 years) for men and 23.6 years (2014: 23.8 years) for

women. The weighted average duration of the plan scheme liabilities

at the end of the period is 20 years (2014: 18 years).

A full triennial actuarial valuation of the assets and

liabilities of the defined benefit scheme was completed in 2013,

based on data at 31 March 2012. As a result of this review, the

Group and the Trustees agreed to alter the employer's contributions

from 8.2% of salary to 13.3% of salary. Additionally, the Group

committed to making a GBP194,000 annual contribution towards the

running costs of the scheme from March 2014, which will increase by

3.25% per annum thereafter. The Group also committed to make

additional annual contributions, to cover the past service deficit,

of GBP456,000 per annum commencing in December 2013, increasing by

5% per annum thereafter. The next full actuarial valuation of the

scheme will be based on the pension scheme's position at 31 March

2015 and is expected to be completed before June 2016.

Borrowings and bank finance

At the year end, the Group had cash balances of GBP10.7 million

(2014: net cash of GBP5.3 million) comprising cash balances of

GBP10.7 million (2014: GBP7.9 million) offset by gross borrowings

of GBPnil (2014: GBP2.6 million).

The Group signed a five year borrowing facility agreement on 25

January 2013 comprising a five year US$20 million revolving credit

facility, a GBP2.5 million term loan (reduced to GBPnil million at

30 November 2015) and a GBP2.5 million overdraft facility. These

facilities have margins over LIBOR ranging between 1.95% and

2.25%.

At 30 November 2015, the Group had GBP13.3 million (2014:

GBP10.8 million) of unused loan facilities, an unused overdraft

facility of GBP2.5 million (2014: GBP2.5 million) and net cash

balances of GBP10.7 million (2014: GBP7.9 million).

Finance and treasury policy

The treasury function at Porvair is managed centrally, under

Board supervision. It is not a profit centre and does not undertake

speculative transactions. It seeks to limit the Group's trading

exposure to currency movements. The Group does not hedge against

the impact of exchange rate movements on the translation of profits

and losses of overseas operations.

The Group finances its operations through share capital,

retained profits and, when required, bank debt. It has adequate

facilities to finance its current operations and capital plans for

the foreseeable future.

Chris Tyler

Group Finance Director

22 January 2016

Consolidated income statement

For the year ended 30 November

2015 2014

Continuing operations GBP'000 GBP'000

Revenue 1 95,828 104,004

Cost of sales (63,474) (74,157)

--------- ---------

Gross profit 32,354 29,847

Distribution costs (1,207) (1,227)

Administrative expenses (21,346) (19,415)

--------- ---------

Operating profit 1 9,801 9,205

Finance income 12 -

Finance costs (616) (785)

Profit before income

tax 9,197 8,420

Income tax expense (2,241) (2,087)

Profit for the year attributable

to shareholders 1 6,956 6,333

--------- ---------

Earnings per share (basic) 2 15.5p 14.4p

Earnings per share (diluted) 2 15.4p 14.2p

Consolidated statement of comprehensive income

For the year ended 30 November

2015 2014

GBP'000 GBP'000

Profit for the year 6,956 6,333

--------- ---------

Other comprehensive income/(expense):

Items that will not be reclassified

to profit and loss

Actuarial gains/(losses) in defined

benefit pension plans net of

tax 368 (1,066)

--------- ---------

Items that may subsequently be

classified to profit and loss

Exchange differences on translation

of foreign subsidiaries 890 1,125

Changes in fair value of interest

rate swaps held as a cash flow

hedge - 20

Changes in fair value of forex

contracts held as a cash flow

hedge (156) (866)

--------- ---------

734 279

--------- ---------

Net other comprehensive income/(expense) 1,102 (787)

--------- ---------

Total comprehensive income for

the year attributable to shareholders

of Porvair plc 8,058 5,546

--------- ---------

Consolidated balance sheet

As at 30 November

Note 2015 2014

GBP'000 GBP'000

Non-current assets

Property, plant and equipment 4 14,216 12,336

Goodwill and other intangible

assets 5 43,547 43,209

Deferred tax asset 2,529 3,240

60,292 58,785

Current assets

Inventories 12,350 11,363

Trade and other receivables 14,621 17,067

Derivative financial instruments - 66

Cash and cash equivalents 10,738 7,891

--------- -----------

37,709 36,387

Current liabilities

Trade and other payables 6 (23,192) (24,910)

Current tax liabilities (1,405) (919)

Borrowings 8 - (727)

Derivative financial instruments (154) (118)

--------- -----------

(24,751) (26,674)

Net current assets 12,958 9,713

--------- -----------

Non-current liabilities

Borrowings 8 - (1,900)

Deferred tax liability (1,465) (1,494)

Retirement benefit obligations (11,993) (12,833)

Provisions for other liabilities

and charges (728) (138)

--------- -----------

(14,186) (16,365)

--------- -----------

Net assets 59,064 52,133

--------- -----------

Capital and reserves

Share capital 9 896 887

Share premium account 9 35,359 35,334

Cumulative translation reserve 10 1,706 816

Retained earnings 10 21,103 15,096

--------- -----------

Total equity 59,064 52,133

--------- -----------

Consolidated cash flow statement

(MORE TO FOLLOW) Dow Jones Newswires

January 25, 2016 02:00 ET (07:00 GMT)

For the year ended 30 November

Note 2015 2014

GBP'000 GBP'000

Cash flows from operating

activities

Cash generated from operations 13 13,294 14,156

Interest paid (155) (328)

Tax paid (1,836) (2,205)

--------- ---------

Net cash generated from operating

activities 11,303 11,623

--------- ---------

Cash flows from investing

activities

Interest received 12 -

Acquisition of subsidiaries

(net of cash acquired) 12 (1,087) (707)

Purchase of property, plant

and equipment 4 (3,823) (4,930)

Purchase of intangible assets 5 (16) (167)

Proceeds from sale of property,

plant and equipment 502 1

Net cash used in investing

activities (4,412) (5,803)

--------- ---------

Cash flows from financing

activities

Proceeds from issue of ordinary

share capital 9 34 199

Repayment of borrowings (2,630) (3,654)

Dividends paid to shareholders 3 (1,479) (1,325)

Net cash used in financing

activities (4,075) (4,780)

--------- ---------

Net increase in cash and

cash equivalents 2,816 1,040

Gains on cash and cash equivalents 31 78

--------- ---------

2,847 1,118

Cash and cash equivalents

at 1 December 7,891 6,773

--------- ---------

Cash and cash equivalents

at 30 November 10,738 7,891

--------- ---------

Reconciliation of net cash flow to movement in net cash

2015 2014

GBP'000 GBP'000

Net increase in cash and cash

equivalents 2,816 1,040

Effects of exchange rate changes 28 (9)

Repayment of borrowings 2,630 3,654

Net cash at 1 December 5,264 579

--------- ---------

Net cash at 30 November 10,738 5,264

--------- ---------

Consolidated statement of changes in equity

Share Cumulative

Share premium translation Retained

capital account reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 December

2013 875 35,147 (309) 11,967 47,680

---------- --------- ------------- ----------- ----------

Profit for the year - - - 6,333 6,333

Other comprehensive

income/(expense):

Exchange differences

on translation of

foreign subsidiaries - - 1,125 - 1,125

Changes in fair value

of interest rate swaps

held as a cash flow

hedge - - - 20 20

Changes in fair value

of foreign exchange

contracts held as

a cash flow hedge - - - (866) (866)

Actuarial losses in

defined benefit pension

plans net of tax - - - (1,066) (1,066)

---------- --------- ------------- ----------- ----------

Total comprehensive

income for the year - - 1,125 4,421 5,546

---------- --------- ------------- ----------- ----------

Transactions with

owners:

Employee share option

schemes:

* value of employee services net of tax - - - 33 33

Proceeds from shares

issued 12 187 - - 199

Dividends approved

or paid - - - (1,325) (1,325)

---------- --------- ------------- ----------- ----------

Total transactions

with owners recognised

directly in equity 12 187 - (1,292) (1,093)

---------- --------- ------------- ----------- ----------

Balance at 30 November

2014 887 35,334 816 15,096 52,133

---------- --------- ------------- ----------- ----------

Balance at 1 December

2014 887 35,334 816 15,096 52,133

---------- --------- ------------- ----------- ----------

Profit for the year - - - 6,956 6,956

Other comprehensive

income/(expense):

Exchange differences

on translation of

foreign subsidiaries - - 890 - 890

Changes in fair value

of foreign exchange

contracts held as

a cash flow hedge - - - (156) (156)

Actuarial gains in

defined benefit pension

plans net of tax - - - 368 368

---------- --------- ------------- ----------- ----------

Total comprehensive

income for the year - - 890 7,168 8,058

---------- --------- ------------- ----------- ----------

Transactions with

owners:

Employee share option

schemes:

* value of employee services net of tax - - - 318 318

Proceeds from shares

issued 9 25 - - 34

Dividends approved

or paid - - - (1,479) (1,479)

---------- --------- ------------- ----------- ----------

Total transactions

with owners recognised

directly in equity 9 25 - (1,161) (1,127)

---------- --------- ------------- ----------- ----------

Balance at 30 November

2015 896 35,359 1,706 21,103 59,064

---------- --------- ------------- ----------- ----------

Notes

1. Segment information

The segmental analyses of revenue, operating profit/(loss),

segment assets and liabilities and geographical analyses of revenue

are set out below:

2015 Metals Microfiltration Other Group

Filtration Unallocated

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 30,984 64,844 - 95,828

------------ ---------------- ------------- --------

Operating profit/(loss) 2,448 9,704 (2,351) 9,801

Net finance costs - - (604) (604)

------------ ---------------- ------------- --------

Profit/(loss) before

income tax 2,448 9,704 (2,955) 9,197

Income tax expense - - (2,241) (2,241)

------------ ---------------- ------------- --------

Profit/(loss) for

the year 2,448 9,704 (5,196) 6,956

------------ ---------------- ------------- --------

2014 Metals Microfiltration Other Group

Filtration Unallocated

GBP'000 GBP'000 GBP'000 GBP'000

Revenue 30,061 73,943 - 104,004

------------ ---------------- ------------- --------

Operating profit/(loss) 2,558 8,710 (2,063) 9,205

Net finance costs - - (785) (785)

(MORE TO FOLLOW) Dow Jones Newswires

January 25, 2016 02:00 ET (07:00 GMT)

------------ ---------------- ------------- --------

Profit/(loss) before

income tax 2,558 8,710 (2,848) 8,420

Income tax expense - - (2,087) (2,087)

------------ ---------------- ------------- --------

Profit/(loss) for

the year 2,558 8,710 (4,935) 6,333

------------ ---------------- ------------- --------

Other Group operations are included in "Other Unallocated".

These mainly comprise Group corporate expenditure such as head

office and Board costs, new business development and general

financial costs.

1. Segment information continued

Segment assets and liabilities

At 30 November Metals Microfiltration Other Group

2015 Filtration Unallocated

GBP'000 GBP'000 GBP'000 GBP'000

Segmental assets 28,520 55,445 3,298 87,263

Cash and cash

equivalents - - 10,738 10,738

------------ ---------------- ------------- ---------

Total assets 28,520 55,445 14,036 98,001

------------ ---------------- ------------- ---------

Segmental liabilities (3,851) (19,087) (4,006) (26,944)

Retirement benefit

obligations - - (11,993) (11,993)

Total liabilities (3,851) (19,087) (15,999) (38,937)

------------ ---------------- ------------- ---------

At 30 November Metals Microfiltration Other Group

2014 Filtration Unallocated

GBP'000 GBP'000 GBP'000 GBP'000

Segmental assets 27,119 55,481 4,681 87,281

Cash and cash

equivalents - - 7,891 7,891

------------ ---------------- ------------- ---------

Total assets 27,119 55,481 12,572 95,172

------------ ---------------- ------------- ---------

Segmental liabilities (3,249) (20,379) (3,951) (27,579)

Retirement benefit

obligations - - (12,833) (12,833)

Borrowings - - (2,627) (2,627)

------------ ---------------- ------------- ---------

Total liabilities (3,249) (20,379) (19,411) (43,039)

------------ ---------------- ------------- ---------

Geographical analysis

2015 2014

By destination By origin By destination By origin

GBP'000 GBP'000 GBP'000 GBP'000

Revenue

United Kingdom 15,516 40,051 17,730 52,380

Continental Europe 13,050 7,572 11,630 7,623

United States of

America 36,758 46,601 33,372 42,671

Other NAFTA 6,925 - 6,195 -

South America 1,415 - 1,661 -

Asia 21,027 1,604 31,643 1,330

Africa 1,137 - 1,773 -

--------------- ---------- --------------- ----------

95,828 95,828 104,004 104,004

--------------- ---------- --------------- ----------

2. Earnings per share

2015 2014

Earnings Weighted Per Earnings Weighted Per

average share average share

number amount number amount

of shares of shares

Basic EPS GBP'000 GBP'000

(pence) (pence)

Earnings attributable

to ordinary

shareholders 6,956 44,736,977 15.5 6,333 44,121,412 14.4

Effect of dilutive

securities

- share options - 455,668 (0.1) - 587,422 (0.2)

--------- ------------- --------- --------- ------------- ---------

Diluted EPS 6,956 45,192,645 15.4 6,333 44,708,834 14.2

--------- ------------- --------- --------- ------------- ---------

3. Dividends per share

2015 2014

Per share GBP'000 Per share GBP'000

Final dividend paid 2.0p 896 1.8p 795

Interim dividend

paid 1.3p 583 1.2p 530

---------- -------- ---------- --------

3.3p 1,479 3.0p 1,325

---------- -------- ---------- --------

The Directors recommend the payment of a final dividend of 2.2

pence per share (2014: 2.0 pence per share) on 3 June 2016 to

shareholders on the register on 29 April 2016; the ex-dividend date

is 28 April 2016. This makes a total dividend for the year of 3.5

pence per share (2014: 3.2 pence per share).

4. Property, plant and equipment

Cost Land Assets Plant, Total

and buildings in the machinery

course and equipment

of construction

GBP'000 GBP'000 GBP'000 GBP'000

At 1 December

2014 6,008 1,887 27,503 35,398

Reclassification 1,414 (1,887) 473 -

Additions 542 1,147 2,134 3,823

Acquisitions - - 159 159

Disposals (566) - (4,202) (4,768)

Exchange differences 118 25 477 620

At 30 November

2015 7,516 1,172 26,544 35,232

--------------- ----------------- --------------- --------

Depreciation

At 1 December

2014 (2,158) - (20,904) (23,062)

Charge for the

year (166) - (1,650) (1,816)

Disposals 118 - 4,165 4,283

Exchange differences (10) - (411) (421)

At 30 November

2015 (2,216) - (18,800) (21,016)

-------- --------- ---------

Net book value

At 30 November

2015 5,300 1,172 7,744 14,216

------ ------ ------ -------

At 30 November

2014 3,850 1,887 6,599 12,336

------ ------ ------ -------

5. Goodwill and other intangible assets

Trademarks,

Development knowhow

expenditure Software and other

Goodwill capitalised capitalised intangibles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Net book

amount at

1 December

2014 42,207 223 13 766 43,209

Additions - - 16 - 16

Acquisitions 79 - - 33 112

Disposals

cost - (1,380) - - (1,380)

Disposals

amortisation - 1,380 - - 1,380

Amortisation

charges - (113) (15) (212) (340)

Exchange

differences 539 14 (3) - 550

-----------

Net book

amount at

30 November

2015 42,825 124 11 587 43,547

----------- -------------- -------------- ------------- ---------

At 30 November Trademarks,

2015 Development knowhow

expenditure Software and other

Goodwill capitalised capitalised intangibles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost 61,385 513 1,053 1,264 64,215

Accumulated

amortisation

and impairment (18,560) (389) (1,042) (677) (20,668)

(MORE TO FOLLOW) Dow Jones Newswires

January 25, 2016 02:00 ET (07:00 GMT)

Net book

amount 42,825 124 11 587 43,547

----------- -------------- -------------- ------------- -----------

6. Trade and other payables

2015 2014

Amounts falling due within one year: GBP'000 GBP'000

Trade payables 6,741 6,977

Taxation and social security 724 1,020

Other payables 64 924

Accruals and deferred income 15,663 15,989

At 30 November 23,192 24,910

--------- ---------

7. Construction contracts

2015 2014

GBP'000 GBP'000

Amounts due from contract customers

included in trade receivables - 2,564

--------- ---------

Contracts in progress at 30 November

Amounts due to contract customers

included in accruals and deferred

income (7,730) (8,586)

--------- ---------

Net amounts due to contract customers (7,730) (8,586)

--------- ---------

Contract costs incurred plus recognised

profits less recognised losses to

date 35,160 29,611

Less: progress billings (42,890) (38,197)

Contracts in progress at 30 November (7,730) (8,586)

--------- ---------

8. Borrowings

2015 2014

GBP'000 GBP'000

Secured multi-currency revolving

credit facility of US$20 million

(2014: US$20 million) maturing in

January 2018 with interest at 2.25%

(2014: 2.25%) above US dollar LIBOR - 1,900

Secured five year amortising debt

facility of GBPnil (2014: GBP0.75

million) expiring in June 2015 with

interest at 2.0% (2014: 2.0%) above

LIBOR - 727

At 30 November - 2,627

----------- ---------

On 25 January 2013, the Group entered into new five year banking

facilities sufficient for its foreseeable needs comprising a US $20

million revolving credit facility, a GBP2.5 million amortising term

loan (reduced to GBP750,000 at 30 November 2014) and a GBP2.5

million overdraft. At 30 November 2015, the Group had GBP13.2

million of unused facilities (2014: GBP10.8 million of unused

facilities) and an unutilised overdraft facility of GBP2.5 million

(2014: GBP2.5 million).

9. Share capital and premium

Number Ordinary Share Total

of shares shares premium

account

Thousands GBP'000 GBP'000 GBP'000

At 1 December

2014 44,363 887 35,334 36,221

Issue of shares

on exercise of

share options 460 9 25 34

At 30 November

2015 44,823 896 35,359 36,255

----------- --------- --------- --------

In February 2015, 441,000 ordinary shares of 2 pence each were

issued on the exercise of Long Term Share Plan share options for a

cash consideration of GBP9,000. In December 2014 and May 2015,

9,221 ordinary shares of 2 pence each were issued on exercise of

Save As You Earn share options for a cash consideration of

GBP10,000. In November 2015, 10,000 ordinary shares of 2 pence each

were issued on the exercise of EMI share options for a cash

consideration of GBP15,000.

10. Other reserves

Cumulative Retained

translation earnings

reserve

GBP'000 GBP'000

At 1 December 2013 (309) 11,967

Profit for the year attributable

to shareholders - 6,333

Dividends paid - (1,325)

Actuarial losses - (900)

Tax on actuarial losses - (166)

Share based payments - 503

Tax on share based payments - (470)

Interest rate swap cash

flow hedge - 20

Foreign exchange contract

cash flow hedge - (866)

Exchange differences 1,125 -

------------- ----------

At 30 November 2014 816 15,096

Profit for the year attributable

to shareholders - 6,956

Dividends paid - (1,479)

Actuarial gains - 872

Tax on actuarial gains - (504)

Share based payments - 502

Tax on share based payments - (184)

Foreign exchange contract

cash flow hedge - (156)

Exchange differences 890 -

------------- ----------

At 30 November 2015 1,706 21,103

------------- ----------

11. Acquisition

On 29 June 2015 the Group, through its subsidiary Selee

Corporation, purchased the trade and assets of Fiber Ceramics from

Joy-Mark, Inc. The trade is the manufacture of specialist filters

and is based in the USA. The trade contributed external revenue of

$217,000 (GBP141,000) and a net profit of $32,000 (GBP21,000) in

the period 29 June 2015 to 30 November 2015. It is estimated that

if the acquisition had occurred on 1 December 2014, the acquisition

would have contributed external revenue of $700,000 (GBP456,000)

and a net profit of $80,000 (GBP52,000) for the year ended 30

November 2015. The total consideration is $509,000 (GBP324,000);

$425,000 (GBP271,000) was paid by 30 November 2015, with the

balance due by 31 December 2015. The purchase is accounted for as

an acquisition. Acquisition related costs of $27,000 (GBP18,000)

have been charged to administrative expenses in the consolidated

income statement in the year ended 30 November 2015.

12. Deferred and contingent consideration on acquisitions

GBP'000

At 1 December 2014 924

Purchase consideration in the period 324

Cash paid in the period (1,087)

Recognised in the income statement (129)

Exchange movements 24

--------

At 30 November 2015 56

--------

13. Cash generated from operations

2015 2014

GBP'000 GBP'000

Operating profit 9,801 9,205

Post-employment benefits 75 26

Share based payments 502 503

Depreciation, amortisation and

impairment 2,156 2,235

Profit on disposal of property,

plant and equipment (17) (1)

--------- ---------

Operating cash flows before

movement in working capital 12,517 11,968

--------- ---------

(Increase)/decrease in inventories (904) 415

Decrease/(increase) in trade

and other receivables 2,492 (2,440)

(Decrease)/increase in payables (1,389) 4,213

Increase in provisions 578 -

Decrease in working capital 777 2,188

--------- ---------

Cash generated from operations 13,294 14,156

--------- ---------

14. Post balance sheet event

On 4 December 2015 the Group, through its subsidiary Porvair

Filtration Group, Inc., purchased the trade and assets of TEM

Filter Company. The trade is the manufacture of specialist filters

and is based in the USA. The total consideration is $4,888,000

(GBP3,236,000); $4,350,000 (GBP2,880,000) was paid on 4 December

2015, with the balance being contingent and due for payment before

31 May 2017. The direct costs of acquisition, which will be charged

to the income statement, were $58,000 (GBP38,000).

15. Basis of preparation

(MORE TO FOLLOW) Dow Jones Newswires

January 25, 2016 02:00 ET (07:00 GMT)

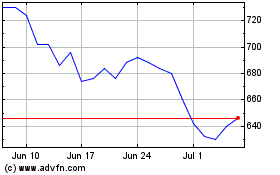

Porvair (LSE:PRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Porvair (LSE:PRV)

Historical Stock Chart

From Apr 2023 to Apr 2024