Pitney Bowes Completes Sale of Marketing Services Business

May 29 2015 - 9:04AM

Business Wire

Pitney Bowes Inc. (NYSE:PBI), a global technology company that

provides products and solutions that power commerce, today

announced the successful completion of the sale of its Imagitas

marketing services business to Red Ventures for $310 million in

cash, subject to adjustment. The company expects proceeds from the

sale of approximately $280 million, net of estimated closing costs,

transaction fees and taxes.

This transaction is the latest in a series of actions that the

company has taken to unlock greater value for shareholders, while

increasing its focus on clients in the markets where it can

lead.

The Imagitas business generated $128 million in revenue in 2014.

The company will provide more detail about the expected impact of

this transaction during its scheduled discussion of second quarter

results at 8 am EST on July 30th. Instructions for listening to

Pitney Bowes earnings results via the Web are available on the

Investor Relations page of its web site

at www.pitneybowes.com.

About Pitney Bowes

Pitney Bowes (NYSE:PBI) is a global technology company offering

innovative products and solutions that enable commerce in the areas

of customer information management, location intelligence, customer

engagement, shipping and mailing, and global ecommerce. More than

1.5 million clients in approximately 100 countries around the world

rely on products, solutions and services from Pitney Bowes. For

additional information, visit Pitney Bowes at

www.pitneybowes.com.

Forward Looking Statements

This document contains “forward-looking statements” about the

Company’s expected or potential future business and financial

performance. Forward-looking statements include, but are not

limited to, statements about its future revenue and earnings

guidance and other statements about future events or conditions.

Forward-looking statements are not guarantees of future performance

and involve risks and uncertainties that could cause actual results

to differ materially from those projected. These risks and

uncertainties include, but are not limited to: mail volumes; the

uncertain economic environment; timely development, market

acceptance and regulatory approvals, if needed, of new products;

fluctuations in customer demand; changes in postal regulations;

interrupted use of key information systems; management of

outsourcing arrangements; the implementation of a new enterprise

resource planning system; changes in business portfolio; the

success of our investment in rebranding the Company; the risk of

customer concentration in our Digital Commerce Solutions segment;

foreign currency exchange rates; changes in our credit ratings;

management of credit risk; changes in interest rates; the financial

health of national posts; and other factors beyond its control as

more fully outlined in the Company's 2014 Form 10-K Annual Report

and other reports filed with the Securities and Exchange

Commission. Pitney Bowes assumes no obligation to update any

forward-looking statements contained in this document as a result

of new information, events or developments.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150529005490/en/

Editorial -Carol WallaceMedia Relations

Director203-351-6974Financial -Charles F. McBrideVP, Investor

Relations203-351-6349

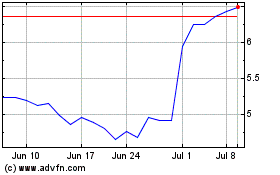

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

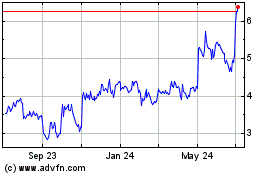

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Apr 2023 to Apr 2024