Pitney Bowes Inc. (NYSE:PBI), a global technology company that

provides products and solutions that power commerce, today reported

financial results for the second quarter 2016.

Quarterly Financial Results:

- Revenue of $836 million, a decline of 5

percent; a decline of 4 percent when adjusted for both the impact

of currency and market exits.

- Revenue comparison to prior year

unfavorably impacted by an estimated 2 percentage points as a

result of the cutover period for the new enterprise business

platform.

- GAAP EPS of $0.28; Adjusted EPS of

$0.39

- GAAP cash from operations of $95

million; free cash flow of $86 million

- Repurchased 3.5 million shares of

common stock.

- Updating annual revenue, adjusted EPS

and free cash flow guidance.

"The second quarter was a critical period for Pitney Bowes, the

progress of our strategic initiatives, and the long-term success of

our Company," said Marc B. Lautenbach, President and CEO, Pitney

Bowes. "During the quarter, we deployed our new enterprise business

platform in the U.S., which is already delivering operational

benefits across the Company; launched our Commerce Cloud, which

unlocks new value for the small and medium business market and our

clients; and signed agreements with several systems integrators to

sell our software solutions and other products. Going forward, we

remain optimistic about our ability to deliver sustained value for

our shareholders, clients and employees in the second half and

beyond.”

Second Quarter 2016 Results

Revenue totaled $836 million for the quarter, which was a

decline of 5 percent. Revenue declined 4 percent versus the prior

year when adjusted for both the impact of currency and the impact

from the previously exited direct operations (market exits) in

Mexico, South Africa and five markets in Asia. The revenue

comparison to prior year was unfavorably impacted by an estimated

$15 million to $20 million, or 2 percentage points, due to the

temporary business impacts of the cutover to the new enterprise

business platform in the U.S.

Digital Commerce Solutions revenue grew 11 percent on a reported

basis and 12 percent on a constant currency basis. Revenue

benefited from growth in Global Ecommerce, while revenue declined

in Software Solutions.

Enterprise Business Solutions revenue was flat. Revenue grew 1

percent compared to the prior year when adjusted for the impacts of

currency and market exits. Revenue benefited from continued growth

in Presort Services.

Small and Medium Business (SMB) Solutions revenue declined 8

percent. Revenue declined 7 percent when adjusted for the impacts

of currency and market exits. Within SMB, North America Mailing’s

revenue comparison to prior year was unfavorably impacted by an

estimated $15 million to $20 million, or 5 percentage points, due

to the temporary business impacts of the cutover to the new

enterprise business platform in the U.S. This impact resulted

principally from lost daily sales activity and productivity during

the cutover period.

Generally Accepted Accounting Principles earnings per diluted

share (GAAP EPS) were $0.28, which included $0.09 per share for

restructuring and asset impairment charges and $0.01 loss for

discontinued operations.

Adjusted earnings per diluted share from continuing operations

(Adjusted EPS) were $0.39. The Company uses Adjusted EPS to

measure profitability and performance.

Earnings per share comparisons to prior year were unfavorably

impacted by $0.02 per share for higher ERP related expenses; $0.02

per share for the absence of Imagitas earnings and an estimated

$0.03 related to the new enterprise business platform cutover.

The Company’s earnings per share results for the quarter are

summarized in the table below:

Second Quarter*

2016

2015

Adjusted EPS $ 0.39 $ 0.45 Other

income – gain on sale of Imagitas -

0.44 Other expense -

(0.05

) SG&A – compensation expense -

(0.04

) Restructuring and asset impairments

(0.09

)

(0.04

) Discontinued operations – (loss)

(0.01

) -

GAAP EPS $ 0.28

$ 0.75 * The sum of the earnings per share may not

equal the totals above due to rounding.

GAAP Cash from Operations and Free Cash Flow Results

GAAP cash from operations during the quarter was $95 million

while free cash flow was $86 million. Free cash flow was slightly

favorable to prior year as favorable working capital and lower

capital expenditures were partly offset by lower net income.

During the quarter, the Company used cash for: $35 million in

dividends to its common shareholders; $66 million for share

repurchases and $12 million for restructuring payments. The Company

also received $18 million of cash from investing activities related

to the sale of a building in Troy, New York.

Business Segment Reporting

The Company’s business segment reporting reflects the clients

served in each market and the way it manages these segments for

growth and profitability. The primary reporting segment groups are

the SMB Solutions group; the Enterprise Business Solutions group;

and the Digital Commerce Solutions group.

The SMB Solutions group offers mailing equipment, financing,

services and supplies for small and medium businesses to

efficiently create mail and evidence postage. This group includes

the North America Mailing and International Mailing segments. North

America Mailing includes the operations of U.S. and Canada Mailing.

International Mailing includes all other SMB operations around the

world.

The Enterprise Business Solutions group includes the global

Production Mail and Presort Services segments. Production Mail

provides mailing and printing equipment and services for large

enterprise clients to process mail. Presort Services provides

sortation services to qualify large mail volumes for postal

worksharing discounts.

The Digital Commerce Solutions group includes the Software

Solutions and Global Ecommerce segments. Software Solutions provide

customer engagement, customer information and location intelligence

software. Global Ecommerce facilitates global cross-border

ecommerce transactions and shipping solutions for businesses of all

sizes.

The Other segment is comprised of the Imagitas marketing

services business, which was sold on May 29, 2015.

SMB Solutions Group

($ millions) Second Quarter

Y/Y

Y/Y

Y/Y Ex Currency

Revenue

2016

2015

Reported

Ex

Currency

& Market

Exits*

North America Mailing $ 322 $ 357 (10 %) (9 %) (9 %) International

Mailing

106 111

(4 %) (3

%) 0 % SMB Solutions

Total $ 428 $ 467 (8

%) (8 %) (7 %)

EBIT North America Mailing $ 142 $ 159 (11 %) International

Mailing

13 14

(10 %) SMB Solutions Total

$ 155 $ 174 (11 %) *

Excluding $2.2 million related to the impacts of currency and

adjusting prior year for $2.8 million related to the divested

revenues resulting from the exit of direct operations in Mexico,

South Africa and five markets in Asia.

North America Mailing

The business experienced temporary impacts from the enterprise

business platform cutover in the U.S., and, as a result, the

revenue rate of decline was greater than prior quarters. Equipment

sales declined double digits and recurring revenue streams declined

at a high single-digit rate. The equipment sales impact resulted

principally from lost daily sales activity and productivity during

the cutover period. The recurring revenue streams were impacted in

part by financing fee waivers and lower supply purchases during

this transition. The Company estimates that the North America

Mailing segment revenue was unfavorably impacted by an estimated

$15 million to $20 million, or 5 percentage points of growth, in

the quarter due to this transition. Of this estimated amount,

approximately two-thirds was attributed to equipment sales and

one-third was attributed to the recurring revenue streams. EBIT

margin was slightly lower than prior year due to the overall lower

revenue.

International Mailing

Revenue trends compared to prior year continued to improve.

Although reported revenue declined, when adjusted for both the

impact of currency and market exits, revenue would have been flat

to prior year. Equipment sales increased versus prior year most

notably in France, Italy and Japan, in part due to improved sales

productivity as disruption from go-to-market changes, especially in

France, have subsided. The decline in recurring revenue streams was

the lowest in seven quarters. EBIT margin declined versus the prior

year primarily as a result of the mix of equipment sales.

Enterprise Business Solutions

Group

($ millions) Second Quarter

Y/Y

Y/Y

Y/Y Ex Currency

Revenue

2016

2015

Reported

Ex

Currency

& Market

Exits*

Production Mail $ 96 $ 98 (2 %) (2 %) 1 % Presort Services

116 114

2 % 2 %

2 % Enterprise Business Total

$ 212 $ 212 0 % 0

% 1 % EBIT Production Mail $ 13

$ 10 29 % Presort Services

21

24 (10 %)

Enterprise Business Total $ 34 $

34 2 % * Excluding $0.2 million related to the

impacts of currency and adjusting prior year for $2.9 million

related to the divested revenues resulting from the exit of direct

operations in Mexico, South Africa and five markets in Asia

Production Mail

Equipment sales grew due to higher sorter equipment

installations during the quarter. Support services and supplies

revenue declined, in part, as a result of some in-house mailers

shifting their mail processing to third party outsourcers and the

recent market exits. EBIT margin improved from prior year driven by

service delivery cost management initiatives.

Presort Services

Revenue benefited from the higher volume of First Class mail

processed as well as expansion into new markets. This was partially

offset by a decline in Standard mail volumes processed. EBIT margin

declined versus the prior year primarily due to the USPS rate

change and increased mail processing costs related to higher labor

costs.

Digital Commerce Solutions

Group

($ millions) Second Quarter

Y/Y

Y/Y

Revenue

2016

2015

Reported

Ex

Currency

Software Solutions $ 90 $ 99 (9 %) (7 %) Global Ecommerce

105 78

35 % 36 %

Digital Commerce Total $ 196 $

177 11 % 12 %

EBIT

Software Solutions $ 10 $ 16 (37

%)

Global Ecommerce

4 3

20

%

Digital Commerce Total $ 14 $ 19

(28

%)

Software Solutions

Revenue declined due to lower licensing and data-related revenue

versus the prior year. The Company has signed agreements with 2

global and 9 regional systems integrators as part of the continued

focus on expanding the indirect channel. The Company continues to

focus on improving sales efficiency to grow the pipeline of deals.

EBIT margin declined as a result of the lower licensing revenue,

which has a high margin.

Global Ecommerce

Results included a full quarter of Borderfree revenue as

compared to one month in the prior year. Revenue benefited from

strong growth in the UK marketplace and the launch of new retail

storefronts. Outbound U.S. marketplace package shipments grew in

the quarter despite the stronger U.S. dollar versus prior year.

When adding pre-acquisition Borderfree revenue back to the prior

year, for comparative purposes, organic growth in the Cross-Border

Ecommerce business grew 11 percent in the quarter, which is an

improvement from the first quarter performance.

EBIT margin declined slightly versus the prior year due to the

amortization of acquisition-related intangible costs and

investments for growth. The Company remains on-track to achieve its

cross border synergy run-rate objective by the end of the year. In

addition, the higher-margin domestic shipping business was

temporarily impacted by the new enterprise business platform

cutover in the U.S.

Other

($ millions) Second Quarter

Y/Y

Y/Y

2016

2015

Reported

Ex

Currency

Revenue $ 0 $ 25 NM

NM EBIT $ 0 $ 6 NM

The Other segment is comprised of the Imagitas marketing

services business, which was sold in May 2015.

2016 Guidance

This guidance discusses future results, which are inherently

subject to unforeseen risks and developments. As such, discussions

about the business outlook should be read in the context of an

uncertain future, as well as the risk factors identified in the

safe harbor language at the end of this release and as more fully

outlined in the Company's 2015 Form 10-K Annual Report and other

reports filed with the Securities and Exchange Commission.

This guidance excludes any unusual items that may occur or

additional portfolio or restructuring actions, not specifically

identified, as the Company implements plans to further streamline

its operations and reduce costs. Revenue guidance is provided on a

constant currency basis because the Company cannot reasonably

predict the impact future changes in currency exchange rates will

have on revenue. Additionally, the Company cannot provide GAAP EPS

and GAAP cash from operations guidance due to the uncertainty of

future potential restructurings, goodwill and asset write-downs,

unusual tax settlements or payments and contributions to its

pension funds, acquisitions, divestitures and other potential

adjustments, which could (individually or in the aggregate) have a

material impact on the Company’s performance. The Company’s

guidance is based on an assumption that the global economy and

foreign exchange markets in 2016 will not change significantly.

The Company expects improving trends in the business in the

second half of the year as a result of actions taken to achieve its

long term strategic initiatives. Based on year-to-date results,

particularly in Software, along with the second quarter temporary

impact in North America Mailing as a result of the new enterprise

business platform cutover, the Company is adjusting its annual

guidance.

The Company now expects, for the full year 2016:

- Revenue, on a constant currency basis,

to be in the range of a 1 percent decline to 3 percent decline when

compared to 2015.

- Adjusted EPS to be in the range of

$1.75 to $1.82, excluding the year-to-date EPS charge of $0.13

related to restructuring, asset impairments, dispositions expense

and discontinued operations.

- Free cash flow to be in the range of

$400 million to $450 million.

- Annual tax rate in the range of 33

percent to 35 percent.

Therefore, for the second half of 2016 the Company expects:

- Revenue, on a constant currency basis,

to be in the range of 2 percent growth to 2 percent decline when

compared to 2015.

- Adjusted EPS to be in the range of

$1.03 to $1.10.

- Free cash flow to be in the range of

$254 million to $304 million.

To achieve improvement in the second half of the year as

compared to the first half, the Company expects:

- The North America Mailing business to

return to a more normalized level as the Company continues to make

progress post the new enterprise business platform cutover.

- Enterprise Solutions Group to perform

similar to the first half.

- Within Digital Commerce Solutions,

Software license revenue growth is expected to improve as a result

of the progress the Company is making in channel efficiency and

channel partner engagement. Global Ecommerce, post the anniversary

of the Borderfree acquisition, is expected to grow revenue

double-digits in the second half, subject to no material changes in

key currency valuations or any new material impacts from the Brexit

decision or Canada Post labor negotiations. This will be driven by

continued transaction volume growth, as well as the acquisition of

new and expansion of existing retail clients.

- Adjusted EPS and free cash flow will

benefit from the expected revenue improvements, reduced marketing

and ERP expense from first half levels.

- Adjusted EPS will also benefit from the

early benefits from the new enterprise business platform cost

savings, particularly in the fourth quarter.

- Free cash flow will also benefit from

the recovery of delayed billing and collections activity related to

the enterprise business system cutover.

Conference Call and Webcast

Management of Pitney Bowes will discuss the Company’s results in

a broadcast over the Internet today at 8:00 a.m. ET. Instructions

for listening to the earnings results via the Web are available on

the Investor Relations page of the Company’s web site at

www.pb.com.

About Pitney Bowes

Pitney Bowes (NYSE:PBI), is a global technology company powering

billions of transactions – physical and digital – in the connected

and borderless world of commerce. Clients around the world,

including 90 percent of the Fortune 500, rely on products,

solutions and services from Pitney Bowes in the areas of customer

information management, location intelligence, customer engagement,

shipping, mailing, and global ecommerce. And with the innovative

Pitney Bowes Commerce Cloud, clients can access the broad range of

Pitney Bowes solutions, analytics, and APIs to drive commerce. For

additional information visit Pitney Bowes, the Craftsmen of

Commerce, at www.pitneybowes.com.

The Company's financial results are reported in accordance with

generally accepted accounting principles (GAAP).

The Company reports measures such as adjusted earnings before

interest and taxes (EBIT) and Adjusted EPS and adjusted income from

continuing operations to exclude the impact of special items like

restructuring charges, tax adjustments, goodwill and asset

write-downs, and costs related to recent dispositions and market

exits. While these are actual Company expenses, they can mask

underlying trends associated with its business. Such items are

often inconsistent in amount and frequency and as such, the

adjustments allow an investor greater insight into the current

underlying operating trends of the business.

In addition, revenue growth is presented on a constant currency

basis to exclude the impact of changes in foreign currency exchange

rates since the prior period under comparison. Constant currency

measures are intended to help investors better understand the

underlying operational performance of the business excluding the

impacts of shifts in currency exchange rates over the period.

Constant currency is calculated by converting our current quarter

reported results using the prior year’s exchange rate for the

comparable quarter. In addition, this quarter the Company reported

the comparison of “revenue excluding the impact of currency and

market exits” to prior year, which excludes the impact of changes

in foreign currency exchange rates since the prior period and also

excludes the revenues associated with the recent market exits in

several smaller markets. This comparison allows an investor insight

into the underlying revenue performance of the business and true

operational performance from a comparable basis to prior period. A

reconciliation of reported revenue to constant currency revenue, as

well as reported revenue to “revenue excluding the impact of

currency and market exits” can be found in the Company’s attached

financial schedules.

The Company reports free cash flow in order to provide investors

insight into the amount of cash that management could have

available for other discretionary uses. Free cash flow adjusts GAAP

cash from operations for capital expenditures, restructuring

payments, unusual tax settlements, contributions to the Company’s

pension fund and cash used for other special items. A

reconciliation of GAAP cash from operations to free cash flow can

be found in the Company’s attached financial schedules.

In addition, Management uses segment EBIT to measure

profitability and performance at the segment level. Segment EBIT is

determined by deducting from revenue the related costs and expenses

attributable to the segment. Segment EBIT excludes interest, taxes,

general corporate expenses not allocated to a particular business

segment, restructuring charges and goodwill and asset impairments,

which are recognized on a consolidated basis. A reconciliation of

Segment EBIT to the Company’s total Net Income can be found in the

Company’s attached financial schedules.

Pitney Bowes has provided a quantitative reconciliation to GAAP

in supplemental schedules. This information may also be found at

the Company's web site www.pb.com/investorrelations.

This document contains “forward-looking statements” about the

Company’s expected or potential future business and financial

performance. Forward-looking statements include, but are not

limited to, statements about its future revenue and earnings

guidance and other statements about future events or conditions.

Forward-looking statements are not guarantees of future performance

and involve risks and uncertainties that could cause actual results

to differ materially from those projected. These risks and

uncertainties include, but are not limited to: mail volumes; the

uncertain economic environment; timely development, market

acceptance and regulatory approvals, if needed, of new products;

fluctuations in customer demand; changes in postal regulations;

interrupted use of key information systems; the ability to protect

the Company’s information technology systems against service

interruptions, misappropriation of data, or breaches of security

resulting from cyber-attacks or other events; management of

outsourcing arrangements; the implementation of a new enterprise

business platform; changes in business portfolio; the success of

our investment in rebranding the Company; the risk of losing some

of the Company’s larger clients in the Global Ecommerce segment;

integrating newly acquired businesses, including operations and

product and service offerings; foreign currency exchange rates;

changes in our credit ratings; management of credit risk; changes

in interest rates; the financial health of national posts;

increased customs and regulatory risks associated with cross-border

transactions; and other factors beyond its control as more fully

outlined in the Company's 2015 Form 10-K Annual Report and other

reports filed with the Securities and Exchange Commission. Pitney

Bowes assumes no obligation to update any forward-looking

statements contained in this document as a result of new

information, events or developments.

Note: Consolidated statements of income; revenue and EBIT by

business segment; and reconciliation of GAAP to non-GAAP measures

for the three and six months ended June 30, 2016 and 2015, and

consolidated balance sheets at June 30, 2016 and December 31, 2015

are attached.

Pitney Bowes Inc. Consolidated Statements of Income

(Unaudited; in thousands, except share and per share amounts)

Three months ended June 30,

Six months ended June 30, 2016 2015

2016 2015 Revenue: Equipment sales $ 152,641 $

165,507 $ 312,002 $ 331,471 Supplies 65,274 70,636 137,325 144,004

Software 90,615 99,184 168,673 185,541 Rentals 102,869 111,312

206,959 225,309 Financing 91,609 101,437 189,032 207,067 Support

services 131,418 139,237 259,678 278,795 Business services

201,460 193,578 406,806

399,385 Total revenue 835,886

880,891 1,680,475 1,771,572

Costs and expenses: Cost of equipment sales 78,055 79,043

149,594 154,056 Cost of supplies 19,624 21,624 40,314 44,283 Cost

of software 26,983 28,501 53,798 58,365 Cost of rentals 18,415

21,003 38,910 41,704 Financing interest expense 13,495 17,868

28,410 36,638 Cost of support services 74,742 81,507 149,991

165,106 Cost of business services 140,830 135,636 276,368 275,555

Selling, general and administrative 288,580 315,578 615,462 630,107

Research and development 34,513 28,492 61,081 54,540 Restructuring

charges and asset impairments, net 26,076 14,350 33,009 14,269

Interest expense, net 20,799 20,971 40,100 45,035 Other expense

(income), net 536 (93,135 ) 536

(93,135 ) Total costs and expenses 742,648

671,438 1,487,573

1,426,523 Income from continuing operations before

income taxes 93,238 209,453 192,902 345,049 Provision for income

taxes 33,394 52,351 70,418

102,898 Income from continuing

operations 59,844 157,102 122,484 242,151 Loss from discontinued

operations, net of tax (1,660 ) (739 ) (1,660

) (582 ) Net income 58,184 156,363 120,824 241,569

Less: Preferred stock dividends attributable to noncontrolling

interests 4,594 4,593 9,188

9,187 Net income - Pitney Bowes Inc. $

53,590 $ 151,770 $ 111,636 $ 232,382

Amounts attributable to common stockholders: Net income from

continuing operations $ 55,250 $ 152,509 $ 113,296 $ 232,964 Loss

from discontinued operations, net of tax (1,660 )

(739 ) (1,660 ) (582 ) Net income - Pitney

Bowes Inc. $ 53,590 $ 151,770 $ 111,636 $

232,382 Basic earnings per share attributable to

common stockholders (1): Continuing operations $ 0.29 $ 0.76 $ 0.60

$ 1.16 Discontinued operations (0.01 ) -

(0.01 ) - Net income - Pitney Bowes

Inc. $ 0.29 $ 0.75 $ 0.59 $ 1.15

Diluted earnings per share attributable to common stockholders (1):

Continuing operations $ 0.29 $ 0.75 $ 0.59 $ 1.15 Discontinued

operations (0.01 ) - (0.01 ) -

Net income - Pitney Bowes Inc. $ 0.28 $ 0.75

$ 0.59 $ 1.15 Weighted-average shares

used in diluted earnings per share 188,362,278

202,839,944 190,806,261 202,634,107

(1) The sum of the earnings per share amounts may not

equal the totals due to rounding.

Pitney Bowes Inc.

Consolidated Balance Sheets (Unaudited; in thousands, except

share amounts)

June 30,

December 31,

Assets

2016

2015 (1)

Current assets: Cash and cash equivalents $ 675,972 $ 650,557

Short-term investments 74,809 117,021 Accounts receivable, net

431,580 476,583 Short-term finance receivables, net 918,974 918,383

Inventories 110,960 88,824 Current income taxes 12,186 6,584 Other

current assets and prepayments 61,039 67,400

Total current assets 2,285,520 2,325,352

Property, plant and equipment, net 309,491 330,088 Rental property

and equipment, net 172,269 177,515 Long-term finance receivables,

net 693,589 760,657 Goodwill 1,752,714 1,745,957 Intangible assets,

net 172,785 187,378 Noncurrent income taxes 66,942 70,294 Other

assets 510,267 525,891 Total

assets $ 5,963,577 $ 6,123,132

Liabilities,

noncontrolling interests and stockholders' equity

Current liabilities: Accounts payable and accrued liabilities $

1,345,653 $ 1,448,321 Current income taxes 7,235 16,620 Current

portion of long-term debt and notes payable 470,058 461,085 Advance

billings 308,728 353,025 Total

current liabilities 2,131,674 2,279,051 Deferred taxes on

income 212,607 205,668 Tax uncertainties and other income tax

liabilities 69,803 68,429 Long-term debt 2,623,764 2,489,583 Other

noncurrent liabilities 550,546 605,310

Total liabilities 5,588,394 5,648,041

Noncontrolling interests (Preferred stockholders'

equity in subsidiaries) 296,370 296,370 Stockholders'

equity: Cumulative preferred stock, $50 par value, 4% convertible 1

1 Cumulative preference stock, no par value, $2.12 convertible 489

505 Common stock, $1 par value 323,338 323,338 Additional

paid-in-capital 148,154 161,280 Retained earnings 5,196,194

5,155,537 Accumulated other comprehensive loss (840,427 ) (888,635

) Treasury stock, at cost (4,748,936 ) (4,573,305 )

Total Pitney Bowes Inc. stockholders' equity 78,813

178,721 Total liabilities,

noncontrolling interests and stockholders' equity $ 5,963,577

$ 6,123,132 (1) Certain prior year amounts

have been revised for accounting rules that became effective

January 1, 2016 and to conform to current year presentation.

Pitney Bowes Inc. Business Segments - Revenue and

EBIT (Unaudited; in thousands)

Three months

ended June 30, Six months ended June 30,

2016 2015 % Change 2016

2015 % Change

Revenue

North America Mailing $ 322,068 $ 356,791 (10 %) $ 671,794 $

718,665 (7 %) International Mailing 106,338

110,610 (4 %) 210,097 226,783 (7

%)

Small & Medium Business Solutions 428,406

467,401 (8 %) 881,891

945,448 (7 %) Production Mail 95,874 97,731 (2 %)

183,299 197,234 (7 %) Presort Services 115,765

113,922 2 % 243,161 235,453 3 %

Enterprise Business Solutions 211,639

211,653 0 % 426,460 432,687 (1

%) Software Solutions 90,464 99,041 (9 %) 168,386 185,278 (9

%) Global Ecommerce 105,377 77,966 35 %

203,738 153,352 33 %

Digital

Commerce Solutions 195,841 177,007

11 % 372,124 338,630 10 % Other

- 24,830 (100 %) - 54,807 (100 %)

Total revenue $ 835,886 $ 880,891

(5 %) $ 1,680,475 $ 1,771,572 (5 %)

EBIT

(1)

North America Mailing $ 142,227 $ 159,392 (11 %) $ 298,142 $

323,057 (8 %) International Mailing 12,781

14,122 (9 %) 24,632 25,846 (5 %)

Small & Medium Business Solutions 155,008

173,514 (11 %) 322,774 348,903

(7 %) Production Mail 12,914 10,028 29 % 19,738

19,060 4 % Presort Services 21,214 23,544

(10 %) 50,124 51,038 (2 %)

Enterprise Business Solutions 34,128

33,572 2 % 69,862 70,098 0 %

Software Solutions 10,151 16,158 (37 %) 7,579 20,291 (63 %)

Global Ecommerce 3,674 3,056 20 %

4,446 11,202 (60 %)

Digital Commerce

Solutions 13,825 19,214 (28 %)

12,025 31,493 (62 %) Other -

5,611 (100 %) - 10,569 (100 %)

Segment EBIT $ 202,961 $ 231,911 (12 %)

$ 404,661 $ 461,063 (12 %)

Reconciliation of segment EBIT to net income

Segment EBIT $ 202,961 $ 231,911 $ 404,661 $ 461,063

Corporate expenses (48,777 ) (51,921 )

(106,544 ) (102,724 )

Adjusted EBIT 154,184 179,990

298,117 358,339 Interest, net (2) (34,294 ) (38,839 ) (68,510 )

(81,673 ) Restructuring charges and asset impairments, net (26,076

) (14,350 ) (33,009 ) (14,269 ) Other (expense) income, net (536 )

93,135 (536 ) 93,135 Acquisition/disposition related expenses

(40 ) (10,483 ) (3,160 ) (10,483 )

Income from continuing operations before income taxes 93,238

209,453 192,902 345,049 Provision for income taxes (33,394 )

(52,351 ) (70,418 ) (102,898 )

Income from

continuing operations 59,844 157,102 122,484 242,151 Loss from

discontinued operations, net of tax (1,660 ) (739 )

(1,660 ) (582 )

Net income $ 58,184 $

156,363 $ 120,824 $ 241,569 (1) Segment

EBIT excludes interest, taxes, general corporate expenses,

restructuring charges and other items, which are not allocated to a

particular business segment. (2) Includes financing interest

expense and interest expense, net.

Pitney Bowes Inc.

Reconciliation of Reported Consolidated Results to Adjusted

Results (Unaudited; in thousands, except per share amounts)

Three months ended June 30,

Six months ended June 30, 2016

2015 Y/Y Chg. 2016 2015 Y/Y

Chg. Reconciliation of reported revenue to

revenue excluding currency and Market Exits Revenue, as

reported $ 835,886 $ 880,891 (5 %) $ 1,680,475 $ 1,771,572 (5 %)

Unfavorable impact on revenue due to currency 4,770

- NM 14,721 - NM

Revenue, excluding currency 840,656 880,891 (5 %) 1,695,196

1,771,572 (4 %) Less: Revenue from Market Exits -

5,717 (100 %) 480 11,541

(96 %) Revenue, excluding currency and Market Exits $ 840,656

$ 875,174 (4 %) $ 1,694,716 $ 1,760,031

(4 %)

Reconciliation of reported net income

to adjusted earnings Net income $ 58,184 $ 156,363 $ 120,824 $

241,569 Loss from discontinued operations, net of tax 1,660 739

1,660 582 Restructuring charges and asset impairments, net 16,931

8,613 21,559 8,560 Loss (gain) on disposition of businesses 271

(88,429 ) 2,330 (88,429 ) Transaction costs related to acquisitions

and dispositions 93 6,105 209 6,105 Legal settlement - 4,620 -

4,620 Acquisition/disposition related expenses -

7,246 - 7,246

Income from continuing operations, after

income taxes, as adjusted

77,139 95,257 146,582 180,253 Provision for income taxes, as

adjusted 42,751 45,894 83,025

96,413 Income from continuing operations

before income taxes, as adjusted 119,890 141,151 229,607 276,666

Interest, net 34,294 38,839

68,510 81,673 EBIT, as adjusted 154,184

179,990 298,117 358,339 Depreciation and amortization 45,238

42,657 89,538 85,153

EBITDA, as adjusted $ 199,422 $ 222,647 $

387,655 $ 443,492

Reconciliation of

reported diluted earnings per share to adjusted diluted earnings

per share from continuing operations Diluted earnings per share

$ 0.28 $ 0.75 $ 0.59 $ 1.15 Loss from discontinued operations, net

of tax 0.01 - 0.01 - Restructuring charges and asset impairments,

net 0.09 0.04 0.11 0.04 Loss (gain) on disposition of businesses -

(0.44 ) 0.01 (0.44 ) Transaction costs related to acquisitions and

dispositions - 0.03 - 0.03 Legal settlement - 0.02 - 0.02

Acquisition/disposition related expenses -

0.04 - 0.04

Diluted earnings per share from continuing

operations, as adjusted

$ 0.39 $ 0.45 $ 0.72 $ 0.84

Note: The sum of the earnings per share amounts may not

equal the totals due to rounding.

Reconciliation of reported net cash from operating activities to

free cash flow, as adjusted Net cash provided by operating

activities $ 95,221 $ 96,915 $ 153,587 $ 201,008 Capital

expenditures (30,855 ) (45,498 ) (71,359 ) (89,612 ) Restructuring

payments 12,210 8,901 33,866 30,775 Pension contribution - - 36,731

- Reserve account deposits 9,110 (1,387 ) (7,143 ) (21,464 )

Payments related to investment divestiture - 3,215 - 26,375

Acquisition/disposition related expenses - 10,483 - 10,483 Cash

transaction fees 146 11,116 335

11,116 Free cash flow, as adjusted $

85,832 $ 83,745 $ 146,017 $ 168,681

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160802005385/en/

Pitney BowesEditorial -Bill Hughes, 203-351-6785Chief

Communications OfficerorFinancial -Adam David, 203-351-7175VP,

Investor Relations

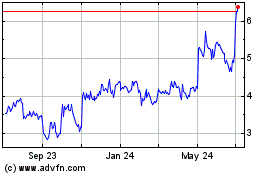

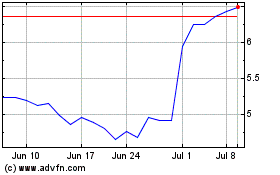

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Apr 2023 to Apr 2024