Pitney Bowes Inc. (NYSE:PBI), a global technology company

providing innovative technology solutions to power commerce, today

reported financial results for the full year and the fourth quarter

2016. The Company also has provided an update to its annual

guidance for 2017.

Full-Year 2016:

- Revenue of $3.4 billion, a decline of 5

percent; a decline of 4 percent when adjusted for the impact of

currency; a decline of 3 percent when adjusted for both the impact

of currency and market exits

- GAAP EPS of $0.50; Adjusted EPS of

$1.68

- GAAP cash from operations of $491

million; free cash flow of $430 million

- Issued $600 million of 5 year notes and

redeemed the Pitney Bowes International Holdings, Inc. preferred

stock of $300 million

- Repurchased 10.5 million shares of

common stock

Fourth Quarter 2016:

- Revenue of $887 million, a decline of 5

percent; a decline of 4 percent when adjusted for the impact of

currency and market exits

- GAAP EPS loss of $0.44; Adjusted EPS of

$0.53

- GAAP EPS includes a non-cash $0.89 per

share goodwill impairment charge related to the Software Solutions

business

- GAAP cash from operations of $200

million; free cash flow of $164 million

“Our fourth quarter and full-year results were not what we

wanted or expected,” said Marc B. Lautenbach, President and Chief

Executive Officer. “While we were disappointed in our fourth

quarter performance, especially in our Software Solutions business,

we closed the year with much of the heavy lifting and short-term

disruptions from our transformation initiatives behind us. We are

poised to take advantage of all of the hard work we completed in

2016 and over the past four years. Going forward, I remain

confident in our long-term strategy, our competitive position, our

operational excellence initiatives, and our ability to unlock value

for our shareholders.”

Full Year 2016 Results

Revenue totaled $3.4 billion for the year, which was a decline

of 5 percent versus prior year. Revenue declined 4 percent versus

the prior year when adjusted for the impact of currency and

declined 3 percent when adjusted for the impact of currency and

previously exited direct operations (market exits) in Mexico, South

Africa and five markets in Asia.

Generally Accepted Accounting Principles earnings per diluted

share (GAAP EPS) were $0.50, which included $0.22 per share for

restructuring and asset impairment charges, $0.03 per share charge

from the redemption of the preferred stock of the Company’s Pitney

Bowes International Holdings (PBIH) subsidiary, $0.02 from loss on

dispositions and $0.01 loss for discontinued operations.

In addition, the Company recorded a non-cash estimate of $0.88

per share goodwill impairment charge related to the Software

Solutions business principally as a result of recent operating

experience. The Company expects to finalize the valuation

assessment and resulting goodwill impairment charge at the time the

10-K is filed and does not anticipate any material adjustment.

Adjusted earnings per diluted share from continuing operations

(Adjusted EPS) were $1.68. The Company uses Adjusted EPS to measure

performance.

GAAP cash flow from operations for the year was $491 million

while free cash flow was $430 million. During the year, the Company

used cash to pay $197 million for share repurchases, $141 million

in dividends to common shareholders and $65 million in

restructuring payments.

Fourth Quarter 2016 Results

Revenue totaled $887 million for the quarter, which was a

decline of 5 percent versus prior year. Revenue declined 4 percent

versus the prior year when adjusted for the impact of currency and

market exits.

Digital Commerce Solutions revenue declined 2 percent on a

reported basis and grew 1 percent on a constant currency basis.

Double-digit revenue growth in ecommerce marketplace and retail was

offset by a decline in Software Solutions and office shipping

revenues.

Enterprise Business Solutions revenue declined 5 percent.

Revenue declined 3 percent compared to the prior year when adjusted

for the impact of currency and market exits. Revenue declined in

both Production Mail and Presort Services.

Small and Medium Business (SMB) Solutions revenue declined 7

percent. Revenue declined 6 percent when adjusted for the impact of

currency and market exits. North America and International Mailing

both contributed to the decline.

GAAP EPS was a loss of $0.44, which included a non-cash estimate

of $0.89 per share goodwill impairment charge, $0.05 per share for

restructuring and asset impairment charges, $0.01 per share from

the redemption of the preferred stock of the Company’s PBIH

subsidiary and $0.01 from loss on dispositions. Adjusted EPS were

$0.53, which grew $0.05 per share over prior year.

GAAP cash flow from operations for the quarter was $200 million

while free cash flow was $164 million. In comparison to the prior

year, free cash flow improved largely due to timing of working

capital requirements. During the quarter, the Company used cash to

pay $35 million in dividends to common shareholders and $14 million

in restructuring payments.

The Company’s earnings per share results for the fourth quarter

and full year are summarized in the table below:

Fourth Quarter Full Year

2016

2015

2016

2015

GAAP EPS ($0.44 ) $ 0.44

$ 0.50 $ 2.03 Discontinued operations –

(income) loss - ($0.03 )

$ 0.01 ($0.03 )

GAAP EPS from continuing

operations ($0.44 ) $ 0.41 $

0.52 $ 2.00 Goodwill impairment charge $ 0.89

- $ 0.88 - Restructuring charges and asset impairments, net $ 0.05

$ 0.05 $ 0.22 $ 0.09 Preferred stock redemption $ 0.01 - $ 0.03 -

Impact of acquisition / divestiture transactions $ 0.01 $ 0.02 $

0.02 ($0.32 ) Legal settlement - - - $ 0.02 Investment divestiture

- - -

($0.04 )

Adjusted EPS $

0.53 $ 0.48 $ 1.68 $

1.75 * The sum of the earnings per share may

not equal the totals above due to rounding.

Debt Management

During the year, the Company issued $600 million of 3.375

percent 5-year fixed rate notes. The issuance was a debt neutral

transaction as the Company paid down commercial paper outstanding

and redeemed all $300 million of outstanding shares of the PBIH

preferred stock on November 1, 2016. The Company had no commercial

paper outstanding as of December 31, 2016.

Fourth Quarter 2016 Business Segment Reporting

The Company’s business segment reporting reflects the clients

served in each market and the way it manages these segments for

growth and profitability. The reporting segment groups are the SMB

Solutions group; the Enterprise Business Solutions group; and the

Digital Commerce Solutions group. The segment results for the

quarter and prior year may not equal the subtotals for each segment

group due to rounding.

The SMB Solutions group offers mailing equipment, financing,

services and supplies for small and medium businesses to

efficiently create mail and evidence postage. This group includes

the North America Mailing and International Mailing segments. North

America Mailing includes the operations of U.S. and Canada Mailing.

International Mailing includes all other SMB operations around the

world.

The Enterprise Business Solutions group includes the global

Production Mail and Presort Services segments. Production Mail

provides mailing and printing equipment and services for large

enterprise clients to process mail. Presort Services provides

sortation services to qualify large mail volumes for postal

worksharing discounts.

The Digital Commerce Solutions group includes the Software

Solutions and Global Ecommerce segments. Software Solutions provide

customer engagement, customer information and location intelligence

software. Global Ecommerce facilitates global cross-border

ecommerce transactions and shipping solutions for businesses of all

sizes.

SMB Solutions Group

($ millions) Fourth Quarter

Revenue

2016

2015

Y/YReported

Y/YEx

Currency

Y/Y Ex Currency&

Market Exits*

North America Mailing $ 341 $ 363 (6 %) (6 %) (6 %) International

Mailing

101 114

(11 %) (6 %)

(4 %) SMB Solutions Total $

442 $ 477 (7 %) (6

%) (6 %) EBIT North America

Mailing $ 138 $ 165 (16 %) International Mailing

12 14 (16

%) SMB Solutions Total $ 151

$ 179 (16 %) * Excluding

$6.2 million related to the impact of currency and $1.7 million

related to the divested revenues resulting from the exit of direct

operations in Mexico, South Africa and five markets in Asia.

North America Mailing

Compared to the prior year, overall revenue was primarily

affected by lower financing and supplies revenues, as well as some

weakness in equipment sales at the end of the quarter. EBIT margin

was lower than prior year largely due to the decline in

higher-margin recurring revenue streams.

International Mailing

Excluding the effects from currency and market exits, revenue

declined at a mid-single digit rate. Equipment sales declined from

prior year as strong growth in France was more than offset by

weakness in the UK and Italy. Italy’s year-to-year decline was a

result of a large government transaction in the prior year. The

decline in recurring revenue streams was consistent with the prior

quarter. EBIT margin was down versus prior year due to the decline

in higher-margin recurring revenue streams partially offset by

lower expenses.

Enterprise Business Solutions Group

($ millions) Fourth Quarter

Revenue

2016

2015

Y/YReported

Y/YEx

Currency

Y/Y Ex Currency&

Market Exits*

Production Mail $ 115 $ 122 (6 %) (5 %) (4 %) Presort Services

118 122 (3

%) (3 %) (3

%) Enterprise Business Total $

233 $ 245 (5 %) (4

%) (3 %) EBIT Production Mail $

19 $ 17 11 % Presort Services

26

28 (6 %) Enterprise

Business Total $ 45 $ 45 0

% * Excluding $1.2 million related to the

impact of currency and $1.8 million related to the divested

revenues resulting from the exit of direct operations in Mexico,

South Africa and five markets in Asia

Production Mail

Equipment sales grew 1 percent over prior year on higher

inserter equipment placements. Support services revenue declined as

a result of the shift from in-house mail production to third party

service bureaus who tend to self-service, as well as reduced

service revenue associated with the market exits. EBIT margin

improved from prior year driven by equipment sales margin and lower

expenses.

Presort Services

The revenue decline was driven by lower First Class volumes

along with lower average revenue per piece of mail processed

largely as a result of the earlier USPS rate change. This was

somewhat offset by an increase in Standard Class mail volumes

processed.

Digital Commerce Solutions Group

($ millions) Fourth Quarter

Revenue

2016

2015

Y/YReported

Y/YEx

Currency

Software Solutions $ 91 $ 103 (12 %) (9 %) Global Ecommerce

121 112 8

% 10 % Digital Commerce

Total $ 212 $ 215 (2

%) 1 % EBIT Software Solutions $

12 $ 14 (10

%)

Global Ecommerce

10 9

12

%

Digital Commerce Total $ 23 $ 23

(1

%)

Software Solutions

The revenue decline was driven by several anticipated large

deals which did not get completed in the last few weeks of the

quarter. Customer Engagement and Location Intelligence license

revenues declined but were partly offset by growth in Customer

Information Management licenses. The Company continues to invest in

expanding the indirect channel and training partner sales and

technical resources to build future partner-led pipeline and

revenue. The Company has made changes to the sales organization

structure to improve the direct salesforce effectiveness. EBIT

margin improved slightly mostly due to lower expenses.

Global Ecommerce

Excluding the effects of currency, Ecommerce marketplace and

retail revenues grew 18 percent from prior year. This was driven by

strong growth in UK outbound marketplace and retail volumes.

Revenue grew despite a stronger U.S. dollar versus prior year. The

Ecommerce marketplace and retail revenue growth was partially

offset by a decline in office shipping.

EBIT margin increased versus the prior year due to cross border

synergy savings and revenue growth. This was partially offset by a

decline in higher-margin domestic office shipping and higher

research and development costs.

2017 Guidance

This guidance discusses future results, which are inherently

subject to unforeseen risks and developments. As such, discussions

about the business outlook should be read in the context of an

uncertain future, as well as the risk factors identified in the

safe harbor language at the end of this release and as more fully

outlined in the Company's 2015 Form 10-K Annual Report and other

reports filed with the Securities and Exchange Commission.

This guidance excludes any unusual items that may occur or

additional portfolio or restructuring actions, not specifically

identified, as the Company implements plans to further streamline

its operations and reduce costs. Revenue guidance is provided on a

constant currency basis. The Company cannot reasonably predict the

impact that future changes in currency exchange rates will have on

revenue and net income. Additionally, the Company cannot provide

GAAP EPS and GAAP cash from operations guidance due to the

uncertainty of future potential restructurings, goodwill and asset

write-downs, unusual tax settlements or payments and contributions

to its pension funds, acquisitions, divestitures and other

potential adjustments, which could (individually or in the

aggregate) have a material impact on the Company’s performance. The

Company’s guidance is based on an assumption that the global

economy and foreign exchange markets in 2017 will not change

significantly.

Based on 2016 results, including the final fourth quarter

outcome, the Company is updating its 2017 annual guidance,

principally to reflect a more conservative outlook for the Software

Solutions business.

The Company now expects, for the full year 2017:

- Revenue, on a constant currency basis,

to be in the range of a 2 percent decline to 1 percent growth when

compared to 2016.

- Adjusted EPS to be in the range of

$1.70 to $1.85 compared to the original range of $1.80 to

$1.95.

- Free cash flow to be in the range of

$400 million to $460 million compared to the original range of $415

million to $485 million.

In 2017, the Company expects:

- Revenue to benefit from improving

trends throughout the year from the following:

- SMB new products and digital

capabilities;

- Ecommerce volume growth;

- Software partner channel expansion and

improvement in the direct channel;

- Expansion of the Presort Services

network and the January 2017 USPS rate change.

- Ongoing improvement in cost and expense

driven by the expected benefits from the Company’s operational

excellence initiatives.

- Incremental Marketing expense related

to enhancing the Company’s digital capabilities.

- Normalization of variable compensation

compared to 2016.

- A tax rate on adjusted earnings

expected to be in the range of 31 to 35 percent.

Conference Call and Webcast

Management of Pitney Bowes will discuss the Company’s results in

a broadcast over the Internet today at 8:00 a.m. ET. Instructions

for listening to the earnings results via the Web are available on

the Investor Relations page of the Company’s web site at

www.pb.com.

About Pitney Bowes

Pitney Bowes (NYSE:PBI), is a global technology company powering

billions of transactions – physical and digital – in the connected

and borderless world of commerce. Clients around the world,

including 90 percent of the Fortune 500, rely on products,

solutions and services from Pitney Bowes in the areas of customer

information management, location intelligence, customer engagement,

shipping, mailing, and global ecommerce. And with the innovative

Pitney Bowes Commerce Cloud, clients can access the broad range of

Pitney Bowes solutions, analytics, and APIs to drive commerce. For

additional information visit Pitney Bowes, the Craftsmen of

Commerce, at www.pitneybowes.com.

Use of Non-GAAP Measures

The Company's financial results are reported in accordance with

generally accepted accounting principles (GAAP); however, in our

disclosures we use certain non-GAAP measures, such as adjusted

earnings before interest and taxes, Adjusted EPS, revenue growth on

a constant currency basis, revenue excluding the impact of currency

and market exits, free cash flow and Segment EBIT.

The Company reports measures such as adjusted earnings before

interest and taxes (EBIT) and Adjusted EPS and adjusted income from

continuing operations to exclude the impact of special items like

restructuring charges, tax adjustments, goodwill and asset

write-downs, and costs related to recent dispositions and market

exits. While these are actual Company expenses, they can mask

underlying trends associated with its business. Such items are

often inconsistent in amount and frequency and as such, the

adjustments allow an investor greater insight into the current

underlying operating trends of the business.

In addition, revenue growth is presented on a constant currency

basis to exclude the impact of changes in foreign currency exchange

rates since the prior period under comparison. Constant currency

measures are intended to help investors better understand the

underlying operational performance of the business excluding the

impacts of shifts in currency exchange rates over the period.

Constant currency is calculated by converting our current quarter

reported results using the prior year’s exchange rate for the

comparable quarter. In addition, this quarter the Company reported

the comparison of “revenue excluding the impact of currency and

market exits” to prior year, which excludes the impact of changes

in foreign currency exchange rates since the prior period and also

excludes the revenues associated with the recent market exits in

several smaller markets. This comparison allows an investor insight

into the underlying revenue performance of the business and true

operational performance from a comparable basis to prior period. A

reconciliation of reported revenue to constant currency revenue, as

well as reported revenue to “revenue excluding the impact of

currency and market exits” can be found in the Company’s attached

financial schedules.

The Company reports free cash flow in order to provide investors

insight into the amount of cash that management could have

available for other discretionary uses. Free cash flow adjusts GAAP

cash from operations for capital expenditures, restructuring

payments, unusual tax settlements, contributions to the Company’s

pension fund and cash used for other special items. A

reconciliation of GAAP cash from operations to free cash flow can

be found in the Company’s attached financial schedules.

In addition, Management uses segment EBIT to measure

profitability and performance at the segment level. Segment EBIT is

determined by deducting from revenue the related costs and expenses

attributable to the segment. Segment EBIT excludes interest, taxes,

general corporate expenses not allocated to a particular business

segment, restructuring charges and goodwill and asset impairments,

which are recognized on a consolidated basis. A reconciliation of

Segment EBIT to the Company’s total Net Income can be found in the

Company’s attached financial schedules.

Pitney Bowes has provided a quantitative reconciliation to GAAP

in supplemental schedules. This information may also be found at

the Company's web site www.pb.com/investorrelations.

This document contains “forward-looking statements” about the

Company’s expected or potential future business and financial

performance. Forward-looking statements include, but are not

limited to, statements about its future revenue and earnings

guidance and other statements about future events or conditions.

Forward-looking statements are not guarantees of future performance

and involve risks and uncertainties that could cause actual results

to differ materially from those projected. These risks and

uncertainties include, but are not limited to: mail volumes; the

uncertain economic environment; timely development, market

acceptance and regulatory approvals, if needed, of new products;

fluctuations in customer demand; changes in postal regulations;

interrupted use of key information systems; the ability to protect

the Company’s information technology systems against service

interruptions, misappropriation of data, or breaches of security

resulting from cyber-attacks or other events; management of

outsourcing arrangements; the implementation of a new enterprise

business platform; changes in business portfolio; the success of

our investment in rebranding the Company; the risk of losing some

of the Company’s larger clients in the Global Ecommerce segment;

integrating newly acquired businesses, including operations and

product and service offerings; foreign currency exchange rates;

changes in our credit ratings; management of credit risk; changes

in interest rates; the financial health of national posts;

increased customs and regulatory risks associated with cross-border

transactions; and other factors beyond its control as more fully

outlined in the Company's 2015 Form 10-K Annual Report and other

reports filed with the Securities and Exchange Commission. Pitney

Bowes assumes no obligation to update any forward-looking

statements contained in this document as a result of new

information, events or developments.

Note: Consolidated statements of income; revenue and EBIT by

business segment; and reconciliation of GAAP to non-GAAP measures

for the three and twelve months ended December 31, 2016 and 2015,

and consolidated balance sheets as of December 31, 2016 and

December 31, 2015 are attached.

Pitney Bowes Inc. Consolidated Statements of

Income (Unaudited; in thousands, except share and per share

amounts)

Three months ended December 31,

Twelve months ended December 31, 2016

2015 2016 2015 Revenue: Equipment sales

$ 190,306 $ 199,831 $ 675,451 $ 695,159 Supplies 64,051 72,925

262,682 288,103 Software 90,901 103,265 348,661 386,506 Rentals

103,032 107,934 412,738 441,663 Financing 89,632 103,043 366,547

410,035 Support services 129,188 139,149 512,820 554,764 Business

services 219,959 210,800 827,676

801,830 Total revenue 887,069

936,947 3,406,575

3,578,060 Costs and expenses: Cost of equipment sales

96,201 98,363 331,942 331,069 Cost of supplies 20,758 22,890 81,420

88,802 Cost of software 26,345 27,996 105,841 113,580 Cost of

rentals 21,089 21,061 76,040 84,188 Financing interest expense

13,866 17,620 55,241 71,791 Cost of support services 70,895 78,107

295,685 322,960 Cost of business services 151,152 140,642 568,509

546,201 Selling, general and administrative 283,882 340,643

1,200,327 1,279,961 Research and development 31,545 26,463 121,306

110,156 Goodwill impairment 168,563 - 168,563 - Restructuring

charges and asset impairments, net 13,793 11,477 63,296 25,782

Interest expense, net 26,576 22,383 88,970 87,583 Other expense

(income), net - 78 536

(94,838 ) Total costs and expenses 924,665

807,723 3,157,676

2,967,235 (Loss) income from continuing operations

before income taxes (37,596 ) 129,224 248,899 610,825 Provision for

income taxes 38,235 44,204

131,850 189,778 (Loss) income from

continuing operations (75,831 ) 85,020 117,049 421,047 (Loss)

income from discontinued operations, net of tax (750 )

5,853 (2,701 ) 5,271 Net

(loss) income (76,581 ) 90,873 114,348 426,318 Less: Preferred

stock dividends attributable to noncontrolling interests

5,264 4,594 19,045 18,375

Net (loss) income - Pitney Bowes Inc. $ (81,845 ) $

86,279 $ 95,303 $ 407,943 Amounts

attributable to common stockholders: Net (loss) income from

continuing operations $ (81,095 ) $ 80,426 $ 98,004 $ 402,672

(Loss) income from discontinued operations, net of tax (750

) 5,853 (2,701 ) 5,271

Net (loss) income - Pitney Bowes Inc. $ (81,845 ) $ 86,279 $

95,303 $ 407,943 Basic (loss) earnings per

share attributable to common stockholders (1): Continuing

operations $ (0.44 ) $ 0.41 $ 0.52 $ 2.01 Discontinued operations

(0.00 ) 0.03 (0.01 ) 0.03

Net (loss) income - Pitney Bowes Inc. $ (0.44 ) $ 0.44

$ 0.51 $ 2.04 Diluted (loss) earnings

per share attributable to common stockholders (1): Continuing

operations $ (0.44 ) $ 0.41 $ 0.52 $ 2.00 Discontinued operations

(0.00 ) 0.03 (0.01 ) 0.03

Net (loss) income - Pitney Bowes Inc. $ (0.44 ) $ 0.44

$ 0.50 $ 2.03 Weighted-average shares

used in diluted earnings per share 185,645,814

197,959,779 188,975,198 200,944,874

(1) The sum of the earnings per share amounts

may not equal the totals due to rounding.

Pitney

Bowes Inc. Consolidated Balance Sheets (Unaudited; in

thousands, except share amounts)

Assets

December 31,2016

December 31,2015

(1)

Current assets: Cash and cash equivalents $ 770,985 $ 650,557

Short-term investments 31,985 117,021 Accounts receivable, net

463,483 476,583 Short-term finance receivables, net 885,994 918,383

Inventories 92,726 88,824 Current income taxes 11,373 6,584 Other

current assets and prepayments 68,637 67,400

Total current assets 2,325,183 2,325,352

Property, plant and equipment, net 314,603 330,088 Rental property

and equipment, net 188,054 177,515 Long-term finance receivables,

net 673,207 760,657 Goodwill 1,573,864 1,745,957 Intangible assets,

net 165,172 187,378 Noncurrent income taxes 74,806 70,294 Other

assets 524,773 525,891 Total

assets $ 5,839,662 $ 6,123,132

Liabilities,

noncontrolling interests and stockholders' (deficit)

equity

Current liabilities: Accounts payable and accrued liabilities $

1,378,822 $ 1,448,321 Current income taxes 34,434 16,620 Current

portion of long-term debt and notes payable 614,485 461,085 Advance

billings 303,469 353,025 Total

current liabilities 2,331,210 2,279,051 Deferred taxes on

income 204,320 205,668 Tax uncertainties and other income tax

liabilities 61,276 68,429 Long-term debt 2,750,405 2,489,583 Other

noncurrent liabilities 593,613 605,310

Total liabilities 5,940,824 5,648,041

Noncontrolling interests (Preferred stockholders'

equity in subsidiaries) - 296,370 Stockholders' (deficit)

equity: Cumulative preferred stock, $50 par value, 4% convertible 1

1 Cumulative preference stock, no par value, $2.12 convertible 483

505 Common stock, $1 par value 323,338 323,338 Additional

paid-in-capital 148,125 161,280 Retained earnings 5,110,232

5,155,537 Accumulated other comprehensive loss (940,133 ) (888,635

) Treasury stock, at cost (4,743,208 ) (4,573,305 )

Total Pitney Bowes Inc. stockholders' (deficit) equity

(101,162 ) 178,721 Total liabilities,

noncontrolling interests and stockholders' (deficit) equity $

5,839,662 $ 6,123,132 (1)

Certain prior year amounts have been

revised for accounting rules that became effective January 1, 2016

and to conform to current year presentation.

Pitney Bowes Inc. Business Segments -

Revenue and EBIT (Unaudited; in thousands)

Three months ended December 31, Twelve months

ended December 31, 2016 2015 %

Change 2016 2015 % Change

Revenue

North America Mailing $ 340,884 $ 363,316 (6 %) $ 1,342,673

$ 1,435,140 (6 %) International Mailing 101,072

113,930 (11 %) 406,797 445,328

(9 %)

Small & Medium Business Solutions

441,956 477,246 (7 %) 1,749,470

1,880,468 (7 %) Production Mail 115,054

122,298 (6 %) 404,703 421,178 (4 %) Presort Services 118,368

122,247 (3 %) 475,582

473,612 0 %

Enterprise Business Solutions

233,422 244,545 (5 %) 880,285

894,790 (2 %) Software Solutions 90,817

102,992 (12 %) 348,234 385,908 (10 %) Global Ecommerce

120,874 112,164 8 % 428,586

362,087 18 %

Digital Commerce Solutions

211,691 215,156 (2 %) 776,820

747,995 4 % Other - - - - 54,807 (100 %)

Total revenue $

887,069 $ 936,947 (5 %) $ 3,406,575 $

3,578,060 (5 %)

EBIT

(1)

North America Mailing $ 138,350 $ 164,537 (16 %) $ 575,080 $

646,913 (11 %) International Mailing 12,182

14,485 (16 %) 46,547 51,070 (9

%)

Small & Medium Business Solutions 150,532

179,022 (16 %) 621,627

697,983 (11 %) Production Mail 18,627 16,793 11 %

54,061 48,254 12 % Presort Services 25,953

27,709 (6 %) 95,258 104,655 (9

%)

Enterprise Business Solutions 44,580

44,502 0 % 149,319 152,909 (2 %)

Software Solutions 12,251 13,627 (10 %) 30,159 48,531 (38 %)

Global Ecommerce 10,365 9,267 12 %

19,200 19,229 (0 %)

Digital Commerce

Solutions 22,616 22,894 (1 %)

49,359 67,760 (27 %) Other - - -

- 10,569 (100 %)

Segment EBIT $ 217,728 $ 246,418 (12 %) $

820,305 $ 929,221 (12 %)

Reconciliation of segment EBIT to net (loss) income

Segment EBIT $ 217,728 $ 246,418 $ 820,305 $ 929,221

Corporate expenses (30,679 ) (61,136 )

(189,215 ) (213,095 )

Adjusted EBIT 187,049 185,282

631,090 716,126 Interest, net (2) (40,442 ) (40,003 ) (144,211 )

(159,374 ) Goodwill impairment (168,563 ) - (168,563 ) -

Restructuring charges and asset impairments, net (13,793 ) (11,477

) (63,296 ) (25,782 ) Other (expense) income, net - (78 ) (536 )

94,838 Acquisition/disposition related expenses (1,847 )

(4,500 ) (5,585 ) (14,983 )

(Loss) income

from continuing operations before income taxes (37,596 )

129,224 248,899 610,825 Provision for income taxes (38,235 )

(44,204 ) (131,850 ) (189,778 )

(Loss)

income from continuing operations (75,831 ) 85,020 117,049

421,047 (Loss) income from discontinued operations, net of tax

(750 ) 5,853 (2,701 ) 5,271

Net (loss) income $ (76,581 ) $ 90,873 $

114,348 $ 426,318 (1) Segment EBIT

excludes interest, taxes, general corporate expenses, restructuring

charges, and other items that are not allocated to a particular

business segment. (2) Includes financing interest expense

and interest expense, net.

Pitney Bowes Inc.

Reconciliation of Reported Consolidated Results to Adjusted

Results (Unaudited; in thousands, except per share amounts)

Three months endedDecember

31,

Twelve months endedDecember

31,

2016 2015

Y/Y Chg.

2016 2015 Y/Y Chg.

Reconciliation of reported revenue to

revenue excluding currencyand Market Exits

Revenue, as reported $ 887,069 $ 936,947 (5 %) $ 3,406,575 $

3,578,060 (5 %) Unfavorable impact on revenue due to currency

13,379 - NM 36,536

- NM Revenue, excluding currency 900,448 936,947 (4 %)

3,443,111 3,578,060 (4 %) Less revenue from Market Exits

(2,280 ) (6,018 ) NM (5,983 ) (25,912 ) NM

Revenue, excluding currency and Market Exits $ 898,168 $

930,929 (4 %) $ 3,437,128 $ 3,552,148 (3 %)

Reconciliation of reported net (loss) income to

adjusted earnings Net (loss) income $ (76,581 ) $ 90,873 $

114,348 $ 426,318 Loss (income) from discontinued operations, net

of tax 750 (5,853 ) 2,701 (5,271 ) Goodwill impairment 166,526 -

166,526 - Restructuring charges and asset impairments, net 9,945

9,481 42,343 18,089 Loss (gain) on disposition of businesses 1,194

4,149 3,893 (84,250 ) Preferred stock redemption (2,047 ) - 2,800 -

Transaction costs related to acquisitions and dispositions - 48 206

11,475 Acquisition/disposition related expenses - - - 7,246 Legal

settlement - - - 4,250 Investment divestiture -

- - (7,756 ) Income from

continuing operations, after income taxes, as adjusted 99,787

98,698 332,817 370,101 Provision for income taxes, as adjusted

46,820 46,581 154,062

186,651 Income from continuing operations before

income taxes, as adjusted 146,607 145,279 486,879 556,752 Interest,

net 40,442 40,003 144,211

159,374 EBIT, as adjusted 187,049 185,282 631,090

716,126 Depreciation and amortization 38,261

45,826 178,486 173,312 EBITDA,

as adjusted $ 225,310 $ 231,108 $ 809,576 $

889,438

Reconciliation of reported diluted

(loss) earnings per share toadjusted diluted earnings per

share from continuing operations

Diluted (loss) earnings per share $ (0.44 ) $ 0.44 $ 0.50 $ 2.03

Loss (income) from discontinued operations, net of tax 0.00 (0.03 )

0.01 (0.03 ) Goodwill impairment 0.89 - 0.88 - Restructuring

charges and asset impairments, net 0.05 0.05 0.22 0.09 Loss (gain)

on disposition of businesses 0.01 0.02 0.02 (0.42 ) Preferred stock

redemption 0.01 - 0.03 - Transaction costs related to acquisitions

and dispositions - - - 0.06 Acquisition/disposition related

expenses - - - 0.04 Legal settlement - - - 0.02 Investment

divestiture - - -

(0.04 ) Diluted earnings per share from continuing operations, as

adjusted $ 0.53 $ 0.48 $ 1.68 $ 1.75

Note: The sum of the earnings per share amounts may

not equal the totals due to rounding.

Reconciliation of reported net cash

from operating activities to freecash flow

Net cash provided by operating activities $ 199,763 $ 163,656 $

490,692 $ 515,056 Capital expenditures (45,299 ) (36,418 ) (160,831

) (166,746 ) Restructuring payments 13,769 16,030 64,930 62,086

Pension contribution - - 36,731 - Reserve account deposits (3,996 )

1,428 (2,183 ) (24,202 ) Acquisition/disposition related expenses -

- - 10,483 Tax payment related to investment divestiture - - -

20,602 Tax payment related to sale of Imagitas - 5,306 - 21,224

Cash transaction fees - 6,856

335 17,971 Free cash flow $ 164,237

$ 156,858 $ 429,674 $ 456,474

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170201005187/en/

Pitney Bowes Inc.Editorial -Bill Hughes, 203/351-6785Chief

Communications OfficerorFinancial -Adam David, 203/351-7175VP,

Investor Relations

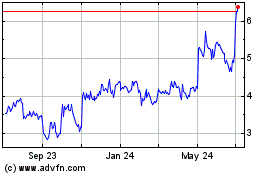

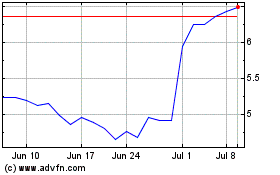

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Apr 2023 to Apr 2024