Pimco's New Turnaround Man: Manny Roman

July 20 2016 - 7:10AM

Dow Jones News

By Laurence Fletcher and Giles Turner

In Manny Roman, Pacific Investment Management Co. may have found

the tough turnaround specialist the giant U.S. bond manager has

been looking for.

French-born Mr. Roman, a 52-year-old former Goldman Sachs banker

and serial deal-maker, is widely credited with leading a turnaround

at hedge-fund group Man Group PLC that has included a raft of big

acquisitions to diversify the business and sweeping changes to his

management team.

Known for his ruthlessness, collection of French wines, keen

intellect and willingness to spend hours talking about his beloved

Arsenal F.C., a soccer team in the English Premier League, Mr.

Roman took over the reins at Man Group--then a struggling

company--in early 2013.

The London-based hedge-fund firm had for years been battling

client outflows and losses from its flagship computer-driven hedge

fund AHL. It had also been tainted by the revelation it had

invested around $360 million with Bernard Madoff, the man behind

the biggest financial swindle in history.

Mr. Roman arrived at Man Group with its 2010 takeover of

London-based GLG Partners, a firm of hedge-fund traders known for

its tough culture, where he was a co-chief executive. The takeover,

seen by many at the time as gamble by Man Group, was a clash of

cultures epitomized by Mr. Roman's rise to the top.

One employee at AHL, which uses highly complex mathematical

models to trade markets, described the deal as being "like the

chess club taking over the football team."

Mr. Roman was made Man Group's president and chief operating

officer but was seen by many insiders as the power behind the

throne. He eventually took over the CEO role from Peter Clarke, Man

Group's former finance director, in early 2013, after a contest in

which many observers saw only one eventual winner.

Mr. Roman embarked on a trail of acquisitions including

Boston-based Numeric Holdings and Connecticut-based Silvermine

Capital, capped bonuses and appointed Sandy Rattray head of AHL,

which went on to become one of the world's top-performing hedge

funds in 2014.

"This is a loss for Man," said RBC Capital Markets analyst Peter

Lenardos. "Manny had a respectable tenure at Man Group.

"However, Man has other talented senior executives. Jonathan

Sorrell, the CFO, immediately comes to mind," he said.

Pimco, a unit of German insurer Allianz SE, made the decision to

hire a new senior executive a few months ago, with a focus on

corporate strategy, according to a person familiar with the hiring

process, which was led by the firm's chief investment officer,

Daniel Ivascyn.

The search evolved into a hunt for a chief executive, involving

Allianz. At the same time, Allianz also announced the hiring of

Jacqueline Hunt as a management board member overseeing Pimco,

starting in July. She replaced Jay Ralph, a strong defender of

Pimco before the departure of co-founder and Chief Investment

Officer Bill Gross in 2014.

" Doug Hodge has done a terrific job of leading Pimco through

what was a challenging time," said Ms. Hunt in a statement,

referring to Mr. Roman's predecessor at Pimco.

Mr. Hodge, who reported to Ms. Hunt, will now focus on

relationships with Pimco's clients.

Soon after taking up the reins at Pimco, Mr. Hodge told The Wall

Street Journal there was a "overwhelming" sense of relief and

excitement at the giant asset manager following the departure of

Mr. Gross.

While Mr. Hodge focused on the public face of the company, Mr.

Gross's investment management role was taken up by Mr. Ivascyn. A

series of deputy CIOs were also appointed, as the manager attempted

to move away from the autocratic style of Mr. Gross.

Pimco quickly ended its move into global equities, a drive

backed by Mr. Gross, leading to the departure of one of its new

CIOs. The manager also made changes to how its junior employees

were handled and placed a greater emphasis on team management.

Client withdrawals from its flagship Total Return bond fund that

Mr. Gross managed have since slowed. Investors pulled a net $900

million from the $88 billion fund in March, according to Pimco.

Write to Laurence Fletcher at laurence.fletcher@wsj.com and

Giles Turner at giles.turner@wsj.com

(END) Dow Jones Newswires

July 20, 2016 06:55 ET (10:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

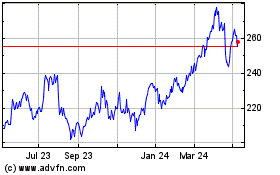

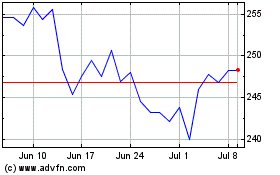

Man (LSE:EMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Man (LSE:EMG)

Historical Stock Chart

From Apr 2023 to Apr 2024