Pimco's New Turnaround Man: Manny Roman -- 2nd Update

July 20 2016 - 9:04AM

Dow Jones News

By Laurence Fletcher and Giles Turner

In Manny Roman, Pacific Investment Management Co. may have found

the tough turnaround specialist the giant U.S. bond manager has

been looking for.

French-born Mr. Roman, a 52-year-old former Goldman Sachs banker

and serial deal-maker, is widely credited with leading a turnaround

at hedge-fund group Man Group PLC that has included a raft of big

acquisitions to diversify the business and sweeping changes to his

management team.

Known for his ruthlessness, collection of French wines, keen

intellect and willingness to spend hours talking about his beloved

Arsenal F.C., a soccer team in the English Premier League, Mr.

Roman took over the reins at Man Group--then a struggling

company--in early 2013.

The London-based hedge-fund firm had for years been battling

client outflows and losses from its flagship computer-driven hedge

fund AHL. It had also been tainted by the revelation it had

invested around $360 million with Bernard Madoff, the man behind

the biggest financial swindle in history.

Mr. Roman arrived at Man Group with its 2010 takeover of

London-based GLG Partners, a firm of hedge-fund traders known for

its tough culture, where he was a co-chief executive. The takeover,

seen by many at the time as gamble by Man Group, was a clash of

cultures epitomized by Mr. Roman's rise to the top.

One employee at AHL, which uses highly complex mathematical

models to trade markets, described the deal as being "like the

chess club taking over the football team."

Mr. Roman was made Man Group's president and chief operating

officer but was seen by many insiders as the power behind the

throne. He eventually took over the CEO role from Peter Clarke, Man

Group's former finance director, in early 2013, after a contest in

which many observers saw only one eventual winner.

Mr. Roman embarked on a trail of acquisitions including

Boston-based Numeric Holdings and Connecticut-based Silvermine

Capital, capped bonuses and appointed Sandy Rattray head of AHL,

which went on to become one of the world's top-performing hedge

funds in 2014.

"This is a loss for Man," said RBC Capital Markets analyst Peter

Lenardos. "Manny had a respectable tenure at Man Group.

"However, Man has other talented senior executives. Jonathan

Sorrell, the CFO, immediately comes to mind," he said.

Mr. Roman, the son of a Parisian artist, is an art collector and

keen literary buff admired by those who know him for his ability to

speed-read documents and books. He is on the board of directors of

publisher Penguin Random House and a supporter of the Paris Review

of Books. He has embraced Man's sponsorship of world-wide literary

award the Booker Prize.

His interest in 20th century history saw him support the Centre

for Cold War Studies at the London School of Economics and take a

keen interest in the dramatic decline of the city of Detroit.

Last year he was elected to the board of trustees of the

University of Chicago, where he did his M.B.A. and where he has

funded a post named after him in culture and society.

A close friend of Credit Suisse Chief Executive Tidjane Thiam,

Mr. Roman has often shied away from a media profile, although his

time at the helm of Man has meant greater scrutiny. Last year his

total pay package at Man was nearly $5.4 million, while he was

among those to profit handsomely from Man's $1.6 billion takeover

of GLG in 2010.

The move to California will on a personal level suit Mr. Roman,

whose wife is American and whose family is based in the U.S.

Former colleagues agree that clients typically viewed Mr. Roman

very differently to subordinates. One former colleague said he

could flip a switch and turn on the charm with clients but could

often come across as rude, particularly to junior staff

members.

One former colleague from Goldman, where Mr. Roman was a

partner, says he was a study in dedication. "In some ways he was a

classic Goldman partner. He would work on a bank holiday if it

meant he could get a game of golf in with clients."

Write to Laurence Fletcher at laurence.fletcher@wsj.com and

Giles Turner at giles.turner@wsj.com

(END) Dow Jones Newswires

July 20, 2016 08:49 ET (12:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

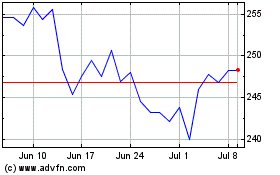

Man (LSE:EMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

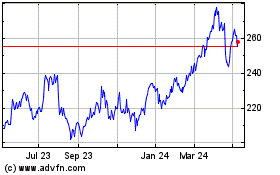

Man (LSE:EMG)

Historical Stock Chart

From Apr 2023 to Apr 2024