$225 Million of Medical Facility Investments

Completed in Fourth Quarter 2016

The Retirement of the Company’s Founder and

Chief Investment Officer John W. Sweet

The Promotion of Deeni Taylor to EVP-Chief

Investment Officer and the Promotion of Daniel M. Klein to the

Position of SVP-Deputy Chief Investment Officer

Physicians Realty Trust (NYSE:DOC) (the “Company”), a

self-managed healthcare properties REIT, announced today that the

Company completed investments during 2016 of approximately $1.28

billion, with the addition of 11 medical office facilities acquired

during the fourth quarter for $225 million.

John Thomas, the Company’s President and Chief Executive

Officer, stated, “2016 was another record year of growth for

Physicians Realty Trust, led by our investment in medical office

facilities affiliated with Catholic Health Initiatives (“CHI”), but

also many more investments with high quality health systems and

physician groups all around the United States. We now have nearly

11 million rentable square feet of medical office space which is

more than 95% leased, and approximately 1,100 health system and

medical service provider tenants. We look forward to sharing more

information about all of the fourth quarter acquisitions and an

update on our progress with the CHI investments with our earnings

release on February 24, 2017.”

The Company also announces today the retirement of John W.

Sweet, our founder, and since the initial public offering, our

Executive Vice President and Chief Investment Officer, effective as

of December 31, 2016. Mr. Sweet will continue in a consulting role

with the Company, working on specific projects and investment

opportunities with the Company’s CEO and his successor Chief

Investment Officer.

Prior to the Company’s IPO, Mr. Sweet served from 2005 to 2013

as a Managing Director for the investment banking firm, BC Ziegler

and raised and managed a medical office building investment fund

which became the initial core portfolio for the Company. In 2002,

he cofounded Windrose Medical Properties Trust, a publicly traded

medical office REIT that was sold in 2006 to Healthcare REIT, now

known as Welltower (NYSE:HCN). From 1997-2001, he was a Managing

Director of BC Ziegler, engaged in healthcare related mergers and

acquisitions.

Over a span of 50 years, John served in numerous financial

positions with public and private companies as well as serving in

senior advisory positions with family investment offices. He has

also served on the boards of philanthropic and charitable

organizations and was in the Army from 1968-1970. Mr. Sweet has a

B.S. in Business Administration from St. John Fisher College and a

Master’s from Rochester Institute of Technology.

Mr. Sweet was most recently appointed to the Board of Directors

of Wheeler Real Estate Investment Trust (NASDAQ:WHLR).

John Thomas commented, “John Sweet is a great husband, father,

grandfather, and entrepreneur. His legacy includes three public

companies he led through the public offering process, as well as

building a foundation for our Company that we expect to last for

generations to come. John has been more than an icon in our

industry for a long time, but a true mentor and friend, and we will

miss him around the office on a daily basis. During Mr. Sweet’s

tenure as our Chief Investment Officer, the Company has grown from

$125 million in real estate assets to just shy of $3 billion at the

time of his retirement, with all of that growth achieved in less

than 42 months. It should be noted, he led the fund and sourced all

of that original $125 million in medical office facilities as well.

Fortunately, John has agreed to continue to support us from time to

time with specific projects and potential investments, while he

also fulfills his responsibilities on the Wheeler Board of

Directors and other business and community interests he

pursues.”

Governor Tommy G. Thompson, Chairman of the Board of Trustees of

the Company, added, “On behalf of the Board of Trustees of

Physicians Realty Trust, we would like to recognize and commend

John Sweet for his incredible career and the legacy we now all

enjoy with the Company. We wish him many healthy and happy years in

retirement with his wife, four children, two grandchildren, and

many friends and colleagues, in his future endeavors and

interests.”

Mr. Sweet added, “This has been the most extraordinary and

rewarding period of my working career. I may be credited with

coming up with the idea to go public, but from there on, it was our

board, our management team, and the entire DOC team that made this

company a reality and huge success.”

As part of the Company’s succession plan, it announced today

that it has promoted Deeni Taylor to succeed Mr. Sweet, to serve as

the Company’s Executive Vice President-Chief Investment Officer,

effective January 1, 2017. Mr. Taylor joined the Company on October

1, 2015. Mr. Taylor will continue to report directly to the

Company’s President and Chief Executive Officer, John T.

Thomas.

Mr. Thomas commented, “Deeni Taylor is one of the most respected

executives in the healthcare and medical office industry, with

healthcare industry relationships across the United States. Deeni,

similar to John Sweet and me, is a healthcare professional who

entered healthcare real estate investment and development. He has

been a fabulous addition to our team since he joined us in late

2015, helping Mr. Sweet and the Company reach record levels of

acquisitions and growth in 2016. While he has very big shoes to

fill, we are confident Deeni can help lead us to even greater

growth and high quality medical office facility investments with

his and our relationships.”

Deeni Taylor came to the Company from Indianapolis-based Duke

Realty, Inc. (NYSE:DRE), where Deeni served as an Executive Vice

President helping to lead Duke’s healthcare team since he joined

that firm in 2006. Prior to his healthcare real estate career,

Deeni enjoyed a 25-year hospital career. He served as Executive

Vice President and Chief Strategy Officer for St. Vincent Health,

an Ascension Health Ministry, including 16 hospitals serving

central Indiana. He also served as President of UNITY Health

Management Services in Birmingham, Alabama and worked for

Ascension’s St. Vincent’s Hospital in Birmingham, Alabama as the

Vice President of Planning and Marketing. Prior to that, Deeni

worked for St. Joseph Hospital in Augusta, Georgia, where he served

as Vice President Ancillary Services.

A graduate of Purdue University, with a B.S. in Pharmacy, and

Central Michigan University with a Masters in Science

Administration, Mr. Taylor is a member of ULI and serves on its

Healthcare and Life Science Council. He is a past Diplomat in

American College of Healthcare Executives and is an active member

of the Purdue National Leadership Circle Executive Committee. Mr.

Taylor has served on Peyton Manning's PeyBack Foundation since

2001.

Mr. Taylor stated, “I have enjoyed my time over the past 15

months with Physicians Realty Trust, working closely with John

Sweet, Governor Tommy Thompson, and John Thomas, as we have worked

together to continue to build an outstanding organization that John

Sweet founded. I look forward to continuing to build upon that

foundation and success.”

The Company also announced today that it has named Daniel M.

Klein to the newly created position of Senior Vice President-Deputy

Chief Investment Officer. Mr. Klein will report directly to the

Company’s President and CEO, John Thomas, while working hand in

hand with the Company’s EVP-CIO, Deeni Taylor. In this role, Dan

will help drive the Company’s new investment activities with health

systems, physicians, and real estate developers working closely

with these health systems, physicians, and other providers.

Dan Klein joined the Company in 2016, with a specific focus on

supporting the Company’s integration of the CHI medical office

facilities, as well as supporting new business development working

with Messrs. Sweet, Taylor, and Thomas. Dan sits on several

prominent industry boards, is a frequent speaker at industry

events, and has published articles in the medical office space. Dan

also worked for many years at Welltower (NYSE:HCN). Prior to that,

Mr. Klein was Co-Founder and President of CB Richard Ellis/Reichle

Klein, a full-service commercial real estate firm. He is an

attorney and holds IREM’s CPM© designation. Mr. Klein received a

B.S. from the University of Virginia, where he was a four-year

member of the men’s golf team, and a law degree from The University

of Toledo College of Law. Dan lives in Charleston, South Carolina

with his wife, Robin, and four daughters.

John Thomas commented, “I am thrilled to have the opportunity to

work with Dan Klein again, as we have worked closely together since

2010. Dan’s physician and provider network of relationships,

diverse real estate background and skill set, and professionalism,

are great additions to our organization. Not only will he assist

Mr. Taylor and me, primarily, with new business development, he

brings extensive experience to support our asset management and

leasing team. Dan also enhances our senior team for long term

growth and stability.”

Mr. Klein added, “I am very excited to be part of this

organization, which is full of talented and diligent people. The

company is poised for continued growth, I look forward to doing my

part to contribute to our future success, and I look forward to

working with John, Deeni and the rest of the leadership team.”

About Physicians Realty Trust

Physicians Realty Trust is a self-managed healthcare real estate

company organized to acquire, selectively develop, own and manage

healthcare properties that are leased to physicians, hospitals and

healthcare delivery systems. The Company invests in real estate

that is integral to providing high quality healthcare. The Company

conducts its business through an UPREIT structure in which its

properties are owned by Physicians Realty L.P., a Delaware limited

partnership (the “operating partnership”), directly or through

limited partnerships, limited liability companies or other

subsidiaries. The Company is the sole general partner of the

operating partnership and, as of September 30, 2016, owned

approximately 97.4% of the partnership interests in our operating

partnership (“OP Units”).

Investors are encouraged to visit the Investor Relations portion

of the Company’s website (www.docreit.com) for additional

information, including annual reports on Form 10-K, quarterly

reports on Form 10-Q, current reports on Form 8-K and amendments to

those reports filed or furnished pursuant to Section 13(a) or 15(d)

of the Securities Exchange Act of 1934, as amended, press releases,

supplemental information packages and investor presentations.

Forward-Looking Statements

This press release contains statements that are “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. Forward-looking

statements may be identified by the use of words such as

“anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook”,

and “project” and other similar expressions that predict or

indicate future events or trends or that are not statements of

historical matters. These forward looking statements may include

statements regarding the Company’s strategic and operational plans,

the Company’s ability to generate internal and external growth, the

future outlook, anticipated cash returns, cap rates or yields on

properties, anticipated closing of property acquisitions, and

ability to execute its business plan. While forward-looking

statements reflect our good faith beliefs, they are not guarantees

of future performance. Forward looking statements should not be

read as a guarantee of future performance or results, and will not

necessarily be accurate indications of the times at, or by, which

such performance or results will be achieved. Forward looking

statements are based on information available at the time those

statements are made and/or management’s good faith belief as of

that time with respect to future events, and are subject to risks

and uncertainties that could cause actual performance or results to

differ materially from those expressed in or suggested by the

forward looking statements. These forward-looking statements are

subject to various risks and uncertainties, not all of which are

known to the Company and many of which are beyond the Company’s

control, which could cause actual results to differ materially from

such statements. These risks and uncertainties are described in

greater detail in the Company’s filings with the Securities and

Exchange Commission (the “Commission”), including, without

limitation, the Company’s annual and periodic reports and other

documents filed with the Commission. Unless legally required, the

Company disclaims any obligation to update any forward-looking

statements after the date of this release, whether as a result of

new information, future events or otherwise. For a description of

factors that may cause the Company’s actual results or performance

to differ from its forward-looking statements, please review the

information under the heading “Risk Factors” included in the

Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2015 filed by the Company with the Commission on

February 29, 2016.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170103005397/en/

Physicians Realty TrustJohn T. Thomas, 214-549-6611President and

CEOjtt@docreit.comorJeffrey N. Theiler, 414-367-5610Executive Vice

President and CFOjnt@docreit.com

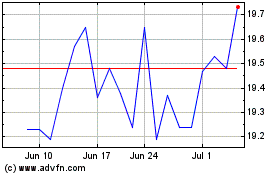

Healthpeak Properties (NYSE:DOC)

Historical Stock Chart

From Mar 2024 to Apr 2024

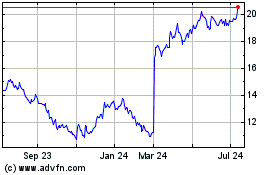

Healthpeak Properties (NYSE:DOC)

Historical Stock Chart

From Apr 2023 to Apr 2024