Philips NV Sells Shares in Lighting Division at Lower End of Target Range -- Update

May 26 2016 - 5:16PM

Dow Jones News

By Maarten van Tartwijk

AMSTERDAM -- Royal Philips NV said it sold shares in its

125-year-old lighting division at the lower end of the targeted

range, valuing the business at EUR3 billion ($3.36 billion).

The Dutch technology group sold a 25% stake in Philips Lighting

for EUR20 a share, according to a statement released Thursday. The

pricing was slightly below the midpoint of a range of EUR18.50 to

EUR22.50 announced last week.

Shares in Philips Lighting will start trading on Euronext

Amsterdam on Friday. The offering is one of the largest listings in

Europe so far this year.

The sale, which was first announced in September 2014, is the

final step in a years-long restructuring spearheaded by Chief

Executive Frans van Houten. It will mark the end of Philips as a

sprawling conglomerate that produced everything from lightbulbs and

television sets to medical scanners and coffee machines.

Philips started making its first incandescent light bulbs in

1891 in the southern Dutch city of Eindhoven. It grew to become one

of Europe's biggest technology giants, credited with innovations

like the compact disc and the electric shaver.

Over the past decade, the company embarked on a dramatic

strategic overhaul as it was dogged by profit warnings and

criticism that its diversified corporate structure was slowing it

down. Mr. van Houten, a company veteran who took the helm in 2011,

has said restructuring Philips is similar to running a

marathon.

The Amsterdam-based company now seeks to concentrate on selling

health-care technology and services in a market where it competes

with General Electric Co. and Siemens AG. It believes the

health-care business is more profitable and offers better long-term

growth opportunities.

Philips has a good record when it comes to spinning off assets.

ASML Holding NV and NXP Semiconductors NV, two former Philips

subsidiaries, have fared well after being spun off in the 1990s and

2000s. Both semiconductor companies now have a bigger market value

than their former parent.

The future of Philips Lighting, the world's biggest lighting

company with EUR7.5 billion in revenue last year, may be less

bright. The business still makes most of its profit from producing

conventional lamps, a market that is in structural decline, while

its fast-growing LED business is facing cutthroat competition.

To become less reliant on manufacturing, Philips management has

been seeking to shift the focus of the business to services, such

as supplying lighting systems for cities, sporting venues and

theaters.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

May 26, 2016 17:01 ET (21:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

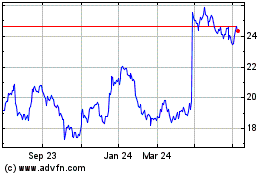

Koninklijke Philips NV (EU:PHIA)

Historical Stock Chart

From Mar 2024 to Apr 2024

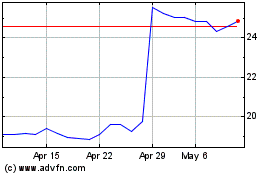

Koninklijke Philips NV (EU:PHIA)

Historical Stock Chart

From Apr 2023 to Apr 2024