Philip Falcone's HC2 Makes $1 Billion Offer for Andersons

May 17 2016 - 6:20PM

Dow Jones News

Former hedge-fund manager Philip Falcone's HC2 Holdings Inc. has

made a bid to buy agricultural company Andersons Inc. for about $1

billion in cash.

The offer values shares in Andersons at $37 a piece, according

to a letter viewed by The Wall Street Journal, a 43% premium over

Tuesday's closing price but well below the near $70 peak the stock

hit in late 2014.

Shares of Andersons rose 21% to $31.40 in after-hours trading

following the Journal's report of the bid.

In his letter Tuesday to Andersons Chairman Michael Anderson,

Mr. Falcone said that HC2 "has repeatedly expressed its interest"

in Andersons to enter into a negotiated transaction. "Yet neither

you nor anyone at the company had substantively responded to our

$37 all-cash offer." Mr. Falcone stated that while Andersons

assured "a meaningful exchange of information" at a meeting on

April 18, it has "only stated that the price was too low without

providing any indication of an acceptable price or justification

for a higher price."

"Unfortunately, you have left us no choice but to make your

shareholders aware of our proposals," the letter said.

A representative for Andersons didn't immediately respond to a

request for comment.

Mr. Falcone, who formerly led Harbinger Capital Partners, shot

from relative obscurity to become one of the investing stars of the

financial crisis with lucrative bets against subprime mortgages.

But the firm started to suffer deep losses and regulatory issues

emerged, and in 2013 Mr. Falcone admitted wrongdoing as part of a

civil settlement with securities regulators and agreed to a

five-year ban from the securities industry.

Since stepping down from the holding company behind Harbinger,

Mr. Falcone has been running a smaller public holding

company—HC2—that invests in growth-oriented businesses. The firm,

which has lost about two-thirds of its value over the past 12

months, counts steel fabricator Schuff Steel, game publisher

Dusenberry Martin Racing and energy company American Natural Gas

among its holdings.

In the letter Tuesday, Mr. Falcone called Andersons "poorly

managed" and ineffective in "extracting synergies." He said HC2 is

interested in acquiring all of Andersons, though he also expressed

interest in alternatively buying two of the company's five

entities—its grain business, which is its largest, and its rail

segment. Under that scenario, HC2 would provide "stalking horse

bids," designed to set a floor for potential bids, for the

remaining assets.

Andersons, based in Maumee, Ohio, specializes in the grain,

ethanol, plant-nutrient and rail sectors. In its most recent

quarter, the company posted a loss of $14.7 million, down from a

year-earlier profit of $4.1 million. Chief Executive Pat Bowe

pointed to unfavorable conditions in the grain market, in addition

to lower shipments to China. Mr. Bowe said earlier this month that

performance would be "challenged until the fall harvest, which

should produce opportunities to return to normal levels of

profitability."

Mr. Falcone is also known for having founded wireless venture

LightSquared, which filed for bankruptcy in 2012 after the Federal

Communications Commission rejected its plans to launch a wireless

network. Last year, a bankruptcy judge approved LightSquared's

restructuring plan, ending a battle with Dish Network Corp.'s

Chairman Charlie Ergen.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

May 17, 2016 18:05 ET (22:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

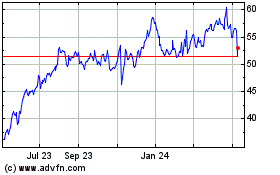

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

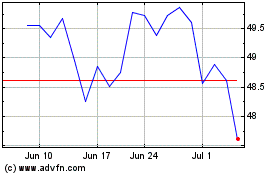

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Apr 2023 to Apr 2024