Petrobras Is No Longer a Buy for Emerging-Markets Investor Mobius

February 05 2016 - 3:40PM

Dow Jones News

By Luciana Magalhaes

São Paulo--Emerging-markets guru Mark Mobius said Friday that he

no longer is investing in Brazil's troubled state-run oil giant

Petróleo Brasileiro SA and that he would buy shares only if oil

prices rise sharply and the state-run firm is successful in cutting

its huge debt.

Meeting with journalists in São Paulo, the executive chairman of

Templeton Emerging Markets Group said current low oil prices have

made it difficult for the company, known as Petrobras, to meet its

debt obligations given the high production costs at its deep-sea

oil fields.

He said Petrobras, the world's most indebted oil company, may

need a government bailout to overcome its financial challenges and

that it also will need to find a way to restructure its debt. "The

government will need to come in and help out," he said.

Officials from Petrobras weren't immediately available for

comment.

Petrobras has been struggling to regain its footing in the wake

of a major corruption scandal that has cost the company billions

and all but paralyzed Brazil's oil and gas sector. And it also is

laboring under a massive debt load taken on during the commodities

boom to develop deep-water petroleum reserves.

The company ended the third quarter of 2015 with total debt of

506.58 billion Brazilian reais ($129.56 billion), up 44% from the

end of 2014 in local-currency terms. It is trying to sell some $15

billion in assets this year to pay down its debt.

Shares of Petrobras have fallen more than 80% since 2010, when

the company raised about $70 billion in a share sale, one of the

largest on record at the time. The company reported a net loss of

3.76 billion reais ($97.3 million) in the third quarter.

Mr. Mobius said Friday that Templeton last year liquidated all

of its holdings in Petrobras in response to the

bid-rigging-and-bribery scandal. In February 2015, Mr. Mobius told

reporters Templeton had about $100 million invested in the oil

firm.

He still oversees about $900 million in assets in Brazil, and

said Templeton is willing to expand investments in some of the

companies already in its portfolio, including banks Itaú Unibanco

SA and Bradesco SA.

Write to Luciana Magalhaes at Luciana.Magalhaes@dowjones.com

(END) Dow Jones Newswires

February 05, 2016 15:25 ET (20:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

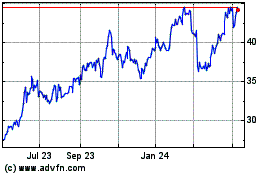

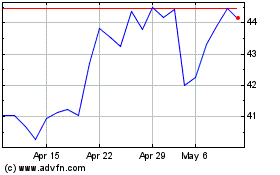

PETROBRAS ON (BOV:PETR3)

Historical Stock Chart

From Mar 2024 to Apr 2024

PETROBRAS ON (BOV:PETR3)

Historical Stock Chart

From Apr 2023 to Apr 2024