Revenue up 14%, Gross margin up 15%, EBITDAS up

11%; Company reaffirms 2015 earnings guidance

Perficient, Inc. (NASDAQ: PRFT) (“Perficient”), a leading

information technology and management consulting firm serving

Global 2000® and other large enterprise customers throughout North

America, today reported its financial results for the quarter ended

March 31, 2015.

Financial Highlights

For the quarter ended March 31, 2015:

- Revenue increased 14% to $110.6 million

from $97.2 million for the first quarter of 2014;

- Services revenue increased 11% to $98.6

million from $88.5 million for the first quarter of 2014;

- Gross Margin increased 15% to $36.1

million from $31.5 million for the first quarter of 2014;

- Adjusted earnings per share results (a

non-GAAP measure; see attached schedule, which reconciles to GAAP

earnings per share) on a fully diluted basis increased to $0.26

from $0.25 for the first quarter of 2014;

- Earnings per share results on a fully

diluted basis increased to $0.12 from $0.09 for the first quarter

of 2014;

- EBITDAS (a non-GAAP measure; see

attached schedule, which reconciles to GAAP net income) increased

to $15.5 million from $14.0 million for the first quarter of

2014;

- Net income increased to $4.1 million

from $3.0 million for the first quarter of 2014; and

- Perficient repurchased 187,000 shares

of its common stock at a total cost of $3.7 million.

“Perficient’s digital experience, business optimization and

industry solutions are resonating well in the market as evidenced

by a growing pipeline of opportunities and strong bookings trends

in recent months,” said Jeff Davis, chief executive officer and

president. “We’re well-positioned for another year of solid top-

and bottom-line growth.”

“Higher than anticipated benefit costs negatively impacted

margins during the quarter,” said Paul Martin, chief financial

officer. “We anticipate margin improvement in the current quarter

and second half of the year.”

Other Highlights

Among other recent achievements, Perficient:

- Completed the acquisition of Zeon

Solutions, Inc. and its subsidiary, Grand River Interactive LLC,

which enhances and expands Perficient’s e-commerce, content

management, product information management, mobile and digital

marketing services and solution expertise;

- Earned the Platinum Implementation

Partner designation from Sitecore due to our advanced

implementation capability and our demonstrated leadership in

customer experience management with Sitecore clients;

- Received the prestigious IBM Beacon

Award for Outstanding Information Management Solution, awarded to

elite IBM Business Partners who deliver exceptional solutions that

drive business value and transform the way clients and industries

do business;

- Received two accolades from Magento –

the Spirit of Excellence Award for North America, recognizing

exemplary service to Magento clients, and the Best B2B User

Experience Award, for best-in-class innovation and brilliance in

creating e-commerce solutions; and

- Added new customer relationships and

follow-on projects with leading companies such as Blue Cross Blue

Shield of Massachusetts, Bon-Ton, Carhatt, Cigna, Citizens

Financial Group, Cole-Parmer, C&S Wholesale Grocers, Depository

Trust and Clearing Corp., Fidelis, Health Data Compass, Laclede

Gas, MoneyGram International, NRG Energy, Presbyterian Health Care

Services, Scottrade, Sears Canada, Transpace, U.S. Concrete, the

University of Houston, and Zoetis.

Business Outlook

Perficient expects its second quarter 2015 services and software

revenue, including reimbursed expenses, to be in the range of

$110.5 million to $120.9 million, comprised of $104.5 million to

$109.9 million of revenue from services including reimbursed

expenses and $6.0 million to $11.0 million of revenue from sales of

software. The midpoint of second quarter 2015 services revenue

guidance represents growth of 21% over second quarter 2014 services

revenue.

The company is narrowing its full year 2015 revenue guidance

range of $470 million to $495 million and reaffirming its 2015

adjusted earnings per share guidance range of $1.38 to $1.49.

Conference Call Details

Perficient will host a conference call regarding first quarter

2015 financial results today at 10 a.m. Eastern.

WHAT: Perficient Reports First

Quarter 2015 Results

WHEN: Thursday, May 7, 2015, at 10

a.m. Eastern

CONFERENCE CALL NUMBERS:

877-415-3178 (U.S. and Canada); 857-244-7321 (International)

PARTICIPANT PASSCODE: 93252544

REPLAY TIMES: Thursday, May 7,

2015, at 2 p.m. Eastern, through Thursday, May 14, 2015

REPLAY NUMBER: 888-286-8010 (U.S.

and Canada) 617-801-6888 (International)

REPLAY PASSCODE: 54878916

About Perficient

Perficient is a leading information technology and management

consulting firm serving Global 2000 and enterprise customers

throughout North America. Perficient delivers digital experience,

business optimization and industry solutions that enable clients to

improve productivity and competitiveness; strengthen relationships

with customers, suppliers and partners; and reduce costs.

Perficient’s professionals serve clients from a network of offices

across North America and offshore locations in India and China.

Traded on the Nasdaq Global Select Market, Perficient is a member

of the Russell 2000 index and the S&P SmallCap 600 index.

Perficient is an award-winning Premier Level IBM business partner,

a Microsoft National Service Provider and Gold Certified Partner,

an Oracle Platinum Partner, and a Platinum Salesforce Cloud

Alliance Partner. For more information, visit

www.perficient.com.

Safe Harbor Statement

Some of the statements contained in this news release that are

not purely historical statements discuss future expectations or

state other forward-looking information related to financial

results and business outlook for 2015. Those statements are subject

to known and unknown risks, uncertainties, and other factors that

could cause the actual results to differ materially from those

contemplated by the statements. The forward-looking information is

based on management’s current intent, belief, expectations,

estimates, and projections regarding our company and our industry.

You should be aware that those statements only reflect our

predictions. Actual events or results may differ

substantially. Important factors that could cause our actual

results to be materially different from the forward-looking

statements include (but are not limited to) those disclosed under

the heading “Risk Factors” in our annual report on Form 10-K for

the year ended December 31, 2014 and the following:

(1) the possibility that our actual

results do not meet the projections and guidance contained in this

news release;

(2) the impact of the general economy and economic uncertainty on

our business; (3) risks associated with the operation of our

business generally, including: a) client demand for our services

and solutions; b) maintaining a balance of our supply of skills and

resources with client demand; c) effectively competing in a highly

competitive market; d) protecting our clients’ and our data and

information; e) risks from international operations including

fluctuations in exchange rates; f) obtaining favorable pricing to

reflect services provided; g) adapting to changes in technologies

and offerings; h) risk of loss of one or more significant software

vendors; and i) the recent implementation of our new Employee

Resource Planning system; (4) legal liabilities, including

intellectual property protection and infringement or the disclosure

of personally identifiable information; (5) risks associated with

managing growth organically and through acquisitions; and (6) the

risks detailed from time to time within our filings with the

Securities and Exchange Commission.

Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee

future results, levels of activity, performance, or achievements.

This cautionary statement is provided pursuant to Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. The forward-looking

statements in this release are made only as of the date hereof and

we undertake no obligation to update publicly any forward-looking

statement for any reason, even if new information becomes available

or other events occur in the future.

PERFICIENT, INC. CONSOLIDATED STATEMENTS OF

OPERATIONS (unaudited) (in thousands, except per share data)

Three Months Ended March 31,

2015 2014 Revenues

Services $ 98,629 $ 88,489 Software and hardware 8,502 5,003

Reimbursable expenses 3,467 3,678 Total

revenues 110,598 97,170 Cost of

revenues Project personnel costs 62,248 55,663 Software and

hardware costs 6,728 4,502 Reimbursable expenses 3,467 3,678 Other

project related expenses 896 786 Stock compensation 1,199

1,082 Total cost of revenues 74,538

65,711 Gross margin 36,060 31,459

Selling, general and administrative 21,735 18,568 Stock

compensation 2,308 2,115 12,017 10,776

Depreciation 1,081 912 Amortization 3,801 2,736 Acquisition

costs - 1,493 Adjustment to fair value of contingent consideration

85 214 Income from operations

7,050 5,421 Net interest expense (553 )

(167 ) Net other (expense) income (280 ) 20

Income before income taxes 6,217 5,274 Provision for income taxes

2,151 2,229 Net income $ 4,066 $

3,045 Basic earnings per share $ 0.12 $ 0.10 Diluted

earnings per share $ 0.12 $ 0.09 Shares used in computing

basic earnings per share 33,046 30,729 Shares used in computing

diluted earnings per share 34,164 32,628

PERFICIENT,

INC. CONSOLIDATED BALANCE SHEETS (unaudited) (in

thousands)

March 31, December 31,

2015 2014 ASSETS

Current assets: Cash and cash equivalents $ 6,353 $ 10,935 Accounts

receivable, net 99,427 113,928 Prepaid expenses 3,910 2,476 Other

current assets 5,105 4,679 Total

current assets 114,795 132,018 Property and equipment, net 8,336

7,966 Goodwill 252,819 236,130 Intangible assets, net 55,333 46,105

Other non-current assets 4,251 3,823

Total assets $ 435,534 $ 426,042

LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities:

Accounts payable $ 10,901 $ 22,035 Other current liabilities

26,476 33,028 Total current liabilities 37,377

55,063 Long-term debt 67,500 54,000 Other non-current liabilities

10,375 12,251 Total liabilities 115,252

121,314 Stockholders' equity: Common stock 44 43 Additional

paid-in capital 349,980 334,645 Accumulated other comprehensive

loss (822 ) (651 ) Treasury stock (99,030 ) (95,353 ) Retained

earnings 70,110 66,044 Total

stockholders' equity 320,282 304,728

Total liabilities and stockholders' equity $ 435,534 $

426,042

About Non-GAAP Financial Information

This news release includes non-GAAP financial measures. For a

description of these non-GAAP financial measures, including the

reasons management uses each measure, and reconciliations of these

non-GAAP financial measures to the most directly comparable

financial measures prepared in accordance with Generally Accepted

Accounting Principles (GAAP), please see the section entitled

“About Non-GAAP Financial Measures” and the accompanying tables

entitled “Reconciliation of GAAP to Non-GAAP Measures.”

About Non-GAAP Financial Measures

Perficient provides non-GAAP financial measures for EBITDAS

(earnings before interest, income taxes, depreciation,

amortization, and stock compensation), adjusted net income, and

adjusted earnings per share data as supplemental information

regarding Perficient’s business performance. Perficient believes

that these non-GAAP financial measures are useful to investors

because they provide investors with a better understanding of

Perficient’s past financial performance and future results.

Perficient’s management uses these non-GAAP financial measures when

it internally evaluates the performance of Perficient’s business

and makes operating decisions, including internal operating

budgeting, performance measurement, and the calculation of bonuses

and discretionary compensation. Management excludes stock-based

compensation related to employee stock options and restricted stock

awards, the amortization of intangible assets, acquisition costs,

adjustments to the fair value of contingent consideration, and

income tax effects of the foregoing, when making operational

decisions.

Perficient believes that providing the non-GAAP financial

measures to its investors is useful because it allows investors to

evaluate Perficient’s performance using the same methodology and

information used by Perficient’s management. Specifically, adjusted

net income is used by management primarily to review business

performance and determine performance-based incentive compensation

for executives and other employees. Management uses EBITDAS to

measure operating profitability, evaluate trends, and make

strategic business decisions.

Non-GAAP financial measures are subject to inherent limitations

because they do not include all of the expenses included under GAAP

and because they involve the exercise of discretionary judgment as

to which charges are excluded from the non-GAAP financial measure.

However, Perficient’s management compensates for these limitations

by providing the relevant disclosure of the items excluded in the

calculation of EBITDAS, adjusted net income, and adjusted earnings

per share. In addition, some items that are excluded from adjusted

net income and adjusted earnings per share can have a material

impact on cash. Management compensates for these limitations by

evaluating the non-GAAP measure together with the most directly

comparable GAAP measure. Perficient has historically provided

non-GAAP financial measures to the investment community as a

supplement to its GAAP results to enable investors to evaluate

Perficient’s business performance in the way that management does.

Perficient’s definition may be different from similar non-GAAP

financial measures used by other companies and/or analysts.

The non-GAAP adjustments, and the basis for excluding them, are

outlined below:

Amortization of Intangible AssetsPerficient has incurred expense

on amortization of intangible assets primarily related to various

acquisitions. Management excludes these items for the purposes of

calculating EBITDAS, adjusted net income, and adjusted earnings per

share. Perficient believes that eliminating this expense from its

non-GAAP financial measures is useful to investors because the

amortization of intangible assets can be inconsistent in amount and

frequency, and is significantly impacted by the timing and

magnitude of Perficient’s acquisition transactions, which also vary

substantially in frequency from period to period.

Acquisition CostsPerficient incurs transaction costs related to

acquisitions which are expensed in its GAAP financial statements.

Management excludes these items for the purposes of calculating

EBITDAS, adjusted net income, and adjusted earnings per share.

Perficient believes that excluding these expenses from its non-GAAP

financial measures is useful to investors because these are

expenses associated with each transaction, and are inconsistent in

amount and frequency causing comparison of current and historical

financial results to be difficult.

Adjustments to Fair Value of Contingent ConsiderationPerficient

is required to remeasure its contingent consideration liability

related to acquisitions each reporting period until the contingency

is settled. Any changes in fair value are recognized in earnings.

Management excludes these items for the purposes of calculating

adjusted net income and adjusted earnings per share. Perficient

believes that excluding these adjustments from its non-GAAP

financial measures is useful to investors because they are related

to acquisitions, and are inconsistent in amount and frequency from

period to period.

Stock-Based CompensationPerficient incurs stock-based

compensation expense under Financial Accounting Standards Board

Accounting Standards Codification Topic 718, Compensation – Stock

Compensation. Perficient excludes this item for the purposes of

calculating EBITDAS, adjusted net income, and adjusted earnings per

share because it is a non-cash expense, which Perficient believes

is not reflective of its business performance. The nature of

stock-based compensation expense also makes it very difficult to

estimate prospectively, since the expense will vary with changes in

the stock price and market conditions at the time of new grants,

varying valuation methodologies, subjective assumptions, and

different award types, making the comparison of current results

with forward-looking guidance potentially difficult for investors

to interpret. The tax effects of stock-based compensation expense

may also vary significantly from period to period, without any

change in underlying operational performance, thereby obscuring the

underlying profitability of operations relative to prior periods.

Perficient believes that non-GAAP measures of profitability, which

exclude stock-based compensation are widely used by analysts and

investors.

PERFICIENT, INC. RECONCILIATION OF GAAP TO

NON-GAAP MEASURES (unaudited) (in thousands, except per share

data)

Three Months Ended March 31,

2015 2014 GAAP Net Income $ 4,066 $ 3,045

Additions: Provision for income taxes 2,151 2,229 Amortization

3,801 2,736 Acquisition costs - 1,493 Adjustment to fair value of

contingent consideration 85 214 Stock compensation 3,507

3,197 Adjusted Net Income Before Tax 13,610 12,914 Adjusted

income tax (1) 4,832 4,869 Adjusted Net Income $

8,778 $ 8,045 GAAP Earnings Per Share (diluted) $ 0.12 $

0.09 Adjusted Earnings Per Share (diluted) $ 0.26 $ 0.25 Shares

used in computing GAAP and Adjusted Earnings Per Share (diluted)

34,164 32,628 (1) The estimated adjusted effective tax rate

of 35.5% and 37.7% for the three months ended March 31, 2015 and

2014, respectively, has been used to calculate the provision for

income taxes for non-GAAP purposes.

PERFICIENT,

INC. RECONCILIATION OF GAAP TO NON-GAAP MEASURES

(unaudited) (in thousands)

Three Months Ended March 31,

2015 2014 GAAP Net Income $ 4,066

$ 3,045 Additions: Provision for income taxes 2,151 2,229 Net

interest expense 553 167 Net other expense (income) 280 (20 )

Depreciation 1,081 912 Amortization 3,801 2,736 Acquisition costs -

1,493 Adjustment to fair value of contingent consideration 85

214 Stock compensation 3,507

3,197 EBITDAS (1) $ 15,524

$ 13,973 (1) EBITDAS is a non-GAAP performance measure and

is not intended to be a performance measure that should be regarded

as an alternative to or more meaningful than either GAAP operating

income or GAAP net income. EBITDAS measures presented may not be

comparable to similarly titled measures presented by other

companies.

PerficientBill Davis, 314-529-3555bill.davis@perficient.com

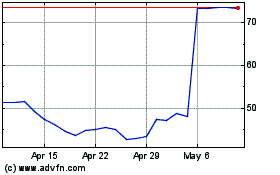

Perficient (NASDAQ:PRFT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Perficient (NASDAQ:PRFT)

Historical Stock Chart

From Apr 2023 to Apr 2024