PepsiCo Boosts Earnings Forecast as Results Top Views -- Update

September 29 2016 - 11:50AM

Dow Jones News

By Mike Esterl

PepsiCo Inc. raised its 2016 profit outlook after revenue surged

in key overseas markets like China and as the U.S. beverage

business picked up steam in the third quarter.

The maker of Lay's potato chips and Tropicana juice said

Thursday it now expects adjusted earnings per share to grow 10%

instead of 9% this year, the second straight quarter it has raised

guidance as a cost-cutting push also helped lift the bottom

line.

Chief Executive Indra Nooyi said the global economy remains

"troubled," but the snack and beverage giant is "cautiously

optimistic" about developing and emerging markets after seeing

recent improvement.

"Whether they last at this point we don't know, but they are

looking pretty good," Ms. Nooyi told analysts on an earnings

conference call.

Organic revenue rose 8% in developing and emerging markets after

stripping out currency swings in the quarter ended Sept. 3. That

included 11% growth in China and Mexico, while revenue rose 7% in

Russia, where "the consumer economy is starting to come back a

little bit," Chief Financial Officer Hugh Johnston said in an

interview.

The Purchase, N.Y. company generates nearly half its sales

abroad with everyday staples like soda, potato chips and juice,

making it an easy proxy for consumer spending.

PepsiCo's share price was 0.9% higher at $108.32 in morning

trade on the New York Stock Exchange after profit and revenue were

both seen to have topped Wall Street expectations.

The company also got a boost from is North American beverage

unit, where volumes rose 2% in the third quarter after being flat

in the first half. Executives pointed to strong growth in

noncarbonated beverages, including Naked juice, Pure Leaf tea and

Propel electrolyte-enhanced water. That is offsetting declines in

sodas, particularly Diet Pepsi, as consumers avoid artificial

sweeteners.

PepsiCo said gross operating margins expanded for the 15th

straight quarter, putting it on track to book at least $1 billion

in productivity gains this year as part of a five-year, $5 billion

cost-cutting plan.

Snack and beverage volumes rose 3% and 2%, respectively. Organic

revenue grew 4.2% after stripping out the impact of weaker foreign

currencies and the troubled Venezuelan business, which the company

removed from its balance sheet last year.

PepsiCo now expects 2016 earnings per share to rise to $4.78 in

2016 from $4.57 last year, up from its July estimate of $4.71. It

forecasts a negative impact of 2% from the deconsolidation of

Venezuelan operations and a negative impact of 3% from foreign

exchange.

Third-quarter profit more than tripled to $1.99 billion from

$533 million a year earlier. Results in the year-earlier quarter

were weighed down by a $1.36 billion Venezuelan impairment

charge.

Revenue declined 1.9% to $16.03 billion from $16.33 billion a

year earlier. Weaker foreign currencies and the Venezuelan

deconsolidation each had a negative impact of 3 percentage points

in the most recent quarter.

Third-quarter adjusted earnings per share were $1.40, beating

Wall Street's expectation of $1.32, according to a Thomson Reuters

poll of analyst estimates. Revenue was also roughly $200 million

higher than analyst forecasts.

Write to Mike Esterl at mike.esterl@wsj.com

(END) Dow Jones Newswires

September 29, 2016 11:35 ET (15:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

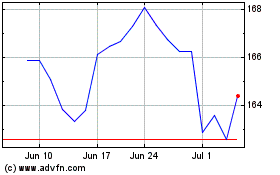

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Mar 2024 to Apr 2024

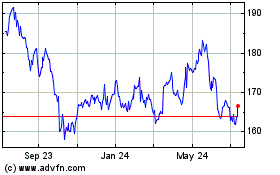

PepsiCo (NASDAQ:PEP)

Historical Stock Chart

From Apr 2023 to Apr 2024