LONDON, United Kingdom - May 11, 2017 - Pentair

plc (NYSE: PNR) ("Pentair") announced today that certain of its

subsidiaries have commenced a cash tender offer (the "Tender

Offer") for certain series of outstanding notes specified below

(the "Notes"). The terms and conditions of the Tender Offer are

described in an Offer to Purchase and Solicitations of Consents

(the "Offer to Purchase") and the related Consent and Letter of

Transmittal (the "Letter of Transmittal"), each dated May 11,

2017.

Pentair Finance S.A. and Pentair, Inc. (each, an

"Offeror" and together, the "Offerors") are offering to purchase

for cash the applicable series of Notes set out in the table below

for an aggregate purchase price (including principal and premium)

of up to $1,750,000,000 (as such amount may be increased, the

"Maximum Tender Amount"), plus accrued and unpaid interest on the

Notes from the last applicable interest payment date up to, but not

including, the applicable Settlement Date (as defined below). The

amount of a series of Notes that is purchased in the Tender Offer

will be based on the order of priority (the "Acceptance Priority

Level") for such series of Notes as set forth in the table below,

with 1 being the highest Acceptance Priority Level and 8 being the

lowest Acceptance Priority Level. If there are sufficient remaining

funds from the Maximum Tender Amount to purchase some, but not all,

of the Notes tendered of any series, the amount of Notes purchased

in that series will be subject to proration using the procedure

more fully described in the Offer to Purchase.

The Offerors' obligation to accept and pay for the

tendered Notes in the Tender Offer is subject to the satisfaction

or waiver of certain conditions described in the Offer to Purchase

and the Letter of Transmittal.

Concurrently with the Tender Offer, the Offerors

are soliciting (the "Consent Solicitation") consents (the

"Consents") from each holder of the Notes, subject to the terms and

conditions set forth in the Offer to Purchase, to certain proposed

amendments (the "Proposed Amendments") to the indentures governing

each series of Notes (collectively, the "Existing

Indentures"). The purpose of the Proposed Amendments is to

modify or eliminate substantially all of the restrictive covenants,

certain events of default and related provisions contained in each

applicable Existing Indenture. The Offerors intend to execute

a supplement to each applicable Existing Indenture (each, a

"Supplemental Indenture") if Consents from holders of a majority of

the outstanding aggregate principal amount of the applicable series

of Notes are received (with respect to each series of Notes, the

"Requisite Consents"). Each Supplemental Indenture will

become effective upon the execution of such Supplemental Indenture,

but will provide that the Proposed Amendments for the applicable

series of Notes will not become operative unless the applicable

Offeror accepts the applicable Notes for purchase in the Tender

Offer and the amount of Notes purchased in such series was not

subject to proration. In the event that the Requisite

Consents for a series of Notes is received but Holders who validly

tendered and did not validly withdraw Notes of such series are

subject to proration, the Proposed Amendments with respect to such

Notes will not become operative despite the applicable Offeror

accepting Notes of such series in the Tender Offer.

|

Title of Security

|

CUSIP

|

Aggregate Principal Amount Outstanding

|

Acceptance Priority Level

|

Reference U.S. Treasury Security

|

Bloomberg Reference Page

|

Fixed Spread (basis points)

|

Early Tender Premium(1)

|

| 5.000%

Senior Notes due 2021 |

709629

AJ8

709629 AG4 |

$373,026,000 |

1 |

1.875% due

4/30/2022 |

FIT1 |

50 |

$30.00 |

| 5.000%

Senior Notes due 2021(2) |

709631

AD7 |

$126,974,000 |

2 |

1.875% due

4/30/2022 |

FIT1 |

50 |

$30.00 |

| 4.650%

Senior Notes due 2025 |

709629

AP4 |

$250,000,000 |

3 |

2.250% due

2/15/2027 |

FIT1 |

110 |

$30.00 |

| 3.625%

Senior Notes due 2020 |

709629

AN9 |

$400,000,000 |

4 |

1.500% due

5/15/2020 |

FIT1 |

60 |

$30.00 |

| 3.150%

Senior Notes due 2022 |

709629

AL3 |

$550,000,000 |

5 |

1.875% due

4/30/2022 |

FIT1 |

80 |

$30.00 |

| 2.900%

Senior Notes due 2018 |

709629

AM1 |

$500,000,000 |

6 |

1.000% due

9/15/2018 |

FIT4 |

40 |

$30.00 |

| 2.650%

Senior Notes due 2019 |

709629

AF6 |

$250,000,000 |

7 |

1.250% due

4/30/2019 |

FIT1 |

60 |

$30.00 |

| 1.875%

Senior Notes due 2017 |

709629

AK5

L9373XAA2 |

$350,000,000 |

8 |

1.000% due

9/15/2017 |

FIT3 |

20 |

$30.00 |

(1) Per $1,000 principal

amount of Notes.

(2) Pentair, Inc. is the Offeror for this

series of Notes; Pentair Finance S.A. is the Offeror for all other

series of Notes.

The Tender Offer will expire at midnight, New York

City time, on June 8, 2017, unless extended or earlier terminated

(such date and time, as the same may be extended, the "Expiration

Date"). The Consent Solicitation will expire at midnight, New York

City time, on June 8, 2017, unless extended or earlier terminated.

For the avoidance of doubt, the term "midnight" refers

to the end of a given date and not the beginning of a given

date.

Holders of Notes must validly tender and not

validly withdraw and their Notes at or prior to 5:00 p.m., New York

City time, on May 24, 2017 (such date and time, as the same may be

extended, the "Early Tender Date"), to be eligible to receive the

applicable "Total Consideration", which includes an early tender

premium of $30.00 per $1,000 of principal amount of Notes accepted

for purchase (the "Early Tender Premium"). Holders of Notes who

tender their Notes after the Early Tender Date, but at or prior to

the Expiration Date, will be eligible to receive only the

applicable "Tender Offer Consideration", which is an amount equal

to the Total Consideration minus the Early Tender Premium. The

Total Consideration or Tender Offer Consideration, as applicable,

will only be paid to holders of tendered Notes to the extent that

the applicable Offeror accepts such Notes for purchase.

Holders who tender their Notes in the Tender Offer

must consent to the Proposed Amendments applicable to such

Notes. Pursuant to the terms of the Offer to Purchase, the

tender of Notes will be deemed to constitute the delivery of a

consent of such tendering holder to the applicable Proposed

Amendments.

The Total Consideration or the Tender Offer

Consideration, as applicable, for each series per $1,000 principal

amount of Notes validly tendered and accepted for purchase pursuant

to the Tender Offer will be determined in the manner described in

the Offer to Purchase by reference to a fixed spread specified for

each series of Notes over the applicable yield based on the bid

side price of the U.S. Treasury Security specified for each series

of Notes in the table above, as calculated by the Lead Dealer

Manager at 2:00 p.m., New York City time, on May 25, 2017. In

addition to the Total Consideration or the Tender Offer

Consideration, as applicable, accrued and unpaid interest on the

Notes accepted for purchase will be paid from the last applicable

interest payment date up to, but not including, the applicable

Settlement Date.

Notes tendered in the Tender Offer and Consents

delivered in the Consent Solicitation may be validly withdrawn or

revoked at any time at or prior to 5:00 p.m., New York City time,

on May 24, 2017, but not thereafter unless otherwise required by

applicable law to permit withdrawal.

Payment for the Notes that are validly tendered

and not validly withdrawn prior to the Early Tender Date and

accepted for purchase by the applicable Offeror will be made on the

date referred to as the "Early Settlement Date." The Early

Settlement Date for the Notes is anticipated to be May 26, 2017,

the second business day after the Early Tender Date. Payment for

the Notes that are validly tendered and not validly withdrawn after

the Early Tender Date and prior to the Expiration Date and accepted

for purchase by the applicable Offeror will be made on the date

referred to as the "Final Settlement Date." The Final Settlement

Date for the Notes will be promptly following the Expiration Date.

It is anticipated that the Final Settlement Date for the Notes will

be June 9, 2017, the first business day after the Expiration

Date.

The Lead Dealer Manager for the Tender Offer and

the Lead Solicitation Agent for the Consent Solicitation is

Citigroup Global Markets Inc. Investors with questions regarding

the Tender Offer and Consent Solicitation may contact Citigroup

Global Markets Inc. at (800) 558-3745 (toll-free) or (212) 723-6106

(collect). Copies of the Offer to Purchase and Consent and Letter

of Transmittal may be obtained from the Information Agent, Global

Bondholder Services Corporation, at (866) 470-3800 (toll-free) or

(212) 430-3774 (collect) or in writing at 65 Broadway, Suite 404,

New York, NY 10006. Holders of Notes are urged to carefully read

these materials prior to making any decisions with respect to the

Tender Offer and Consent Solicitation.

This press release is for informational purposes

only and is not an offer to buy, or the solicitation of an offer to

sell, any of the Notes or any other securities. The Offerors are

making the Tender Offer and Consent Solicitation only by, and

pursuant to, the terms of the Offer to Purchase and the Letter of

Transmittal. The Tender Offer and Consent Solicitation are not

being made in any jurisdiction in which the making of or acceptance

thereof would not be in compliance with the securities laws, blue

sky laws or other laws of such jurisdiction. None of the Offerors

or Pentair, their respective boards of directors, the Dealer

Managers, the Depositary and the Information Agent or the trustees

makes any recommendation that any holder of Notes tender or refrain

from tendering all or any portion of the principal amount of its

Notes or deliver Consents pursuant to the Consent Solicitation, and

no one has been authorized by any of them to make such a

recommendation. Holders must make their own decision as to

whether to deliver Consents and tender their Notes, and, if so, the

principal amount of Notes to tender.

CAUTION CONCERNING FORWARD-LOOKING

STATEMENTS

This press release contains statements that we

believe to be "forward-looking statements". All statements, other

than statements of historical fact are forward-looking statements.

Without limitation, any statements preceded or followed by or that

include the words "targets," "plans," "believes," "expects,"

"intends," "will," "likely," "may," "anticipates," "estimates,"

"projects," "should," "would," "positioned," "strategy," "future"

or words, phrases or terms of similar substance or the negative

thereof, are forward-looking statements. These forward-looking

statements are not guarantees of future performance and are subject

to risks, uncertainties, assumptions and other factors, some of

which are beyond our control, which could cause actual results to

differ materially from those expressed or implied by such

forward-looking statements. These factors include our ability

to satisfy the necessary conditions to consummate the proposed

separation into two independent, publicly-traded companies on a

timely basis or at all; our ability to successfully separate the

two companies and realize the anticipated benefits from the

proposed separation; the ability of the two companies to operate

independently to operate independently following the proposed

separation; overall global economic and business conditions; the

ability to achieve the benefits of our restructuring plans; the

ability to successfully identify, finance, complete and integrate

acquisitions; competition and pricing pressures in the markets we

serve; the strength of housing and related markets; volatility in

currency exchange rates and commodity prices; inability to generate

savings from excellence in operations initiatives consisting of

lean enterprise, supply management and cash flow practices;

increased risks associated with operating foreign businesses;

failure of markets to accept new product introductions and

enhancements; the impact of changes in laws and regulations,

including those that limit U.S. tax benefits; the outcome of

litigation and governmental proceedings; and the ability to achieve

our long-term strategic operating goals. Additional information

concerning these and other factors is contained in our filings with

the U.S. Securities and Exchange Commission, including in our 2016

Annual Report on Form 10-K. All forward-looking statements speak

only as of the date of this report. We assume no obligation, and

disclaim any obligation, to update the information contained in

this press release.

ABOUT PENTAIR PLC

Pentair plc (NYSE: PNR) is a global company

dedicated to building a safer, more sustainable world. Pentair

delivers industry leading products, services and solutions that

help people make the best use of the resources they rely on most.

Its technology moves the world forward by ensuring that water is

plentiful, useful and pure, and that critical equipment and those

near it are protected. With 2016 revenues of $4.9 billion, Pentair

employs approximately 19,000 people worldwide. To learn more, visit

pentair.com.

###

PENTAIR CONTACTS:

Jim Lucas

Vice President, Investor Relations

Direct: 763-656-5575

Email: jim.lucas@pentair.com

Rebecca Osborn

Senior Manager, External Communications

Direct: 763-656-5589

Email: rebecca.osborn@pentair.com

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Pentair plc via Globenewswire

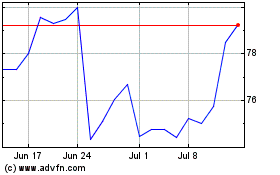

Pentair (NYSE:PNR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pentair (NYSE:PNR)

Historical Stock Chart

From Apr 2023 to Apr 2024