Pendragon PLC PENDRAGON PLC INTERIM MANAGEMENT STATEMENT (2840E)

November 03 2015 - 2:00AM

UK Regulatory

TIDMPDG

RNS Number : 2840E

Pendragon PLC

03 November 2015

PENDRAGON PLC INTERIM MANAGEMENT STATEMENT (ISSUED

03-NOV-2015)

This Interim Management Statement for Pendragon PLC, the largest

and leading automotive retailer in the UK, covers the period from 1

July 2015 to 2 November 2015. Unless otherwise stated, figures

quoted in this statement are for the three months ended 30

September 2015.

Trevor Finn, Chief Executive:

"We continue to go from strength to strength after another

strong quarter across our key sectors of aftersales, used and new.

We continue to deliver on our winning strategy of offering choice,

value, service and convenience to our customers and we are ideally

positioned to gain from favourable underlying market conditions for

aftersales, used and new. The performance of the Group is in line

with expectations for the full year, which were upgraded in

August."

Highlights

-- Used gross profit grew by a significant 15.2% on a like for like basis, as our focussed strategy continues to

increase our market share and profitability.

-- Aftersales gross profit grew by 3.8% on a like for like basis as we benefit from strong underlying market

dynamics together with our aftersales initiatives.

-- New gross profit increased 5.3% on a like for like basis, as a result of the continued improvement in the new

vehicle market.

-- Overall in the quarter, underlying like for like profit before tax increased by 6.6%.

-- Online visits to Stratstone.com and Evanshalshaw.com increased by 35.9% in the nine months ended 30 September

2015. This significant increase is assisting our brand building and used and aftersales activity levels.

-- We continue to be encouraged by the results of the UK's first automotive 'click and collect' service, "Move Me

Closer" and our "Sell Your Car" initiative.

-- Our financial position is strong, with our debt ratio remaining significantly below our target range.

Trading Update

We operate our core business in the used, aftersales and new

vehicle sectors under the Evanshalshaw.com and Stratstone.com

brands. We also have a number of support businesses in the

associated markets of dealer IT systems, vehicle leasing and

parts.

Aftersales is our largest profitability contributor and gross

profit grew by 3.8% in the period on a like for like basis. The

Group is benefiting from the increased new vehicle supply which

continues to increase the less than three year old car parc and the

four to six year old car parc. Additionally, we have achieved

growth by enhancing the customer proposition through technology,

such as enabling the customer to view vehicle service and repair

issues on video direct from the workshop and to authorise work from

the link provided, all via their electronic device.

Used profitability growth continues to significantly enhance the

profitability of the Group and is a key strategic priority for the

Group. Used gross profit grew by 15.2% in the period on a like for

like basis. This resulted from a number of initiatives including:

our 'click and collect' proposition

(www.evanshalshaw.com/move-me-closer), providing convenience with

over 200 retail points, our product choice, with over 20,000 used

vehicles to view and our focus on stock procurement. We are

maintaining our marketing investment in this area so we continue to

build market share.

New gross profit, our third largest contributor to

profitability, grew by 5.3% in the period on a like for like basis.

In the year to date we have invested GBP21.8m in relation to our

franchise facilities including expenditure on refurbishment work,

relocation of sites and acquisition of freehold interests.

Our financial position remains strong, with our debt: underlying

EBITDA ratio remaining significantly below our target range of 1.0

to 1.5. We are in the process of further investment in the roll-out

of additional footprint to provide us a truly national UK presence

for the sale and servicing of vehicles.

Industry Insight

When publishing our prior year interim and year end results we

indicated that new car registrations would now run in 2015 at a

more "natural" level of 2.5 to 2.6 million units per annum. After

analysing September registrations we are expecting 2015 annual

registrations to be over 2.6 million units. Year to date

registrations to 30 September 2015 increased by 7.1% year on year,

with retail registrations increasing by 2.4%. We believe the UK new

car market has reached its natural level.

The latest available data shows that the used car market

increased by around 0.8% in the first half of 2015. We are still

expecting the used car market to grow by between 1.0% and 2.0% for

the whole of 2015.

The aftersales market continues to be favourable for the nearly

new vehicle car parc as a result of the new car market increases in

the last three years. These favourable conditions will flow into

the four to six year old car parc in the coming years. We continue

to expect the less than three year old car parc to grow by 7.0% and

the four to six year old parc to grow by 2.0% in 2015.

Outlook

As the largest and leading automotive retailer in the UK, we are

focussed on our winning strategy and continue to build market share

in our key markets. We are well positioned financially and

strategically to continue to be the largest and leading automotive

retailer in the UK. We expect 2015 full year performance to be in

line with expectations.

Enquiries

================ =================== ============ ==============

Pendragon

Trevor Finn Chief Executive PLC 01623 725114

Pendragon

Tim Holden Finance Director PLC 01623 725114

Gordon Simpson Partner Finsbury 0207 2513801

Philip Walters Principal Finsbury 0207 2513801

================ =================== ============ ==============

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSDLLFBEFFBFBL

(END) Dow Jones Newswires

November 03, 2015 02:00 ET (07:00 GMT)

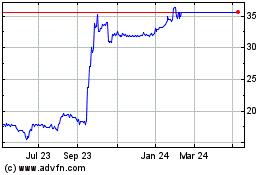

Pendragon (LSE:PDG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pendragon (LSE:PDG)

Historical Stock Chart

From Apr 2023 to Apr 2024