Pendragon PLC INTERIM MANAGEMENT STATEMENT (5812W)

April 28 2016 - 2:01AM

UK Regulatory

TIDMPDG

RNS Number : 5812W

Pendragon PLC

28 April 2016

PENDRAGON PLC INTERIM MANAGEMENT STATEMENT (ISSUED

28-APRIL-2016)

This Interim Management Statement for Pendragon PLC, the UK's

leading automotive online retailer, covers the period from 01

January 2016 to 27 April 2016. Unless otherwise stated, figures

quoted in this statement are for the three months ended 31 March

2016.

Trevor Finn, Chief Executive:

"Our first quarter underlying profit before tax increased by

8.7% which is testament to our continued delivery of our strategy.

We remain focussed on initiatives which provide choice, value,

service and convenience to our customers. Many of our initiatives

are orientated around online consumer activity, from research of

vehicles to the nationwide availability of a vehicle. We are

expecting to see growth in profitability across aftersales, used

and new for the full year as we continue to benefit from favourable

market conditions and further implement our winning retail

initiatives. We are expecting the Group to perform in line with

expectations for the full year."

Highlights

-- Our underlying profit before tax increased by 8.7%.

-- Like for like gross profit increased across all our main

vehicle sectors of aftersales, used and new, due to a combination

of market dynamics, our customer initiatives and our clear

strategy.

-- Aftersales gross profit increased by 1.2% on a like for like basis.

-- Used gross profit increased by 4.2% on a like for like basis.

-- New gross profit increased by 15.2% on a like for like basis.

-- Online visits to Stratstone.com and Evanshalshaw.com increased by 18.5% in the period.

-- In the period we opened three stores in Bristol, Norwich and

Peterborough, all new territories for us. We will acquire further

sites this year to supplement our national footprint.

-- Our target debt : underlying EBITDA ratio continues to be

significantly below our target range so we are assessing the best

use of funds.

Trading Update

We operate our core business in the used, aftersales and new

vehicle sectors under the Evanshalshaw.com and Stratstone.com

brands. We also have a number of support businesses in the

associated markets of dealer IT systems, vehicle leasing and

parts.

Aftersales is our largest profitability contributor. In the

period, aftersales gross profit grew by 1.2% on a like for like

basis. The Group is benefiting from the increased new vehicle

supply which continues to increase the less than three year old car

parc and the four to six year old car parc. We continue to develop

our product and service offering to our customers by providing

transparent online interactions, from the point of online service

booking through to online video of the vehicle for servicing.

Our key strategy of focussing on used profitability continues to

enhance the market share and profitability of the Group. Used gross

profit grew by 4.2% in the period on a like for like basis.

New gross profit on a like for like basis increased by 15.2% in

the period, largely as a result of margin improvement from

Evanshalshaw.com. We are not expecting to maintain this level of

growth in new gross profitability in the remaining part of the

year, as we expect the new vehicle market to operate at more

moderate levels of growth.

Our financial position remains strong, with our debt :

underlying EBITDA ratio remaining significantly below our target

range of 1.0 to 1.5. We are currently assessing our best use of

funds.

Industry Insight

Year to date to 31 March 2016 UK vehicle registrations increased

by 5.1% year on year, with retail registrations increasing by 6.3%

and fleet increasing by 3.9%. For the brands we represent, retail

registrations increased by 3.7%. We expected the level of growth to

slow, as the new market growth becomes more moderate during the

year, and believe the UK market will be around 2.7 million for the

full year 2016, representing growth of around 2.5% over the prior

year.

The used vehicle market increased by 3% in the full year of

2015, following strong growth in the fourth quarter of 2015. We are

still expecting the used car market to grow by around 3% in

2016.

The aftersales market continues to be favourable for the nearly

new vehicle car parc as a result of the new car market increases in

the last three years. We expect the less than three year old car

parc to grow by 5.2% and the four to six year old parc to grow by

4.3% in 2016.

Outlook

As the UK's leading automotive online retailer, we are focussed

on our winning strategy of delivering choice, value, service and

convenience to our customers. We are expecting the growth rate in

the new vehicle market to slow but the underlying market dynamics

in used and aftersales to remain strong. We expect the full year

performance for 2016 to be in line with expectations.

Enquiries

================ =================== ============ ==============

Pendragon

Trevor Finn Chief Executive PLC 01623 725114

================ =================== ============ ==============

Pendragon

Tim Holden Finance Director PLC 01623 725114

================ =================== ============ ==============

Gordon Simpson Partner Finsbury 0207 2513801

================ =================== ============ ==============

Philip Walters Principal Finsbury 0207 2513801

================ =================== ============ ==============

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCUBOWRNSASUAR

(END) Dow Jones Newswires

April 28, 2016 02:01 ET (06:01 GMT)

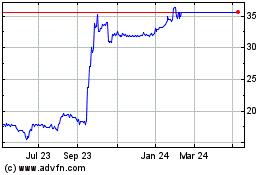

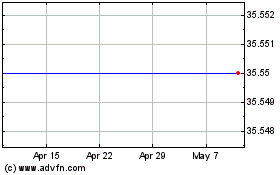

Pendragon (LSE:PDG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pendragon (LSE:PDG)

Historical Stock Chart

From Apr 2023 to Apr 2024