TIDMPDG

RNS Number : 0638F

Pendragon PLC

17 February 2015

Issued: 17 February 2015 Press Release

PENDRAGON PLC - The UK's Leading Automotive Retailer

Announces Full Year Results To 31 December 2014

"Profits up 36% to GBP60.2 million; launch of the UK's first

automotive click and collect service"

Financial Highlights

-- Operating leverage continues, with gross profit up 4.5% and operating profit up 17.9%.

-- Underlying profit before tax up GBP16.0 million (+36.2%),

from GBP44.2 million to GBP60.2 million. Underlying profit has

doubled in three years.

-- Underlying earnings per share up 0.8p (+34.8%), from 2.3p to 3.1p.

-- Net debt : EBITDA ratio at 0.8, which remains below the lower end of our target range.

-- Final proposed dividend doubled to 0.6p per share. Our 2015

interim dividend is also expected to double to 0.6p per share.

Strategic Highlights

-- Delivering our strategy - resulting in underlying profit

before tax up by 36.2% to GBP60.2 million.

-- Our four strategic 'pillars' are key to our success:

-- No. 1 Online - Launch of 'Move Me Closer', the UK's first

automotive 'click and collect' service.

-- Value - 'Sell Your Car' providing value to the consumer and

additional used car supply for the Group.

-- IT Superiority - our proprietary IT solutions provide a key differentiator in the market.

-- National Footprint - 227 retail points and further roll-out

of footprint planned for 2015.

Operational Highlights

-- Our focus on used continues to enhance profitability, with record performance in 2014.

-- Online visits to Stratstone.com, Evanshalshaw.com and

Quicks.co.uk increased by 2.2 million (+16.3%), from 13.5 million

to 15.7 million.

-- Aftersales gross profit increased by GBP7.2 million (+4.0%),

as the vehicle parc grows (like for like).

-- Used gross profit increased by GBP10.5 million (+7.9%), with

sales up 8.1% year on year (like for like).

-- New gross profit increased by GBP11.2 million (+8.0%), with

strong growth in Stratstone.com (like for like).

Trevor Finn, Chief Executive, commented:

"We are delighted with the performance across our business, with

a 36% improvement in underlying profitability. The heart of our

proposition is to offer value, choice, service and convenience to

our consumers from our key brands of Evanshalshaw.com and

Stratstone.com. We have expanded our convenience proposition, with

the launch of 'Move Me Closer' on Evanshalshaw.com - the UK's first

automotive 'click and collect' service and enhanced our value

proposition with the implementation of 'Sell Your Car'. We have a

clear strategy which will enable us to continue to grow and are

well positioned to take the business to the next level.

We have doubled the dividend to reward our shareholders and our

strong balance sheet and cashflow generation will ensure we can

maintain this dividend level alongside our expansion plans. We

thank our people for their continued support in helping to deliver

our performance and we are looking forward to 2015. We are

confident that 2015 will be another year of good performance, with

Group performance in line with current expectations for the

year."

Enquiries

================ ================== ============== ============

Trevor Finn Chief Executive Pendragon PLC 01623 725114

Tim Holden Finance Director Pendragon PLC 01623 725114

Gordon Simpson Partner RLM Finsbury 0207 2513801

Philip Walters Associate Partner RLM Finsbury 0207 2513801

================ ================== ============== ============

Summary of Contents

1. Financial Overview

2. Segmental Results

3. Strategic Progress

4. Industry Insight and Outlook

5. Detailed Financials

1. Financial Overview

Pendragon PLC Summary Results* Year Ended Year Ended YOY

31 December 2014 31 December 2013 Change

GBPm %

-------------------------------- ----------------- ----------------- -------

Underlying Revenue 4,000.4 3,848.9 +3.9%

-------------------------------- ----------------- ----------------- -------

Underlying Gross Profit 522.6 499.9 +4.5%

Underlying Operating Costs (431.7) (422.8) +2.1%

-------------------------------- ----------------- ----------------- -------

Underlying Operating Profit 90.9 77.1 +17.9%

Underlying Interest (30.7) (32.9) -6.7%

-------------------------------- ----------------- ----------------- -------

Underlying Profit Before Tax 60.2 44.2 +36.2%

-------------------------------- ----------------- ----------------- -------

Operating Profit 97.2 77.2 +25.9%

Interest (32.6) (38.3) -14.9%

-------------------------------- ----------------- ----------------- -------

Profit Before Tax 64.6 38.9 +66.1%

-------------------------------- ----------------- ----------------- -------

Underlying Gross Margin (%) 13.1% 13.0% +0.1%

Underlying Operating Margin

(%) 2.3% 2.0% +0.3%

Underlying Earnings Per Share

(p) 3.1 2.3 +34.8%

Full Year Dividend Per Share**

(p) 0.9 0.4 +125.0%

-------------------------------- ----------------- ----------------- -------

* Underlying results, where stated, exclude items that have

non-trading attributes due to their size, nature or incidence

** Full Year Dividend Per Share is the interim dividend per

share plus the proposed final dividend per share

NOTE: Within this document, like for like results include only

current trading businesses which have a 12 month comparative

history. All percentages shown are the calculated value from the

table shown and may vary from the actual numbers due to rounding.

Year on year percentage variances for margins show the absolute

percentage movement only. All commentary is versus the prior year,

unless stated.

Income Statement Highlights

Revenue increased by GBP151.5 million, up 3.9% on the prior

year, mainly due to increases within the used and new vehicle

departments. On a like for like basis, revenue increased by

GBP216.9 million and we improved used revenue by 8.1%, new revenues

by 4.3% and aftersales revenues by 3.6%.

Underlying gross profit increased by GBP22.7 million (+4.5%) in

the period and on a like for like basis by GBP30.7 million (+6.3%)

over the prior year. We achieved record performance in our used

vehicle sector, with gross profit up GBP10.5 million (+7.9%) on a

like for like basis. In the used vehicle sector, we continue to

grow our presence and reputation and deliver further efficiency

gains. The new sector has increased by GBP11.2 million (+8.0%) on a

like for like basis as the new car market continues to grow.

Aftersales has grown by GBP7.2 million (+4.0%) on a like for like

basis as a result of new car sales growth and our growth in used

vehicle sales increasing the available vehicle parc. In the period,

we increased overall underlying gross margin by 10 basis points, to

13.1%.

Operating costs increased on a like for like basis by GBP18.4

million (+4.6%), of which half relates to variable costs (+4.6%)

and half to indirect costs, with the key cost increases due to

property, people related costs and marketing costs.

Underlying operating profit increased by GBP13.8 million in the

period and increased by GBP12.3 million on a like for like basis.

Underlying interest savings of GBP2.2 million were achieved in the

period as the debt level has been further reduced. Our operating

profit margin of 2.3% is a 30 basis points improvement on the prior

year.

Balance Sheet and Cash Flow

The Group has been focussing on achieving a strong balance sheet

and lowering its debt profile. The following table summarises the

cash flows and net debt of the Group for the years ended 31

December 2014 and 31 December 2013 as follows:

Summary Cashflow and Net Debt Year Ended Year Ended

31 December 31 December

GBPm 2014 2013

------------------------------------------------ ------------ ------------

Underlying Operating Profit Before Other

Income 89.8 76.8

Depreciation and Amortisation 27.0 19.8

Non-underlying Items - 2.0

Share Based Payments 1.5 1.6

Working Capital and Contract Hire Vehicle

Movements (11.9) 35.1

Operating Cash Flow 106.4 135.3

------------------------------------------------ ------------ ------------

Tax Paid (8.3) (0.9)

Underlying Net Interest Paid (29.0) (33.6)

Non-underlying Net Interest Paid & Refinancing

Costs - (8.0)

Replacement Capital Expenditure (21.8) (19.5)

Acquisitions (20.8) (12.5)

Disposals 12.6 16.3

Dividends (8.6) (2.8)

Other 0.3 2.5

Reduction In Net Debt 30.8 76.8

------------------------------------------------ ------------ ------------

Closing Net Debt 108.8 139.6

------------------------------------------------ ------------ ------------

The Group's net debt fell from GBP139.6 million at 31 December

2013 to GBP108.8 million at 31 December 2014. This GBP30.8 million

net debt reduction was largely due to increased underlying

operating profit before other income of GBP13.0 million.

The following table illustrates the debt : underlying EBITDA

ratio for the years ended 31 December 2014 and 31 December

2013:

Debt : Underlying EBITDA Ratio Year on

Year Ended Year Ended Year

GBPm 31 December 2014 31 December 2013 Improvement

-------------------------------- ----------------- ----------------- ------------

Underlying Operating Profit 90.9 77.1 +17.9%

Depreciation & Amortisation 50.2 40.9 +22.7%

Underlying EBITDA 141.1 118.0 +19.6%

-------------------------------- ----------------- ----------------- ------------

Net Debt 108.8 139.6 -22.1%

-------------------------------- ----------------- ----------------- ------------

Debt : Underlying EBITDA Ratio 0.8 1.2 -33.3%

-------------------------------- ----------------- ----------------- ------------

As a consequence of this lower debt level and strong EBITDA

performance, the debt : underlying EBITDA ratio has reduced from

1.2 at 31 December 2013 to 0.8 at 31 December 2014 and falls below

the lower end of our target range of 1.0 to 1.5. This reflects the

appropriate balance of capital efficiency and growth potential,

providing both a strong balance sheet and, with our strong cashflow

generation and realisations from low performing assets, the ability

to invest for the future.

Property, acquisitions and disposals

Our property portfolio is an important aspect of our business,

with the Group operating from both leasehold and freehold

properties. In addition, through strategic investment choices,

including the decision to close some franchise points, we have a

number of vacant property assets which we hold for sale. At 31

December 2014, the Group had GBP164.4 million of land and property

assets (2013: GBP161.3 million). Additionally, the Group held

assets for sale of GBP11.6 million (2013: GBP13.1 million).

Acquisitions of GBP20.8 million include the purchase of six

properties from King Arthur Properties for GBP12.9 million.

Disposals consist of GBP1.1 million from business disposals and

GBP11.5 million from property disposals. Business disposals

resulted in a profit on disposal of GBP0.1 million and property

disposals resulted in a profit of GBP3.1 million. During the

period, the Group closed or disposed of 12 franchise points which

were low performing or surplus to requirements, and added one used

vehicle point.

Property Joint Venture

The Group occupies as tenant a number of properties that were

previously held in a joint venture in which the Group held an

investment. In November 2013 the Group invested GBP10.0 million in

a new company, King Arthur Properties which acquired all of the

property from the joint venture. This 6% stake in the new company

generated an underlying dividend of GBP1.1 million, received by the

Group in the year. During the year we received non-underlying

dividends of GBP3.1 million relating to property disposals and

refinancing of King Arthur Properties. This investment has been

realised subsequent to the year end, resulting in a non-underlying

profit of GBP14 million and a cash inflow to be received in 2015 of

GBP24 million. We also took the opportunity to acquire six

properties from King Arthur Properties in December 2014 for GBP12.9

million, saving rent of GBP1.3 million per annum.

Pensions

The net liability for defined benefit pension scheme obligations

has increased from GBP43.4 million at 31 December 2013 to GBP66.4

million at 31 December 2014. Whilst the value of scheme assets

increased by GBP21.3 million, this was offset by an increase in

benefit obligations of GBP44.3 million which has been caused by a

90 basis points reduction in the pension scheme discount rate. This

increase in the deficit of 53% in the year contrasts with the

reported increase in deficits in FTSE 350 companies of 90%.

Dividend

We are delighted to be proposing to double the final dividend.

Our 35% increase in earnings for the year is backed by a strong

balance sheet, cashflow generation and recycling of low performing

assets which gives us the capacity to fund our expansion of

footprint and anticipated growth in other sectors. The Board is

therefore confident to announce an increase in the proposed final

dividend to 0.6p per share in respect of 2014.

Following this rebasing of our dividend cover, the Board intends

to adopt a progressive dividend approach in the future.

A final dividend of 0.3p per share was paid in May in respect of

2013 and an interim dividend of 0.3p per share was paid in October

in respect of 2014.

The proposed final dividend, subject to approval at the AGM,

will be paid on the 22 May 2015 for those shares registered on 24

April 2015. The Board currently anticipates that the interim

dividend, usually paid in October, will also be doubled to 0.6p per

share.

Non-underlying Items

Non-underlying items for the years ended 31 December 2014 and 31

December 2013 are as follows:

Non-underlying Items Year Ended Year Ended

31 December 31 December

GBPm 2014 2013

------------------------------------------- ------------ ------------

Refinancing Costs and Interest - (7.1)

Property Impairments and Gain / (Loss) on

Disposals 3.2 (1.9)

Pensions (1.9) (1.3)

Dividends received 3.1 -

VAT Settlements - 5.0

------------------------------------------- ------------ ------------

Total 4.4 (5.3)

------------------------------------------- ------------ ------------

In the period, property disposal profits net of impairments and

associated property and business disposal costs provide a GBP3.2

million credit in the period versus a GBP1.9 million charge in the

prior year. The Group sold seven properties, yielding proceeds of

GBP11.5 million.

In the period, the Group received GBP3.1 million of

non-underlying dividend income (2013: GBPnil) which relates to King

Arthur Properties, a company in which we had a 6% investment.

On 30 January 2015 we realised this investment resulting in a

non-underlying profit of GBP14 million for 2015. This will result

in a cash inflow of circa GBP24 million in 2015.

Risks and Uncertainties

The Board maintains a policy of continuous identification and

review of risks which may cause our actual future Group results to

differ materially from expected results. The principal risks

identified were: failure to adopt the right strategy or failure of

our adopted strategy to be effectively implemented or to deliver

the desired results, dependence on vehicle manufacturers for the

success of our business, failure to meet competitive challenges to

our business model or sector, European economic instability

affecting the UK in particular impacting used vehicle prices, UK

governmental spending constraints, changes to the type of vehicles

sold or the amount of road use, availability of debt funding,

funding requirements of the occupational pension scheme,

significant litigation or regulator action against or otherwise

impacting the Group, failure of systems, reliance on the use of

estimates, failure to attract, develop, motivate and retain good

quality team members, failure to provide safe working and retail

environments and failure to control environmental hazards. The

Board has recently reviewed the risk factors and confirms that they

should remain valid for the rest of the current year. The Board

considers the main areas of risk and uncertainty that could impact

profitability to be used vehicle prices and economic and business

conditions.

2. Segmental Results

The Group has four segments, which we refer to as the Motor

Segment and three segments which we refer to as the Support

Segment. The Motor Segment consists of: Stratstone, Evans Halshaw,

California and Quicks. The Support Segment consists of: Pinewood,

Leasing and Quickco. The following table shows the revenue, gross

profit, operating costs and operating profit by segment for our

Motor Segment for the years ended 31 December 2014 and 31 December

2013:

Motor Segment Results for Year Ended 31 December

======================================================================================================

GBPm Stratstone Evans Halshaw Quicks California Motor Segment

(unless stated) 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013

================== ======= ======= ======= ======= ===== ===== ====== ====== ======= =======

Revenue:

Aftersales 132.5 132.1 144.7 142.5 2.7 2.7 23.1 23.6 303.0 300.9

Used 683.2 624.5 878.1 852.3 46.9 46.2 61.2 52.7 1,669.4 1,575.7

New 775.4 711.3 1,047.5 1,061.8 - - 119.7 118.6 1,942.6 1,891.7

Revenue 1,591.1 1,467.9 2,073.3 2,056.6 49.6 48.9 204.0 194.9 3,915.0 3,768.3

================== ======= ======= ======= ======= ===== ===== ====== ====== ======= =======

Gross Profit:

Aftersales 76.2 75.4 102.3 99.2 0.6 0.6 12.2 12.8 191.3 188.0

Used 47.2 42.1 91.1 86.5 4.2 4.6 3.8 4.4 146.3 137.6

New 70.0 63.5 65.0 63.5 - - 18.2 17.4 153.2 144.4

Gross Profit 193.4 181.0 258.4 249.2 4.8 5.2 34.2 34.6 490.8 470.0

Operating Costs (157.9) (154.1) (225.8) (221.8) (7.0) (7.5) (25.6) (25.6) (416.3) (409.0)

================== ======= ======= ======= ======= ===== ===== ====== ====== ======= =======

Operating Profit 35.5 26.9 32.6 27.4 (2.2) (2.3) 8.6 9.0 74.5 61.0

================== ======= ======= ======= ======= ===== ===== ====== ====== ======= =======

Metrics:

Gross Margin

% 12.2% 12.3% 12.5% 12.1% 9.7% 10.6% 16.8% 17.8% 12.5% 12.5%

Units Sold

('000) 54.9 53.1 200.8 200.3 6.7 7.3 4.8 4.6 267.2 265.3

Stratstone (Stratstone.com)

Our Stratstone business is one of the UK's leading premium motor

car retailers, with 79 franchise points. Stratstone holds

franchises to retail and service Aston Martin, BMW, Ferrari, Honda,

Jaguar, Land Rover, Mercedes-Benz, MINI, Morgan, Porsche and Smart

vehicles as well as three motor-cycle franchises. This segment also

contains our retail and service outlets for DAF commercial

vehicles, under our Chatfields brand name.

Stratstone.com had a strong year, with performance improvements

across all departments. On a like for like basis, operating profit

increased by GBP6.5 million. Stratstone's largest area of

improvement was in used, with gross profit increasing by 14.6% on a

like for like basis, mainly due to revenue growth with margin

slightly improved. The new department improved like for like gross

profit by 13.6% as a result of strong growth in Aston Martin, Land

Rover, Mercedes-Benz and Porsche. Aftersales continues to grow,

with 5.2% gross profit growth on a like for like basis and a 6.5%

increase in retail labour sales. Stratstone businesses have

extended their use of high definition videos from the sales teams'

online presentation of used vehicles to the aftersales department

communication of vehicle service and repair. This has further

enhanced our customer proposition, enabling the customer to see

vehicle service and repair issues direct from the workshop on their

electronic device and to authorise work from the link provided.

This further illustrates our investment in our online activities

and the IT infrastructure that supports all our businesses and

activities.

Evans Halshaw (Evanshalshaw.com)

Our Evans Halshaw business is the UK's leading volume motor car

retailer, with 125 franchise points. Evans Halshaw holds franchises

to retail and service Citroen, Dacia, Ford, Hyundai, Kia, Nissan,

Peugeot, Renault, SEAT and Vauxhall vehicles.

Evanshalshaw.com increased like for like operating profit by

GBP5.8 million, with strong performance across all sectors. The

greatest improvement in gross profit in Evans Halshaw came from the

used sector, with like for like gross profit up 6.0% as a result of

both revenue and margin improvement.

In the period, Evans Halshaw focussed on improving used margin,

resulting in like for like used gross profit increasing by GBP5.1

million, an improvement of 6.0%. Aftersales like for like gross

profit increased by GBP4.0 million or 4.1%. Retail labour sales

grew by 2.1% on a like for like basis in 2014 and the increased

used stock and sales volume has increased internal vehicle

preparation by 11.6% in the year. We are continuing to identify

efficiency gains and capacity improvements to achieve further

growth. At Evans Halshaw, consumers can choose how they transact,

from a variety of methods and channels for aftersales services. We

believe our innovation and responsiveness to consumers' needs in

this area is giving us an advantage. We increased our like for like

new vehicle gross profit in the period by GBP2.1 million, as we

improved our new vehicle margin by 30 basis points.

Quicks (Quicks.co.uk)

At Quicks, our dedicated used car business, we retail used motor

vehicles and provide associated aftersales services. We take the

opportunity in Quicks to test systems and processes prior to

implementation within the Group. In the period, Quicks performed in

line with the prior year, but, on a like for like basis, the

business improved by GBP0.1 million.

California

Our motor retail business in the US continues to achieve strong

results from its nine franchise points in Southern California,

which represent the Aston Martin, Jaguar and Land Rover brands.

Operating profit fell by just GBP0.4 million from the exceptional

year of 2013. New car performance continues to improve, offset by

small profit reductions in aftersales and used. We continue to

explore earnings enhancing opportunities to add to our existing US

operations.

Support Businesses

Our Support businesses provide a broad range of services, both

to the Group and to external customers. These specialist businesses

consist of Pinewood for dealer management systems, Leasing for

fleet and contract hire vehicles and Quickco for wholesale vehicle

parts.

The following table shows the revenue and operating profit for

our Support segment and the Group results, for each of the years

ended 31 December 2014 and 31 December 2013:

Underlying Support Sector Results For Year Ended 31 December

Pinewood Leasing Quickco Support Group*

Segment

GBPm 2014 2013 2014 2013 2014 2013 2014 2013 2014 2013

================== ===== ===== ===== ===== ==== ==== ===== ===== ======= =======

Revenue 10.9 10.4 22.2 18.0 52.3 52.2 85.4 80.6 4,000.4 3,848.9

Operating Profit 8.7 8.9 5.6 5.4 2.1 1.8 16.4 16.1 90.9 77.1

Operating Margin

(%) 79.8% 85.6% 25.2% 30.0% 4.0% 3.4% 19.2% 20.0% 2.3% 2.0%

================== ===== ===== ===== ===== ==== ==== ===== ===== ======= =======

* Group comprises the total of the support segment and the motor

segment.

3. Strategic Progress

Strategy

Our strategy is to grow profitability in used, aftersales and

new and we represent this by our four strategic pillars. These

strategic pillars are: number one online, value, superior IT and

national footprint and are supported by the 'our people'

foundation.

Number One Online

We continue to invest in our online platforms. Visits to

Stratstone.com, Evanshalshaw.com and Quicks.co.uk increased by

16.3% over the prior year, to 15.7 million visitors. Overall, we

are attracting over 10.2 million online visitors more than we did

five years ago. This channel is becoming a key aspect of our

business, supported by our national retail locations.

Evanshalshaw.com and Quicks.co.uk are operating on our latest

platform, which recognises and is dynamic to consumers' chosen

electronic device. Stratstone will transfer to this platform at the

end of quarter one of 2015. We are now fully operational with our

'Sell Your Car' initiative (www.evanshalshaw.com/sell-your-car/)

where consumers can sell their car direct to evanshalshaw.com, and

we will guarantee to pay more than 'webuyanycar.com'. Having added

a further four retail locations since the October interim

management statement, we now offer this service at a total of 42

retail locations in the UK, gaining an inflow of used cars sourced

directly from consumers.

In February 2015, we launched 'Move Me Closer' which enables the

consumer to reserve a vehicle direct from their electronic device

and choose to have it physically delivered to their nearest store

location (www.evanshalshaw.com/move-me-closer/). Through this

service, consumers can research and view online over 20,000

vehicles then inspect the vehicle they reserved at a physical

location convenient to them.

Value

Our value pricing provides consumers with the assurance of

frequently researched prices. We have been operating our value

pricing methodology for over six years, enabling us to provide

pricing transparency to our customers. By applying this process, in

2014 we made over 600,000 price changes to used cars through

updates made twice a day to our internet prices, to ensure we

provide value for our customers. We continue to invest in

developing this area, to ensure we can continue to monitor value

effectively, as we increase our stock holding, range, geographical

footprint and consumer base.

Superior IT

Our business benefits from an IT platform superior to those of

our competitors, owing to the strength and expertise of our

wholly-owned technology company. This enables us more directly to

monitor, control, analyse and report on our results and the

progress we are making against our objectives. This platform also

enables us to react quickly to customer demands and needs,

transforming the customer experience in a number of areas. For

example, within aftersales, we now offer customers a fully

integrated online service booking, supported by a HD video vehicle

health check for them to view. Our 'Move Me Closer' service was

conceived and designed, proved and launched in a time scale

achieved only as a result of this superior IT capability.

National Footprint

Our business has the largest motor retail footprint and scale in

the UK. This brings benefits to our customers: for both vehicle

selection and purchasing, and for aftersales services, they can

visit our stores at locations convenient to them. We have commenced

a programme to invest and open stores in the key market areas in

the UK where we do not yet have a significant presence. This

investment will bring us even closer to existing and potential

customers, by further enhancing our offering of choice, convenience

of contact and service and our unique used car consumer

proposition. This, coupled with the 'Move Me Closer' initiative,

gives our UK consumers even more opportunity to touch and appraise

their potential vehicle purchase at a place local to them.

At this stage we have identified three properties which we

already either own or lease which are suitable for our retail

location expansion. In addition we have begun a programme of new

site search and selection which we anticipate will result in adding

five sites during 2015, taking us towards our planned total of 40

additional sites. We expect to finance this growth through our

cashflow and by recycling low performing assets.

Our People

Our people are a foundational asset and key to the success of

our business. We have always placed a significant focus on our team

members and defining and refining how we do business, communicate,

and engage with our customers. Not only has this foundation

supported our plans to further enhance our human resource

approaches and our plans to develop our teams; it has also been the

driver behind new processes and propositions for our customers and

reward and recognition of our team members. In 2014, we opened our

training academy, further evidence of our investment in training

and belief in development for all our people.

Finally we celebrated 25 years as a 'plc' in November 2014 and

we thank all our people, both long-term and current team members,

for their hard work, loyalty, energy and dedication to Pendragon

PLC.

We are looking forward to the next 25 years!

4. Industry Insight and Outlook

New Sector

The new vehicle sector consists of the first registration of

cars and commercial vehicles. In 2014, the UK new car market, the

second largest market in Europe, increased by 9.3% over the prior

year, with 2.476 million registrations, up from 2.265 million in

2013.

The UK new car market is primarily divided into retail and fleet

markets. The retail market is the direct selling of vehicle units

to individual consumers and operates at a higher margin than the

fleet market. The fleet market represents selling of multiple

vehicles to businesses and is predominantly transacted at a lower

margin and consumes higher levels of working capital than does

retail. The retail market is the key market opportunity for the

Group and represents just under half of the total UK market.

The following table summarises the UK new car vehicle market,

separating the retail and fleet components for the years ended 31

December 2014 and 31 December 2013:

New Car Vehicle Registrations for Year Ended 31 December ('000)

------------------------------------------------------------------------

2014 2013 Change Change %

----------------------------------- ------- ------- ------ ---------

UK Retail Market 1,179.5 1,074.6 104.9 +9.8%

UK Fleet Market 1,296.9 1,190.1 106.8 +9.0%

----------------------------------- ------- ------- ------ ---------

UK New Market 2,476.4 2,264.7 211.7 +9.3%

Group Represented* UK Retail

Market 797.8 724.3 73.5 +10.1%

Group Represented* UK Fleet

Market 900.9 856.6 44.3 +5.2%

----------------------------------- ------- ------- ------ ---------

Group Represented* UK New Market 1,698.7 1,580.9 117.8 +7.5%

----------------------------------- ------- ------- ------ ---------

* Group Represented is defined as national registrations for the

franchised brands that the Group represents as a franchised

dealer.

The UK commercial vehicle market, consisting of light commercial

vehicles and trucks, had a market size of 363 thousand units in

2014, an increase of 11% over the prior year. SMMT's expectations

for 2015 are that the light commercial vehicle market will be

stable.

The Group has a small and successful representation in

California. The USA new vehicle market was 16.4 million in 2014, an

increase of 6% over 2013. This was the highest vehicle market since

2006 and The National Automobile Dealers' Association expects the

USA market to be 16.9 million vehicles in 2015, an increase of 3%.

The USA market provides an opportunity for earnings enhancing

acquisitions.

New Industry Insight

We believe that 2015 will see continued growth in the UK new car

market, but the levels of growth will be more moderate than 2014.

March 2014 saw the highest monthly registrations in a decade. We

believe that achieving strong growth on top of this comparative is

unlikely. Summarising, the year on year growth phase is coming to

an end and we expect this will become apparent in the March 2015

year on year comparison. We believe the UK new car market should

now run at a "natural" 2.5 million to 2.6 million units per annum

level, a slight upward revision on the estimate we gave following

publication of the September 2014 new car registrations data.

Used Sector

The used vehicle sector comprises the selling of vehicles by one

party to another for all vehicles except newly registered vehicles.

Provisional UK national used vehicle market data is only available

up to 30 September 2014, and current estimates show the used market

increasing by 2.8%. We are expecting the market to be around 7.0

million for the full year to 2014, rising to 7.11 million in 2015.

Around half of these transactions are conducted by franchised

dealers and the balance by independent dealers and private

individuals.

Used Industry Insight

We have modelled the impact of the last three years' increases

in new market volumes on the used car market. Whilst the used car

market has been constant, at around 6.7 million transactions

annually, we believe we will see steady growth of 1 to 2 percent

per annum over the next three years. When we segment the used

market by age of vehicle, our analysis shows that the supply of

vehicles in the less than three years old segment will continue to

grow. Additionally, we believe we will see growth in the four to

six years old segment in 2015 following 2014's decline.

Aftersales Sector

Aftersales encompasses the servicing, maintenance and repair of

motor vehicles, including bodyshop repairs and the retailing of

parts and other motor related accessories. The main determinant of

the aftersales market is the number of vehicles on the road, known

as the 'vehicle parc'. The vehicle parc in the UK has risen to 33

million vehicles, having been typically around 32 million vehicles

in the prior three years. The vehicle parc can also be segmented

into markets representing different age groups. Typically, around

20% of the car parc is represented by less than three year old

cars, around 17% is represented by four to six year old cars and

63% is greater than seven year old cars.

The size of each of these age groups within the car parc is

determined by the number of new cars entering the parc and the

number exiting the parc. The demand for servicing and repair

activity is less impacted by any adverse economic conditions than

other sectors, as motor vehicles require regular maintenance and

repair for safety, economy and performance reasons.

Aftersales Industry Insight

The aftersales servicing and repair business will benefit from

increased new and used car activity. As a result of the increased

new vehicle supply, we are anticipating growth in 2015 in the less

than three year old car parc of around 7%. Interestingly, within

the four to six year old vehicle parc, we are expecting growth of

around 2% following two years of decline, as a result of increased

registration of new cars from 2012 falling into this segment in

2015.

Customer Insight

Our customers are central to everything we do. We monitor our

customer satisfaction scores closely and regard as a key measure of

our success the proportion of customers who have given us a four or

five star rating for vehicle sales and aftersales service. We are

pleased to report that our overall rating in this area has

increased from 83.4% at 31 December 2013 to 85.3% at 31 December

2014. We see this as an important component of our business going

forward and will continue to invest to build on our recent

innovations and success in this area.

Outlook

Delivery of our clear strategy is reflected in an outstanding

set of results. We are excited by a number of current developments

we have in progress, from the roll out of our 'Sell Your Car'

initiative, to the launch of our 'Move Me Closer' online

proposition and our national footprint expansion, all of which will

propel the Group forward. Together with this, we see further growth

in the used and aftersales markets as result of strong market

dynamics, providing further impetus for our business. Our strategic

plans to expand our business will be supported by our strong

balance sheet and funded from cashflow and the recycling of low

performing assets. Our prospects for 2015 are in line with current

expectations.

5. Detailed Financials

Consolidated Income Statement

Year ended 31 December 2014

Underlying Non- underlying 2014 Underlying Non- underlying 2013

GBPm GBPm GBPm GBPm GBPm GBPm

--------------------------------- ---------- --------------- --------- ---------- --------------- ---------

Revenue 4,000.4 - 4,000.4 3,848.9 - 3,848.9

Cost of sales (3,477.8) - (3,477.8) (3,349.0) - (3,349.0)

--------------------------------- ---------- --------------- --------- ---------- --------------- ---------

Gross profit 522.6 - 522.6 499.9 - 499.9

Operating expenses (432.8) - (432.8) (423.1) 0.7 (422.4)

--------------------------------- ---------- --------------- --------- ---------- --------------- ---------

Operating profit before

other income 89.8 - 89.8 76.8 0.7 77.5

Other income - gains / (losses)

on the

sale of businesses and property - 3.2 3.2 - (0.6) (0.6)

Other income - dividends

received 1.1 3.1 4.2 0.3 - 0.3

--------------------------------- ---------- --------------- --------- ---------- --------------- ---------

Operating profit 90.9 6.3 97.2 77.1 0.1 77.2

Finance expense (note 4) (31.2) (1.9) (33.1) (33.3) (9.3) (42.6)

Finance income (note 5) 0.5 - 0.5 0.4 3.9 4.3

--------------------------------- ---------- --------------- --------- ---------- --------------- ---------

Net finance costs (30.7) (1.9) (32.6) (32.9) (5.4) (38.3)

--------------------------------- ---------- --------------- --------- ---------- --------------- ---------

Profit before taxation 60.2 4.4 64.6 44.2 (5.3) 38.9

Income tax (expense) / credit (15.3) 0.5 (14.8) (11.4) 13.6 2.2

--------------------------------- ---------- --------------- --------- ---------- --------------- ---------

Profit for the year 44.9 4.9 49.8 32.8 8.3 41.1

--------------------------------- ---------- --------------- --------- ---------- --------------- ---------

Profit for the year attributable

to:

Equity shareholders of the

parent 44.9 4.9 49.8 32.8 6.4 39.2

Non-controlling interests

(pension

related) - - - - 1.9 1.9

--------------------------------- ---------- --------------- --------- ---------- --------------- ---------

44.9 4.9 49.8 32.8 8.3 41.1

--------------------------------- ---------- --------------- --------- ---------- --------------- ---------

Earnings per share (note

3)

Basic earnings per share 3.5p 2.8p

Diluted earnings per share 3.4p 2.7p

Non GAAP measure (note 3)

Underlying basic earnings

per share 3.1p 2.3p

Underlying diluted earnings

per share 3.1p 2.2p

--------------------------------- ---------- --------------- --------- ---------- --------------- ---------

Consolidated Statement of Comprehensive Income

Year ended 31 December 2014

2014 2013

GBPm GBPm

---------------------------------------------------------------- ------- ------

Profit for the year 49.8 41.1

------------------------------------------------------------------ ------- ------

Other comprehensive income

Items that will never be reclassified to profit and loss:

Defined benefit plan remeasurement gains and (losses) (24.0) 23.5

Income tax relating to defined benefit plan remeasurement

gains and (losses) 4.8 (4.7)

Income tax relating to amendment to the pension partnership

agreement - 7.2

(19.2) 26.0

---------------------------------------------------------------- ------- ------

Items that are or may be reclassified to profit and loss:

Fair value gains on investments 14.0 -

Foreign currency translation differences of foreign operations 0.3 (0.5)

------------------------------------------------------------------ ------- ------

14.3 (0.5)

---------------------------------------------------------------- ------- ------

Other comprehensive income for the year, net of tax (4.9) 25.5

------------------------------------------------------------------ ------- ------

Total comprehensive income for the year 44.9 66.6

------------------------------------------------------------------ ------- ------

Total comprehensive income for the year attributable to:

Equity shareholders of the parent 44.9 64.7

Non-controlling interests (pension related) - 1.9

------------------------------------------------------------------ ------- ------

44.9 66.6

---------------------------------------------------------------- ------- ------

Consolidated Statement of Changes in Equity

Year ended 31 December 2014

Capital

Share Share redemption Other Translation Retained Non-controlling

capital premium reserve reserves reserve earnings interests Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

------------------------- -------- -------- ----------- --------- ----------- --------- --------------- ------

Balance at 1 January

2014 71.9 56.8 2.5 12.6 (0.9) 162.3 - 305.2

------------------------- -------- -------- ----------- --------- ----------- --------- --------------- ------

Total comprehensive

income for 2014

Profit for the year - - - - - 49.8 - 49.8

Other comprehensive

income for the year,

net of tax - - - - 0.3 (5.2) - (4.9)

------------------------- -------- -------- ----------- --------- ----------- --------- --------------- ------

Total comprehensive

income for the year - - - - 0.3 44.6 - 44.9

Issue of ordinary

shares 0.9 - - - - (0.5) - 0.4

Dividends paid - - - - - (8.6) - (8.6)

Own shares (acquired)

/ issued under share

schemes - - - - - (3.7) - (3.7)

Share based payments - - - - - 1.5 - 1.5

Income tax relating

to share based payments - - - - - 0.2 - 0.2

------------------------- -------- -------- ----------- --------- ----------- --------- --------------- ------

Balance at 31 December

2014 72.8 56.8 2.5 12.6 (0.6) 195.8 - 339.9

------------------------- -------- -------- ----------- --------- ----------- --------- --------------- ------

Balance at 1 January

2013 71.8 56.8 2.5 12.6 (0.4) 98.3 33.8 275.4

------------------------- -------- -------- ----------- --------- ----------- --------- --------------- ------

Total comprehensive

income for 2013

Profit for the year - - - - - 39.2 1.9 41.1

Other comprehensive

income for the year,

net of tax - - - - (0.5) 26.0 - 25.5

------------------------- -------- -------- ----------- --------- ----------- --------- --------------- ------

Total comprehensive

income for the year - - - - (0.5) 65.2 1.9 66.6

Issue of ordinary

shares 0.1 - - - - (0.1) - -

Dividends paid - - - - - (2.8) - (2.8)

Own shares issued

under share schemes - - - - - 1.2 - 1.2

Distribution from

pension partnership

to pension scheme - - - - - - (2.5) (2.5)

Amendment to the pension

partnership agreement - - - - - (2.8) (33.2) (36.0)

Share based payments - - - - - 1.6 - 1.6

Income tax relating

to share based payments - - - - - 1.7 - 1.7

------------------------- -------- -------- ----------- --------- ----------- --------- --------------- ------

Balance at 31 December

2013 71.9 56.8 2.5 12.6 (0.9) 162.3 - 305.2

------------------------- -------- -------- ----------- --------- ----------- --------- --------------- ------

Consolidated Balance Sheet

At 31 December 2014

2014 2013

GBPm GBPm

Non-current assets

Property, plant and equipment 312.0 295.7

Goodwill 365.4 365.4

Other intangible assets 6.1 5.0

Investments 24.0 10.0

Deferred tax assets 23.9 22.7

--------------------------------------------------- ---------- ----------

Total non-current assets 731.4 698.8

--------------------------------------------------- ---------- ----------

Current assets

Inventories 676.1 602.5

Trade and other receivables 117.9 103.2

Cash and cash equivalents 91.4 58.4

Non-current assets classified as held for

sale 11.6 13.1

--------------------------------------------------- ---------- ----------

Total current assets 897.0 777.2

--------------------------------------------------- ---------- ----------

Total assets 1,628.4 1,476.0

--------------------------------------------------- ---------- ----------

Current liabilities

Trade and other payables (884.1) (796.8)

Deferred income (26.2) (24.9)

Current tax payable (33.0) (30.5)

Provisions (2.5) (2.4)

--------------------------------------------------- ---------- ----------

Total current liabilities (945.8) (854.3)

--------------------------------------------------- ---------- ----------

Non-current liabilities

Interest bearing loans and borrowings (200.2) (198.0)

Trade and other payables (31.0) (28.3)

Deferred income (41.6) (43.1)

Retirement benefit obligations (66.4) (43.4)

Provisions (3.5) (3.7)

--------------------------------------------------- ---------- ----------

Total non-current liabilities (342.7) (316.5)

--------------------------------------------------- ---------- ----------

Total liabilities (1,288.3) (1,170.8)

--------------------------------------------------- ---------- ----------

Net assets 339.9 305.2

--------------------------------------------------- ---------- ----------

Capital and reserves

Called up share capital 72.8 71.9

Share premium account 56.8 56.8

Capital redemption reserve 2.5 2.5

Other reserves 12.6 12.6

Translation reserve (0.6) (0.9)

Retained earnings 195.8 162.3

--------------------------------------------------- ---------- ----------

Total equity attributable to equity shareholders

of the Company 339.9 305.2

--------------------------------------------------- ---------- ----------

Registered Company Number: 2304195

Consolidated Cash Flow Statement

Year ended 31 December 2014 2014 2013

GBPm GBPm

Cash flows from operating activities

Profit for the year 49.8 41.1

Adjustment for taxation 14.8 (2.2)

Adjustment for net financing expense 32.6 38.3

Adjustment for dividend received (4.2) (0.3)

93.0 76.9

Depreciation and amortization 27.0 19.8

Share based payments 1.5 1.6

(Profit) / Loss on sale of businesses and property (3.2) 0.6

Impairment of property, plant and equipment - 0.9

Impairment of assets held for sale 1.0 1.0

Reversal of impairment of assets held for sale (1.0) (0.6)

Changes in inventories (60.1) (1.0)

Changes in trade and other receivables (15.1) (6.2)

Changes in trade and other payables 83.5 56.9

Changes in retirement benefit obligations (2.9) (0.2)

Changes in provisions 0.2 (0.1)

Movement in contract hire vehicle balances (17.5) (14.3)

------------------------------------------------------- -------- --------

Cash generated from operations 106.4 135.3

Taxation paid (8.3) (0.9)

Interest received 0.5 4.3

Interest paid (29.5) (34.0)

------------------------------------------------------- -------- --------

Net cash from operating activities 69.1 104.7

------------------------------------------------------- -------- --------

Cash flows from investing activities

Dividends received 4.2 0.3

Proceeds from sale of businesses 1.1 9.0

Purchase of property, plant, equipment and intangible

assets (96.7) (68.1)

Proceeds from sale of property, plant and equipment 65.6 53.4

Acquisition of investments - (10.0)

------------------------------------------------------- -------- --------

Net cash used in investing activities (25.8) (15.4)

------------------------------------------------------- -------- --------

Cash flows from financing activities

Proceeds on issue of shares (net of costs paid) 0.4 -

Dividends paid to shareholders (8.6) (2.8)

Own shares (acquired) / issued under share schemes (3.7) 1.2

Repayment of bank loans 1.6 (272.6)

Proceeds from issue of bond and loans - 199.7

Payment of transaction costs related to bonds

and loans - (11.9)

Distribution from pension partnership to pension

scheme - (2.5)

Net cash outflow from financing activities (10.3) (88.9)

------------------------------------------------------- -------- --------

Net increase in cash and cash equivalents 33.0 0.4

Cash and cash equivalents at 1 January 58.4 58.0

Cash and cash equivalents at 31 December 91.4 58.4

------------------------------------------------------- -------- --------

Reconciliation of net cash flow to movement in

net debt

2014 2013

GBPm GBPm

------------------------------------------------------- -------- --------

Net increase in cash and cash equivalents 33.0 0.4

Repayment of bank loans (1.6) 272.6

Proceeds from issue of bond and loans (net of

directly attributable transaction costs) - (195.8)

Non-cash movements (0.6) (0.4)

------------------------------------------------------- -------- --------

Decrease in net debt in the year 30.8 76.8

Opening net debt (139.6) (216.4)

------------------------------------------------------- -------- --------

Closing net debt (108.8) (139.6)

------------------------------------------------------- -------- --------

NOTE: The reconciliation of net cash flow to movement in net

debt is not a primary statement and does not form part of the

consolidated

cash flow statement but forms part of the notes to the financial

statements.

Notes to the Financial Statements

1. Basis of preparation

The Group summary financial statements have been prepared and approved

by the directors in accordance with international accounting standards,

being the International Financial Reporting Standards as adopted by the

EU ("adopted IFRSs").

The summary financial statements are presented in millions of UK pounds,

rounded to the nearest GBP0.1m. They have been prepared under the historical

cost convention except for certain financial instruments which are stated

at their fair value. In addition, non-current assets classified as held

for sale are measured at the lower of their carrying amount and fair

value less costs to sell.

The summary financial statements have been prepared on a going concern

basis. In determining the appropriate basis of preparation of the financial

statements, the directors are required to consider whether the Group

can continue in operational existence for the foreseeable future.

The directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable future.

Thus they continue to adopt the going concern basis of accounting in

preparing the annual financial statement.

The preparation of summary financial statements in conformity with adopted

IFRSs requires the use of estimates and assumptions that affect the reported

amounts of assets and liabilities at the date of the summary financial

statements and the reported amounts of revenues and expenses during the

reporting year. Although these estimates are based on management's best

knowledge of the amount, events or actions, actual results ultimately

may differ from those estimates. The estimates and underlying assumptions

are reviewed on an ongoing basis. Revisions to accounting estimates are

recognised in the period in which the estimate is revised if the revision

affects only that period, or in the period of the revision and future

periods if the revision affects both current and future periods.

Non-underlying income and expenses are items that have non-trading attributes

due to their size, nature or incidence. The directors consider that these

items should be disclosed separately to enable a full understanding of

the Group's results.

2. Non-underlying items

2014 2013

GBPm GBPm

-------------------------------------- --------------- ------------- ----------- -----------

Within operating expenses:

Impairment of property, plant and equipment - (0.9)

Impairment of assets held

for sale (1.0) (1.0)

Reversal of impairment on assets classified as

held for sale 1.0 0.6

VAT assessment refunds - 2.0

------------------------------------------------------- ------------------ ----------- -----------

- 0.7

--------------- --------------------------------------------------------- ----------- -----------

Within other income - gains / (losses) on the sale of businesses

and property:

Gains / (losses) on the sale

of businesses 0.1 (1.1)

Gains on the sale of property 3.1 0.5

---------------------------------------------------------------------- --- ----------- -----------

3.2 (0.6)

--------------- --------------------------------------------------------- ----------- -----------

Within other income - dividends

received:

-------------------------------------- --------------- ------------- ----------- -----------

Dividends received 3.1 -

-------------------------------------- --------------- ------------- ----------- -----------

Within finance expense:

Net interest on pension scheme obligations (1.9) (1.3)

Refinancing fees and costs - (8.0)

---------------------------------------------------------------------- --- ----------- -----------

(1.9) (9.3)

--------------- --------------------------------------------------------- ----------- -----------

Within finance income:

Interest receivable - 0.9

Interest on VAT refunds - 3.0

---------------------------------------------------------------------- --- ----------- -----------

- 3.9

--------------- --------------------------------------------------------- ----------- -----------

Total non-underlying items

(before tax) 4.4 (5.3)

---------------------------------------------------------------------- --- ----------- -----------

Total non-underlying items attributable

to:

Equity shareholders of the

parent 4.4 (7.2)

Non-controlling interests (pension

related) - 1.9

------------------------------------------------------- ------------------ ----------- -----------

4.4 (5.3)

--------------- --------------------------------------------------------- ----------- -----------

The following amounts have been presented as non-underlying items in

the financial statements:

Group tangible fixed assets and assets held for sale have been reviewed

for possible impairments in the light of economic conditions. As a result

of this review there was an impairment charge against assets held for

sale tangible fixed assets of GBP1.0m during the year (2013: GBP1.0m).

In addition, a reversal of previous impairment charges of GBP1.0m was

made for assets held for sale where anticipated proceeds less costs to

sell have increased over their impaired carrying values (2013: GBP0.6m).

In the previous period there was also an impairment charge recognised

against tangible fixed assets of GBP0.9m.

The net financing return on pension obligations in respect of the defined

benefit schemes closed to future accrual is shown as a non-underlying

item due to the volatility of this amount. A net expense of GBP1.9m has

been recognised during the year (2013: GBP1.3m of which GBP1.9m was attributable

to the non-controlling interests).

Other income, being the profit on disposal of businesses and property,

comprises a GBP3.1m profit on sale of properties (2013: GBP0.5m) and

a GBP0.1m profit on the disposal of motor vehicle dealerships (2013:

loss GBP1.1m).

During the year the Group received dividend income from its investment

in King Arthur Holdings S.a.r.L of GBP4.2m. Of this GBP3.1m was deemed

to be non-underlying in nature as the income related to a distribution

of profits the company made on disposal of some of it's investment properties

and cash released following it's refinancing, rather than that earned

from the rental of those properties.

During the previous year, upon the successful completion of the refinancing

of the Group in May 2013, a net loss of GBP8.0m was recorded which comprised

of refinancing related costs.

A VAT refund of GBP2.0m, net of costs, was received in the previous year

in respect of VAT overpaid on demonstrator vehicles over the period from

1973 to 1996. Associated interest received of GBP3.0m during the previous

year is disclosed within finance income.

The Group received a refund of overcharged interest of GBP0.9m during

the previous year. This was in respect of a business acquired in 2006

and the overcharge related to a period prior to that acquisition.

3. Earnings per share

2014 2014 2013 2013

Earnings Earnings Earnings Earnings

per share Total per share Total

pence GBPm pence GBPm

----------------------------------------- ----------- ---------- ----------- --------------

Basic earnings per share 3.5 49.8 2.8 39.2

Adjusting items:

Non-underlying items attributable

to the parent (see note 2) (0.4) (4.4) 0.5 7.2

Tax effect of non-underlying

items - (0.5) (1.0) (13.6)

----------------------------------------- ----------- ---------- ----------- --------------

Underlying earnings per share

(Non GAAP measure) 3.1 44.9 2.3 32.8

----------------------------------------- ----------- ---------- ----------- --------------

Diluted earnings per share 3.4 49.8 2.7 39.2

Diluted earnings per share

- underlying (Non GAAP measure) 3.1 44.9 2.2 32.8

----------------------------------------- ----------- ---------- ----------- --------------

The calculation of basic, adjusted and diluted earnings per share is

based on the following number of shares in issue (millions):

2014 2013

Number Number

------------------------------------- --------------- ---------- ----------- --------------

Weighted average number of

ordinary shares in issue 1,428.6 1,421.0

Weighted average number of dilutive shares

under option 27.0 55.6

----------------------------------------------------------- ---------- ----------- --------------

Weighted average number of shares in

issue taking account of applicable outstanding

share options 1,455.6 1,476.6

----------------------------------------------------------- ---------- ----------- --------------

Non-dilutive shares under

option 15.7 25.5

----------------------------------------- ---------------- ---------- ----------- --------------

The directors consider that the underlying earnings per share figure

provides a better measure of comparative performance.

4. Finance expense

2014 2013

Recognised in profit and loss GBPm GBPm

------------------------------------------ ----------- --------- --------- --------------

Interest payable on bank borrowings,

bond and loan notes 15.0 16.2

Refinancing fees and costs (non-underlying) - 8.0

Vehicle stocking plan interest 14.6 15.2

Interest payable on finance

leases 0.1 0.1

Net interest on pension scheme obligations

(non-underlying) 1.9 1.3

Less : interest capitalised (0.1) -

------------------------------------------ ----------- --------- --------- --------------

Total interest expense in respect of

financial liabilities held at amortised

cost 31.5 40.8

Unwinding of discounts in contract hire

residual values 1.6 1.8

------------------------------------------------------- --------- --------- --------------

Total finance expense 33.1 42.6

------------------------------------------------------- --- --------- --------- --------------

5. Finance income 2014 2013

Recognised in profit and loss GBPm GBPm

------------------------------------------ ----------- --------- --------- --------------

Interest receivable on bank

deposits 0.5 0.4

Other interest receivable (non-underlying) - 0.9

Interest on VAT refunds (non-underlying) - 3.0

Total finance income 0.5 4.3

------------------------------------------------------- --- --------- --------- --------------

6. Net Debt 2014 2013

GBPm GBPm

------------------------------------------ ----------- --------- --------- --------------

Cash and cash equivalents 91.4 58.4

Non-current interest bearing

loans and borrowings (200.2) (198.0)

(108.8) (139.6)

----------------------------------------------------------- --------- --------- --------------

7. Movement in contract hire 2014 2013

vehicle balances GBPm GBPm

------------------------------------------ ----------- --------- --------- --------------

Depreciation 23.2 21.1

Changes in trade and other payables and

deferred income 8.0 6.1

Purchases of contract hire

vehicles (47.1) (39.7)

Unwinding of discounts in contract hire

residual values (1.6) (1.8)

------------------------------------------------------------ --------- --------- --------------

(17.5) (14.3)

----------------------------------------------------------- --------- --------- --------------

8. Pension Funds

The net liability for defined benefit obligations has increased from

GBP43.4m at 31 December 2013 to GBP66.4m at 31 December 2014. The increase

of GBP23.0m comprises contributions of GBP2.9m, net expense recognised

in the income statement of GBP1.9m and a net actuarial loss of GBP24.0m.

The net actuarial loss has arisen due in part to changes in the principal

assumptions used in the valuation of the scheme's assets and liabilities

and also the change in value of the assets held over the year. The main

assumptions subject to change are the discount rate of 3.60% (2013: 4.50%),

inflation rate (RPI) of 3.00% (2013: 3.50%) and inflation rate (CPI)

of 2.00% (2013: 2.50%).

9. Annual report

The financial information set out above does not constitute the company's

statutory accounts for the years ended 31 December 2014 or 2013 but is

derived from those accounts. Statutory accounts for 2013 have been delivered

to the registrar of companies, and those for 2014 will be delivered in

due course. The auditor has reported on those accounts; their reports

were (i) unqualified, (ii) did not include a reference to any matters

to which the auditor drew attention by way of emphasis without qualifying

their report and (iii) did not contain a statement under section 498

(2) or (3) of the Companies Act 2006.

Full financial statements for the year ended 31 December 2014 are published

on the Group's website at www.pendragonplc.com and will be posted to

shareholders and after adoption at the Annual General Meeting on 8 May

2015 they will be delivered to the registrar.

Copies of this announcement are available from Pendragon PLC, Loxley

House, 2 Oakwood Court, Little Oak Drive, Annesley, Nottinghamshire,

NG15 0DR.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR TFMLTMBIBBJA

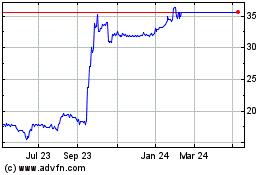

Pendragon (LSE:PDG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pendragon (LSE:PDG)

Historical Stock Chart

From Apr 2023 to Apr 2024