TIDMRNK

RNS Number : 1781F

Peel Hunt LLP

18 February 2015

Not for publication, distribution or release directly or

indirectly, in whole or in part, in or into the United States,

Australia, Canada, Japan or Republic of South Africa or any other

jurisdiction in which offers or sales would be prohibited by

law.

Proposed placing of approximately 50,000,000 ordinary shares in

The Rank Group plc by GuoLine Overseas Limited ("GuoLine")

GuoLine Overseas Limited ("GuoLine"), a subsidiary of Hong Leong

Company (Malaysia) Berhad ("Hong Leong"), announces that it intends

to sell approximately 50 million ordinary shares ("Placing Shares")

in The Rank Group plc ("Rank" or the "Company") to institutional

investors (the "Placing"). The Placing Shares represent

approximately 12.8% of Rank's entire issued share capital.

The Placing will be conducted by means of an accelerated

bookbuilt secondary placing to institutional investors. The books

of the Placing will open with immediate effect. The final price at

which the Placing Shares are to be sold will be agreed by Peel Hunt

LLP ("Peel Hunt") and GuoLine at the close of the bookbuild

process, subject to a minimum price of 185 pence per Placing Share.

The results of the Placing will be announced as soon as practicable

thereafter. The timing of the closing of the books will be at the

absolute discretion of Peel Hunt but the books will, in any event,

be closed by 5pm on 18(th) February 2015. The Placing Shares are

expected to be sold on a T+5 basis.

Post completion of the Placing, the Hong Leong Group's remaining

stake in Rank is expected to comprise approximately 219.1 million

ordinary Rank shares, equivalent to approximately 56.1% of Rank's

entire issued ordinary share capital.

The Placing will significantly increase the free float in Rank

and is expected to improve liquidity in Rank's shares.

GuoLine, through GuocoCapital Limited, an affiliate of GuoLine

and a licensed corporation with the Securities and Futures

Commission of Hong Kong, has entered into a placing agreement with

Peel Hunt LLP ("Peel Hunt") under which Peel Hunt will act as sole

bookrunner in relation to the Placing.

Enquiries:

Peel Hunt LLP +44 (0) 207 418 8900

Al Rae (ECM) +44 (0) 207 418 8914

Alex Carter (Sales) +44 (0) 207 418 8970

Dan Webster (Corporate)

Richard Brown

George Sellar

The distribution of this announcement and the offer and sale of

the Placing Shares in certain jurisdictions may be restricted by

law. The Placing Shares may not be offered to the public in any

jurisdiction in circumstances which would require the preparation

or registration of any prospectus or offering document relating to

the Placing Shares in such jurisdiction. No action has been taken

by Hong Leong or by Peel Hunt or any of their respective affiliates

that would permit an offering of the Placing Shares or possession

or distribution of this announcement or any other offering or

publicity material relating to such securities in any jurisdiction

where action for that purpose is required. This announcement is not

an offer of securities or investments for sale nor a solicitation

of an offer to buy securities or investments in any jurisdiction

where such offer or solicitation would be unlawful.

This announcement is not for publication, distribution or

release, directly or indirectly, in or into the United States of

America (including its territories and dependencies, any State of

the United States and the District of Columbia), Australia, Canada,

Japanor Republic of South Africa or any other jurisdiction where

such an announcement would be unlawful. The distribution of this

announcement may be restricted by law in certain jurisdictions and

persons into whose possession this announcement or other

information referred to herein comes, should inform themselves

about and observe any such restriction. Any failure to comply with

these restrictions may constitute a violation of the securities

laws of any such jurisdiction.

The securities referred to herein have not been and will not be

registered under the U.S. Securities Act of 1933, as amended (the

"Securities Act"), and may not be offered or sold in the United

States except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements of the Securities

Act. Neither this announcement nor the information contained herein

constitutes or forms part of an offer to sell or the solicitation

of an offer to buy securities in the United States. There will be

no public offering of any securities in the United Statesor in any

other jurisdiction.

In member states of the European Economic Area ("EEA") which

have implemented the Prospectus Directive (each, a "Relevant Member

State"), this announcement and any offer if made subsequently is

directed exclusively at persons who are 'qualified investors'

within the meaning of the Prospectus Directive ("Qualified

Investors"). For these purposes, the expression 'Prospectus

Directive' means Directive 2003/71/EC (and amendments thereto,

including the 2010 PD Amending Directive, to the extent implemented

in a Relevant Member State), and includes any relevant implementing

measure in the Relevant Member State and the expression '2010 PD

Amending Directive' means Directive 2010/73/EU. In the United

Kingdom this announcement is directed exclusively at Qualified

Investors (i) who have professional experience in matters relating

to investments falling within Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005, as

amended (the "Order") or (ii) who fall within Article 49(2)(A) to

(D) of the Order, and (iii) to whom it may otherwise lawfully be

communicated.

In connection with any offering, Peel Hunt and any of its

respective affiliates acting as an investor for its own account may

take up as a proprietary position any Placing Shares and in that

capacity may retain, purchase or sell for their own account such

Placing Shares. In addition they may enter into financing

arrangements and swaps with investors in connection with which they

may from time to time acquire, hold or dispose of Placing Shares.

Peel Hunt does not intend to disclose the extent of any such

investment or transactions otherwise than in accordance with any

legal or regulatory obligation to do so.

Peel Hunt which is authorised and regulated in the United

Kingdomby the Prudential Regulation Authority and regulated by the

Financial Conduct Authority, is acting on behalf of Hong Leong and

no one else in connection with any offering of the Placing Shares

and will not be responsible to any other person for providing the

protections afforded to any of their clients or for providing

advice in relation to any offering of the Placing Shares. Peel Hunt

will not regard any other person as its client in relation to the

offering of the Placing Shares.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by Peel Hunt or by any of its affiliates or

agents as to, or in relation to, the accuracy or completeness of

this announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers, and any liability therefore is expressly disclaimed.

The price of shares and the income from them may go down as well

as up and investors may not get back the full amount invested on

disposal of the shares. Past performance is no guide to future

performance and persons needing advice should consult an

independent financial advisor.

This announcement includes statements that are, or may be deemed

to be, forward-looking statements. These forward-looking statements

may be identified by the use of forward-looking terminology,

including the terms "intends", "expects", "will", or "may", or, in

each case, their negative or other variations or comparable

terminology, or by discussions of strategy, plans, objectives,

goals, future events or intentions. These forward-looking

statements include all matters that are not historical facts. Any

forward-looking statements are subject to risks relating to future

events and assumptions relating to Rank's business, in particular

from changes in political conditions, economic conditions, evolving

business strategy, or the retail industry. No assurances can be

given that the forward-looking statements in this announcement will

be realized. As a result, no undue reliance should be placed on

these forward-looking statements as a prediction of actual results

or otherwise.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAEAXFSPSEAF

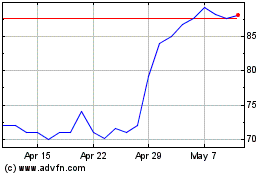

Rank (LSE:RNK)

Historical Stock Chart

From Mar 2024 to Apr 2024

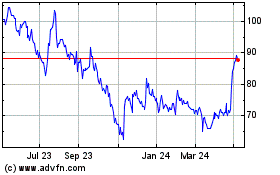

Rank (LSE:RNK)

Historical Stock Chart

From Apr 2023 to Apr 2024