Paypal Profit Rises as User Growth and Volume Hit Milestones -- Update

July 26 2017 - 8:50PM

Dow Jones News

By Peter Rudegeair

PayPal Holdings Inc. said Wednesday that new milestones reached

in user growth and payment volume helped boost its second-quarter

profit by 27%.

The San Jose, Calif.-based payments company reported a quarterly

profit of $411 million, or 34 cents a share. That compares with a

profit of $323 million, or $0.27 a share, in the same period of

2016. Excluding certain items, the company's per-share earnings

rose to 46 cents, above the estimate of analysts polled by Thomson

Reuters.

A flurry of deals that PayPal reached with banks, technology

firms and credit-card companies to expand its reach resulted in its

total payment volume exceeding $100 billion for the first time in

the second quarter. Active customer accounts increased by a net of

6.5 million to 210 million, the largest quarterly gain since PayPal

split from eBay Inc. two years ago.

New partnerships the company announced on Wednesday include one

with Baidu Inc. that would allow 100 million users of the Chinese

search giant's mobile wallet to shop at PayPal merchants outside of

China. A separate deal announced Wednesday will make it easier for

Bank of America Corp.'s customers to add their credit cards to

PayPal accounts.

"It's hard to overstate the difference in the relationships we

now have with companies across multiple sectors who many have once

viewed as potential competitors," PayPal Chief Executive Dan

Schulman said on a conference call with analysts.

As part of some of these agreements, PayPal agreed not to

default users into funding their PayPal transactions with the

cheapest option to the company, usually a bank transfer. As a

result of that decision and overall growth in payment volumes,

PayPal's transaction expense increased in the second quarter by

nearly one-third to $1.06 billion.

The share of revenue PayPal takes from each transaction fell to

2.58% from 2.69% a year ago. A doubling in transaction volume that

was processed by Venmo, PayPal's digital person-to-person payments

service, accounted for much of that decline. Venmo handled $8

billion in volume during the second quarter, but the unit doesn't

charge users anything for the majority of those transactions.

Over all, second-quarter revenue rose 18% to $3.14 billion. That

was above the $3.09 billion that analysts were expecting.

Revenue from PayPal's lending activities and its other

value-added services rose 18% from a year earlier to $387 million;

the company's consumer-loan portfolio expanded by around 31% to

$5.5 billion. PayPal has been weighing a sale of that portfolio to

free up cash.

Mr. Schulman said in an interview that he is encouraged with

discussions with potential buyers and companies that would fund

PayPal loans in the future. He didn't, though, provide a time frame

of when any new strategy would be enacted.

Shares in PayPal increased around 2% in aftermarket trading.

Since the start of the year, PayPal shares have risen 49%, compared

with an 11% rise in the S&P 500 index.

Write to Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

July 26, 2017 20:35 ET (00:35 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

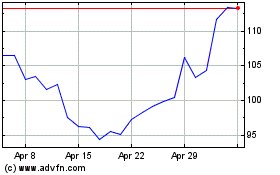

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Mar 2024 to Apr 2024

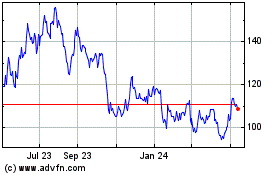

Baidu (NASDAQ:BIDU)

Historical Stock Chart

From Apr 2023 to Apr 2024