TIDMPFP

RNS Number : 6128K

Pathfinder Minerals Plc

23 September 2016

Embargoed: 0700hrs 23 September 2016

Pathfinder Minerals Plc

("Pathfinder," the "Company" or the "Group")

Interim Financial Statements for the Six Months Ended 30 June

2016

Chairman's statement

Introduction

It has been approximately three months since I last updated

shareholders, in my statement accompanying the 2015 annual report,

on the steps being taken to recover Pathfinder's assets and address

Company's financial situation. Pathfinder made progress in both of

these areas during the six month period ended 30 June 2016.

Steps to recover the Company's assets

On 6 May 2016, Pathfinder announced the appointment of Eduardo

C. Mondlane Jr as its regional representative in Mozambique. Mr

Mondlane Jr is a highly respected Mozambican who has been providing

strategic advisory services in Africa for thirty years across

industries including aerospace, infrastructure, energy, power and

financial services. He has advised companies including Boeing

Commercial Airplanes, United Technologies, Siemens and GE Capital

Aviation. He has also served on the boards of Absa Group and Bank

(Barclays Africa) and other Barclays African subsidiary banks.

Mr Mondlane Jr and members of Pathfinder's legal counsel in

Mozambique have in recent months been actively engaged in

discussions with relevant departments within the Mozambique

Government with the ultimate aim of restoring control of the areas

previously licensed to the Company under mining concessions 760C

and 4623C (the "Licences"). Shareholders will recall that the

Company was deprived of the Licences in late 2011 as a result of

their transfer to an unaffiliated entity via a process which the

Company believes was defective. Pathfinder is doing all it can to

advance such discussions but I am unable to provide any visibility

over either the outcome of the dialogue or the time it may take to

achieve a resolution. We are however encouraged by the much

improved level of engagement with the Mozambique Government.

Pathfinder continues to pursue its legal strategy in parallel

with the Company's dialogue with the Mozambique Government. The

most significant element remains the decisions awaited from the

Mozambique Supreme Court (the "Supreme Court") in respect of the

Company's application to appeal, on the basis of a previous

conflicting decision, the Supreme Court's decision to refuse to

recognise certain costs orders made by the English courts; and in

respect of the Company's application to the Supreme Court to

recognise the substantive judgment by the English court regarding

Pathfinder's ownership of Companhia Mineira de Naburi SARL

("CMDN"), the subsidiary company to which the Licences were

registered prior to their expropriation.

It remains impossible to predict what the outcome will be from

the Supreme Court. Indeed, the Company is advised by its Mozambique

counsel that a positive outcome from the Supreme Court would likely

have the effect of bringing to a successful conclusion the various

proceedings in the commercial court in Maputo surrounding the same

issue on which the English court has already ruled. Whatever the

outcome, the Company may still seek to recover its assets or seek

compensation for its loss through other judicial processes.

The only update to have been received this year in respect of

the legal proceedings ongoing in the commercial court in Maputo

(the "Maputo Court") was announced on 8 April 2016. This

announcement recorded the Maputo Court's refusal to hear a

challenge brought by Pathfinder's subsidiary, IM Minerals Limited,

to the validity of a shareholder resolution of CMDN, purportedly

passed in May 2009. Pathfinder applied to the Maputo Court on 13

April 2016 to appeal this defective decision, which is inconsistent

with previous judgments in each of the Supreme Court, the English

High Court and the Maputo Court. Permission to appeal was granted

on 13 June 2016 and a decision is awaited.

Corporate events

On 10 March 2016, James Normand resigned from the Board as

Finance Director and, on 29 March 2016, we welcomed Robert Easby as

his replacement. Robert qualified as a Chartered Accountant in 2000

and spent his early career in audit compliance and as a Company Law

specialist within a large regional Chartered Certified Accountancy

practice.

Concurrent with the appointment of Mr Mondlane Jr, and as

announced on 6 May 2016, the Company has agreed that, in the event

that Pathfinder is successful in regaining control of the Licences,

it will issue ordinary shares to Mr Mondlane Jr equivalent to up to

25 per cent of the enlarged issued share capital of Pathfinder. In

such circumstances, it is envisaged that the Mr Mondlane Jr will

assist with the ongoing administration of Pathfinder's local

operating subsidiaries and with the Company's relationships with

regional and national authorities and with local communities.

On 22 June 2016, Pathfinder announced that it had been

successful in obtaining final charging orders from the English High

Court against the aggregate 19,824,000 shares held in Pathfinder by

Jacinto Veloso's company and Diogo Cavaco (the "Defendants"). The

English High Court has previously ordered the Defendants to pay

GBP1.1 million worth of costs to Pathfinder in respect of the 2012

English proceedings but the Defendants have not complied with any

of the costs orders. The effect of the charging orders was to

charge their shares in the Company with payment of the amount of

the costs orders plus interest, currently totalling in excess of

GBP1.4 million. On 24 August 2016, Pathfinder announced that it has

successfully achieved the next objective in this process and

obtained a sale order in respect of those shares. The effect is

that, unless the Defendants pay Pathfinder the amounts described

above, the Company may sell sufficient of their shares to discharge

the debt. The directors intend to maximise the value which will be

obtained from the sale of the shares at some point in the future by

way of an orderly placing.

Financial results and current financial position

The Board has taken a number of definitive actions to reduce the

central overhead of the Company to enhance its ability to continue

pursuing it asset recovery strategy - which, among other things,

necessitates the ongoing payment of legal fees. The Company has

foregone a physical head office; the overall cost of directors'

fees has reduced and was approximately 10% less than the cost of

directors' fees in the equivalent period in 2015; and payment of an

aggregate 25% of the directors' fees incurred in the period under

review has been deferred until such time as the Company is in

materially better financial health. We expect the cost of

directors' fees, and the amounts of which are being deferred, to

reduce further still in the second half of the year as the full

benefit of the reconfigured Board takes effect.

A number of share subscriptions occurred during the period under

review which have the effect of moderately strengthening the

Company's cash position while the directors seek more substantial

sources of funding required to shore up the Company's balance

sheet. Accordingly, the Company's cash resources were bolstered by

the receipt of GBP295,500 in net proceeds received from two share

subscriptions in March 2016 - one-third of which was invested by

the Company's chief executive officer.

The financial statements of the Pathfinder Group for the six

months ended 30 June 2016 follow later in this report. The Income

Statement shows a reduced loss of GBP404,000 (H1 2015 - GBP695,000)

of which GBP113,000 relates to directors' fees that are recorded as

a liability in Trade and other payables but actual payment of which

have been deferred as described above and in Note 2 to these

accounts.

The Group's Statement of Financial Position shows net assets

(excluding the GBP113,000 of deferred fees described above) at 30

June 2016 of GBP51,000 (31 December 2015 - GBP42,000). The assets

are held largely in the form of cash deposits (totalling GBP135,000

at the end of the period). Two further subscriptions by private

investors occurred after the period under review, in August 2016,

producing a further GBP45,000 in net proceeds.

Outlook

The Board is encouraged by the ongoing dialogue with the

Mozambique Government which reflects a level of engagement that the

Company has not hitherto been afforded. We are at the same time

continuing to pursue our legal strategy vigorously in the event

that we should need to rely upon it to resolve the matters or

provide compensation for the Company's loss. The directors are

continuing to address the financial position of the Company with

the aim of sourcing sufficient capital to bring its strategy to

recover the Licences to a successful conclusion. On behalf of the

Board, I should like to thank our investors once again for their

unwavering support as we seek to recover the valuable assets of

which the Company has been unlawfully deprived.

Sir Henry Bellingham

Chairman

22 September 2016

Consolidated statement of comprehensive income

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 June 30 31 December

2016 June 2015

2015

---------- ---------- -------------

GBP '000 GBP GBP '000

'000

Revenue - - -

Other operating income - - 3

Administrative expenses (404) (699) (1,104)

---------- ---------- -------------

Operating loss (404) (699) (1,101)

Finance income - 4 8

---------- ---------- -------------

Loss on ordinary activities

before taxation (404) (695) (1,093)

Taxation - - -

Comprehensive loss for the

period (404) (695) (1,093)

========== ========== =============

Loss per share

(2015 figures based on 103,716,723

shares in issue throughout

the period) (0.34p) (0.67p) (1.05p)

Statement of financial position

Unaudited Unaudited Audited

30 June 30 31 December

2016 June 2015

2015

---------- ---------- -------------

GBP '000 GBP GBP '000

'000

Assets

Current assets

Trade and other receivables 23 123 94

Cash and cash equivalents 135 592 80

----------

158 715 174

---------- ---------- -------------

Total assets 158 715 174

---------- ---------- -------------

Equity

Share capital - issued and

fully paid 18,322 18,289 18,289

Share premium 11,289 11,022 11,022

Retained loss (29,673) (28,871) (29,269)

Total equity (62) 440 42

========== ========== =============

Liabilities

Current liabilities

Trade and other payables 220 275 132

Total liabilities 220 275 132

---------- ---------- -------------

Total equity and liabilities 158 715 174

========== ========== =============

Consolidated statement of changes in shareholders' equity

Share Share Retained Total

Capital Premium Earnings

--------- --------- ---------- --------

GBP'000 GBP'000 GBP'000 GBP'000

1 January 2015 18,289 11,022 (28,176) 1,135

Loss for the period - - (695) (695)

30 June 2015 18,289 11,022 (28,871) 440

--------- --------- ---------- --------

1 January 2015 18,289 11,022 (28,176) 1,135

Loss for the year - - (1,093) (1,093)

31 December 2015 18,289 11,022 (29,269) 42

--------- --------- ---------- --------

1 January 2016 18,289 11,022 (29,269) 42

Loss for the period - - (404) (404)

Share issue 33 267 - 300

--------- --------- ---------- --------

30 June 2016 18,322 11,289 (29,673) (62)

========= ========= ========== ========

CONSOLIDATED CASH FLOW STATEMENT

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30 June 30 31 December

2016 June 2015

2015

---------- ---------- -------------

GBP '000 GBP GBP '000

'000

Cash flows from operating

activities

Operating loss (404) (695) (1,093)

Finance income - (4) (8)

(Increase) decrease in trade

and other receivables 71 (62) (33)

Increase (decrease) in trade

and other payables 88 177 34

---------- ---------- -------------

Cash absorbed by operations (245) (584) (1,100)

Cash flows from investing

activities

Finance income - 4 8

Share issue 300 - -

Net movement in cash 55 (580) (1,092)

Cash at the beginning of

the period 80 1,172 1,172

Cash at the end of the period 135 592 80

========== ========== =============

NOTES

1. BASIS OF PREPARATION

These financial statements have been prepared under the

historical cost convention and on a going concern basis (see note 2

below); and in accordance with International Financial Reporting

Standards and IFRIC interpretations adopted for use in the European

Union.

The financial information for the period ended 30 June 2016 has

not been audited or reviewed in accordance with the International

Standard on Review Engagements 2410 issued by the Auditing

Practices Board. The figures were prepared using applicable

accounting policies and practices consistent with those adopted in

the statutory financial statements for the year ended 31 December

2015. The figures for the year ended 31 December 2015 have been

extracted from these financial statements, which have been

delivered to the Registrar of Companies and which contain an

unqualified audit report.

The financial information contained in this document does not

constitute statutory financial statements as defined by Section 435

of the Companies Act 2006. In the opinion of the directors, the

financial information for this period fairly presents the financial

position, result of operations and cash flows for the period.

This Interim Financial Report was approved by the Board of

Directors on 22 September 2016.

2. GOING CONCERN

As explained in the 2015 annual report, the availability of

funds to continue to finance the Company's activities has a direct

impact on the ability of the Company to continue to trade as a

going concern. The Board has concluded, as set out in the

Chairman's Statement, that it currently believes that it has

sufficient resources to see through its strategy to recover the

assets improperly expropriated from it.

The Board has therefore continued to adopt a going concern basis

for the preparation of these financial statements.

Included within the figure for Trade and other payables are

amounts due to the directors in respect of deferred salaries and

related benefits, totalling GBP113,000. The directors have agreed

defer these amounts until such time as the company can reasonably

afford to make these payments without materially adversely

effecting its cash position.

3. SEGMENTAL ANALYSIS

The development of the Group's mining interest in Mozambique

comprises the whole of the Group's activity. The Group has one

activity only. Of the Group's administrative expenses, GBP28,000

(2015 - GBP148,000) was spent in Mozambique. Since, in the interest

of accounting prudence, full provision has been made against cost

of its Mozambique assets, the whole of the value of the Group's net

assets is attributable to its UK assets and liabilities (also the

case at 30 June 2015).

4. CONTINGENT LIABILITIES

As part of the agreement for the purchase of the shares in its

subsidiary, Companhia Mineira de Naburi SARL, the Company has

agreed to pay the vendors a further sum of $9,900,000 if, following

further exploration and appraisal, an agreement is reached for the

construction of a facility for the processing of ore extracted from

the Naburi mineral sands deposit. Similarly, as part of its

agreement for the purchase of the whole of the issued share capital

of Sociedade Geral de Mineracao de Moçambique SARL, Companhia

Mineira de Naburi SARL has agreed to pay the vendors, BHP Billiton,

a further sum of $9,500,000 if, following further exploration and

appraisal, an agreement is reached for the construction of a

facility for the processing of ore extracted from the Moebase

mineral sands deposit.

Enquiries:

Pathfinder Minerals Plc

Nick Trew, Chief Executive

Tel. +44 (0)20 3440 7775

WH Ireland Limited (Nomad and Broker)

Paul Shackleton or James Bavister

Tel. +44 (0)20 7220 1666

Vigo Communications (Public Relations)

Ben Simons or Ali Roper

Tel. +44 (0)20 7830 9700

Email. pathfinderminerals@vigocomms.com

Notes to Editors:

Pathfinder Minerals Plc is incorporated in England & Wales

and is admitted to trading on the AIM market of the London Stock

Exchange.

CMdN, a subsidiary of Pathfinder, was issued mining concession

licences 760C and 4623C on 13 September 2004 and 13 July 2011

respectively, each for a period of twenty-five years. Taken

together, these mining concessions cover approximately 32,000

hectares of land on the Indian Ocean coast of the Zambezia province

of Mozambique, known to contain the heavy minerals, ilmenite,

rutile and zircon.

As announced on 3 February 2012, ownership of these licences is

being disputed.

END

IR QLLFLQKFLBBB

(END) Dow Jones Newswires

September 23, 2016 02:00 ET (06:00 GMT)

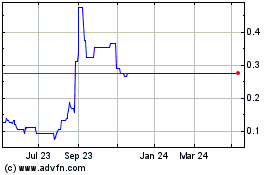

Pathfinder Minerals (LSE:PFP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pathfinder Minerals (LSE:PFP)

Historical Stock Chart

From Apr 2023 to Apr 2024