TIDMPMG

RNS Number : 5476P

Parkmead Group (The) PLC

18 November 2016

18 November 2016

The Parkmead Group plc

("Parkmead", "the Company" or "the Group")

Preliminary Results for the year ended 30 June 2016

Parkmead, the UK and Netherlands focused oil and gas group, is

pleased to report its preliminary results for the

year ended 30 June 2016.

HIGHLIGHTS

Successful fast-track development. Substantial increase in gas

production

-- Increased Netherlands gas production more than six fold

-- First commercial gas production achieved at the Diever West

gas field in the Netherlands, following a successful fast-track

development

-- Gas production has continuously outperformed expectations,

averaging approximately 34 million cubic feet per day during June

2016 (approximately 5,850 barrels of oil equivalent per day)

-- Diever West field brought onstream within just 14 months of discovery

-- Low-cost onshore gas portfolio in the Netherlands produces

from four separate gas fields with an average operating cost of

US$14 per barrel of oil equivalent, ensuring that Parkmead is cash

flow positive on an operating basis

-- Further production enhancement work planned on Parkmead's

Netherlands portfolio, including a new well at the Geesbrug gas

field to maximise production, serving as a natural hedge to the

current low oil price environment

Attractive new licence awards strengthen asset base

-- Awarded a new oil and gas licence in the West of Shetland

area, targeting the Sanda North and Sanda South prospects which

have the potential to contain 280 million barrels of recoverable

oil on a most likely, P50 basis

-- New West of Shetland licence completes Parkmead's total award

of six new oil and gas licences in the UKCS 28th Licensing Round,

covering 10 offshore blocks

-- Detailed technical work undertaken this year has allowed

Parkmead to release non-core acreage, considerably reducing licence

costs

Major progress on valuable development projects. Additional

licence acquisitions

-- New minimal platform concept at the Platypus gas field

further increases the attractiveness of the development

-- Doubled stake in the Polecat and Marten oil fields in the

Central North Sea in August 2016, which are jointly estimated to

hold over 90 million barrels of oil in place

-- Increased stake in the Perth and Dolphin fields to 60.05% in

September 2016, building Parkmead's oil reserves

-- Perth and Dolphin are at the core of Parkmead's

Perth-Dolphin-Lowlander (PDL) oil hub project which has been fully

appraised, with a combined total of 13 wells drilled, and has

expected recoverable reserves of approximately 80 million barrels

of oil

-- The Polecat and Marten fields have the potential to be highly

valuable to Parkmead as, given their close proximity to PDL, they

could be jointly developed as part of the Greater PDL Area

project

Increasing oil and gas reserves and resources

-- Considerable 2P reserves of 27.9 million barrels of oil

equivalent as at 30 September 2016, a 19% increase from Parkmead's

31 December 2015 reserves position of 23.5 million barrels of oil

equivalent

-- 2C resources increased by 41% to 59.1 million barrels of oil

equivalent as at 30 September 2016 (41.9 million barrels of oil

equivalent at 31 December 2015)

Well positioned for further acquisitions

-- Six acquisitions, at both an asset and corporate level, have been completed to date

-- The Parkmead team is evaluating further acquisition

opportunities to take advantage of the current low oil price

environment

Financial Strength

-- Strong total asset base of GBP87.5 million at 30 June 2016

-- Parkmead maintains strict financial discipline

-- Well capitalised, with cash balances of US$37.9 million

(GBP28.3 million) as at 30 June 2016

-- Parkmead remains debt free

-- Since January 2016, Parkmead has been cash flow positive on an operating basis

-- All revenues from Netherlands gas production received in

Euros, mitigating recent currency fluctuations

Parkmead's Executive Chairman, Tom Cross, commented:

"I am pleased to report an excellent year of progress for

Parkmead, despite the challenges of the low oil price environment.

Parkmead discovered and brought onstream a new gas field at Diever

West, in the Netherlands, within just 14 months. This field is

delivering profitable gas production and important additional cash

flow to the Group.

Parkmead is increasing the Group's gas production in the

Netherlands through a low-cost, onshore work programme. This acts

as a natural hedge to low global oil prices.

The Group's reserves and resources have significantly increased

in 2016 through two licence acquisitions. Parkmead has strengthened

its position around the important PDL oil hub in the UK North

Sea.

Our new licence awards in the 28th Round were an outstanding

result for Parkmead, with 10 new offshore oil and gas blocks

awarded to the Group. We are delighted with the new award in the

West of Shetland region targeting two prospects, Sanda North and

Sanda South. West of Shetland is an area we understand well and has

the potential to add major value to the Company.

Parkmead is well positioned to take advantage of the ongoing

lower oil price environment, and the opportunities that are arising

from this. We have excellent regional expertise, significant cash

resources, and a growing, low-cost gas portfolio. The Group will

continue to build upon the inherent value in its existing interests

with a licensing and acquisition-led growth strategy, securing

opportunities that maximise long-term value for our

shareholders."

For enquiries please contact:

The Parkmead Group plc +44 (0) 1224 622200

Tom Cross (Executive Chairman)

Ryan Stroulger (Chief Financial

Officer)

Panmure Gordon (UK) Limited

(Financial Adviser, NOMAD

and Corporate

Broker to Parkmead) +44 (0) 20 7886 2500

Adam James

James Greenwood

Instinctif Partners Limited

(PR Adviser to

Parkmead) +44 (0) 20 7457 2020

David Simonson

George Yeomans

CHAIRMAN'S STATEMENT

This has been an excellent year of progress for Parkmead,

despite the challenging low oil price environment. Building on the

significant growth in the prior period, the Company achieved first

commercial gas production from the Diever West field in the

Netherlands. The field has performed well above expectations,

averaging some 30 million cubic feet per day (approximately 5,340

barrels of oil equivalent per day) since first production.

Parkmead has also delivered a highly successful period of

licence acquisition growth. The Company increased its equity in a

major oil area of the UK Central North Sea through two

transactions. The first doubled Parkmead's stake in the Polecat and

Marten oil fields, increasing the Company's 2C resources by 41%.

This was followed by Parkmead increasing its interest in the Perth

and Dolphin oil fields which are at the core of the major

Perth-Dolphin-Lowlander (PDL) oil hub project.

Operations and Portfolio Growth

Parkmead has made further progress towards building a balanced

independent oil and gas group of breadth and scale, by developing

its current portfolio and adding new assets through acquisition and

through the licensing round process.

Major milestones have been achieved across Parkmead's licence

portfolio in the Netherlands. In November 2015, first commercial

production was achieved at the Diever West gas field.

The field was discovered in September 2014 and, through a

fast-track and low-cost development programme, it was tied into

existing production facilities through a new dedicated pipeline

with gas export via the Garijp treatment system. Parkmead worked

closely with its joint-venture partners on the fast-track

development of the Diever West field, and the partnership

successfully brought the field onstream within just 14 months of

discovery. This is an outstanding achievement.

The Diever-2 well was drilled on behalf of the co-venturers by

operator Vermilion Energy, and gas was discovered in a good quality

Rotliegendes age sandstone reservoir. A 157 foot gas column was

encountered, with both net pay and porosity values exceeding

pre-drill expectations. The field has performed well above

expectations since first production, averaging 30 million cubic

feet per day (approximately 5,340 barrels of oil equivalent per

day). The new production from Diever West has increased Parkmead's

net gas production in the Netherlands more than six fold.

Parkmead's low-cost onshore portfolio in the Netherlands

produces gas from four separate fields with a very low average

operating cost of just US$14 per barrel of oil equivalent. The

profitable gas production from Diever West, and Parkmead's wider

portfolio of gas fields in the Netherlands, provides important cash

flow to the Group.

A number of enhanced production opportunities have been

identified within Parkmead's existing Netherlands portfolio, which

the Group intends to capitalise on with the aim of further

increasing its gas production. These include a new low-cost infill

well at Geesbrug and workovers at Brakel and Grolloo. In addition,

a further Rotliegendes exploration target, De Mussels, has been

identified. Parkmead's robust gas production in the Netherlands

serves as a natural hedge to low and volatile oil prices.

Parkmead also achieved a successful period of licence

acquisition growth. In August 2016, the Group doubled its stake in

the Polecat and Marten oil fields in the UK Central North Sea. The

Polecat and Marten fields are located in Blocks 20/3c & 20/4a

within Licence P. 2218. Parkmead acquired a further 50% of Licence

P. 2218, and now operates this area with 100% equity. Parkmead

initially secured its first 50% interest in these blocks as part of

its success in the UK 28(th) Licensing Round awards, where the

Company gained a total of six new oil and gas licences covering 10

offshore blocks.

The Polecat and Marten fields lie approximately 20km east of the

Buzzard field, and are located close to Parkmead's major PDL hub

project in the prolific Moray Firth area of the Central North Sea.

Polecat and Marten are two sizeable existing Buzzard sandstone oil

accumulations, which are jointly estimated to hold over 90 million

barrels of oil in place and over 33 million barrels of 2C

resources. Through this acquisition, Parkmead has increased the

Group's total 2C resources by 41%, from 41.9 to 59.1 million

barrels of oil equivalent.

Polecat and Marten have the potential to be highly valuable to

Parkmead as, given their close proximity to PDL, they could be

jointly developed as part of the Greater PDL Area project. Polecat

was discovered in 2005 and appraised in 2010. The 2010 appraisal

well flow tested at 4,373 barrels per day of good quality 32deg API

oil. The Marten discovery was made in 1984, encountering three oil

bearing Upper Buzzard sandstone intervals. Parkmead benefits from

the large amount of existing data on the block, gathered as a

result of wells already drilled in the area.

In September 2016, Parkmead increased its stake in the centre of

the PDL area by securing additional equity in the Perth and Dolphin

oil fields. The Perth and Dolphin fields are located across Blocks

15/21a, b, c and f & 14/25a in the UK Central North Sea.

Through this growth step, Parkmead has increased its equity in

these licences to 60.05%. The Perth and Dolphin fields, which are

both operated by Parkmead, are at the core of Parkmead's PDL oil

hub project.

Perth and Dolphin are located in the Moray Firth area of the UK

Central North Sea, which contains very large oil fields such as

Piper, Claymore and Tartan. Through a series of licensing round

successes and strategic acquisitions, Parkmead has established an

important position for itself in this area of the North Sea. Perth

and Dolphin are two substantial Upper Jurassic Claymore sandstone

accumulations that have tested 32-38deg API oil at production rates

of up to 6,000 bopd per well. As a result of this latest move,

Parkmead has increased the Group's total proved and probable (2P)

reserves by 19% from 23.5 to 27.9 million barrels of oil

equivalent.

PDL is one of the largest undeveloped oil projects in the North

Sea. During 2014, a joint development study was carried out to

assess the potential of a development of the Lowlander field with

Perth and Dolphin. The analysis indicated that a joint development

of the three fields could significantly increase the value of the

Perth area.

An integrated, single project would create valuable economies of

scale, by using the same dedicated production facilities, whilst

providing a new long-term hub for other future projects in the

area. The three fields have been fully appraised, with a combined

total of 13 wells drilled, and contain oil in place of over 400

million barrels. It is expected that recoverable reserves from the

PDL oil hub development will be over 80 million barrels of oil,

which is double the initial recoverable reserves of the Perth field

as a standalone project.

Parkmead has made further progress in the period on the PDL

project, conducting detailed engineering and commercial work in

addition to working alongside regional partners in line with the

Wood Review and Moray Firth area study. Parkmead has continued to

work towards incorporating other proven oil fields in the wider

area into the PDL development. The Group's technical team is

studying a number of further oil accumulations in the area. One of

these is the Athena oil field to the west of Perth, in which

Parkmead is the largest equity owner.

Parkmead has also added exciting exploration acreage to its

portfolio during this reporting period. In July 2015, the Company

was awarded a new licence in the highly prospective West of

Shetland area. This new licence, covering Block 205/13, lies

adjacent to Parkmead's existing licence in the area targeting the

large Davaar prospect. Detailed mapping of Block 205/13 indicates

two new exploration targets, Sanda North and Sanda South, which

have the potential to contain 280 million barrels of recoverable

oil on a most likely, P50 basis. Parkmead's experienced team of

geoscientists has already begun detailed seismic reprocessing work

on this new licence.

Parkmead will continue to invest in licensing round applications

and views this as a key component in the Group's strategy of

building an attractive and balanced portfolio with significant

exploration upside.

Results

The Group's revenue for the year to 30 June 2016 was GBP10.4m

(2015: GBP18.6m). The significant reduction in global oil prices

has in turn reduced the Group's revenue during the period. During

the financial year the price of Brent crude oil averaged US$43 per

barrel and fell to a thirteen-year low of US$26 per barrel in

January 2016. This is a significant reduction from the previous

year's average oil price of US$74 per barrel and has therefore

severely impacted the revenues and cash flows of oil and gas

producers globally. Parkmead and its co-venturers have worked

tirelessly to reduce operating costs across the entire asset

portfolio to reflect the considerably altered macro

environment.

Oil production at the Athena field was shut-in in January 2016

as part of this cost reduction programme, substantially reducing

the Group's cost of sales from this point forward. Parkmead has

re-allocated capital to the Company's low-cost producing gas fields

in the Netherlands, where Parkmead's four separate gas fields have

an average operating cost of just US$14 per barrel of oil

equivalent. The new Diever West field in particular has extremely

low operating costs in the region of US$12 per barrel of oil

equivalent. Parkmead's gas portfolio in the Netherlands generates

positive cash flows despite the low current commodity prices.

Administrative expenses were GBP0.5m (2015: GBP1.2m credit), which

includes a credit in respect of a non-cash share based payment

charge.

Parkmead's total assets at 30 June 2016 were GBP87.5m (2015:

GBP105.6m). Available-for-sale financial assets were GBP2.6m (2015:

GBP3.3m). Cash and cash equivalents at year end were GBP28.3m

(2015: GBP41.1m). Parkmead is very carefully managed and remains

debt free. The Group's net asset value was GBP73.2m (2015:

GBP80.5m). Parkmead is therefore well positioned to withstand the

current market conditions, and indeed views the current macro

environment as an opportunity for further growth. This positive

position is a direct result of experienced portfolio management and

a strong focus on capital discipline.

Due to Parkmead's ongoing growth opportunities and associated

investment programme, the Board is not recommending the payment of

a dividend in 2016 (2015:GBPnil).

Investments

The Group's principal available-for-sale investment is its

shareholding in Faroe Petroleum plc ("Faroe") (LSE AIM: FPM.L). As

at 30 June 2016, the value of this investment was GBP2.6m (30 June

2015: GBP3.3m). Faroe's closing share price at 30 June 2016 was

68.00 pence per share.

Outlook

The Directors of Parkmead are pleased with the Group's

continuing progress in building an independent oil and gas company

of increasing breadth and scale. Parkmead has a balanced portfolio

of licences, growing gas production and a strong asset base.

Therefore, we believe Parkmead is well positioned to build further

on the progress to date and to capitalise on new opportunities. In

particular, we are delighted by the outperformance of production

achieved at Diever West and the significant additional oil reserves

secured in the UK North Sea at Perth and Dolphin, which strengthens

our strategic position in the region.

As we move towards 2017, Parkmead maintains its appetite for

acquisitions. We will also seek to add shareholder value through a

dynamic work programme to maximise the inherent value in our

existing assets. The Group has built a strong platform from which

to become a key E&P player in the North Sea, and we look

forward to updating shareholders as we make further progress.

Tom Cross

Executive Chairman

17 November 2016

This announcement is inside information for the purposes of

Article 7 of Regulation 596/2014.

Notes:

1. Dr Colin Percival, Parkmead's Technical Director, who holds a

First Class Honours Degree in Geology and a Ph.D in Sedimentology

and has over 30 years of experience in the oil and gas industry,

has reviewed and approved the technical information contained in

this announcement. Parkmead's evaluation of reserves and resources

was completed in accordance with the 2007 Petroleum Resources

Management System prepared by the Oil and Gas Reserves Committee of

the Society of Petroleum Engineers and reviewed and jointly

sponsored by the World Petroleum Council, the American Association

of Petroleum Geologists and the Society of Petroleum Evaluation

Engineers.

Glossary of key terms

Oil in place The total quantity of petroleum that is estimated to exist originally in naturally

occurring

reservoirs

Contingent Resources Those quantities of petroleum estimated, as of a given date, to be potentially

recoverable

from known accumulations by application of development projects but which are not

currently

considered to be commercially recoverable due to one or more contingencies.

Contingent Resources

are a class of discovered recoverable resources

Recoverable resources Those quantities of hydrocarbons that are estimated to be producible from discovered

or undiscovered

accumulations.

Proved and Probable or "2P" Those additional Reserves which analysis of geoscience and engineering data indicate

are less

likely to be recovered than Proved Reserve but more certain to be recovered than

Possible

Reserves. It is equally likely that actual remaining quantities recovered will be

greater

than or less than the sum of the estimated Proved plus Probable Reserves (2P). In

this context,

when probabilistic methods are used, there should be at least a 50 per cent.

probability that

the actual quantities recovered will equal or exceed the 2P estimate

Reserves Reserves are those quantities of petroleum anticipated to be commercially recoverable

by application

of development projects to known accumulations from a given date forward under

defined conditions.

Reserves must further satisfy four criteria: they must be discovered, recoverable,

commercial,

and remaining (as of the evaluation date) based on the development project(s)

applied. Reserves

are further categorized in accordance with the level of certainty associated with the

estimates

and may be sub-classified based on project maturity and/or characterized by

development and

production status

P50 Reflects a volume estimate that, assuming the accumulation is developed, there is a

50% probability

that the quantities actually recovered will equal or exceed the estimate. This is

therefore

a median or best case estimate

2C Denotes the best estimate scenario, or P50, of Contingent Resources

Group statement of profit

or loss

for the year ended 30 June

2016

Note 2016 2015

GBP'000 GBP'000

Continuing operations

Revenue 10,441 18,639

Cost of sales (15,061) (39,418)

Impairment of property, plant

and equipment 2 - (12,905)

-------------------------------- ----- --------- -----------

Gross loss (4,620) (33,684)

Exploration and evaluation

expenses (669) (266)

Administrative expenses 3 (527) 1,237

Operating loss (5,816) (32,713)

Finance income 164 4,074

Finance costs (766) (2,193)

Loss before taxation (6,418) (30,832)

Taxation (274) (529)

-------------------------------- ----- --------- -----------

Loss for the year attributable

to the equity holders of

the Parent (6,692) (31,361)

-------------------------------- ----- --------- -----------

Loss per share (pence)

Continuing operations

Basic 4 (6.76) (35.22)

Diluted (6.76) (35.22)

Group and company statement of profit or loss and

other comprehensive income

for the year ended 30 June 2016

Group Company

2016 2015 2016 2015

GBP'000 GBP'000 GBP'000 GBP'000

Profit / (loss)

for the year (6,692) (31,361) 523 (14,451)

Other comprehensive

income

Items that may

be reclassified

subsequently to

profit or loss

Fair value loss

on available-for-sale

financial assets (671) (1,506) (671) (1,506)

------------------------- --------- --------- --------- ---------

(671) (1,506) (671) (1,506)

Other comprehensive

loss income for

the year, net of

tax (671) (1,506) (671) (1,506)

------------------------- --------- --------- --------- ---------

Total comprehensive

loss for the year

attributable to

the equity holders

of the Parent (7,363) (32,867) (148) (15,957)

------------------------- --------- --------- --------- ---------

Group and company statement of financial position

as at 30 June 2016

Group Company

2016 2015 2016 2015

GBP'000 GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and

equipment: development

& production 17,986 18,717 - -

Property, plant and

equipment: other 75 139 75 135

Goodwill 2,174 2,174 - -

Other intangible

assets - - - -

Exploration and evaluation

assets 34,642 33,630 - -

Investment in subsidiaries

and joint ventures - - 25,025 16,640

Available-for-sale

financial assets 2,644 3,315 2,644 3,315

Deferred tax assets 3 242 - -

Total non-current

assets 57,524 58,217 27,744 20,090

------------------------------ --------- --------- --------- ---------

Current assets

Trade and other receivables 1,475 5,978 45,367 45,024

Current tax assets 195 243 - -

Cash and cash equivalents 28,288 41,121 15,492 26,069

------------------------------ --------- --------- --------- ---------

Total current assets 29,958 47,342 60,859 71,093

------------------------------ --------- --------- --------- ---------

Total assets 87,482 105,559 88,603 91,183

------------------------------ --------- --------- --------- ---------

Current liabilities

Trade and other payables (2,528) (14,634) (2,581) (4,821)

Interest-bearing

loans and borrowings - (412) - -

Current tax liabilities - - - -

Total current liabilities (2,528) (15,046) (2,581) (4,821)

------------------------------ --------- --------- --------- ---------

Non-current liabilities

Other liabilities (27) (278) (26) (276)

Deferred tax liabilities (1,284) (1,284) - -

Decommissioning provisions (10,479) (8,482) - -

------------------------------ --------- --------- --------- ---------

Total non-current

liabilities (11,790) (10,044) (26) (276)

------------------------------ --------- --------- --------- ---------

Total liabilities (14,318) (25,090) (2,607) (5,097)

------------------------------ --------- --------- --------- ---------

Net assets 73,164 80,469 85,996 86,086

------------------------------ --------- --------- --------- ---------

Equity attributable

to equity holders

Called up share capital 19,533 19,533 19,533 19,533

Share premium 87,805 87,805 87,805 87,805

Merger reserve 27,187 27,187 27,187 27,187

Revaluation reserve (3,381) (2,710) (3,381) (2,710)

Retained deficit (57,980) (51,346) (45,148) (45,729)

------------------------------ --------- --------- --------- ---------

Total Equity 73,164 80,469 85,996 86,086

------------------------------ --------- --------- --------- -----------

Group statement of changes in equity

for the year ended 30 June 2016

Share Share Merger Revaluation Retained Total

capital premium reserve reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July

2014 19,365 74,967 27,187 (1,204) (20,599) 99,716

Loss for

the year - - - - (31,361) (31,361)

Fair value

loss on available-for-sale

financial

assets - - - (1,506) - (1,506)

----------------------------- --------- --------- --------- ------------ ---------- ---------

Total comprehensive

loss for

the year - - - (1,506) (31,361) (32,867)

Issue of

new ordinary

shares 168 12,838 - - - 13,006

Gains arising

on repayment

of employee

share based

loans - - - - 271 271

Share-based

payments - - - - 343 343

----------------------------- --------- --------- --------- ------------ ---------- ---------

At 30 June

2015 19,533 87,805 27,187 (2,710) (51,346) 80,469

----------------------------- --------- --------- --------- ------------ ---------- ---------

Loss for

the year - - - - (6,692) (6,692)

Fair value

loss on available-for-sale

financial

assets - - - (671) - (671)

----------------------------- --------- --------- --------- ------------ ---------- ---------

Total comprehensive

loss for

the year - - - (671) (6,692) (7,363)

Share-based

payments - - - - 58 58

----------------------------- --------- --------- --------- ------------ ---------- ---------

At 30 June

2016 19,533 87,805 27,187 (3,381) (57,980) 73,164

----------------------------- --------- --------- --------- ------------ ---------- ---------

Company statement of changes in equity

for the year ended 30 June 2016

Share Share Merger Revaluation Retained Total

capital premium reserve reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July

2014 19,365 74,967 27,187 (1,204) (31,892) 88,423

Loss for

the year - - - - (14,451) (14,451)

Fair value

loss on available-for-sale

financial

assets - - - (1,506) - (1,506)

----------------------------- --------- --------- --------- ------------ ---------- ---------

Total comprehensive

loss for

the year - - - (1,506) (14,451) (15,957)

Issue of

new ordinary

shares 168 12,838 - - - 13,006

Gains arising

on repayment

of employee

share based

loans - - - - 271 271

Share-based

payments - - - - 343 343

----------------------------- --------- --------- --------- ------------ ---------- ---------

At 30 June

2015 19,533 87,805 27,187 (2,710) (45,729) 86,086

----------------------------- --------- --------- --------- ------------ ---------- ---------

Profit for

the year - - - - 523 523

Fair value

loss on available-for-sale

financial

assets - - - (671) - (671)

----------------------------- --------- --------- --------- ------------ ---------- ---------

Total comprehensive

income /

(loss) for

the year - - - (671) 523 (148)

Share-based

payments - - - - 58 58

----------------------------- --------- --------- --------- ------------ ---------- ---------

At 30 June

2016 19,533 87,805 27,187 (3,381) (45,148) 85,996

----------------------------- --------- --------- --------- ------------ ---------- ---------

Group and company statement of cashflows

for the year ended 30 June 2016

Group Company

2016 2015 2016 2015

Note GBP'000 GBP'000 GBP'000 GBP'000

Cashflows from operating

activities

Continuing activities 5 (10,581) (1,762) (10,739) (10,865)

Taxation paid 45 (469) - -

---------------------------------- ----- --------- --------- --------- ---------

Net cash (used in)

/ generated by operating

activities (10,536) (2,231) (10,739) (10,865)

---------------------------------- ----- --------- --------- --------- ---------

Cash flow from investing

activities

Interest received 132 152 102 124

Acquisition of exploration

and evaluation assets (1,490) (3,485) - -

Proceeds from available-for-sale

financial assets 32 - 32 -

Acquisition of property,

plant and equipment:

development and production (621) (9,026) - -

Acquisition of property,

plant and equipment:

other (21) (55) (21) (55)

Repayment of employee

share based loans - 271 - 271

Net cash (used in)

/ generated by investing

activities (1,968) (12,143) 113 362

---------------------------------- ----- --------- --------- --------- ---------

Cash flow from financing

activities

Issue of ordinary

shares - 13,007 - 13,007

Interest paid (29) (1,219) - -

Repayments of loans

and borrowings (438) (2,389) - (2,000)

Net cash (used in)

/ generated by financing

activities (467) 9,399 - 11,007

---------------------------------- ----- --------- --------- --------- ---------

Net decrease in cash

and cash equivalents (12,971) (4,975) (10,626) (15,490)

---------------------------------- ----- --------- --------- --------- ---------

Cash and cash equivalents

at beginning of year 41,121 46,346 26,069 41,589

Effect of foreign

exchange rate differences 138 (250) 49 (30)

---------------------------------- ----- --------- --------- --------- ---------

Cash and cash equivalents

at end of year 28,288 41,121 15,492 26,069

---------------------------------- ----- --------- --------- --------- ---------

Notes to the financial information for the year ended 30 June

2016

1. Basis of preparation of the financial information

The financial information set out in this announcement does not

comprise the Group and Company's statutory accounts for the years

ended 30 June 2016 or 30 June 2015.

The financial information has been extracted from the audited

statutory accounts for the years ended 30 June

2016 and 30 June 2015. The auditors reported on those accounts;

their reports were unqualified and did not

contain a statement under either Section 498 (2) or Section 498

(3) of the Companies Act 2006 and did not

include references to any matters to which the auditor drew

attention by way of emphasis.

The statutory accounts for the year ended 30 June 2015 have been

delivered to the Registrar of Companies. The

statutory accounts for the year ended 30 June 2016 will be

delivered to the Registrar of Companies following the

Company's Annual General Meeting.

The accounting policies are consistent with those applied in the

preparation of the interim results for the period

ended 31 December 2015 and the statutory accounts for the year

ended 30 June 2015, which have been prepared

in accordance with International Financial Reporting Standards

("IFRS").

2. Impairment of property, plant and equipment

The prior year comparative includes an impairment charge of

GBP12,905,000 in respect of the Athena producing asset in

accordance with IAS 36 "Impairment of assets". The impairment

reflected the difference between the carrying book value and the

estimated future economic value in use as a result of the altered

commodity price environment. Full details of the assumptions

applied in the impairment review as at 30 June 2016 are detailed in

Note 13 of the 2016 Annual Report.

3. Administrative expenses

Administrative expenses include a credit in respect of a

non-cash revaluation of share appreciation rights (SARs) and share

based payments totalling GBP1,359,000 (2015: GBP3,695,000). The

SARs may be settled by cash and are therefore revalued with the

movement in share price. The valuation was impacted by the altered

commodity price environment leading to a decline in share price

between 30 June 2015 and 30 June 2016.

4. Loss per share

Loss per share attributable to equity holders of the Company

arising from continuing operations was as follows:

2016 2015

Loss per 1.5p ordinary share

from continuing operations

(pence)

Basic (6.76) (35.22)

Diluted (6.76) (35.22)

The calculations were based on the following information:

2016 2015

GBP'000 GBP'000

Loss attributable to ordinary

shareholders

Continuing operations (6,692) (31,361)

Total (6,692) (31,361)

------------------------------------- ----------- -----------

Weighted average number of

shares in issue

Basic weighted average number

of shares 98,929,160 89,048,512

------------------------------------- ----------- -----------

Dilutive potential ordinary

shares

Share options - -

------------------------------------- ----------- -----------

Profit / (loss) per share is calculated by dividing the profit

or loss for the year by the weighted average number of ordinary

shares outstanding during the year.

Diluted loss per share

Loss per share requires presentation of diluted loss per share

when a company could be called upon to issue shares that would

decrease net profit or increase net loss per share. When the Group

makes a loss the outstanding share options are therefore

anti-dilutive and so are not included in dilutive potential

ordinary shares.

5. Notes to the statement of cashflows

Reconciliation of operating loss to net cash flow from

continuing operations

Group Company

2016 2015 2016 2015

GBP'000 GBP'000 GBP'000 GBP'000

Operating loss (5,816) (32,713) (12,400) (14,597)

Depreciation 2,724 6,422 81 88

Amortisation and exploration write off 478 265 - -

Impairment of property, plant and equipment - 12,905 - -

Provision for share based payments (674) (3,506) (674) (3,506)

Provision for intercompany receivable - - (4,983) 5,247

Impairment in subsidiary - - 17,405 11,377

Currency translation adjustments (138) 250 (49) 30

Decrease / (increase) in receivables 4,473 5,582 (8,362) (24,180)

Increase / (decrease) in payables (11,605) 9,494 (1,757) (857)

Increase / (decrease) in other provisions (23) (461) - (461)

---------------------------------------------- --------- --------- --------- ---------

Net cash flow from operations (10,581) (1,762) (10,739) (26,859)

---------------------------------------------- --------- --------- --------- ---------

6. Approval of this preliminary announcement

This announcement was approved by the Board of Directors on 17

November 2016.

7. Posting of annual report and accounts

Copies of the Annual Report and Accounts will be posted to

shareholders shortly. The Annual Report and Accounts will be made

available to download, along with a copy of this announcement, on

the investor relations section of the Company's website

www.parkmeadgroup.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR LIFFRLTLTLIR

(END) Dow Jones Newswires

November 18, 2016 02:01 ET (07:01 GMT)

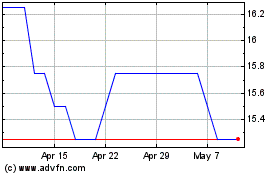

Parkmead (LSE:PMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

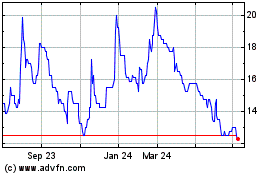

Parkmead (LSE:PMG)

Historical Stock Chart

From Apr 2023 to Apr 2024