TIDMPMG

RNS Number : 1473T

Parkmead Group (The) PLC

24 March 2016

24 March 2016

The Parkmead Group plc

("Parkmead", "the Company" or "the Group")

Interim Results for the six-month period ended 31 December

2015

Parkmead, the UK and Netherlands focused oil and gas group, is

pleased to report its interim results for the six-month period

ended 31 December 2015.

HIGHLIGHTS

Successful fast-track development, substantial increase in gas

production

-- First commercial gas production achieved at the Diever West

gas field in the Netherlands, following a successful fast-track

development

-- Excellent Diever-2 well is outperforming, averaging

approximately 30 million cubic feet per day during February

2016(approximately 5,100 barrels of oil equivalent per day)

-- Diever West field brought onstream within just 14 months of discovery

-- Low-cost onshore gas portfolio in the Netherlands produces

from four separate gas fields with an average operating cost of

US$14 per barrel of oil equivalent

-- Further production enhancement work planned on Parkmead's

Netherlands portfolio, including new wells at the Geesbrug and Wijk

en Aalburg gas fields to maximise production, serving as a natural

hedge to the current low oil price environment

-- Significant development opportunities exist within Parkmead's

Netherlands portfolio, in addition to low-risk exploration upside

such as the Rotliegendes De Mussels prospect

-- Detailed technical work has allowed Parkmead to high-grade

its portfolio and release non-core acreage, significantly reducing

licence costs

Significant progress on valuable development projects and

additional licence award

-- New minimal platform concept at the Platypus gas field

further increases the attractiveness of the development

-- Awarded a further new UK offshore licence, completing an excellent 28th Round for Parkmead

-- Parkmead's new licence is located in the highly prospective

West of Shetland area targeting two new prospects (Sanda North and

Sanda South) adjacent to existing Parkmead licences

Building substantial oil and gas reserves and resources

-- 2P reserves of 23.5 million barrels of oil equivalent as at 31 December 2015

-- Contingent resources of 41.9 million barrels of oil equivalent as at 31 December 2015

Well positioned for further acquisitions

-- Six acquisitions, at both asset and corporate level, have

already been completed since repositioning Parkmead as a new

independent oil and gas company

-- Parkmead is well capitalised with US$43.8 million (GBP29.6

million) of cash resources as at 31 December 2015

-- The Parkmead team is evaluating further acquisition

opportunities to take advantage of the current low oil price

environment

Financial strength

-- Net assets of GBP74.6 million at 31 December 2015 (2014: GBP82.8 million)

-- Revenue of GBP7.0 million (2014: GBP10.1 million)

-- Strong cash position of GBP29.6 million (US$43.8 million) as at 31 December 2015

-- Parkmead operates the majority of assets within its portfolio

and therefore controls the timing and quantum of capital

expenditure, with low capital commitments in 2016

Tom Cross, Executive Chairman of Parkmead commented:

"I am pleased to report significant progress in the period to 31

December 2015. Parkmead has developed a new gas field at Diever

West, in the Netherlands, following its successful discovery. This

is delivering profitable gas production and important additional

cash flow to the Group. We successfully brought this new gas field

onstream within 14 months of discovery, which is an outstanding

achievement.

Parkmead is increasing the Group's overall gas production in the

Netherlands through a low-cost, onshore work programme. This will

act as a natural hedge to the current low global oil prices.

We are delighted with our new additional licence award, in the

West of Shetland region, which further increases the scale of

Parkmead's oil and gas operations in the UK. West of Shetland is an

area we understand well and has the potential to add major value to

the Company.

Parkmead is well positioned to take advantage of the lower oil

price environment and the opportunities that are arising from this.

We have excellent regional expertise, significant cash resources

and a growing, low-cost gas portfolio. The Group will continue with

its licensing and acquisition-led growth strategy, securing

opportunities that maximise long-term value for our

shareholders."

For enquiries please contact:

The Parkmead Group plc +44 (0) 1224 622200

Tom Cross (Executive Chairman)

Ryan Stroulger (Chief Financial

Officer)

Panmure Gordon (UK) Limited +44 (0) 20 7886 2500

(Financial Adviser, NOMAD

and Corporate Broker to Parkmead)

Adam James

Karri Vuori

James Greenwood

Instinctif Partners Limited +44 (0) 20 7457 2020

(PR Adviser to Parkmead)

David Simonson

George Yeomans

Review of Activities

Parkmead has delivered significant growth across its oil and gas

operations in the UK and the Netherlands, continuing to build a

high quality portfolio at every stage of the asset life cycle.

In July 2015, Parkmead was awarded a new offshore licence in the

West of Shetland region under the UK 28th Licensing Round. This

newly awarded licence was part of the second tranche of 28th Round

awards. This latest award followed Parkmead's award of six licences

covering nine offshore blocks in the first tranche of awards. The

new licence, operated by Parkmead, is located in the highly

prospective West of Shetland area where the Group has a deep

technical knowledge of the exploration plays, and a strong

track-record of successful discoveries. This new licence completes

an excellent 28th Round for Parkmead.

The newly awarded licence, covering Block 205/13, is situated

adjacent to some of Parkmead's existing blocks in the West of

Shetland area, all of which are operated by Parkmead. Block 205/13

(Parkmead 74% and operator) is located immediately to the east of

the Parkmead operated Block 205/12, which contains the important

Davaar prospect. The primary play fairway developed on this acreage

is the Paleocene Vaila Formation which forms the reservoir in the

adjacent Foinaven, Schiehallion and Loyal oil fields, and also in

the Laggan and Tormore gas discoveries. Two prospects, Sanda North

and Sanda South, have been identified in Block 205/13 and provide

material upside to the Davaar prospect. On a P50 pre-drill basis,

Davaar has a potential resource of 186 million barrels of

recoverable oil. Parkmead has increased its equity interest in

Block 205/12, containing Davaar, to 74% and aligned the equity

ownership across the two licences.

Parkmead's experienced geoscience team has already initiated a

work programme on the new licence, with detailed biostratigraphic

work underway. The team will continue to work hard on licensing

round applications, both in the UK and Netherlands, and views this

as a key component in the Group's strategy to build an attractive

and balanced portfolio that offers considerable exploration

upside.

In November 2015, first commercial gas production was achieved

at the Diever West gas field in the Netherlands. The field was

discovered in September 2014 and, under a fast-track and low-cost

development programme, was tied into existing production facilities

through a new dedicated pipeline with gas extraction via the Garijp

treatment system. Parkmead has worked closely with its

joint-venture partners on the fast-track development of the Diever

West field, and the partnership successfully brought the field

onstream within just 14 months of discovery. This is an outstanding

achievement.

Diever West is located onshore on the western edge of the Lower

Saxony Basin, approximately 10km to the east of the producing

Weststellingwerf, Noordwolde, Vinkega and Nijensleek fields, on the

Drenthe IIIb Production licence, which also contains Parkmead's

producing Geesbrug gas field.

The Diever-2 well was drilled in September 2014 on behalf of the

co-venturers by operator Vermilion Energy, and gas was discovered

in a good quality Rotliegendes age sandstone reservoir. A 157 foot

gas column was encountered, with both net pay and porosity values

exceeding pre-drill expectations. The well was flow tested after

the successful discovery and recorded an excellent flow rate of 29

million cubic feet of gas per day (approximately 5,000 barrels of

oil equivalent per day).

The Lower Permian Rotliegendes sandstone in this area contains

three productive formations, and Diever-2 confirmed the presence of

all three reservoir sections. The Slochteren Sandstone formation in

the vicinity possesses excellent reservoir properties, typically

exhibiting a net-to-gross ratio in excess of 90% and porosities of

approximately 20%.

The Diever-2 well has performed excellently since first

production was achieved. The average field production in February

2016 was approximately 30 million cubic feet per day (approximately

5,100 barrels of oil equivalent per day). The profitable gas

production from Diever West, and Parkmead's wider portfolio of gas

fields in the Netherlands, provides important additional cash flow

to the Group. A number of enhanced production opportunities are

available across Parkmead's existing Netherlands portfolio, which

the Group intends to capitalise on, with the aim of significantly

increasing its net gas production. These include new low-cost

infill wells at Geesbrug and Wijk en Aalburg, in addition to a

further Rotliegendes exploration target at De Mussels. The new

production from Diever West and the additional Geesbrug well are

forecast to more than quadruple Parkmead's net gas production in

the Netherlands. This will serve as a natural hedge to low and

volatile oil prices.

(MORE TO FOLLOW) Dow Jones Newswires

March 24, 2016 03:01 ET (07:01 GMT)

Significant progress was made during the period at Parkmead's

Platypus gas field development. Detailed development concept work

was undertaken by the joint-venture partners in order to optimise

the development of the Platypus field. It was found that by

collaborating with other facilities in the area a minimal platform

concept can be adopted, substantially reducing development

expenditure. In addition, the field's gas reserves can be

efficiently recovered from two rather than three development wells.

This increases the value of the already economic Platypus

development. The Platypus gas field was discovered in 2010 and was

successfully appraised with a horizontal well in 2012. Platypus was

flow tested at a rate of 27 million cubic feet of gas per day

(approximately 4,600 barrels of oil per day on an equivalent

basis).

Parkmead has made further progress in the period with the major

Perth, Dolphin and Lowlander (PDL) oil hub development. Detailed

engineering and commercial work was carried out in addition to

working alongside regional partners in line with the Wood Review

and Moray Firth area study. Parkmead has continued to make progress

towards incorporating other proven oil fields in the wider area

into the PDL development. The Group's technical team is studying a

number of further oil accumulations in the area, one of which is

the Athena oil field to the west of Perth.

PDL is one of the largest undeveloped oil projects in the North

Sea. During 2014, a joint development study was carried out to

assess the potential of a development of the Lowlander field with

Perth and Dolphin. The analysis indicated that a joint development

of the three fields could significantly increase the value of the

Perth project. This marked an important milestone for Parkmead.

The development of the Perth, Dolphin and Lowlander fields as a

single project creates significant economies of scale, by using the

same dedicated production facilities, whilst providing a new

long-term hub for future projects in the area. The three fields

have been fully appraised, with a combined total of 13 wells

drilled, and contain oil in place of over 400 million barrels. It

is expected that recoverable reserves from the PDL oil hub

development will be over 80 million barrels of oil, double the

initial recoverable reserves of Perth as a standalone project.

Financial Results

During the six month period to 31 December 2015, the Group

generated revenues of GBP7.0 million (2014: GBP10.1 million). The

reduction in revenues was principally attributable to the global

drop in commodity prices with Brent crude oil averaging US$48 per

barrel in the second half of 2015 compared to US$91 per barrel in

the second half of 2014. The reduction in revenue was partly offset

by the increasing contribution from Diever West in the Netherlands

following first gas in November 2015.

A significant reduction in operating costs was achieved in the

period which, combined with no impairment charge being recorded

compared to the corresponding period last year, reduced the Group's

post-tax loss substantially to GBP4.8 million (2014: GBP14.9

million). The Athena field was shut-in in January 2016 following

which the final operating costs will substantially be incurred

before the end of Q1 2016. Parkmead's low-cost producing gas fields

in the Netherlands (where the four separate gas fields have an

average operating cost of US$14 per barrel of oil equivalent)

generate positive cash flows despite very low current commodity

prices. The new Diever West field in particular has extremely low

operating costs in the region of US$12 per barrel of oil

equivalent.

Administrative expenses provided a credit of GBP0.3 million

(2014: GBP1.5 million credit), arising principally from the lower

share price impacting the non-cash share based payment charge. In

addition to the share-based charges recurring administrative

expenses have been reduced and are continually being monitored and

challenged to ensure Parkmead maintains a strong balance sheet.

The Group's cash and cash equivalents stood at GBP29.6 million

at 31 December 2015 with nominal debt, reflecting the strength of

the Group's balance sheet. Parkmead is well positioned to withstand

the unprecedented market conditions, and indeed views the current

macro environment as an opportunity for further growth. This

position is as a result of careful and experienced portfolio

management, with a keen focus on capital discipline. Parkmead

operates the majority of assets within its portfolio and therefore

controls the timing and quantum of capital expenditure, with low

planned capital commitments in 2016.

Total assets were GBP90.3 million as at 31 December 2015

(GBP109.6 million as at 31 December 2014). Net assets were GBP74.6

million as at 31 December 2015 (GBP82.8 million as at 31 December

2014).

Investments

The Group's largest investment is in Faroe Petroleum plc (LSE

AIM: FPM.L). As at 31 December 2015 this investment was carried at

a value of GBP2.1 million.

Outlook

Parkmead has delivered significant growth in its asset base in

the six month period to 31 December 2015. This was achieved through

a successful fast-track development and new licence award, all

within our core areas of the UK and the Netherlands.

The Group is in a strong position, both operationally and

financially, at a challenging time in the global oil and gas

industry. The Board has positioned Parkmead to take advantage of

the lower oil price environment and views this as a good

opportunity to continue the Group's strong trajectory. Our

acquisition-led growth strategy has resulted in six deals for

Parkmead since repositioning the business as an independent oil and

gas company in 2011, and we intend to build on this excellent track

record. As we look forward into 2016 and beyond, we will continue

to keep shareholders informed of our progress across our

exploration, appraisal, development and production activities. The

Board of Directors is pleased with the Group's progress, and

believes that Parkmead is well positioned to drive the business

forward and to build upon the achievements already made to

date.

Tom Cross

Executive Chairman

24 March 2016

Notes:

1. Dr Colin Percival, Parkmead's Technical Director, who holds a

First Class Honours Degree in Geology and a Ph.D in Sedimentology

and has over 30 years of experience in the oil and gas industry,

has reviewed and approved the technical information contained in

this announcement. Reserves and contingent resource estimates are

stated as at 31 December 2015. Parkmead's evaluation of reserves

and resources was prepared in accordance with the 2007 Petroleum

Resources Management System prepared by the Oil and Gas Reserves

Committee of the Society of Petroleum Engineers and reviewed and

jointly sponsored by the World Petroleum Council, the American

Association of Petroleum Geologists and the Society of Petroleum

Evaluation Engineers.

Group statement of profit

or loss

for the six months ended 31 December 2015

Twelve

Six months Six months months

to 31 to 31 to 30

December December June

2015 2014 2015

Notes (unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 6,996 10,118 18,639

Cost of sales (11,081) (16,871) (39,418)

Impairment of property,

plant and equipment 2 - (12,905) (12,905)

----------------------------------------------------- -------- ------------ ------------ ---------

Gross loss (4,085) (19,658) (33,684)

Exploration and evaluation

expenses (550) (57) (266)

Administrative credit 3 347 2,282 1,237

----------------------------------------------------- -------- ------------ ------------ ---------

Operating loss (4,288) (17,433) (32,713)

Finance income 120 1,487 4,074

Finance costs (395) (1,072) (2,193)

Loss before taxation (4,563) (17,018) (30,832)

Taxation (192) 2,091 (529)

----------------------------------------------------- -------- ------------ ------------ ---------

Loss for the period attributable

to the equity

holders of the Parent (4,755) (14,927) (31,361)

--------------------------------------------------------------- ------------ ------------ ---------

Loss per share (pence)

Continuing operations

Basic 4 (4.81) (19.59) (35.22)

Diluted (4.81) (19.59) (35.22)

Group statement of profit or loss and other comprehensive

income

for the six months ended 31 December 2015

Twelve

Six months Six months months

(MORE TO FOLLOW) Dow Jones Newswires

March 24, 2016 03:01 ET (07:01 GMT)

to 31 to 31 to 30

December December June

2015 2014 2015

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Loss for the period (4,755) (14,927) (31,361)

----------------------------------------------------- -------- ------------ ------------ -----------

Other comprehensive income

Items that may be reclassified

subsequently to profit

or loss

Fair value loss on available-for-sale

financial assets (1,205) (2,468) (1,506)

----------------------------------------------------- -------- ------------ ------------ -----------

(1,205) (2,468) (1,506)

Income tax relating to

components of other comprehensive

income - - -

Other comprehensive loss

for the period, net of

tax (1,205) (2,468) (1,506)

Total comprehensive loss

for the period attributable

to the equity holders

of the Parent (5,960) (17,395) (32,867)

----------------------------------------------------- -------- ------------ ------------ -----------

Group statement of financial position

as at 31 December 2015

At 31 At 31 At 30

December December June

2015 2014 2015

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment:

development & production 18,493 25,491 18,717

Property, plant and equipment:

other 112 156 139

Goodwill 2,174 2,174 2,174

Exploration and evaluation

assets 33,675 33,858 33,630

Available-for-sale financial

assets 2,109 2,352 3,315

Deferred tax assets 51 2,942 242

Total non-current assets 56,614 66,973 58,217

--------------------------------- ------------ ------------ ---------

Current assets

Trade and other receivables 3,931 3,159 5,978

Current tax asset 173 111 243

Cash and cash equivalents 29,581 39,394 41,121

Total current assets 33,685 42,664 47,342

--------------------------------- ------------ ------------ ---------

Total assets 90,299 109,637 105,559

--------------------------------- ------------ ------------ ---------

Current liabilities

Trade and other payables (4,184) (6,995) (14,634)

Interest-bearing loans and

borrowings (67) (542) (412)

Other provisions (64) (128) -

Total current liabilities (4,315) (7,665) (15,046)

--------------------------------- ------------ ------------ ---------

Non-current liabilities

Interest-bearing loans and - (4,181)

borrowings -

Other liabilities - (699) (278)

Deferred tax liabilities (1,284) (1,541) (1,284)

Decommissioning provisions (10,121) (12,770) (8,482)

--------------------------------- ------------ ------------ ---------

Total non-current liabilities (11,405) (19,191) (10,044)

--------------------------------- ------------ ------------ ---------

Total liabilities (15,720) (26,856) (25,090)

--------------------------------- ------------ ------------ ---------

Net assets 74,579 82,781 80,469

--------------------------------- ------------ ------------ ---------

Equity attributable to equity

holders

Called up share capital 19,533 19,365 19,533

Share premium 87,805 74,967 87,805

Merger reserve 27,187 27,187 27,187

Revaluation reserve (3,915) (3,672) (2,710)

Retained deficit (56,031) (35,066) (51,346)

--------------------------------- ------------ ------------ ---------

Total equity 74,579 82,781 80,469

--------------------------------- ------------ ------------ ---------

Group statement of changes in equity

for the six months ended 31 December 2015

Share Share Merger Revaluation Retained Total

capital premium reserve reserve earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 July

2014 19,365 74,967 27,187 (1,204) (20,599) 99,716

Loss for

the period - - - - (14,927) (14,927)

Fair value

loss on available-for-sale

financial

assets - - - (2,468) - (2,468)

Total comprehensive

loss for

the period - - - (2,468) (14,927) (17,395)

Gains arising

on repayment

of employee

share based

loan - - - - 271 271

Share-based

payments - - - - 189 189

----------------------------- --------- --------- --------- ------------ ---------- ---------

At 31 December

2014 19,365 74,967 27,187 (3,672) (35,066) 82,781

----------------------------- --------- --------- --------- ------------ ---------- ---------

Loss for

the period - - - - (16,434) (16,434)

Fair value

gain on available-for-sale

financial

assets - - - 962 - 962

----------------------------- --------- --------- --------- ------------ ---------- ---------

Total comprehensive

gain/(loss)

for the period - - - 962 (16,434) (15,472)

Issue of

new ordinary

shares 168 12,838 - - - 13,006

Share-based

payments - - - - 154 154

----------------------------- --------- --------- --------- ------------ ---------- ---------

At 30 June

2015 19,533 87,805 27,187 (2,710) (51,346) 80,469

----------------------------- --------- --------- --------- ------------ ---------- ---------

Loss for

the period - - - - (4,755) (4,755)

Fair value

loss on available-for-sale

financial

assets - - - (1,205) - (1,205)

Total comprehensive

loss for

the period - - - (1,205) (4,755) (5,960)

Share-based

payments - - - - 70 70

----------------------------- --------- --------- --------- ------------ ---------- ---------

At 31 December

2015 19,533 87,805 27,187 (3,915) (56,031) 74,579

----------------------------- --------- --------- --------- ------------ ---------- ---------

Group statement of cashflows

for the six months ended 31 December

2015

Twelve

Six months Six months months

to 31 to 31 to 30

December December June

2015 2014 2015

(unaudited) (unaudited)

Notes GBP'000 GBP'000 GBP'000

Cashflows from operating

activities

Continuing activities 5 (9,772) 4,977 (1,762)

Taxation received/(paid) 80 (139) (469)

----------------------------------- ------ ------------ ------------ ---------

Net cash (used in)/generated

by operating activities (9,692) 4,838 (2,231)

----------------------------------- ------ ------------ ------------ ---------

Cash flow from investing

activities

Interest received 120 92 152

(MORE TO FOLLOW) Dow Jones Newswires

March 24, 2016 03:01 ET (07:01 GMT)

Acquisition of exploration

and evaluation assets (1,005) (2,685) (3,485)

Acquisition of property,

plant and equipment: development

& production (627) (8,634) (9,026)

Acquisition of property,

plant and equipment: other (21) (25) (55)

Repayment of employee share

based loans - 271 271

Net cash (used in) investing

activities (1,533) (10,981) (12,143)

----------------------------------- ------ ------------ ------------ ---------

Cash flow from financing

activities

Issue of ordinary shares - - 13,007

Interest paid (4) (679) (1,219)

Repayments of loans and

borrowings (401) (130) (2,389)

Net cash (used in)/generated

by financing activities (405) (809) 9,399

----------------------------------- ------ ------------ ------------ ---------

Net decrease in cash and

cash equivalents (11,630) (6,952) (4,975)

----------------------------------- ------ ------------ ------------ ---------

Cash and cash equivalents

at beginning of period 41,121 46,346 46,346

Effect of foreign exchange

rate differences 90 - (250)

----------------------------------- ------ ------------ ------------ ---------

Cash and cash equivalents

at end of period 29,581 39,394 41,121

----------------------------------- ------ ------------ ------------ ---------

Notes to the Interim financial statements

1 Accounting policies

Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with International

Financial Reporting Standards (IFRS) as adopted by the European

Union and IFRS Interpretations Committee (IFRIC) interpretations.

IFRS is subject to amendment and interpretation by the

International Accounting Standards Board (IASB) and IFRIC and there

is an ongoing process of review and endorsement by the European

Commission. The financial information has been prepared on the

basis of IFRS that the Directors expect to be adopted by the

European Union and applicable as at 30 June 2016.

The Group has chosen not to adopt IAS 34 - Interim Financial

Statements, in preparing these financial statements.

Non-statutory accounts

The financial information set out in this interim report does

not constitute the Group's statutory accounts.

The financial information for the year ended 30 June 2015 has

been extracted from the audited statutory accounts. The statutory

accounts for the year ended 30 June 2015 have been delivered to the

Registrar of Companies. The auditors reported on those accounts;

their report was unqualified, did not contain a statement under

either Section 498 (2) or Section 498 (3) of the Companies Act 2006

and did not include references to any matters to which the auditor

drew attention by way of emphasis.

The financial information for the 6 months ended 31 December

2015 and 31 December 2014 is unaudited.

2 Impairment of property, plant and equipment

The prior year comparative includes an impairment charge of

GBP12,905,000 recorded in respect of the Athena producing asset in

accordance with IAS 36 "Impairment of assets". Full details of the

impairment were disclosed in the 2015 Annual Report. Further

details on the Athena asset are contained within Note 6 below

(events after the end of the interim period).

3 Administrative expenses

Administrative expenses include a credit in respect of a

non-cash revaluation of share appreciation rights (SARs) totalling

GBP1,428,000 (Six months to 31 December 2014: GBP3,121,000 credit,

Twelve months to 30 June 2015: GBP4,038,000 credit). The SARs are

revalued with the movement in share price. The valuation was

impacted by the decline in share price between 30 June 2015 and 31

December 2015.

4 Loss per share

Loss per share attributable to equity holders of the Company

arise from continuing operations as follows:

Twelve

Six months Six months months

to 31 to 31 to 30

December December June

2015 2014 2015

(unaudited) (unaudited)

Loss per 1.5p ordinary share

from continuing operations

(pence)

Basic (4.81) (19.59) (35.22)

Diluted (4.81) (19.59) (35.22)

-------------------------------- ------------ ------------ --------

The calculations were based on the following information:

Twelve

Six months Six months months

to 31 to 31 to 30

December December June

2015 2014 2015

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Loss attributable to ordinary

shareholders

Continuing operations (4,755) (14,927) (31,361)

Total (4,755) (14,927) (31,361)

------------------------------- ------------ ------------ -----------

Weighted average number

of shares in issue

Basic weighted average

number of shares 98,929,160 76,215,704 89,048,512

------------------------------- ------------ ------------ -----------

Dilutive potential ordinary

shares

Share options - - -

------------------------------- ------------ ------------ -----------

Profit/(loss) per share is calculated by dividing the profit or

loss for the period by the weighted average number of ordinary

shares outstanding during the period.

Diluted loss per share

Loss per share requires presentation of diluted loss per share

when a company could be called upon to issue shares that would

decrease net profit or increase net loss per share. When the Group

makes a loss the outstanding share options are therefore

anti-dilutive and so are not included in dilutive potential

ordinary shares.

5 Notes to the statement of cashflows

Reconciliation of operating loss to net cash flow from

operations

Twelve

Six months Six months months

to 31 to 31 to 30

December December June

2015 2014 2015

(unaudited) (unaudited)

GBP'000 GBP'000 GBP'000

Operating loss (4,288) (17,433) (32,713)

Depreciation 2,589 3,169 6,422

Amortisation and exploration

write-off 550 51 265

Impairment of property,

plant and equipment - 12,905 12,905

Provision for share based

payments (1,289) (2,932) (3,506)

Currency translation adjustments (77) - 250

Decrease in receivables 2,048 8,401 5,582

(Decrease)/Increase in

payables (9,369) 795 9,494

Increase/(decrease) in

other provisions 64 21 (461)

---------------------------------- ------------ ------------ ---------

Net cash flow from operations (9,772) 4,977 (1,762)

---------------------------------- ------------ ------------ ---------

6 Events after the end of the interim period

A decision was made to shut-in the Athena field on 4 January

2016 and the BW Athena FPSO has since been moved off-station. This

followed a dramatic decline in oil price from mid-2014 which was

sustained into 2015. This rendered the offtake solution of a

dedicated FPSO servicing the Athena field no longer commercially

viable in the current environment. The Company will continue to

evaluate an alternative low-cost offtake route, potentially using

Parkmead's other assets in the wider area, to extract the proven

reserves which exist in the Athena reservoir. The financial impact

from the above, all other things being equal, will be a reduction

in both revenue and cost of sales in future periods. Due to the

nature of the oil price environment during the course of 2015 we

anticipate this will have a positive impact on operating results in

2016.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR EAKDLADAKEEF

(END) Dow Jones Newswires

March 24, 2016 03:01 ET (07:01 GMT)

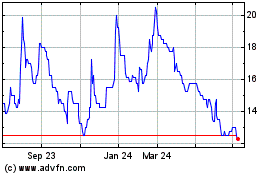

Parkmead (LSE:PMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

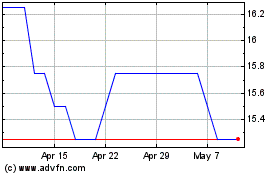

Parkmead (LSE:PMG)

Historical Stock Chart

From Apr 2023 to Apr 2024