TIDMPMG

RNS Number : 4032G

Parkmead Group (The) PLC

20 November 2015

20 November 2015

The Parkmead Group plc

("Parkmead", "the Company" or "the Group")

First gas production from the Diever West gas field

Parkmead, the UK and Netherlands focused independent oil and gas

group, is delighted to announce that first commercial gas

production has been achieved at the Diever West gas field in the

Netherlands. The field was discovered in September 2014 and, under

a fast-track and low-cost development programme, has been tied into

existing production facilities through a new dedicated pipeline

with gas extraction via the Garijp treatment system.

Parkmead has worked closely with its joint-venture partners on

the fast-track development of the Diever West field, and the

partnership has successfully brought the field onstream within just

14 months of discovery. This is an outstanding achievement.

Diever West is located onshore on the western edge of the Lower

Saxony Basin, approximately 10km to the east of the producing

Weststellingwerf, Noordwolde, Vinkega and Nijensleek fields, on the

Drenthe IIIb Production licence, which also contains Parkmead's

producing Geesbrug gas field.

The Diever-2 well was drilled in September 2014 on behalf of the

co-venturers by operator Vermilion Energy, and gas was discovered

in a good quality Rotliegendes age sandstone reservoir. A 157 foot

gas column was encountered, with both net pay and porosity values

exceeding pre-drill expectations. The well was flow tested after

the successful discovery and recorded an excellent flow rate of 29

million cubic feet per day (approximately 5,000 barrels of oil

equivalent per day).

The Lower Permian Rotliegend sandstone in this area contains

three productive formations, and Diever-2 confirmed the presence of

all three reservoir sections. The Slochteren Sandstone formation in

the vicinity possesses excellent reservoir properties, typically

exhibiting a net-to -gross ratio in excess of 90% and porosities of

approximately 20%.

Parkmead's gas assets in the Netherlands continue to provide a

robust revenue stream and important net cash flows to the Company.

A number of enhanced production opportunities are available across

Parkmead's existing Netherlands portfolio, which the Company

intends to capitalise on, with the aim of significantly increasing

its net gas production. These include a new low-cost infill well at

Geesbrug and a further exploration target at De Mussels. The new

production from Diever West and the additional Geesbrug well are

forecast to more than treble Parkmead's net gas production in the

Netherlands. This will serve as a natural hedge against low and

volatile oil prices.

Tom Cross, Executive Chairman, commented:

"We are delighted to achieve first gas from the Diever West

field in the Netherlands, which provides an important additional

revenue stream for Parkmead. The Company has already received

revenues from the first gas sales from the field.

Parkmead has worked closely with its joint-venture partners on

the fast-track development of Diever West. We have successfully

brought this new gas field onstream within just 14 months of

discovery. This is an outstanding achievement.

The new gas production from Diever West will act as a natural

hedge to the low oil price environment at this key stage in

Parkmead's growth."

Enquiries:

The Parkmead Group plc

Tom Cross (Executive Chairman) +44 (0) 1224 622200

Ryan Stroulger (Chief Financial Officer) +44 (0) 1224 622200

Panmure Gordon (UK) Limited (Financial

Adviser, NOMAD and Corporate Broker

to Parkmead)

Mark Taylor +44 (0) 20 7886 2500

Karri Vuori +44 (0) 20 7886 2500

James Greenwood +44 (0) 20 7886 2500

Instinctif Partners Limited (PR Adviser

to Parkmead)

David Simonson +44 (0) 20 7457 2020

Anca Spiridon +44 (0) 20 7457 2020

Notes to Editors:

1. Dr Colin Percival, Parkmead's Technical Director, who holds a

First Class Honours Degree in Geology and a Ph.D in Sedimentology

and has over 30 years of experience in the oil and gas industry,

has reviewed and approved the technical information contained in

this announcement.

2. Parkmead is an independent, upstream oil and gas company that

is admitted to trading on AIM on the London Stock Exchange (symbol:

PMG). Parkmead is focused on growth in the oil and gas exploration

and production sector, targeting transactions at both asset and

corporate levels.

3. In November 2011, Parkmead completed the acquisition of

stakes in UK Blocks 48/1a, 47/5b and 48/1c containing the Platypus

gas field and the Possum gas prospect. Mapping indicates the

potential for Platypus and Possum to contain up to 180 and 100

billion cubic feet of gas in place, respectively.

4. In December 2011, Parkmead agreed to acquire stakes in blocks

47/4d, 47/5d, 47/10c and 48/6c in the UK Southern North Sea, which

contained the Pharos gas prospect. These two gas-basin acquisitions

were important steps in the first stage of Parkmead's development

as a new independent energy company.

5. In March 2012, Parkmead agreed to acquire a portfolio of

Netherlands onshore assets comprising four producing gas fields and

two oil fields from Dyas B.V. This acquisition provided the Group

with its first producing fields and with future oil developments at

Ottoland and Papekop. This acquisition completed in August

2012.

6. In May 2012, Parkmead launched its recommended acquisition of

DEO Petroleum plc. As a result, Parkmead now owns 52% and is

operator of the UKCS Perth oil field

7. In October 2012, Parkmead was awarded several new licences

under the UKCS 27(th) Licensing Round. The six new licences

comprise interests in a total of 25 offshore blocks or partial

blocks across the Central North Sea, West of Scotland and West of

Shetland.

8. In July 2013, Parkmead completed its recommended offer for

Lochard Energy Group plc. This gave Parkmead a 10% interest in the

producing Athena oil field.

9. In December 2013, in the second tranche of the UKCS 27(th)

Licensing Round, Parkmead was awarded a further five UK blocks

through two new licences in the UK Southern North Sea. That made a

total award to Parkmead of 30 UK blocks across eight licences

within the UKCS 27(th) Licensing Round.

10. In January 2014, Parkmead completed a successful

oversubscribed placing raising US$66.0 million which provided the

Company with increased financial firepower and balance sheet

strength.

11. In April 2014, Parkmead completed the acquisition of a 20

per cent. interest in the Athena oil field from EWE VERTRIEB GmbH,

trebling Parkmead's interest in the Athena oil field to 30 per

cent.

12. In September 2014, Parkmead discovered a new gas field

onshore the Netherlands at Diever West.

13. In November 2014, Parkmead was awarded six new licences in

the UKCS 28(th) Licensing Round, all as operator. The six new

licences comprise interests in a total of nine offshore blocks

located in the Central and Southern North Sea.

14. In May 2015, Parkmead completed a successful placing raising

US$21.1 million to accelerate opportunities.

15. In July 2015, Parkmead was awarded three new licences in the

UKCS 28(th) Licensing Round. The three new licences comprise

interest in three offshore blocks located in the Southern North Sea

and West of Shetland vicinity.

16.Through its wholly owned subsidiary, Aupec Limited, The

Parkmead Group provides petroleum benchmarking and economics

expertise to a wide range of government bodies and international

oil and gas companies. Aupec has to date worked with over 100

governments, national oil companies, majors and independents,

across the world, as well as a number of multi-national agencies

such as the European Commission and the World Bank. Aupec is

currently undertaking an important benchmarking project for a group

of the world's largest super-major oil companies.

For further information please refer to Parkmead's website at

www.parkmeadgroup.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCDMMZMVGFGKZG

(END) Dow Jones Newswires

November 20, 2015 02:01 ET (07:01 GMT)

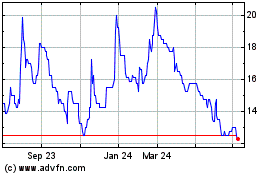

Parkmead (LSE:PMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

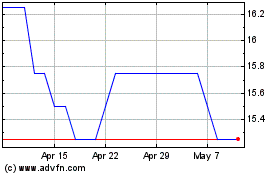

Parkmead (LSE:PMG)

Historical Stock Chart

From Apr 2023 to Apr 2024