Pangaea Logistics Solutions Ltd. (“Pangaea” or the “Company”)

(NASDAQ:PANL), a global provider of comprehensive maritime

logistics solutions, announced today the results for Bulk Partners

(Bermuda) Ltd., (“Bulk Partners”) for the third quarter

ended September 30, 2014. Future reporting will be from

Pangaea, the 100% parent of Bulk Partners as of October 1,

2014.

Third Quarter 2014 Highlights & Recent

Developments

- Revenue of $91.2 million for

the third quarter of 2014

- 25% increase in voyage days,

demonstrating increasing demand for services

- Completed public listing; began trading

under NASDAQ: PANL

- Took delivery of m/v Nordic Oshima, a

76,180 dwt ice-class 1A panamax dry bulk carrier

- Signed two new long-term contracts of

affreightment (“COAs”) to support its ice-class fleet

Edward Coll, Chairman and Chief Executive Officer of Pangaea

Logistics Solutions, stated, “The third quarter of 2014 presented a

challenging rate environment, continuing what we experienced during

the second quarter. Despite these headwinds, we were able

to effectively leverage our relationships in the industry and

create revenue opportunities where others could not. Further, we

are incredibly pleased to have begun publicly trading and look

forward to building increased shareholder value.”

Third Quarter and Nine-Months 2014 Financial Results

For the quarter ended September 30, 2014, total revenue

was $91.2 million. Total revenue was $295.2 million for the

nine months ended September 30, 2014.

Bulk Partners reported a loss from operations of $1.9 million

for the third quarter of 2014, and income from operations of $11.5

million for the nine months ended September 30, 2014.

Bulk Partners reported a net loss after non-controlling

interests of $2.9 million for the third quarter, and net

income after non-controlling interests of $4.9 million for the nine

months ended September 30, 2014.

“Our voyage days increased 25% in the quarter over the same

period last year, demonstrating strong demand for our services,”

Coll added. “That said, operating margins were under significant

pressure due to weakened market rates in the vast majority of the

dry shipping segments.”

Assuming the merger had been consummated as of January 1, 2014,

the Company’s pro forma earnings per share for the nine months

ended September 30, 2014 was $0.11 basic and diluted, which were

calculated based on 34,696,997 shares.

Cash Flows

For the nine months ended September 30, 2014, Bulk

Partners’ net cash provided by operating activities was $16.4

million, compared to $18.9 million for the nine months

ended September 30, 2013.

For the nine months ended September 30, 2014 and 2013, net

cash used in investing activities was $30.1 million and

$75.7 million, respectively. Net cash provided by financing

activities was $14.9 million and $60.9 million for the nine

months ended September 30, 2014 and 2013, respectively. This

reflects increased borrowing to finance the purchase of additional

vessels and take delivery of the m/v Nordic Oshima.

“We continue to invest operating cash flow in newbuilding

vessels in the ice-class trade, a market that is well-protected

from the newbuilding backlog and where we have distinct strategic

advantages,” Coll said.

Recent Developments

The following events took place after the close of the third

quarter:

- On October 1, 2014, Bulk Partners

completed its merger with Quartet. The combined company is a wholly

owned subsidiary of Pangaea Logistics Solutions. On October 3,

2014, the Company’s common shares commenced trading on NASDAQ under

the ticker symbol PANL.

- On October 8, 2014, Pangaea announced

that ASO 2020 Maritime, an affiliate of the Alexander S. Onassis

Public Benefit Foundation, executed a letter of intent to acquire a

stake in Pangaea.

- On October 28, 2014, the Company

announced the delivery of the m/v Nordic Oshima, a 76,180 dwt

ice-class 1A panamax dry bulk carrier. Pangaea took delivery of the

vessel on September 25, 2014 from Oshima Shipbuilding Co.,

Ltd.

- On November 14, 2014, the Company

announced long-term COAs that will help support the activities of

its specialized ice-class 1A panamax vessels.

- The first contract is a new agreement

with an existing client to carry cargo in the Baltic region through

2017. Beginning in 2015, the contract will provide an estimated 240

cargo days of coverage and will contribute revenue of approximately

$10 million per year.

- The second contract is with a new,

blue-chip client to carry cargo from 2015 to 2018. Pangaea’s

ice-hardened fleet is contracted to transport cargo for an

estimated 600 days each summer in the far northern latitudes,

contributing revenue of approximately $22 million per year.

About Pangaea Logistics Solutions Ltd.

Pangaea Logistics Solutions Ltd. (NASDAQ: PANL) provides

logistics services to a broad base of industrial customers who

require the transportation of a wide variety of dry bulk cargoes,

including grains, pig iron, hot briquetted iron, bauxite, alumina,

cement clinker, dolomite, and limestone. The Company addresses the

transportation needs of its customers with a comprehensive set of

services and activities, including cargo loading, cargo discharge,

vessel chartering, and voyage planning. Learn more at

www.pangaeals.com.

Forward-Looking Statements

Certain statements in this press release are "forward-looking

statements" within the meaning of the Private Securities Litigation

Act of 1995. These forward-looking statements are based on our

current expectations and beliefs and are subject to a number of

risk factors and uncertainties that could cause actual results to

differ materially from those described in the forward-looking

statements. Such risks and uncertainties include, without

limitation, the strength of world economies and currencies, general

market conditions, including fluctuations in charter rates and

vessel values, changes in demand for drybulk shipping capacity,

changes in our operating expenses, including bunker prices,

dry-docking and insurance costs, the market for our vessels,

availability of financing and refinancing, charter counterparty

performance, ability to obtain financing and comply with covenants

in such financing arrangements, changes in governmental rules and

regulations or actions taken by regulatory authorities, potential

liability from pending or future litigation, general domestic and

international political conditions, potential disruption of

shipping routes due to accidents or political events, vessels

breakdowns and instances of off-hires and other factors, as well as

other risks that have been included in filings with the Securities

and Exchange Commission, all of which are available

at www.sec.gov.

Bulk Partners (Bermuda) LTD. Consolidated

Statements of Income Three

months ended September 30, Nine months ended September 30,

2014 2013

2014 2013

(unaudited) (unaudited)

(unaudited) (unaudited) Revenues: Voyage revenue $

80,604,263 $ 80,371,836 $ 252,084,882 $ 246,642,009 Charter revenue

10,600,956 14,797,016 43,112,456 34,328,821 91,205,219 95,168,852

295,197,338 280,970,830 Expenses: Voyage expense 46,598,184

45,193,740 136,624,745 147,119,813 Charter hire expense 34,315,719

31,984,645 112,271,588 86,098,418 Vessel operating expense

7,935,565 6,148,253 22,587,314 15,710,044 General and

administrative 2,790,350 2,747,691 7,719,226 8,592,008 Depreciation

and amortization 3,118,973 2,518,726 8,415,174 7,060,351 Gain on

sale of vessels (1,661,368) - (3,947,600) - Total expenses

93,097,423 88,593,055 283,670,447 264,580,634 (Loss) income

from operations (1,892,204) 6,575,797 11,526,891 16,390,196

Other (expense) income: Interest expense (1,348,252) (1,419,338)

(4,338,904) (3,889,788) Interest expense related party debt

(108,422) (194,543) (170,784) (357,341) Imputed interest on related

party long-term debt - (317,942) (322,947) (793,222) Unrealized

(loss) gain on derivative instruments (551,354) 1,854,930

(2,123,246) 183,287 Other income (expense) 83,803 (515,677) 8,030

(197,127) Total other expense, net (1,924,225) (592,570)

(6,947,851) (5,054,191) Net (loss) income (3,816,429)

5,983,227 4,579,040 11,336,005 Loss (income) attributable to

noncontrolling interests 906,822 (113,827) 334,563 (820,323) Net

(loss) income attributable to Pangaea Logistics Solutions Ltd. $

(2,909,607) $ 5,869,400 $ 4,913,603 $ 10,515,682 Loss per

common share: Basic $ (64.68) $ (7.77) $ (15.92) $ (63.30) Diluted

$ (64.68) $ (7.77) $ (15.92) $ (63.30) Weighted average

shares used to compute loss per common share, basic and diluted

87,329 87,329 87,329 87,329

Bulk Partners

(Bermuda) LTD. Consolidated Balance Sheets

September 30, December 31,

2014 2013

(unaudited) Assets Current assets Cash and cash

equivalents

$ 20,157,708 $ 18,927,927 Restricted cash

500,000 500,000

Accounts receivable (net of allowance of

$2,047,603 atSeptember 30, 2014 and $1,662,593 at December 31,

2013)

30,462,924 44,688,470 Other receivables

287,668

133,646 Bunker inventory

21,050,009 21,072,192 Advance hire,

prepaid expenses and other current assets

10,916,092

12,744,125 Total current assets

83,374,401 98,066,360

Fixed assets, net

225,179,262 197,153,889 Investment in

newbuildings in-process

25,576,943 31,900,000 Other

noncurrent assets

1,495,078 3,253,022

Total assets

$ 335,625,684 $ 330,373,271

Liabilities, convertible redeemable

preferred stockand stockholders' equity

Current liabilities Accounts payable and accrued expenses

$

40,623,223 $ 45,878,378 Related party debt

46,371,713

7,616,248 Deferred revenue

5,862,960 16,155,498 Current

portion long-term debt

18,686,730 16,065,483 Line of credit

3,000,000 3,000,000 Dividend payable

29,381,125

23,177,503 Other current liablities

263,982 - Total current

liabilties

144,189,733 111,893,110 Secured long-term

debt, net

91,719,946 83,302,421 Related party long-term

debt, net

- 17,303,918 Commitments and contingencies

Convertible redeemable preferred stock,

net of issuance costs($1,000 par value, 112,500 shares authorized,

89,114and 64,047 shares issued and outstanding at September 30,

2014December 31, 2013, respectively)

103,236,399 103,236,399 Stockholders' equity

(deficit):

Common stock ($1.00 par value, 199,829

shares authorized87,329 shares issued and outstanding at September

30, 2014,December 31, 2013 and December 31, 2012191,606 shares

issued and outstanding on pro forma basis

87,329 87,329 Additional paid-in capital

- -

Accumulated deficit

(7,324,015) (5,933,870)

Total Pangaea

Logistics Solutions Ltd. deficit (7,236,686) (5,846,541)

Non-controlling interest

3,716,292 20,483,964 Total

stockholders' (deficit) equity

(3,520,394) 14,637,423

Total liabilities, convertible reemable preferred stock

and stockholders' (deficit) equity $

335,625,684 # $ 330,373,271 Bulk

Partners (Bermuda) LTD. Consolidated Statements of Cash

Flows Nine months ended

September 30, 2014 2013

(unaudited)

(unaudited)

Operating activities Net income

$

4,579,040 $ 11,336,005 Adjustments to reconcile net income to

net cash provided by operations: Depreciation and amortization

expense

8,415,174 7,060,351 Amortization of deferred

financing costs

627,961 658,089 Unrealized loss (gain) on

derivative instruments

2,123,246 (183,287) Provision for

doubtful accounts

(385,010) - Write off of unamortized

financing costs

241,522 - Amortization of discount on

related party long-term debt

322,947 - Imputed interest on

related party long-term debt

- 793,222 Change in operating

assets and liabilities: Accounts receivable

14,610,555

1,018,218 Other receivables

(154,022) (56,781) Bunker

inventory

22,183 (4,490,193) Advance hire, prepaid expenses

and other current assets

1,770,164 687,302 Other non-current

assets

(236,223) - Account payable, accrued expenses and

other current liabilities

(4,570,546) 2,343,788 Other

current liabilities

(657,491) (381,011) Deferred revenue

(10,292,538) 147,241 Net cash provided by operating

activities

16,416,962 18,932,944

Investing

activites Purchase of vessels

(38,288,452) (75,588,933)

Sale of vessels

19,331,787 - Deposits on newbuildings

in-process

(6,960,499) - Drydocking costs

(3,639,677)

- Purchase of building and equipment

(558,376) (92,388) Net

cash used in investing activities

(30,115,217) (75,681,321)

Financing activities Proceeds of related party debt

4,750,000 21,559,972 Payments on related party debt

(54,507) (203,582) Proceeds from long-term debt

35,500,000 32,205,000 Payments of financing and issuance

costs

(366,800) (1,595,450) Payments on long-term debt

(24,800,657) (9,713,178) Proceeds from issuance of

convertible redeemable preferred stock

- 18,199,180 Common

stock dividends paid

(100,000) (100,000) Decrease (increase)

in restricted cash

- 687,500 Distributions to

non-controlling interest

- (176,667) Net cash provided by

financing activities

14,928,036 60,862,775 Net

increase in cash and cash equivalents

1,229,781 4,114,398

Cash and cash equivalents at beginning of period

18,927,927

19,695,675 Cash and cash equivalents at end of period

$

20,157,708 $ 23,810,073

Bulk Partners

(Bermuda) LTD. Consolidated Statements of Cash Flows

Nine months ended September

30, 2014 2013

(unaudited) (unaudited)

Disclosure of noncash items Dividends declared, not

paid

$ 6,303,622 $ 5,769,050 Issuance of convertible

redeemable preferred stock

as settlement of accrued dividends

$ - $ 213,152 Issuance of convertible redeemable preferred

stock in settlement of notes payable

$ - $ 1,385,503

Beneficial conversion feature of convertible redeemable preferred

stock at issuance date

$ - $ 5,748,464 Modification of

Shareholder loan to on Demand

$ 16,433,108 Imputed

interest on related party long-term debt

$ 322,947 $ 793,222

Discount on related party long-term debt

$ - $ 17,080,063

Cash paid for interest

$ 3,660,117 $ 4,366,007

Investor RelationsProsek PartnersThomas Rozycki,

212-279-3115 x208Managing Directortrozycki@prosek.com

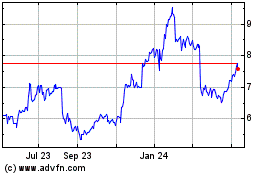

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Mar 2024 to Apr 2024

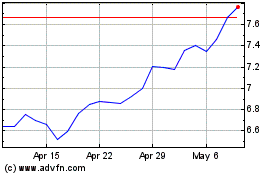

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Apr 2023 to Apr 2024