Pangaea Logistics Solutions, Ltd. Enters into Letter of Intent with ASO 2020 Maritime

October 08 2014 - 5:26PM

Business Wire

Pangaea Logistics Solutions, Ltd. (“Pangaea” or the

“Company”) (NASDAQ:PANL) announced today that it has entered

into an agreement in principle with ASO 2020 Maritime (“ASO 2020”).

Pursuant to the letter of intent and subject to certain conditions,

ASO 2020, an affiliate of the Alexander S. Onassis Foundation, will

acquire a significant stake in Pangaea which was recently listed on

the NASDAQ.

Ed Coll, Pangaea’s chief executive officer, noted, “We are proud

and fortunate to have affiliates of the Onassis Foundation as our

partners. This group has long been associated with best practices

in ocean-going transport and we believe will further strengthen our

positioning.”

Terms of the investment, which is expected to close within 60

days, were not disclosed.

About Pangaea Logistics Solutions, Ltd.

Pangaea Logistics Solutions Ltd. provides logistics services to

a broad base of industrial customers who require the transportation

of a wide variety of dry bulk cargoes, including grains, pig iron,

hot briquetted iron, bauxite, alumina, cement clinker, dolomite,

and limestone. The Company addresses the transportation needs of

its customers with a comprehensive set of services and activities,

including cargo loading, cargo discharge, vessel chartering, and

voyage planning. Learn more at www.pangaeals.com.

Safe Harbor Language

This press release includes certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including statements regarding future financial

performance, future growth and future acquisitions. These

statements are based on Pangaea’s managements’ current expectations

or beliefs and are subject to uncertainty and changes in

circumstances. Actual results may vary materially from those

expressed or implied by the statements herein due to changes in

economic, business, competitive and/or regulatory factors, and

other risks and uncertainties affecting the operation of Pangaea’s

business. These risks, uncertainties and contingencies include:

business conditions; weather and natural disasters; changing

interpretations of GAAP; outcomes of government reviews; inquiries

and investigations and related litigation; continued compliance

with government regulations; legislation or regulatory

environments; requirements or changes adversely affecting the

business in which Pangaea is engaged; fluctuations in customer

demand; management of rapid growth; intensity of competition from

other providers of logistics and shipping services; general

economic conditions; geopolitical events and regulatory changes;

the possibility that the merger does not close, including due to

the failure of closing conditions; and other factors set forth in

Pangaea’s filings with the Securities and Exchange Commission,

including filings of its predecessor companies. The information set

forth herein should be read in light of such risks. Pangaea is not

under any obligation to, and expressly disclaims any obligation to,

update or alter its forward-looking statements, whether as a result

of new information, future events, changes in assumptions or

otherwise.

INVESTOR RELATIONS:Prosek PartnersThomas Rozycki,

212-279-3115 x208Managing Directortrozycki@prosek.com

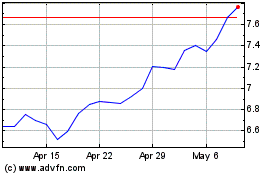

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Mar 2024 to Apr 2024

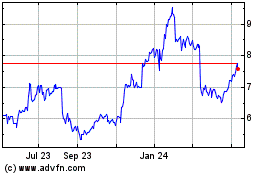

Pangaea Logistics Soluti... (NASDAQ:PANL)

Historical Stock Chart

From Apr 2023 to Apr 2024