PPG Ends $28 Billion Pursuit of Rival Akzo Nobel -- Update

June 01 2017 - 7:09AM

Dow Jones News

By Ben Dummett

Paint giant PPG Industries Inc. dropped its $27.6 billion

takeover pursuit of Akzo Nobel NV Thursday, ending an unusually

bitter trans-Atlantic standoff between two of the world's oldest

industrial companies.

Akzo Nobel's board has " consistently refused to engage and did

not respond to our (latest) call or letter," PPG Chief Executive

Michael McGarry said in a statement. "As a result, we believe it is

in the best interests of PPG and its shareholders to withdraw our

proposal...at this time."

Akzo defended its standalone strategy, betting it will "lead to

a step change in growth," the company's Chief Executive Ton Büchner

said Thursday.

The capitulation marks a setback in PPG's efforts to strengthen

its global reach and offer customers a broader portfolio of paints

and coatings. Rivals, and the chemicals industry generally, have

been consolidating to boost profits with scale and

cost-cutting.

Sherwin-Williams Co. agreed last year to acquire Valspar Corp.

for $9.3 billion. Some analysts considered PPG's bid for Akzo to be

a strategic response to that pact. Meanwhile, U.S.-based Huntsman

Corp. last month agreed to merge with Switzerland's Clariant AG to

create a $14 billion chemicals company, producing an array of

products ranging from polyurethanes, pigments and automotive fluids

that are used in industries ranging from aerospace to household

cleaning.

Akzo's management and board have fought hard to preserve the

company's independence. Now it has prevailed, the Dutch paints and

chemicals maker faces increased pressure to prove that a

stand-alone strategy will work, especially to skeptical

shareholders who backed the deal talks. Akzo has promised to boost

dividend payouts and spin off the company's specialty chemicals

business.

That strategy, however, comes with its own risks. In 2015,

Syngenta AG, the Swiss agribusiness giant, fended off a $46 billion

cash-and-stock takeover bid from rival Monsanto Co., promising

shareholders it could deliver on the organic growth that it

considered preferable to a sale. But in 2016, China National

Chemical Corp. agreed to acquire Syngenta for $43 billion in an

all-cash offer.

Attacks on Akzo's management and board characterized the long

standoff with PPG. Bolstered by a Dutch corporate structure that

provides protection from a shareholder-supported hostile bid, Akzo

fended off three, increasingly higher takeover offers. It also out

survived a shareholder revolt led by U.S. activist investor Elliott

Management Corp.

Elliott, a top Akzo shareholder, urged the company to engage

with PPG in substantial talks. It also tried, unsuccessfully, in a

Dutch court to remove Akzo Chairman Antony Burgmans, who opposed a

combination.

An Elliott representative declined to comment Thursday.

PPG unveiled its second and final sweetened bid in April,

offering EUR24.6 billion ($27.6 billion) or EUR96.75 a share. That

represented a 50% premium to the Dutch company's stock price before

disclosure on March 9 of the initial $22 billion approach. It also

came with concessions such as employment guarantees and a

commitment to pay a fee if regulators blocked the tie-up--a bid to

allay the Akzo's concerns over potential job cuts and antitrust

opposition resulting from a deal.

In a May 29 letter addressed to Mr. Burgmans, PGG's Mr. McGarry

said his company would be willing to consider increasing its offer

price again if Akzo agreed to friendly talks.

Write to Ben Dummett at ben.dummett@wsj.com

(END) Dow Jones Newswires

June 01, 2017 06:54 ET (10:54 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

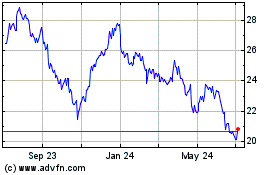

Akzo Nobel NV (QX) (USOTC:AKZOY)

Historical Stock Chart

From Mar 2024 to Apr 2024

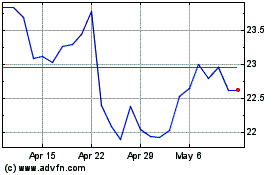

Akzo Nobel NV (QX) (USOTC:AKZOY)

Historical Stock Chart

From Apr 2023 to Apr 2024