PHSC plc Trading Update

June 16 2016 - 2:00AM

UK Regulatory

TIDMPHSC

16 June 2016

PHSC PLC

Trading Update

PHSC plc ("the Group"), a leading provider of health, safety, hygiene and

environmental consultancy services and security solutions to the public and

private sectors, announces an update on its performance for the financial year

ended 31 March 2016.

These indicative figures are per management accounts and after certain

adjustments, and are currently in the final stages of audit. We expect to issue

our Final Results announcement in early August 2016.

Consolidated Group revenue for the period was around GBP 7.04m, representing a

fall of 9% year-on year (2015 - GBP 7.7m). The reduction arises principally

from the ending of a large asbestos management contract previously delivered by

Adamson's Laboratory Services Limited (ALS) with a leading university, as

mentioned in our interim results statement. ALS was unable to find sufficient

replacement work to bridge the gap during the second half.

It is encouraging that Consolidated Group revenue in the second half increased

around 12% over the first half but, as explained below, it is likely that due

principally to an impairment in the carrying value of goodwill the results for

the full year will not meet our expectation at the time of the interim results

statement that we would see a stronger second half to the year.

Underlying EBITDA (excluding the goodwill impairment charge below) stands at

GBP 0.418m (2015: GBP 0.818m) prior to various costs associated with the two

acquisitions made in December 2015. Legal and other costs totalled

approximately GBP 50,000. In addition, a further GBP 50,000 has been expended

in meeting the initial integration costs of one of those acquisitions, SG

Systems (UK) Limited, in the period to 31 March 2016. Should these costs not be

recovered over the earn-out period, they are deductible from the final

instalment due under the share purchase agreement.

Given the difficult trading conditions experienced by ALS, and in accordance

with standard tests applied by our Auditors, we anticipate an impairment of GBP

0.6m in the carrying value of goodwill in respect of ALS, representing a

reduction of approximately 9% in the consolidated net assets of the Group

before this adjustment.

The Company has adopted a progressive dividend policy. The directors believe

that the Company's distributable reserves are more than adequate to support the

payment of a dividend in line with previous years, should such a resolution be

supported at the AGM.

Management accounts indicate that both Group revenues and EBITDA in the early

part of 2016-17 are running ahead of the comparative figures for last year.

Cash flow remains positive and the average bank balance in June 2016 has been

circa GBP 0.25m. The Company also has a facility with its bankers, currently

not called upon, of GBP 0.2m.

For further information please contact:

PHSC plc 01622 717700

Stephen King

Stephen.king@phsc.co.uk

www.phsc.plc.uk

Northland Capital Partners Limited (Nominated Adviser) 0203 861 6625

Edward Hutton/David Hignell

Beaufort Securities Limited (Broker) 020 7382 8300

Elliot Hance

About PHSC

PHSC plc, through its trading subsidiaries Personnel Health & Safety

Consultants Ltd, RSA Environmental Health Ltd, Adamson's Laboratory Services

Ltd, QCS International Ltd, Inspection Services (UK) Ltd and Quality Leisure

Management Ltd, provides a range of health, safety, hygiene, environmental and

quality systems consultancy and training services to organisations across the

UK. B to B Links Ltd and SG Systems (UK) Ltd offer innovative retail security

solutions including tagging, labelling and CCTV.

END

(END) Dow Jones Newswires

June 16, 2016 02:00 ET (06:00 GMT)

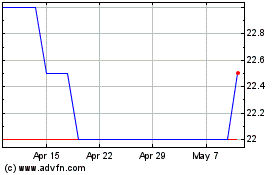

Phsc (LSE:PHSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

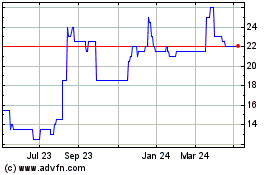

Phsc (LSE:PHSC)

Historical Stock Chart

From Apr 2023 to Apr 2024