PHSC plc Pre-AGM Trading Update

September 08 2016 - 2:00AM

UK Regulatory

TIDMPHSC

8 September 2016

PHSC PLC

Pre-AGM Trading Update

PHSC plc ("the Group"), a leading provider of health, safety, hygiene and

environmental consultancy services and security solutions to the public and

private sectors, announces an update on its performance ahead of its AGM due to

be held today. At that meeting the Group Chief Executive, Stephen King, will be

commenting on the Group's performance for the first four months of the year to

the end of July 2016.

For this period, the Group's unaudited management accounts are showing a

consolidated EBITDA loss of around GBP94k on sales of GBP2.3m but the Board

anticipates that the position will improve before the conclusion of H1 and that

this improvement will be sustained in the second half of the year, as explained

below. Cash at bank (as at 6 September 2016) stood at GBP565k which includes net

proceeds arising from the recent share placing which was announced on 19 August

2016.

Further commentary on each subsidiary's results for this period is given below.

Earnings are shown prior to deduction of central management charges and

taxation.

B to B Links Ltd recorded a loss of around GBP4k and is currently forecast to

deliver sales of approximately GBP1.2m in H1. Despite large monthly fluctuations

in client sign-off and installation activity, sales from key national accounts

have met expectations and continue to deliver much of the company's revenue.

The closure of the Basingstoke office in July marked the final stage in the

integration of the Camerascan CCTV acquisition which has gone smoothly in

operational terms. There has been an erosion of gross margins due to higher

trade costs for imported hardware, security tags and labels as a result of the

weaker pound post the referendum. The outlook for the second half of the year

is strong for key national account activity and management is taking a number

of steps to turn around a sales shortfall in independent retail, one of the

company's traditional strengths.

SG Systems UK Ltd has lost GBP37k as it continued to suffer from an unexpected

and lengthy hiatus in new store opening by one of its larger customers, delays

to a source tagging project, and higher trade costs for imported goods - again

due to the weakness in sterling. The issue delaying new store openings has

very recently been resolved. Work to introduce new products to new customers

has begun to bear fruit, and will enable the company to return to monthly

profits in August and September. This has also provided a healthy pipeline of

potential projects which it is hoped will be converted during the second half

of the year.

RSA Environmental Health Ltd generated profit of GBP24k but August is never a

good month financially as it coincides with closure of schools from which the

majority of RSA's revenues are drawn. Activity is expected to pick up as

schools return in September.

Quality Leisure Management Ltd is showing a profit of just over GBP8k, with Q1

income down mainly due to Local Authorities coming under greater financial

pressure. Local Authorities are the main source of funding to Leisure Trust

clients.

Personnel Health & Safety Consultants Limited expects to deliver around GBP100k

of profit for the first half, having reached GBP70k by the end of July. The

subsidiary's largest client has agreed to extend a contract, originally due to

expire at the end of August, for three months to allow time for negotiations on

a new arrangement.

Inspection Services (UK) Ltd achieved a profit of GBP15k and expects around GBP20k

for the first half, ahead of where it was last year. In addition, it recently

secured its largest single contract, valued at GBP25k, through an insurance

broker. The contract is an enhanced version of a GBP17k order first awarded last

year.

QCS International Ltd achieved a profit of GBP40k and anticipates around GBP60k in

total for the first half. Costs in Q2 were particularly high as the company

incurred legal expenses associated with preventing a competitor from using a

similar trading name and style. Management are confident of a good second half

performance, with bookings already received for training courses and it is also

hoped that a new medical device consultancy project will begin in Q3.

Adamson's Laboratory Services Ltd recorded a loss of GBP54k. It continues to face

considerable difficulties in what has become a highly competitive market for

asbestos management services. A number of steps have been taken to reduce

costs, including staff redundancies, but it will take time for the benefits to

filter through. The company continues to seek new business and has submitted a

number of large tenders and quotations for which decisions are awaited.

We look forward to updating the market at the time of our interim results which

are expected to be announced in early December.

This announcement contains inside information for the purposes of Article 7 of

EU Regulation 596/2014.

For further information please contact:

PHSC plc 01622 717700

Stephen King

Stephen.king@phsc.co.uk

www.phsc.plc.uk

Northland Capital Partners Limited (Nominated Adviser) 0203 861 6625

Edward Hutton/David Hignell

Beaufort Securities Limited (Broker) 020 7382 8300

Elliot Hance

About PHSC

PHSC plc, through its trading subsidiaries Personnel Health & Safety

Consultants Ltd, RSA Environmental Health Ltd, Adamson's Laboratory Services

Ltd, QCS International Ltd, Inspection Services (UK) Ltd and Quality Leisure

Management Ltd, provides a range of health, safety, hygiene, environmental and

quality systems consultancy and training services to organisations across the

UK. B to B Links Ltd and SG Systems (UK) Ltd offer innovative retail security

solutions including tagging, labelling and CCTV.

END

(END) Dow Jones Newswires

September 08, 2016 02:00 ET (06:00 GMT)

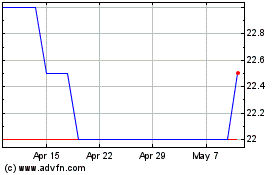

Phsc (LSE:PHSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

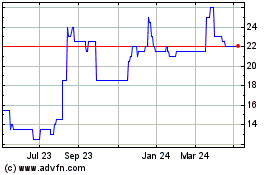

Phsc (LSE:PHSC)

Historical Stock Chart

From Apr 2023 to Apr 2024