TIDMPHSC

01 December 2016

PHSC PLC

("PHSC", the "Company", or the "Group")

Unaudited Interim Results for the six months ended 30 September 2016

GROUP CHIEF EXECUTIVE OFFICER'S STATEMENT

Financial Highlights

* Group turnover for first half up 7% at GBP3.587m compared with GBP3.354m last

year.

* Loss of GBP93k measured as EBITDA after bad debt provision, versus GBP229k

profit last year.

* Loss per share of 0.85p compared with 1.23p per share profit last year.

* Cash balance of GBP301k at period end compared with GBP611k last year.

* Net asset value of GBP6.098m

* Pro-forma net asset value per share of 41.5p compared to a current share

price (mid) of 18p.

* Q2 saw a return to profitable trading, but results impacted by GBP44k bad

debt provision.

Trading Overview

In the trading update preceding our AGM, we reported a consolidated EBITDA loss

of around GBP94k on sales of GBP2.3m for the first four months of the year. We

indicated that improvements would take place by the time of our Interim

results. Were it not for a loss of circa GBP40k caused by one client going into

administration and an additional GBP4k provision for other potential bad debts,

the last two months would have delivered EBITDA of GBP45k.

The board is confident of improvement in the second half of the year and we do

not currently anticipate any additional provisions for bad debts. The Group

returned to profitable trading in the month of October, achieving EBITDA of GBP

25.6k and reducing the cumulative loss to GBP67.4k.

There is an analysis of performance by individual subsidiary later in this

statement. The performances which have the most impact on the Group's

profitability are those of Adamson's Laboratory Services Ltd (ALS) and SG

Systems (UK) Ltd (SG). In the case of ALS, the ongoing loss-making situation is

largely brought about by a continuing erosion of the prices at which work can

be obtained, and a general reduction in revenues against a background of a

predominantly fixed cost base. Management are taking steps to address this

situation and several options are being considered. In the short term, there

have unfortunately had to be a number of redundancies at the company, the costs

of which are not reflected in the results for the first half.

The prognosis for SG is entirely different to that of ALS. This company, which

was acquired in December 2015, has invested heavily in developing solutions to

protect property using radio frequency identification technology (RFID). A

number of significant trials and pilot schemes are underway with private and

public sector clients and the company is hopeful of generating some significant

revenues in the months to come. The cost of investment in technological

solutions has affected the financial performance. In addition, there was

reduced income from routine sales and servicing, both of which have been

affected by a hiatus in orders from a major customer. However, SG returned to

profit in September and October.

The inclusion of SG's revenues and costs in the consolidated accounts has

resulted in higher administrative expenses compared with last year.

B to B Links Limited (B to B), which is a sister company to SG, continues to

work with national accounts in the retail sector and has been successful in

maintaining a strong order book that will see it through the remainder of the

financial year. A negative factor is that the decline in the value of Sterling

following the UK's referendum on EU membership has impacted on both B to B and

SG. Both companies import the vast majority of their electronic components from

Europe or Asia with payment having to be made in USD or Euros.

Training and consultancy relating to new ISO standards that took effect a year

ago have enabled our QCS International Limited subsidiary to increase revenue

and profit, and management are optimistic that this trend can continue over

then next year and beyond. A new standard on health and safety, ISO 45001, is

expected to be approved in 2017 and this will present further potential demand

for the company's services.

Quality Leisure Management Limited has seen a fall in revenue and profits. This

is attributable to reduced local authority funding of many leisure trusts, and

some consolidation in the sector.

Health and safety consultancy and training activity delivered by other group

companies is largely unchanged but it has not been possible to increase income

in line with the rising cost of delivery.

Outlook

The Group expects to trade profitably in the second half of the financial year,

and will be concentrating its efforts on addressing some of the issues

highlighted above. There are likely to be some restructuring costs associated

with our ALS subsidiary as management seek to align costs with the lower

revenues being currently generated. Following an approach by a third party,

discussions were held which could have resulted in ALS leaving the Group. On

this occasion we did not find the proposed terms to be suitable, but we remain

open to future approaches that can be shown to be in shareholders' best

interests.

Dividend Prospects

The Board is not declaring an interim dividend but will consider an appropriate

level of final dividend at the relevant time. Despite the current performance,

the Group has a reasonably strong balance sheet that includes retained earnings

from previous years. However, if the Group does not generate a profit for the

year, it may recommend a lower distribution or elect to forego a dividend

entirely on this occasion.

Cash Flow

The bank balance stood at GBP301k as at the date of the interim accounts,

compared with GBP611k at the interim stage last year. The reduction is primarily

due to the acquisition payments totalling GBP400k made in December 2015. In

addition, the Company raised GBP350k before costs from a share placing, as

announced on 19 August 2016.

The GBP200k overdraft facility in place with our bankers, HSBC, has been subject

to annual review. In view of the trading losses to date it was felt prudent to

increase this facility to GBP300k to give sufficient support.

The bank balance as at 30 November was GBP356,017.

Performance by Trading Subsidiaries

Profit/loss figures for individual subsidiaries are stated before tax and

inter-company charges (including the costs of operating the plc which are

recovered through management charges to trading subsidiaries), interest paid

and received, depreciation and amortisation.

Adamson's Laboratory Services Limited

Revenue of GBP509,800 resulting in a loss of GBP101,400 (the equivalent figures for

the same period last year were GBP1,105,100 and a profit of GBP102,900).

Inspection Services (UK) Limited

Invoiced sales of GBP111,200 yielding a profit of GBP23,000 (the figures for the

same period last year were GBP96,300 and GBP8,900).

Personnel Health and Safety Consultants Limited

Invoiced sales of GBP340,300 yielding a profit of GBP108,100 (the figures for the

same period last year were GBP328,300 and GBP132,000).

RSA Environmental Health Limited

Invoiced sales of GBP189,200 resulting in a profit of GBP34,600 (the figures for

the same period last year were GBP209,700 and GBP21,000).

Quality Leisure Management Limited

Invoiced sales of GBP196,400 resulting in a profit of GBP6,400 (the figures for the

same period last year were GBP239,600 and GBP34,900).

QCS International Limited

Invoiced sales of GBP258,600 yielding a profit of GBP67,300 (the figures for the

same period last year were GBP245,000 and GBP58,000).

B to B Links Limited

Invoiced sales of GBP1,237,900 yielding a profit of GBP38,000 (the figures for the

same period last year were GBP1,120,100 and GBP58,900). The profit for the period

ended 30 September 2016 is shown after deduction of circa GBP40,000 which proved

unrecoverable after a client fell into administration.

SG Systems (UK) Limited

Invoiced sales of GBP743,673 resulting in a loss of GBP18,800 (there are no

comparative figures for last year as the business was acquired in December

2015).

This announcement contains inside information for the purposes of Article 7 of

EU Regulation 596/2014.

For further information please contact:

01622 717700

PHSC plc

Stephen King

Stephen.king@phsc.co.uk

www.phsc.plc.uk

Northland Capital Partners Limited (Nominated Adviser) 0203 861 6625

Edward Hutton/David Hignell

Beaufort Securities Limited (Broker) 020 7382 8300

Elliot Hance

About PHSC

PHSC plc, through its trading subsidiaries Personnel Health & Safety

Consultants Ltd, RSA Environmental Health Ltd, Adamson's Laboratory Services

Ltd, QCS International Ltd, Inspection Services (UK) Ltd and Quality Leisure

Management Ltd, provides a range of health, safety, hygiene, environmental and

quality systems consultancy and training services to organisations across the

UK. B to B Links Ltd and SG Systems (UK) Ltd offer innovative retail security

solutions including tagging, labelling and CCTV.

Six Six Year

Group Statement of Comprehensive Income months months ended

ended ended

30 Sept 30 Sept 31 Mar 16

16 15

Note Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 3 3,587 3,354 7,004

Cost of sales (1,990) (1,804) (3,803)

Gross profit 1,597 1,550 3,201

Administrative expenses (1,713) (1,345) (2,931)

Administrative expenses - exceptional 2 - - (609)

Other income 1 - -

(Loss)/profit from operations (115) 205 (339)

Finance income 1 - 1

Finance costs - - -

(Loss)/profit before taxation (114) 205 (338)

Corporation tax expense - (49) (76)

(Loss)/profit for the period after tax attributable

to owners of parent 3 (114) 156 (414)

Total comprehensive income attributable to (114) 156 (414)

owners of the parent

Attributable to:

Equity holders of the Group (114) 156 (414)

Basic and diluted Earnings per Share for 5 (0.85p) 1.23p (3.23p)

(loss)/profit after tax from continuing

operations attributable to the equity

holders of the Group during the period

Group Statement of Financial Position 30 Sept 30 Sept 31 Mar 16

16 15

Unaudited Unaudited

Note GBP'000 GBP'000 GBP'000

Non-current assets

Property, plant and equipment 4 653 684 675

Goodwill 4,504 4,580 4,504

Deferred tax asset 1 - 1

5,158 5,264 5,180

Current assets

Inventories 493 224 416

Trade and other receivables 1,697 1,864 1,895

Cash and cash equivalents 301 611 256

2,491 2,699 2,567

Total assets 3 7,649 7,963 7,747

Current liabilities

Trade and other payables 1,129 1,126 1,222

Current corporation tax payable 84 134 103

Deferred consideration 200 - 200

1,413 1,260 1,525

Non-current liabilities

Deferred taxation liabilities 63 68 63

Contingent consideration 75 - 75

138 68 138

Total liabilities 1,551 1,328 1,663

Net assets 6,098 6,635 6,084

Capital and reserves attributable to

equity

holders of the Group

Called up share capital 1,468 1,268 1,308

Share premium account 1,915 1,751 1,751

Capital redemption reserve 144 144 144

Merger relief reserve 134 80 134

Retained earnings 2,437 3,392 2,747

6,098 6,635 6,084

Group Statement of Changes in Equity

Share Share Capital Merger Retained

Capital Premium Redemption Relief Earnings

Reserve Reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 April 2016 1,309 1,751 144 134 2,747 6,085

Loss for the period - - - - (114) (114)

attributable to equity holders

Share issue 159 164 - - - 323

Dividends - - - - (196) (196)

Balance at 30 September 2016 1,468 1,915 144 134 2,437 6,098

Balance at 1 April 2015 1,268 1,751 144 80 3,355 6,598

Profit for the period - - - - 156 156

attributable to equity holders

Dividends - - - - (119) (119)

Balance at 30 September 2015 1,268 1,751 144 80 3,392 6,635

Group Statement of Cash Flows Six Six Year

months months

ended ended ended

30 Sept 16 30 Sept 15 31 Mar 16

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Cash flows (used by)/generated from operating

activities

Cash (used by)/generated from operations (64) 306 414

Interest paid - - -

Tax paid (19) (20) (83)

Net cash (used by)/generated from operating (83) 286 331

activities

Cash flows from/(used in) investing activities

Purchase of property, plant and equipment - (18) (36)

Purchase of subsidiary companies net of cash - - (263)

acquired

Disposal of fixed assets - - 1

Interest received 1 - 1

Net cash from/(used in) investing activities 1 (18) (297)

Cash flows from/(used in) financing activities

Payment of deferred consideration - - (50)

Dividends paid to group shareholders (196) (119) (190)

Proceeds from share placement 323 - -

Net cash from/(used in) financing activities 127 (119) (240)

Net increase/(decrease) in cash and cash 45 149 (206)

equivalents

Cash and cash equivalents at beginning of 256 462 462

period

Cash and cash equivalents at end of period 301 611 256

Notes to the cash flow statement

Cash (used by)/generated from operations

Operating (loss)/profit - continuing operations (114) 205 (339)

Depreciation charge 21 24 47

Goodwill impairment - - 609

Loss on sale of fixed assets - - 2

Increase in inventories (77) (8) (28)

Decrease in trade and other receivables 198 115 382

Decrease in trade and other payables (92) (30) (259)

Cash (used by)/generated from operations (64) 306 414

Notes to the Financial Statements

1. Basis of preparation

These condensed consolidated financial statements are presented on the basis of

International Financial Reporting Standards (IFRS) as adopted by the European

Union and interpretations issued by the International Financial Reporting

Interpretations Committee (IFRIC) and have been prepared in accordance with AIM

rules and the Companies Act 2006, as applicable to companies reporting under

IFRS.

The financial information contained in this report, which has not been audited,

does not constitute statutory accounts as defined by Section 434 of the

Companies Act 2006. The Group's statutory financial statements for the year

ended 31 March 2016, prepared under IFRS have been filed with the Registrar of

Companies. The auditors' report for the 2016 financial statements was

unqualified and did not contain a statement under Section 498 (2) or (3) of the

Companies Act 2006.

The same accounting policies and methods of computation are followed within

these interim financial statements as adopted in the most recent annual

financial statements.

New IFRS standards and interpretations not adopted

A number of new standards and amendments to standards and interpretations have

been issued but are not yet effective and in some cases have not been adopted

by the European Union. The directors do not expect the adoption of these

standards will have a material impact on the financial statements of the Group

in future periods, except IFRS 15 may have an impact on revenue recognition and

related disclosures and IFRS 16 may have an impact on the measurement and

treatment of operating leases and related disclosures. At this point it is not

practicable for the directors to provide a reasonable estimate of the effect of

IFRS 15 and IFRS 16 as their detailed review of these standards is still

ongoing.

The information presented within these interim financial statements is in

compliance with IAS 34 "Interim Financial Reporting". This requires the use of

certain accounting estimates and requires that management exercise judgement in

the process of applying the Group's accounting policies. The areas involving a

high degree of judgement or complexity, or areas where the assumptions and

estimates are significant to the interim financial statements are disclosed

below:

Impairment of goodwill

The Board has considered the carrying value of goodwill and although there have

been losses in the interim period the longer term outlook remains positive and

an impairment charge in these interim accounts is not therefore considered

necessary and will be reassessed at the year end.

30 Sept 16 30 Sept 15 31 Mar 16

Unaudited Unaudited

2 Exceptional Administrative Expenses GBP'000 GBP'000 GBP'000

Impairment of PHSC plc's investment - - 609

in

Adamson's Laboratory Services Limited

Notes to the Financial Statements

(continued)

30 Sept 16 30 Sept 15 31 Mar 16

3 Segmental Reporting Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Revenue

PHSC plc - - -

Personnel Health & Safety Consultants 340 328 703

Ltd

RSA Environmental Health Ltd 189 210 413

Adamson's Laboratory Services Ltd 510 1,105 1,827

Inspection Services Ltd 111 106 219

Quality Leisure Management Ltd 196 240 506

Q C S International Ltd 259 245 528

B to B Links Ltd 1,238 1,120 2,552

SG Systems (UK) Ltd 744 - 256

3,587 3,354 7,004

Profit/(loss) after taxation, before

management charge

PHSC plc (259) (205) (495)

Personnel Health & Safety Consultants 90 108 238

Ltd

RSA Environmental Health Ltd 30 19 64

Adamson's Laboratory Services Ltd (105) 89 87

Inspection Services Ltd 19 15 33

Quality Leisure Management Ltd 5 29 83

Q C S International Ltd 58 49 105

B to B Links Ltd 33 52 133

SG Systems (UK) Ltd (20) - (70)

(149) 156 178

Taxation adjustment (group loss relief and 35 - 17

deferred tax)

Goodwill impairment - - (609)

(114) 156 (414)

Total assets

PHSC plc 4,037 6,337 3,963

Personnel Health & Safety Consultants 951 422 864

Ltd

RSA Environmental Health Limited 612 476 610

Adamson's Laboratory Services Ltd 954 815 1,034

Inspection Services Ltd 189 57 144

Quality Leisure Management Ltd 205 98 249

Q C S International Ltd 426 103 352

B to B Links Ltd 1,170 1,126 1,443

SG Systems (UK) Ltd 404 - 387

8,948 9,434 9,046

Adjustment of goodwill (1,299) (1,471) (1,299)

7,649 7,963 7,747

Notes to the Financial Statements 30 Sept 16 30 Sept 15 31 Mar 16

(continued)

Unaudited Unaudited

4 Property, plant and equipment GBP'000 GBP'000 GBP'000

Cost or valuation

Brought forward 1,079 1,055 1,055

Additions - 18 26

Disposals - - (7)

Acquisition of subsidiary - - 9

Carried forward 1,079 1,073 1,083

Depreciation

Brought forward 404 365 365

Charge 22 24 47

Disposals - - (4)

Carried forward 426 389 408

Net book value 653 684 675

5 Earnings per share

The calculation of the basic earnings per share is based on the

following data.

30 Sept 16 30 Sept 15 31 Mar 16

GBP'000 GBP'000 GBP'000

Unaudited Unaudited

Earnings

Continuing activities (114) 156 (414)

Number of shares 30 Sept 16 30 Sept 15 31 Mar 16

Weighted average number of shares

for

the purpose of basic earnings per 13,451,480 12,686,353 12,806,901

share

END

(END) Dow Jones Newswires

December 01, 2016 02:00 ET (07:00 GMT)

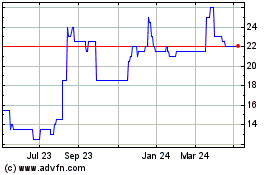

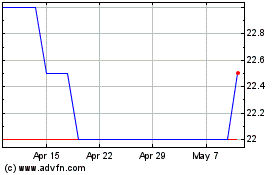

Phsc (LSE:PHSC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Phsc (LSE:PHSC)

Historical Stock Chart

From Apr 2023 to Apr 2024