P&G Sues Edgewell for Patent Infringement -- Update

August 23 2016 - 5:23PM

Dow Jones News

By Sharon Terlep

Gillette is suing a razor rival, again.

The largest seller of shavers filed a lawsuit against Edgewell

Personal Care Co., maker of Schick brand razors and Edge shave

gels, alleging patent infringement and saying its closest

competitor made misleading claims against the Procter & Gamble

Co. unit.

The civil suit, filed on Tuesday in New York by Gillette, asks

the U.S. District Court to force Edgewell to pull newly launched

private-label razors from store shelves and remove claims from

product packaging that the razors "shave as good or better" than

Gillette's Mach 3 blades. The suit focuses on Edgewell's

three-bladed razors sold by retailers such as CVS and Wal-Mart.

"When a competitor makes false and misleading claims against one

of our products and infringes our patents, it's unfair to

consumers, and to our employees and shareholders," Procter &

Gamble's chief legal officer said in a statement. The company is

also seeking damages.

Edgewell called Gillette's claims baseless, noting that

Gillette's Mach 3 patents have expired.

"We are confident in the quality and performance of our private

label products," the company said in a statement.

The suit against a smaller rival is Gillette's third since last

year and comes as upstart online subscription services chip away at

the 120-year-old company's dominance of the $3 billion U.S. market

for razors and blades.

Gillette last year sued the biggest of those online services,

the Dollar Shave Club, seeking to stop sales of razors it says

infringe on one of Gillette's hundreds of patents. The suit is

pending. Dollar Shave Club is being acquired by Anglo-Dutch

consumer-products company Unilever PLC in a deal announced last

month.

Early last year, Gillette sued ShaveLogic Inc. and four former

employees who went to work for the Dallas startup, alleging the men

breached their contracts with Gillette by sharing trade secrets

with their new company.

Representatives for Dollar Shave Club and ShaveLogic declined to

comment.

In the 20-page complaint against Edgewell, P&G says its

rival must have begun marketing and selling its blades before the

Mach 3 patent expired on April 10 because the Edgewell blades were

in stores as early June, Gillette says.

"It can take years to bring a product to market," a P&G

spokeswoman said. "It is clear from the launch date of Edgewell's

private-label product that it was being designed and produced while

the patents were still active, making it a patent violation."

Patent law prohibits making, using or importing an invention

that is still protected, said patent attorney David Long, formerly

a partner at the Washington, D.C., firm Kelley Drye &

Warren.

"Gillette is trying to say, 'We don't know what they did, but we

have reasonable belief that they must have done something'," Mr.

Long said. "The issue is what relief the patent owner can get if

they establish infringement and the practical value of that

relief."

Meantime, Gillette says internal testing proves the Edgewell

blades don't perform as well as the Mach 3, therefore the packaging

claims amount to false advertising. The company says it used a

software program to measure the number of nicks left behind by each

of the razors on a test group of men, and found that the Schick

razors left "a statistically significant number of greater nicks

and cuts."

Packaging for the Edgewell razors say the blades are compatible

with Mach 3 razor handles, according to the lawsuit.

Gillette launched the Mach 3 in 1998 as the first triple-bladed

razor with a pivoting-head design to allow for shaving with less

pressure, thereby reducing skin irritation. The company, in its

suit, says Mach 3 sales have topped $5 billion since the launch,

not including replacement cartridges or disposable razors with the

same name.

P&G's share of the men's razor and blade businesses in the

U.S. fell to 59% last year from 71% in 2010, according to

Euromonitor. Edgewell's share has slipped as well in that time to

11% from 13%, though sales of private-label razors, which includes

some of Edgewell's, grew to 6% from 3%. Dollar Shave Club, which

was founded in 2011, had 5% of the market last year.

P&G's other brands have occasionally turned to the courts to

battle competitors. In 2014, the company sued a small toothpaste

manufacturer, Hello Products LLC, for saying their toothpaste was

99% natural on its package. P&G also won a patent lawsuit

against a private-label competitor to its Crest Whitestrips

teeth-whitening product.

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

August 23, 2016 17:08 ET (21:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

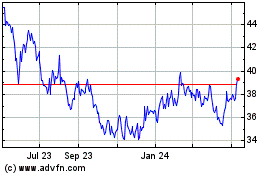

Edgewell Personal Care (NYSE:EPC)

Historical Stock Chart

From Mar 2024 to Apr 2024

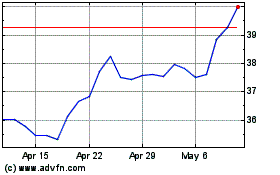

Edgewell Personal Care (NYSE:EPC)

Historical Stock Chart

From Apr 2023 to Apr 2024