The Procter & Gamble Company (NYSE:PG) reported fiscal year

2015 currency neutral core earnings per share growth of 11% versus

the prior year. Core earnings per share were $4.02, a decrease of

two percent. Diluted net earnings per share were $2.44, including a

one-time charge of $2.1 billion, or $0.71 per share, for a change

in the method of accounting for its Venezuelan operations from

consolidation to the cost method, discussed later in this press

release. Organic sales grew one percent as a two percent pricing

benefit more than offset a one percent reduction in shipment

volume. Net sales were $76.3 billion, a decrease of five percent

versus the prior year, including a negative six percentage point

impact from foreign exchange.

For the April - June 2015 quarter, core earnings per share were

$1.00, an increase of eight percent versus the prior year period.

Core EPS results included a $0.09 per share benefit versus the

prior year from non-operating income, primarily minor brand

divestiture gains. Excluding the impact of foreign exchange,

currency-neutral core earnings per share increased 22%. Diluted net

earnings per share were $0.18 including the one-time Venezuela

charge of $0.71 per share and non-core restructuring costs of $0.07

per share. Organic sales were unchanged for the quarter as a three

percentage point benefit from pricing and mix was offset by lower

shipment volume. Net sales were $17.8 billion, a decrease of nine

percent versus the prior year period driven by a negative nine

percentage point impact from foreign exchange.

“In fiscal 2015, P&G delivered strong, double-digit constant

currency core EPS growth and very good free cash flow productivity

of over 100% on modest organic sales growth,” said Chairman,

President, and Chief Executive Officer A.G. Lafley. “We made

significant productivity gains and have largely executed the

reshaping of our business portfolio. Going forward, our objective

is to deliver balanced results across the three main drivers of

operating total shareholder return - sales growth, operating profit

margin expansion and free cash flow generation. We expect continued

strong cost savings and free cash flow productivity, and we are

investing behind product innovation to support an improvement in

top-line growth.”

Fiscal Year Discussion

In fiscal year 2015 net sales decreased five percent to $76.3

billion, including a negative six percentage point impact from

foreign exchange. Organic sales grew one percent. Organic sales

were above year ago levels in four of five business segments.

Volume declined one percent. Pricing increased sales by two percent

with higher pricing in all five business segments.

Foreign

Net

Organic

Organic

Fiscal 2015 Net

Sales Drivers

Volume

Exchange

Price

Mix

Other*

Sales

Volume

Sales

Beauty, Hair and Personal Care (4)% (5)% 2% 0% 0% (7)% (3)% (1)%

Grooming (3)% (8)% 4% 0% 0% (7)% (3)% 1% Health Care (1)% (5)% 2%

3% 0% (1)% (1)% 4% Fabric Care and Home Care 1% (6)% 1% 0% (1)%

(5)% 1% 2% Baby, Feminine and Family Care (1)% (6)%

2% 2% 0% (3)%

(1)% 3%

Total P&G

(1)% (6)% 2% 0%

0% (5)%

(1)% 1%

* Other includes the sales mix impact of

acquisitions/divestitures and rounding impacts necessary to

reconcile volume to net sales.

- Beauty, Hair and Personal Care segment

organic sales declined one percent as pricing benefits only

partially offset lower volume. Innovation-driven sales growth in

Cosmetics and Salon Professional was offset by a sales decline in

Skin and Personal Care due to competition and decreased sales in

Prestige due to lower levels of innovation. Hair Care organic sales

were unchanged as modest growth from pricing in developing markets

was offset by lower volume in developing regions due to competitive

activity.

- Grooming segment organic sales

increased one percent due to higher pricing and innovation on

Blades & Razors and Appliances, which was partially offset by

lower volume mainly due to a combination of continued decline in

consumer shaving incidents and customer inventory reductions.

- Health Care segment organic sales

increased four percent due to favorable mix and pricing in both

Oral Care and Personal Health Care, more than offsetting lower

volume due to competitive activity.

- Fabric Care and Home Care segment

organic sales increased two percent with growth across each

business. Fabric Care sales grew behind volume increases from

product innovation and pricing while Home Care sales benefited from

favorable product mix. Sales also increased in P&G Professional

due to higher volume from increased distribution.

- Baby, Feminine and Family Care segment

organic sales increased three percent driven by pricing, mainly in

Baby Care and Feminine Care, positive product mix from Baby Care

premium products and the Feminine Care adult incontinence launch,

and favorable geographic mix in all businesses. These gains were

slightly offset by a modest decline in Family Care from reduced

distribution in Latin America and reduced pricing in North

America.

Core earnings per share were $4.02, a decrease of two percent

versus the prior year. This excludes losses from discontinued

operations driven by non-cash impairment charges related to the

batteries business, the Venezuela charge, non-core restructuring

charges, charges for European legal matters and balance sheet

devaluation charges resulting from foreign exchange policy changes

in Venezuela prior to the change in accounting. Excluding the

impact of foreign exchange, currency-neutral core earnings per

share increased 11% for the year. Diluted net earnings per share

from continuing operations decreased 21% to $3.06 including the

one-time $0.71 per share impact from the Venezuela charge. Diluted

net earnings per share were $2.44, a decrease of 39% versus the

prior year including the Venezuela charge and a $0.62 per share

loss from discontinued operations.

Reported gross margin decreased 10 basis points, including 30

basis points of non-core restructuring charges. Core gross margin

improved 30 basis points, including 40 basis points of negative

foreign exchange impacts. On a currency-neutral basis, core gross

margin increased 80 basis points, driven by 200 basis points of

productivity cost savings and a 90 basis point benefit from

pricing, which more than offset headwinds from 140 basis points of

mix, 40 basis points from innovation and capacity investments and

20 basis points from higher commodity costs.

Selling, general and administrative expense (SG&A) increased

10 basis points on a reported basis versus the prior year,

including a 30 basis point net benefit from a year-on-year decline

in non-core Venezuelan balance sheet re-measurement charges, which

was partially offset by a 10 basis point increase in non-core

restructuring charges. Core SG&A as a percentage of sales

increased 30 basis points, including 90 basis points of foreign

exchange impacts. On a currency-neutral basis, core SG&A

decreased 60 basis points versus the prior year driven by 130 basis

points of productivity savings from overhead and marketing costs,

which were partially offset by 70 basis points of organization

capability investments and other operating items.

Reported operating profit margin decreased 280 basis points

driven by the impact of the non-core Venezuela charge. Core

operating profit margin was unchanged versus the prior year,

including 130 basis points of foreign exchange impacts. On a

currency-neutral basis, core operating profit margin increased 130

basis points, including 330 basis points of productivity cost

savings.

Operating cash flow was $14.6 billion for the year. Adjusted

free cash flow productivity was 102%. The Company repurchased $4.6

billion of common stock and returned $7.3 billion of cash to

shareholders as dividends. P&G announced an increase to the

quarterly dividend in April, making this the 59th consecutive year

of dividend increases.

Venezuela

P&G announced its decision to stop consolidating the results

of its local Venezuelan operations in its GAAP financial

statements. The Company said it remains committed to serving

Venezuelan consumers with its market leading brands and product

innovations to grow the business. P&G said this change in

accounting treatment does not directly affect the local operations

of its Venezuelan subsidiaries.

The change in accounting treatment reflects the Company’s

inability to convert currency or pay dividends. Therefore,

effective June 30, 2015, the Company stopped consolidating its

Venezuelan subsidiaries and began accounting for its investment in

those subsidiaries using the cost method of accounting.

As a result of this change in accounting, P&G has taken a

one-time, non-core charge of $2.1 billion, or $0.71 per share,

which had no corresponding tax benefit, in its April - June 2015

quarter results to remove all assets and liabilities of its

Venezuelan operations from its balance sheet. In future periods,

the Company’s financial results will be reported using the cost

method of accounting and will include sales of finished products

shipped to the country. Accordingly, beginning with the July -

September 2015 reporting period, P&G will exclude the operating

results of its local Venezuelan subsidiaries from its Consolidated

Financial Statements. Any future dividends from the Company’s

Venezuelan subsidiaries will be recorded as operating income upon

receipt of the cash.

Fiscal Year 2016 Guidance

P&G clarified that its guidance for fiscal year 2016 is

relative to fiscal 2015 results after estimated restatements to

report the earnings from the Beauty categories it plans to exit as

discontinued operations. P&G announced the planned exit of

several Beauty categories on July 9, 2015. P&G said it expects

fiscal year 2015 core EPS, which is based on earnings from

continuing operations, to be restated from the $4.02 level reported

above to approximately $3.77 per share. There is no change in

all-in GAAP reported results. The Company said it plans to furnish

an informational 8-K in September 2015 to provide more details of

the restatement impacts on its financial results.

P&G said it is projecting organic sales to be in-line to up

low-single digits versus fiscal 2015. Foreign exchange is expected

to be a four to five percentage point headwind on all-in sales

growth. As a result, the Company expects all-in sales to be down

low-to-mid single digits versus fiscal 2015 results.

The Company said it expects core earnings per share to be

slightly below to up mid-single digits versus fiscal 2015 restated

core EPS of $3.77. Strong operating profit growth is expected to be

largely offset by a six to seven percentage point core EPS growth

headwind from lower non-operating income and a higher core

effective tax rate. P&G noted that foreign exchange is

estimated to be a three to four percent negative impact on core EPS

growth, with the vast majority of this impact affecting the

first-half of fiscal 2016.

Including the impacts of non-core restructuring costs and

discontinued operations, P&G said it expects all-in GAAP EPS to

be up 53% to 63% versus fiscal year 2015 all-in GAAP EPS of

$2.44.

THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES

(Amounts in Millions Except Per Share

Amounts)

Selected Financial Information GAAP

CORE (NON-GAAP)* Twelve Months Ended June 30 Twelve Months

Ended June 30 2015 2014 % Chg 2015 2014

% Chg NET SALES $ 76,279 $ 80,510 (5 )% $ 76,279

$ 80,510 (5 )% COST OF PRODUCTS SOLD 38,876 41,010 (5

)% 38,343 40,705 (6 )% GROSS PROFIT 37,403 39,500 (5 )% 37,936

39,805 (5 )% SELLING, GENERAL & ADMINISTRATIVE EXPENSE 23,585

24,760 (5 )% 23,228 24,227 (4 )% VENEZUELA CHARGE 2,028 — — % — — —

% OPERATING INCOME 11,790 14,740 (20 )% 14,708 15,528 (5 )% DILUTED

NET EPS FROM CONTINUING OPERATIONS** $ 3.06 $ 3.86 (21 )% $ 4.02 $

4.09 (2 )% TAX RATE 24.6 % 21.1 % 20.9 % 20.6 %

COMPARISONS AS A

% OF NET SALES

Basis PtChange

Basis PtChange

GROSS MARGIN 49.0 % 49.1 % (10 ) 49.7 % 49.4 % 30 SELLING, GENERAL

& ADMINISTRATIVE EXPENSE 30.9 % 30.8 % 10 30.5 % 30.2 % 30

OPERATING MARGIN 15.5 % 18.3 % (280 ) 19.3 % 19.3 % —

CASH FLOW (TWELVE

MONTHS ENDED JUNE 30) - SOURCE/(USE)

2015 2014 OPERATING CASH FLOW $ 14,608 $ 13,958 FREE CASH

FLOW 10,872 10,110 DIVIDENDS (7,287 ) (6,911 ) SHARE REPURCHASE

(4,604 ) (6,005 ) * Core excludes incremental restructuring

charges, certain legal reserves, devaluation impacts from Venezuela

and the Venezuela charge. ** Diluted net earnings per common share

are calculated on net earnings attributable to Procter &

Gamble.

THE PROCTER & GAMBLE COMPANY AND

SUBSIDIARIES

(Amounts in Millions Except Per Share

Amounts)

Selected Financial Information GAAP CORE

(NON-GAAP)* Three Months Ended June 30 Three Months Ended

June 30 2015 2014 % Chg 2015 2014 % Chg

NET SALES $ 17,790 $ 19,596 (9 )% $ 17,790 $

19,596 (9 )% COST OF PRODUCTS SOLD 9,257 10,288 (10 )% 9,056

10,188 (11 )% GROSS PROFIT 8,533 9,308 (8 )% 8,734 9,408 (7 )%

SELLING, GENERAL & ADMINISTRATIVE EXPENSE 5,575 6,146 (9 )%

5,511 6,047 (9 )% VENEZUELA CHARGE 2,028 — — % — — — % OPERATING

INCOME 930 3,162 (71 )% 3,223 3,361 (4 )% DILUTED NET EPS FROM

CONTINUING OPERATIONS** $ 0.22 $ 0.87 (75 )% $ 1.00 $ 0.93 8 % TAX

RATE 49.6 % 18.8 % 19.1 % 18.7 %

COMPARISONS AS A

% OF NET SALES

Basis PtChange

Basis PtChange

GROSS MARGIN 48.0 % 47.5 % 50 49.1 % 48 % 110 SELLING, GENERAL

& ADMINISTRATIVE EXPENSE 31.3 % 31.4 % (10 ) 31.0 % 30.9 % 10

OPERATING MARGIN 5.2 % 16.1 % (1,090 ) 18.1 % 17.2 % 90

CASH FLOW (TWELVE

MONTHS ENDED JUNE 30) - SOURCE/(USE)

2015 2014 OPERATING CASH FLOW $ 14,608 $ 13,958 FREE CASH

FLOW 10,872 10,110 DIVIDENDS (7,287 ) (6,911 ) SHARE REPURCHASE

(4,604 ) (6,005 ) * Core excludes incremental restructuring

charges, certain legal reserves, devaluation impacts from Venezuela

and the Venezuela charge. ** Diluted net earnings per common share

are calculated on net earnings attributable to Procter &

Gamble.

Forward-Looking Statements

Certain statements in this release or presentation, other than

purely historical information, including estimates, projections,

statements relating to our business plans, objectives and expected

operating results, and the assumptions upon which those statements

are based, are "forward-looking statements" within the meaning of

the Private Securities Litigation Reform Act of 1995, Section 27A

of the Securities Act of 1933, and Section 21E of the Securities

Exchange Act of 1934. These forward-looking statements generally

are identified by the words "believe," "project," "anticipate,"

"estimate," "expect," "intend," "strategy," "future,"

"opportunity," "plan," "may," "should," "will," "would," "will be,"

"will continue," "will likely result," and similar expressions.

Forward-looking statements are based on current expectations and

assumptions, which are subject to risks and uncertainties that may

cause results to differ materially from those expressed or implied

in the forward-looking statements. We undertake no obligation to

update or revise publicly any forward-looking statements, whether

because of new information, future events or otherwise.

Risks and uncertainties to which our forward-looking statements

are subject include, without limitation: (1) the ability to

successfully manage global financial, operational and manufacturing

risks, including, among others, (a) an increasingly volatile

economic environment, with potentially significant disruptions and

reduced market growth rates, (b) foreign currency fluctuations, (c)

significant credit or liquidity issues, (d) debt, currency exposure

and repatriation issues in countries with currency exchange, import

authorization or pricing controls (such as Venezuela, Argentina,

China, India and Egypt), (e) maintaining key manufacturing and

supply sources (including sole supplier and sole manufacturing

plant arrangements), and (f) managing disruption of business due to

factors outside of our control, such as natural disasters and acts

of war or terrorism; (2) the ability to successfully manage cost

fluctuations and pressures, including commodity prices, raw

materials, labor costs, energy costs and pension and health care

costs, and achieve cost savings described in our announced

productivity plan; (3) the ability to stay on the leading edge of

innovation, obtain necessary intellectual property protections and

successfully respond to technological advances attained by, and

patents granted to, competitors; (4) the ability to compete with

our local and global competitors by successfully responding to

competitive factors, including prices, promotional incentives and

trade terms for products; (5) the ability to manage and maintain

key customer relationships; (6) the ability to protect our

reputation and brand equity by successfully managing real or

perceived issues, including concerns about safety, quality,

efficacy or similar matters that may arise; (7) the ability to

successfully manage the financial, legal, reputational and

operational risk associated with third party relationships, such as

our suppliers, contractors and external business partners; (8) the

ability to rely on and maintain key information technology systems

and networks (including Company and third-party systems and

networks) and maintain the security and functionality of such

systems and networks and the data contained therein; (9) the

ability to successfully manage regulatory, tax and legal

requirements and matters (including, without limitation, product

liability, intellectual property, price controls, import

restrictions, accounting standards and environmental and tax

policy) and to resolve pending matters within current estimates;

(10) the ability to successfully manage our portfolio optimization

strategy, as well as ongoing acquisition, divestiture and joint

venture activities, to achieve the Company's overall business

strategy, without impacting the delivery of base business

objectives; (11) the ability to successfully achieve productivity

improvements and manage ongoing organizational changes, while

successfully identifying, developing and retaining particularly key

employees, especially in key growth markets where the availability

of skilled or experienced employees may be limited; and (12) the

ability to generate sufficient income and cash flow to allow the

Company to effect the expected share repurchases and dividend

payments. For additional information concerning factors that could

cause actual results to materially differ from those projected

herein, please refer to our most recent 10-K, 10-Q and 8-K

reports.

About Procter & Gamble

P&G serves consumers around the world with one of the

strongest portfolios of trusted, quality, leadership brands,

including Always®, Ambi Pur®, Ariel®, Bounty®, Charmin®, Crest®,

Dawn®, Downy®, Fairy®, Febreze®, Gain®, Gillette®, Head &

Shoulders®, Lenor®, Olay®, Oral-B®, Pampers®, Pantene®, SK-II®,

Tide®, Vicks®, and Whisper®. The P&G community includes

operations in approximately 70 countries worldwide.

Please visit http://www.pg.com for the latest news and

information about P&G and its brands.

THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES

(Amounts in Millions Except Per Share

Amounts)

Consolidated Earnings Information

Three Months Ended June 30 Twelve Months Ended

June 30 2015 2014 % Chg

2015 2014 % Chg NET SALES

$ 17,790 $ 19,596 (9 )% $ 76,279 $ 80,510 (5 )% COST OF PRODUCTS

SOLD 9,257 10,288 (10 )% 38,876 41,010

(5 )%

GROSS PROFIT 8,533 9,308 (8 )% 37,403 39,500 (5 )%

SELLING, GENERAL AND ADMINISTRATIVE EXPENSE 5,575 6,146 (9 )%

23,585 24,760 (5 )% VENEZUELA CHARGE 2,028 — 2,028

OPERATING INCOME 930 3,162 (71 )% 11,790

14,740 (20 )% INTEREST EXPENSE 147 179 (18 )% 626 710 (12 )%

INTEREST INCOME 48 28 71 % 151 101 50 % OTHER NON-OPERATING INCOME,

NET 438 138 217 % 531 206 158 %

EARNINGS FROM CONTINUING OPERATIONS BEFORE INCOME TAXES

1,269 3,149 (60 )% 11,846 14,337 (17 )% INCOME TAXES ON CONTINUING

OPERATIONS 629 593 6 % 2,916 3,019 (3

)%

NET EARNINGS FROM CONTINUING OPERATIONS 640 2,556

(75 )% 8,930 11,318 (21 )%

NET

EARNINGS/(LOSS) FROM DISCONTINUED OPERATIONS (102 ) 64

(259 )% (1,786 ) 467 (482 )%

NET EARNINGS 538 2,620

(79 )% 7,144 11,785 (39 )% LESS: NET EARNINGS ATTRIBUTABLE TO

NONCONTROLLING INTERESTS 17 41 (59 )% 108 142

(24 )%

NET EARNINGS ATTRIBUTABLE TO PROCTER &

GAMBLE $ 521 $ 2,579 (80 )% $ 7,036 $

11,643 (40 )% EFFECTIVE TAX RATE 49.6 % 18.8 % 24.6 %

21.1 %

NET EARNINGS PER COMMON SHARE*: EARNINGS FROM

CONTINUING OPERATIONS $ 0.21 $ 0.90 (77 )% $ 3.16 $ 4.03 (22 )%

EARNINGS/(LOSS) FROM DISCONTINUED OPERATIONS $ (0.04 ) $ 0.02 (300

)% $ (0.66 ) $ 0.16 (513 )% BASIC NET EARNINGS PER COMMON SHARE $

0.17 $ 0.92 (82 )% $ 2.50 $ 4.19 (40 )%

DILUTED NET EARNINGS PER

COMMON SHARE*: EARNINGS FROM CONTINUING OPERATIONS $ 0.22 $

0.87 (75 )% $ 3.06 $ 3.86 (21 )% EARNINGS/(LOSS) FROM DISCONTINUED

OPERATIONS $ (0.04 ) $ 0.02 (300 )% $ (0.62 ) $ 0.15 (513 )%

DILUTED NET EARNINGS PER COMMON SHARE $ 0.18 $ 0.89 (80 )% $ 2.44 $

4.01 (39 )% DIVIDENDS PER COMMON SHARE $ 0.663 $ 0.643 3 % $ 2.590

$ 2.450 6 % DILUTED WEIGHTED AVERAGE COMMON SHARES OUTSTANDING

2,878.5 2,891.9 2,883.6 2,904.7

COMPARISONS AS A % OF NET

SALES

Basis PtChange

Basis PtChange

GROSS MARGIN 48.0% 47.5% 50 49.0% 49.1% (10) SELLING, GENERAL AND

ADMINISTRATIVE EXPENSE 31.3% 31.4% (10) 30.9% 30.8% 10 VENEZUELA

CHARGE 11.4% —% 1,140 2.7% —% 270 OPERATING MARGIN 5.2% 16.1%

(1,090) 15.5% 18.3% (280) EARNINGS FROM CONTINUING OPERATIONS

BEFORE INCOME TAXES 7.1% 16.1% (900) 15.5% 17.8% (230) NET EARNINGS

FROM CONTINUING OPERATIONS 3.6% 13.0% (940) 11.7% 14.1% (240) NET

EARNINGS ATTRIBUTABLE TO PROCTER & GAMBLE 2.9% 13.2% (1,030)

9.2% 14.5% (530)

* Diluted net earnings per common share are calculated on net

earnings attributable to Procter & Gamble.

THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES

(Amounts in Millions Except Per Share

Amounts)

Consolidated Earnings Information Three

Months Ended June 30, 2015 Earnings/(Loss)

from Continuing Net %

Change Operations % Change Earnings/(Loss)

% Change Versus Before Income Versus

from Continuing Versus Net Sales

Year Ago Taxes Year Ago

Operations Year Ago Beauty, Hair and Personal

Care $ 4,144 (10 )% $ 670 1 % $ 495 (1 )% Grooming 1,692 (18 )% 437

(32 )% 321 (34 )% Health Care 1,705 (6 )% 265 (9 )% 173 (1 )%

Fabric Care and Home Care 5,321 (7 )% 960 (1 )% 616 — % Baby,

Feminine and Family Care 4,818 (7 )% 987 (7 )% 662 (9 )% Corporate

110 (38 )% (2,050 ) 325 % (1,627

) (3,005 )%

Total Company $

17,790 (9 )% $

1,269 (60 )% $

640 (75 )%

Three Months Ended June 30, 2015 (Percent Change vs. Year

Ago)* Volume

Volume with Excluding Acquisitions

Acquisitions & & Foreign Net

Sales Divestitures Divestitures

Exchange Price Mix

Other** Growth Beauty, Hair and Personal Care

(6)% (5)% (8)% 5% (1)% —% (10)% Grooming (7)% (7)% (11)% 4% (4)% —%

(18)% Health Care (3)% (3)% (10)% 4% 3% —% (6)% Fabric Care and

Home Care 1% 1% (9)% 2% —% (1)% (7)% Baby, Feminine and Family Care

(4)% (4)% (8)% 3% 2% —%

(7)%

Total Company (3)% (3)%

(9)% 3% —% —%

(9)% Twelve Months Ended June 30,

2015 Earnings/(Loss)

from Continuing Net % Change Operations

% Change Earnings/(Loss) % Change

Versus Before Income Versus from

Continuing Versus Net Sales Year

Ago Taxes Year Ago

Operations Year Ago Beauty, Hair and Personal

Care $ 18,135 (7 )% $ 3,379 (4 )% $ 2,584 (6 )% Grooming 7,441 (7

)% 2,374 (8 )% 1,787 (9 )% Health Care 7,713 (1 )% 1,700 6 % 1,167

8 % Fabric Care and Home Care 22,277 (5 )% 4,061 (5 )% 2,635 (5 )%

Baby, Feminine and Family Care 20,247 (3 )% 4,317 — % 2,938 — %

Corporate 466 (37 )% (3,985 ) 104 %

(2,181 ) 1,191 %

Total Company $

76,279 (5 )% $

11,846 (17 )% $

8,930 (21 )%

Twelve Months Ended June 30, 2015 (Percent Change vs.

Year Ago)* Volume

Volume with Excluding Acquisitions

Acquisitions & & Foreign Net

Sales Divestitures Divestitures

Exchange Price Mix

Other** Growth Beauty, Hair and Personal Care

(4)% (3)% (5)% 2% —% —% (7)% Grooming (3)% (3)% (8)% 4% —% —% (7)%

Health Care (1)% (1)% (5)% 2% 3% —% (1)% Fabric Care and Home Care

1% 1% (6)% 1% —% (1)% (5)% Baby, Feminine and Family Care (1)%

(1)% (6)% 2% 2% —% (3)%

Total Company (1)% (1)%

(6)% 2% —% —%

(5)%

* Sales percentage changes are approximations based on

quantitative formulas that are consistently applied.

** Other includes the sales mix impact of

acquisitions/divestitures and rounding impacts necessary to

reconcile volume to net sales.

THE PROCTER & GAMBLE COMPANY AND SUBSIDIARIES

(Amounts in Millions Except Per Share

Amounts)

Consolidated Statements of Cash Flows

Twelve Months Ended June 30 2015 2014

CASH AND CASH EQUIVALENTS, BEGINNING OF PERIOD $ 8,558 $

5,947

OPERATING ACTIVITIES NET EARNINGS 7,144 11,785

DEPRECIATION AND AMORTIZATION 3,134 3,141 SHARE BASED COMPENSATION

EXPENSE 337 360 DEFERRED INCOME TAXES (803 ) (44 ) GAIN ON SALE OF

BUSINESSES (766 ) (154 ) VENEZUELA CHARGE 2,028 — GOODWILL AND

INDEFINITE-LIVED INTANGIBLE ASSET IMPAIRMENT CHARGES 2,174 —

CHANGES IN: ACCOUNTS RECEIVABLE 349 87 INVENTORIES 313 8 ACCOUNTS

PAYABLE, ACCRUED AND OTHER LIABILITIES 928 1 OTHER OPERATING ASSETS

& LIABILITIES (976 ) (1,557 ) OTHER 746 331

TOTAL OPERATING ACTIVITIES 14,608 13,958

INVESTING ACTIVITIES CAPITAL EXPENDITURES (3,736 ) (3,848 )

PROCEEDS FROM ASSET SALES 4,497 570 CASH RELATED TO VENEZUELA

OPERATIONS (908 ) — ACQUISITIONS, NET OF CASH ACQUIRED (137 ) (24 )

PURCHASES OF SHORT-TERM INVESTMENTS (3,647 ) (568 ) PROCEEDS FROM

SALES OF SHORT-TERM INVESTMENTS 1,203 24 CHANGE IN OTHER

INVESTMENTS (163 ) (261 )

TOTAL INVESTING ACTIVITIES (2,891

) (4,107 )

FINANCING ACTIVITIES DIVIDENDS TO SHAREHOLDERS

(7,287 ) (6,911 ) CHANGE IN SHORT-TERM DEBT (2,580 ) 3,304

ADDITIONS TO LONG-TERM DEBT 2,138 4,334 REDUCTION OF LONG-TERM DEBT

(3,512 ) (4,095 ) TREASURY STOCK PURCHASES (4,604 ) (6,005 ) IMPACT

OF STOCK OPTIONS AND OTHER 2,826 2,094

TOTAL

FINANCING ACTIVITIES (13,019 ) (7,279 )

EFFECT OF EXCHANGE

RATE CHANGES ON CASH AND CASH EQUIVALENTS (411 ) 39

CHANGE IN CASH AND CASH EQUIVALENTS (1,713 ) 2,611

CASH AND CASH EQUIVALENTS, END OF PERIOD $ 6,845 $

8,558

THE PROCTER & GAMBLE COMPANY AND

SUBSIDIARIES

(Amounts in Millions Except Per Share

Amounts)

Condensed Consolidated Balance Sheet

June 30, 2015 June 30, 2014 CASH

AND CASH EQUIVALENTS $ 6,845 $ 8,558 AVAILABLE-FOR-SALE INVESTMENTS

SECURITIES 4,767 2,128 ACCOUNTS RECEIVABLE, NET 4,861 6,386

INVENTORIES 5,454 6,759 ASSETS HELD FOR SALE 3,510 2,849 OTHER

4,209 4,937

TOTAL CURRENT ASSETS 29,646 31,617

PROPERTY, PLANT AND EQUIPMENT, NET 20,268 22,304 GOODWILL AND OTHER

INTANGIBLE ASSETS, NET 74,145 84,547 OTHER NON-CURRENT ASSETS 5,436

5,798

TOTAL ASSETS $ 129,495 $ 144,266

ACCOUNTS PAYABLE $ 8,257 $ 8,461 ACCRUED EXPENSES AND OTHER

LIABILITIES 8,325 8,999 LIABILITIES HELD FOR SALE 1,187 660 DEBT

DUE WITHIN ONE YEAR 12,021 15,606

TOTAL CURRENT

LIABILITIES 29,790 33,726 LONG-TERM DEBT 18,329 19,811 OTHER

18,326 20,753

TOTAL LIABILITIES 66,445 74,290

TOTAL SHAREHOLDERS' EQUITY 63,050 69,976

TOTAL

LIABILITIES & SHAREHOLDERS' EQUITY $ 129,495 $

144,266

The Procter & Gamble Company

Exhibit 1: Non-GAAP Measures

In accordance with the SEC's Regulation G, the following

provides definitions of the non-GAAP measures used in the earnings

release and the reconciliation to the most closely related GAAP

measure.

Organic Sales Growth: Organic sales

growth is a non-GAAP measure of sales growth excluding the impacts

of acquisitions, divestitures and foreign exchange from

year-over-year comparisons. We believe this provides investors with

a more complete understanding of underlying sales trends by

providing sales growth on a consistent basis. Organic sales is also

one of the measures used to evaluate senior management and is a

factor in determining their at-risk compensation.

The reconciliation of reported sales growth to organic sales is

as follows:

Net Foreign Acquisition/

Organic Sales Exchange

Divestiture Sales Twelve Months Ended June 30

Growth Impact Impact* Growth Beauty,

Hair and Personal Care (7)% 5% 0% (1)% Grooming (7)% 8% 0% 1%

Health Care (1)% 5% 0% 4% Fabric Care and Home Care (5)% 6% 1% 2%

Baby, Feminine and Family Care (3)% 6% (1)%

3%

Total P&G (5)% 6%

0% 1% Foreign

Exchange Acquisition/ Organic Sales

Total P&G Net Sales Growth Impact

Divestiture Impact* Growth FY 2016 (Estimate) Down

low-to-mid single digits Approximately 5% —% In line to up low

single digits

* Acquisition/Divestiture Impact includes volume and mix impacts

of acquired and divested businesses, as well as rounding impacts

necessary to reconcile net sales to organic sales.

The core earnings measures included in the following

reconciliation tables refer to the equivalent GAAP measures

adjusted as applicable for the following items:

- charge in 2015 related to the change in

accounting for our Venezuelan subsidiaries

- charges in both years for incremental

restructuring due to increased focus on productivity and cost

savings,

- charges in both years for balance sheet

impacts from the devaluation of the foreign currency exchange rate

in Venezuela and

- charges in both years for certain

European legal matters.

We do not view these items to be part of our sustainable

results. We believe that these Core measures provide an important

perspective of underlying business trends and results and provide a

more comparable measure of year-on-year earnings per share growth.

Core EPS is also one of the measures used to evaluate senior

management and is a factor in determining their at-risk

compensation.

Core EPS and Currency-neutral Core

EPS: Core EPS is a measure of the Company's diluted net

earnings per share from continuing operations adjusted as indicated

below.

Currency-neutral Core EPS is a measure of the Company's Core EPS

excluding the incremental current year impact of foreign exchange.

We believe the currency-neutral Core EPS measure provides a more

comparable view of year-on-year earnings per share growth. The

table below provides a reconciliation of diluted net earnings per

share to Core EPS and Core EPS to Currency-neutral Core EPS:

AMJ 15 AMJ 14 FY 15

FY 14 Diluted Net Earnings Per Share

$0.18 $0.89 $2.44 $4.01 Earnings from

Discontinued Operations $0.04 ($0.02) $0.62 ($0.16) Non-Controlling

Interest from Discontinued Operations $— $— $— $0.01

Earnings

from Continuing Operations $0.22 $0.87

$3.06 $3.86 Incremental Restructuring Charges $0.07

$0.04 $0.20 $0.12 Venezuela Balance Sheet Remeasurement and

Devaluation Impacts $— $— $0.04 $0.09 Charges for European Legal

Matters ($0.01) $0.02 $0.01 $0.02 Venezuela Charge $0.71 $— $0.71

$— Rounding Impacts $0.01 $— $— $—

Core EPS $1.00

$0.93 $4.02 $4.09 Percentage Change vs. Prior

Period 8% (2)% Currency Impact to Earnings $0.13 $0.53

Currency-neutral Core EPS $1.13 $4.55

Percentage Change vs. Prior Period 22% 11%

Note – All reconciling items are presented net of tax. Tax

effects are calculated consistent with the nature of the underlying

transaction.

Impact of Incremental Total

P&G Diluted EPS Growth Non-Core Items*

Core Growth EPS FY 2016 (Estimate) 53% to 63% (48)% to (64)%

Down slightly to up mid-single digits

* Includes absence of significant one-time items (e.g. Venezuela

charge, Batteries impairments).

Core Operating Profit Margin: This

is a measure of the Company's operating margin adjusted for items

as indicated below.

AMJ 15 AMJ 14 FY 15

FY 14 Operating Profit Margin 5.2%

16.1% 15.5% 18.3% Incremental Restructuring

1.5% 0.7% 0.9% 0.5% Venezuela Charge 11.4% —% 2.7% —% Venezuela

Balance Sheet Revaluation and Devaluation —% —% 0.2% 0.4% Charges

for European Legal Matters (0.1)% 0.3% —% 0.1% Rounding 0.1% 0.1%

—% —%

Core Operating Profit Margin 18.1% 17.2%

19.3% 19.3% Basis Point Change 90 —

Core Gross Margin: This is a

measure of the Company's gross margin adjusted for items as

indicated below.

AMJ 15 AMJ 14 FY 15

FY 14 Gross Margin 48.0% 47.5%

49.0% 49.1% Incremental Restructuring 1.1% 0.5% 0.7%

0.4% Rounding (0.1)%

Core Gross Margin

49.1% 48.0% 49.7% 49.4% Basis Point

Change 110 30

Core Selling, General and Administrative

Expense (SG&A) as a percentage of sales: This is a

measure of the Company's SG&A as a percentage of sales adjusted

for items as indicated below.

AMJ 15 AMJ 14 FY 15

FY 14 SG&A as a % of NOS 31.3%

31.4% 30.9% 30.8% Incremental Restructuring

(0.4)% (0.2)% (0.3)% (0.2)% Venezuela Balance Sheet Revaluation and

Devaluation —% —% (0.2)% (0.4)% Charges for European Legal Matters

0.1% (0.3)% —% (0.1)% Rounding 0.1% 0.1%

Core

SG&A as a % of NOS 31.0% 30.9% 30.5%

30.2% Basis Point Change 10 30

Core Tax Rate: This is a measure of

the Company's tax rate on continuing operations adjusted for items

as indicated below.

AMJ 15 AMJ 14 FY 15

FY 14 Effective Tax Rate 49.6%

18.8% 24.6% 21.1% Incremental Restructuring

0.5% 0.2% 0.1% (0.1)% Charges for European Legal Matters 0.1%

(0.3)% —% (0.1)% Venezuela Balance Sheet Revaluation and

Devaluation —% —% 0.1% (0.3)% Venezuela Charge (31.2)% —% (3.8)% —%

Rounding 0.1% —% (0.1)% —%

Core Tax Rate 19.1%

18.7% 20.9% 20.6% Basis Point Change 40 30

Adjusted free cash flow: Adjusted

free cash flow is defined as operating cash flow less capital

spending excluding tax payments for the Pet divestiture. We view

adjusted free cash flow as an important measure because it is one

factor used in determining the amount of cash available for

dividends and discretionary investment. The reconciliation of

adjusted free cash flow is provided below (amounts in

millions):

Operating Capital Free Cash

Cash Tax Payment Adjusted Free

Cash Flow Spending Flow

- Pet Sale Cash Flow FY 2015 $14,608

$(3,736) $10,872 $729 $11,601

Adjusted free cash flow

productivity: Adjusted free cash flow productivity is

defined as the ratio of adjusted free cash flow to net earnings

excluding impairment charges on the Batteries business and the

Venezuela charge. The Company's long-term target is to generate

annual free cash flow at or above 90 percent of net earnings.

Adjusted free cash flow productivity is also a measure used to

evaluate senior management and is a factor in determining their

at-risk compensation. The reconciliation of adjusted free cash flow

productivity is provided below:

Net Earnings Adjusted

Impairment Excl. Impairment Adjusted Free

Cash Net & Venezuela & Venezuela

Free Cash Flow Flow Earnings

Charges Charges

Productivity FY 2015 $11,601 $7,144 $4,187

$11,331 102%

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150730005677/en/

P&G Media

Contacts:Paul Fox, 513-983-3465Jennifer Corso,

513-983-2570orP&G Investor Relations

Contact:John Chevalier, 513-983-9974

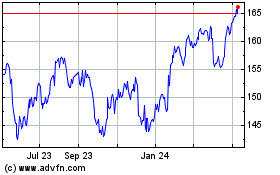

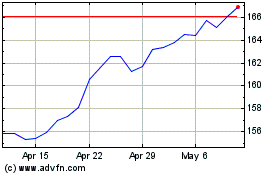

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024