P.A.M. Transportation Services, Inc. (NASDAQ:PTSI) today reported

net income of $3,451,178, or diluted earnings per share of $0.53

($0.54 basic) for the quarter ended September 30, 2016, and net

income of $10,378,057, or diluted earnings per share of $1.54

($1.55 basic) for the nine month period then ended. These results

compare to net income of $5,794,850, or diluted earnings per share

of $0.80 ($0.81 basic), and net income of $18,203,272, or diluted

earnings per share of $2.46 ($2.48 basic), respectively, for the

three and nine months ended September 30, 2015.

Base revenue, which excludes fuel surcharge

revenue, increased 4.2% to $95,926,084 for the third quarter of

2016 compared to $92,076,036 for the third quarter of 2015, while

fuel surcharge revenue decreased 10.4% to $13,467,347 for the third

quarter of 2016 compared to $15,033,696 for the third quarter of

2015. As a result, total operating revenues increased to

$109,393,431 for the third quarter of 2016 compared to $107,109,732

for the third quarter of 2015. For the nine months ended September

30, 2016, base revenue, which excludes fuel surcharge revenue,

increased 8.5% to $288,495,966 compared to $265,813,455 during the

nine months ended September 30, 2015, while fuel surcharge revenue

decreased 26.2% to $36,002,270 for the first nine months of 2016

compared to $48,812,558 for the first nine months of 2015. As a

result, total operating revenues increased 3.1% to $324,498,236 for

the first nine months of 2016 compared to $314,626,013 for the

first nine months of 2015. The decline in fuel surcharge revenue

for each of the periods was due to the decline in retail fuel

prices during the periods compared.

Daniel H. Cushman, President of the Company,

commented, “We continue to be challenged by many of the same

hurdles that others in our industry are currently facing. Our

situation can be summarized as the inability to increase freight

rates to cover increasingly higher operating costs. As the economy

remained somewhat sluggish and overcapacity existed throughout the

quarter, our freight rates continued to be pressured lower. This

trend of declining rates is the polar opposite to that of operating

costs, which continue to rise. Operating costs related to

equipment, insurance, and employee wages and benefits have

continued on an upward trend.

“As we have discussed throughout the year, our

employee health care costs continue to be significantly above our

historical levels and through the first nine months of 2016,

represented a $2.1 million increase, or a 53% increase, over those

costs during the first nine months of 2015. Another area where we

have experienced significantly higher costs relates to our employee

driver recruitment, training, and retention programs. Our efforts

to improve these programs have been successful and higher costs

were anticipated as a part of the improvement process. However, the

current environment does not allow us to recover these additional

costs through rate increases. Through the first nine months of

2016, we have incurred $3.6 million in additional costs related to

these program improvements.

“The used truck market also remains extremely

weak, and gains on the sale of equipment during the quarter

reflected that weakness. When compared to the third quarter of

2015, gains from the sale of equipment decreased by $0.4 million

during the third quarter of this year. Due to the continued

weakness in the used equipment market, we reduced the expected

residual values during the quarter of certain trucks which do not

have a manufacturer guaranteed residual value. These reductions in

residual values increased our depreciation expense by $0.5 million

during the quarter and will continue to increase depreciation

expense in future quarters until each respective truck is sold or

the lowered residual value is reached.

“We continue to stand by our decision to push

for revenue growth in what we knew would be a very challenging

year. Rather than hold our fleet size, or even downsize, we chose

to grow our fleet. For the quarter, trucking revenue growth was

6.3%, which was achieved despite the fact that July revenue was

flat year-over-year as we experienced the negative impact of

automotive downtime returning to more historically normal levels.

While July downtime of a week or two is typical for the automotive

business, we had not experienced this typical level of downtime in

recent years. Since we only had two months of revenue growth during

the quarter, we were unable to meet our desired double-digit level

of growth for the quarter. However, with approximately 50% of our

revenue being derived from automotive industry related customers,

it was encouraging to achieve a significant level of revenue growth

for the quarter and to report earnings per share results for the

quarter representing one of our top three best third quarters on

record.

“While we are pleased with our overall revenue

growth, maintaining revenue within our Expedited Division has been

extremely challenging as this division is in large part supported

by third-party less-than-truckload carriers where we provide

substitute line haul. In many instances, these carriers now have

excess capacity and have decided to haul their own freight instead

of contracting with us to provide our services. However, we have

secured some seasonal opportunities which we believe will have a

positive impact on our results throughout the remainder of the

year. In addition, our Mexico Division continues to flourish.

Cross-border business activity represents between 40% and 45% of

what we do, is one of our more profitable divisions, and is

something our driving professionals desire.

“With the revenue growth achieved thus far for

the year, we continue to successfully expand our customer base. We

continue to develop new customer relations and have managed to

secure five new dedicated fleets with customers that we had not

done business with prior to this year. Developing new customer

relationships is an ongoing goal of ours, and we are pleased to be

experiencing success in that area.

“We have also continued to invest in our truck

and trailer fleets. The average age of our truck fleet is 1.5 years

while the average age of our trailer fleet is 2.8 years. We believe

that these investments help provide us with a competitive advantage

in providing reliable service to our customers, recruiting and

retaining drivers, achieving better fuel economy, and lowering

equipment maintenance costs.

“Finally, as others in the industry have

expressed, we expect that upcoming regulations mandating the use of

electronic logging devices will provide a significant reduction in

capacity as noncompliant carriers are forced to either become

compliant with rules, which could negatively impact their current

equipment utilization, or exit the industry altogether. This

capacity reduction should provide rate pressure relief as shippers

begin to lock-in capacity from a shrinking pool of available

assets.”

P.A.M. Transportation Services, Inc. is a

leading truckload dry van carrier transporting general commodities

throughout the continental United States, as well as in the

Canadian provinces of Ontario and Quebec. The Company also provides

transportation services in Mexico through its gateways in Laredo

and El Paso, Texas under agreements with Mexican carriers.

Certain information included in this document

contains or may contain “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Such forward-looking statements may relate to expected future

financial and operating results or events, and are thus

prospective. Such forward-looking statements are subject to risks,

uncertainties and other factors which could cause actual results to

differ materially from future results expressed or implied by such

forward-looking statements. Potential risks and uncertainties

include, but are not limited to, excess capacity in the trucking

industry; surplus inventories; recessionary economic cycles and

downturns in customers' business cycles; increases or rapid

fluctuations in fuel prices, interest rates, fuel taxes, tolls,

license and registration fees; the resale value of the Company's

used equipment and the price of new equipment; increases in

compensation for and difficulty in attracting and retaining

qualified drivers and owner-operators; increases in insurance

premiums and deductible amounts relating to accident, cargo,

workers' compensation, health, and other claims; unanticipated

increases in the number or amount of claims for which the Company

is self-insured; inability of the Company to continue to secure

acceptable financing arrangements; seasonal factors such as harsh

weather conditions that increase operating costs; competition from

trucking, rail, and intermodal competitors including reductions in

rates resulting from competitive bidding; the ability to identify

acceptable acquisition candidates, consummate acquisitions, and

integrate acquired operations; a significant reduction in or

termination of the Company's trucking service by a key customer;

and other factors, including risk factors, included from time to

time in filings made by the Company with the Securities and

Exchange Commission. The Company undertakes no obligation to

publicly update or revise forward-looking statements, whether as a

result of new information, future events or otherwise. In

light of these risks and uncertainties, the forward-looking events

and circumstances discussed above and in company filings might not

transpire.

| P.A.M.

Transportation Services, Inc. and SubsidiariesKey Financial and

Operating Statistics(unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

|

|

|

|

|

|

|

|

|

| Revenue,

before fuel surcharge |

$ |

95,926,084 |

|

|

$ |

92,076,036 |

|

|

$ |

288,495,966 |

|

|

$ |

265,813,455 |

|

| Fuel

surcharge |

|

13,467,347 |

|

|

|

15,033,696 |

|

|

|

36,002,270 |

|

|

|

48,812,558 |

|

|

|

|

109,393,431 |

|

|

|

107,109,732 |

|

|

|

324,498,236 |

|

|

|

314,626,013 |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses and costs: |

|

|

|

|

|

|

|

| Salaries, wages and benefits |

|

28,166,313 |

|

|

|

26,532,551 |

|

|

|

83,489,780 |

|

|

|

79,031,924 |

|

| Operating supplies and

expenses |

|

21,154,915 |

|

|

|

21,911,638 |

|

|

|

61,315,348 |

|

|

|

69,202,419 |

|

| Rent and purchased

transportation |

|

40,013,802 |

|

|

|

35,255,319 |

|

|

|

118,118,680 |

|

|

|

97,882,536 |

|

| Depreciation |

|

10,166,226 |

|

|

|

8,452,146 |

|

|

|

29,011,407 |

|

|

|

23,752,859 |

|

| Insurance and claims |

|

3,608,575 |

|

|

|

3,889,503 |

|

|

|

12,157,558 |

|

|

|

11,245,760 |

|

| Other |

|

1,937,204 |

|

|

|

2,199,725 |

|

|

|

6,120,997 |

|

|

|

6,867,408 |

|

| Gain on disposition of

equipment |

|

(948,574 |

) |

|

|

(1,357,020 |

) |

|

|

(3,950,800 |

) |

|

|

(4,611,380 |

) |

| Total

operating expenses and costs |

|

104,098,461 |

|

|

|

96,883,862 |

|

|

|

306,262,970 |

|

|

|

283,371,526 |

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

5,294,970 |

|

|

|

10,225,870 |

|

|

|

18,235,266 |

|

|

|

31,254,487 |

|

|

|

|

|

|

|

|

|

|

| Interest

expense |

|

(927,147 |

) |

|

|

(732,385 |

) |

|

|

(2,658,991 |

) |

|

|

(1,992,838 |

) |

|

Non-operating income (loss) |

|

1,235,584 |

|

|

|

(131,605 |

) |

|

|

1,203,123 |

|

|

|

385,372 |

|

|

|

|

|

|

|

|

|

|

| Income

before income taxes |

|

5,603,407 |

|

|

|

9,361,880 |

|

|

|

16,779,398 |

|

|

|

29,647,021 |

|

| Income

tax expense |

|

2,152,229 |

|

|

|

3,567,030 |

|

|

|

6,401,341 |

|

|

|

11,443,749 |

|

|

|

|

|

|

|

|

|

|

| Net

income |

$ |

3,451,178 |

|

|

$ |

5,794,850 |

|

|

$ |

10,378,057 |

|

|

$ |

18,203,272 |

|

|

|

|

|

|

|

|

|

|

| Diluted

earnings per share |

$ |

0.53 |

|

|

$ |

0.80 |

|

|

$ |

1.54 |

|

|

$ |

2.46 |

|

|

|

|

|

|

|

|

|

|

| Average

shares outstanding – Diluted |

|

6,458,358 |

|

|

|

7,218,813 |

|

|

|

6,724,676 |

|

|

|

7,385,484 |

|

|

|

|

|

|

|

|

|

|

| |

|

Quarter Ended September 30, |

|

Nine Months Ended September 30, |

| |

Truckload Operations |

|

2016 |

|

|

|

2015 |

|

|

|

2016 |

|

|

|

2015 |

|

| |

|

|

|

|

|

|

|

|

| |

Total

miles |

|

60,779,414 |

|

|

|

56,260,140 |

|

|

|

178,824,146 |

|

|

|

163,700,636 |

|

| |

Operating ratio (1) |

|

93.92 |

% |

|

|

87.47 |

% |

|

|

93.19 |

% |

|

|

86.90 |

% |

| |

Empty

miles factor |

|

6.93 |

% |

|

|

6.97 |

% |

|

|

6.59 |

% |

|

|

6.68 |

% |

| |

Revenue

per total mile, before fuel surcharge |

$ |

1.40 |

|

|

$ |

1.43 |

|

|

$ |

1.42 |

|

|

$ |

1.42 |

|

| |

Total

loads |

|

81,006 |

|

|

|

79,864 |

|

|

|

245,238 |

|

|

|

229,903 |

|

| |

Revenue

per truck per work day |

$ |

708 |

|

|

$ |

684 |

|

|

$ |

698 |

|

|

$ |

670 |

|

| |

Revenue

per truck per week |

$ |

3,540 |

|

|

$ |

3,420 |

|

|

$ |

3,490 |

|

|

$ |

3,350 |

|

| |

Average

company-driver trucks |

|

1,315 |

|

|

|

1,410 |

|

|

|

1,350 |

|

|

|

1,418 |

|

| |

Average

owner operator trucks |

|

567 |

|

|

|

422 |

|

|

|

546 |

|

|

|

395 |

|

| |

|

|

|

|

|

|

|

|

| |

Logistics Operations |

|

|

|

|

|

|

|

| |

Total

revenue |

$ |

10,640,438 |

|

|

$ |

11,855,964 |

|

|

$ |

34,233,571 |

|

|

$ |

33,552,544 |

|

| |

Operating ratio |

|

99.01 |

% |

|

|

98.52 |

% |

|

|

97.31 |

% |

|

|

97.55 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

) |

Operating ratio is calculated based upon total operating

expenses, net of fuel surcharge, as a percentage of revenue, before

fuel surcharge. We use revenue, before fuel surcharge, and

operating expenses, net of fuel surcharge, because we believe that

eliminating this sometimes volatile source of revenue affords a

more consistent basis for comparing our results of operations from

period to period. |

P.A.M. TRANSPORTATION SERVICES, INC.

P.O. BOX 188

Tontitown, AR 72770

Allen W. West

(479) 361-9111

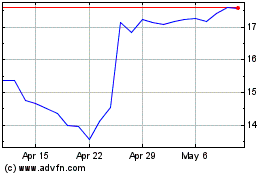

P A M Transport Services (NASDAQ:PTSI)

Historical Stock Chart

From Mar 2024 to Apr 2024

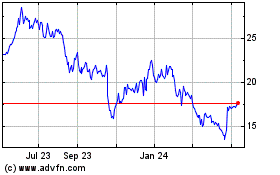

P A M Transport Services (NASDAQ:PTSI)

Historical Stock Chart

From Apr 2023 to Apr 2024