TIDMOXB

RNS Number : 7296J

Oxford Biomedica PLC

13 September 2016

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN, IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN, INTO OR WITHIN THE

UNITED STATES, CANADA, AUSTRALIA, JAPAN, SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH THE SAME WOULD BE UNLAWFUL. PLEASE SEE THE

IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR FORM PART OF ANY OFFER OR INVITATION TO SELL OR

ISSUE, OR ANY SOLICITATION OF ANY OFFER TO PURCHASE OR SUBSCRIBE

FOR, ANY NEW ORDINARY SHARES, NOR SHALL IT (OR ANY PART OF IT), OR

THE FACT OF ITS DISTRIBUTION, FORM THE BASIS OF, OR BE RELIED ON IN

CONNECTION WITH OR ACT AS ANY INDUCEMENT TO ENTER INTO, ANY

CONTRACT OR COMMITMENT WHATSOEVER WITH RESPECT TO THE PLACING,

SUBSCRIPTION AND RELATED PARTY TRANSACTION (THE "FUNDRAISING") OR

OTHERWISE. THIS ANNOUNCEMENT IS NOT A PROSPECTUS AND INVESTORS

SHOULD NOT SUBSCRIBE FOR OR PURCHASE ANY NEW ORDINARY SHARES

REFERRED TO IN THIS ANNOUNCEMENT EXCEPT SOLELY ON THE BASIS OF

INFORMATION IN THE PROSPECTUS EXPECTED TO BE PUBLISHED TODAY.

COPIES OF THE PROSPECTUS WILL, FOLLOWING PUBLICATION, BE AVAILABLE

FROM OXFORD BIOMEDICA'S HEAD OFFICE AT WINDRUSH COURT, TRANSPORT

WAY, OXFORD OX4 6LT.

THE SECURITIES DISCUSSED HEREIN MAY NOT BE OFFERED OR SOLD IN

THE UNITED STATES, UNLESS REGISTERED UNDER THE U.S. SECURITIES ACT

OF 1933, AS AMED (THE "SECURITIES ACT"), OR PURSUANT TO AN

EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, REGISTRATION

UNDER THE SECURITIES ACT. NO PUBLIC OFFERING OF THE SECURITIES

DISCUSSED HEREIN IS BEING MADE IN THE UNITED STATES AND THE

INFORMATION CONTAINED HEREIN DOES NOT CONSTITUTE AN OFFERING OF

SECURITIES FOR SALE IN THE UNITED STATES AND THE COMPANY DOES NOT

CURRENTLY INT TO REGISTER ANY SECURITIES UNDER THE SECURITIES ACT.

ADDITIONALLY, THE SHARES HAVE NOT BEEN APPROVED OR DISAPPROVED BY

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR ANY OTHER

SECURITIES COMMISSION OR REGULATORY AUTHORITY IN THE UNITED STATES,

NOR HAVE ANY OF THE FOREGOING AUTHORITIES PASSED UPON ORORSED THE

MERITS OF THE PROPOSED FUNDRAISING. ANY REPRESENTATION TO THE

CONTRARY IS A CRIMINAL OFFENCE IN THE UNITED STATES.

THE PROSPECTUS WILL ALSO BE AVAILABLE ON THE COMPANY'S WEBSITE

AT: WWW.OXFORDBIOMEDICA.CO.UK.

Oxford BioMedica plc

Publication of Prospectus

Oxford, UK - 13 September 2016: Further to the announcement

published earlier today in connection with the Fundraising by

Oxford BioMedica plc ("Oxford BioMedica" or the "Company", together

with its subsidiaries, the "Group") (LSE: OXB), Oxford BioMedica

confirms that its prospectus dated 13 September 2016 (the

"Prospectus") has been approved by the UK Listing Authority.

Copies of the Prospectus will shortly be available on the

Company's website at: www.oxfordbiomedica.co.uk and free of charge

during normal business hours from Oxford BioMedica's head office at

Windrush Court, Transport Way, Oxford OX4 6LT.

The Prospectus has also been submitted to the National Storage

Mechanism and will shortly be available for inspection at

www.morningstar.co.uk/uk/NSM.

Jefferies International Limited ("Jefferies") is acting as

Sponsor, Global Co-ordinator and Bookrunner for the Company, WG

Partners LLP ("WG Partners") and Scott Harris UK Limited ("Scott

Harris") are acting as UK Placement Agents and Roth Capital

Partners, LLC ("Roth Capital") is acting as US Placement Agent for

the Company in connection with the Fundraising.

For further information, please

contact:

Oxford BioMedica: Tel: +44 (0)1865

John Dawson, Chief Executive 783 000

Officer

Tim Watts, Chief Financial Officer

Jefferies (Sponsor, Global Co-Ordinator Tel: +44 (0)20

and Bookrunner) 7029 8000

Gil Bar-Nahum

Simon Hardy

Lee Morton

Max Jones

Nicholas Moore

WG Partners (UK Placement Agent) Tel: +44(0)20

David Wilson 3705 9330

Claes Spång

Scott Harris UK Limited (UK Placement Tel: +44 (0) 20

Agent) 7653 0030

Jeremy Wiseman

Jamie Blewitt

Financial and corporate communications Tel: +44 (0)20

enquiries: 3709 5700

Consilium Strategic Communications

Mary-Jane Elliott/Matthew Neal/Chris

Welsh/Laura Thornton

IMPORTANT NOTICE

This Announcement and the information contained in this

Announcement is not for release, publication or distribution,

directly or indirectly, in whole or in part, in, into or within the

United States (including its territories and possessions, any State

of the United States and the District of Columbia), Australia,

Canada, Japan or South Africa, or any other jurisdiction where to

do so might constitute a violation of the relevant laws or

regulations of such jurisdiction.

This Announcement does not constitute or form part of any offer

or any solicitation to purchase or subscribe for securities in the

United States.

The securities referred to herein have not been, and will not

be, registered under the US Securities Act of 1933, as amended (the

"Securities Act") or under the applicable securities laws of any

state or other jurisdiction of the United States, and may not be

offered, sold, taken up, resold, transferred or delivered, directly

or indirectly within, into or in the United States except pursuant

to an applicable exemption from, or in a transaction not subject

to, the registration requirements of the Securities Act and in

compliance with the securities laws of any relevant state or other

jurisdiction of the United States. There will be no public offer of

securities in the United States.

The New Ordinary Shares have not been and will not be registered

under the applicable securities laws of Australia, Canada, Japan or

South Africa and, subject to certain exceptions, may not be offered

or sold, directly or indirectly, in Australia, Canada, Japan or

South Africa. There will be no public offering of the New Ordinary

Shares in Australia, Canada, Japan or South Africa or

elsewhere.

This Announcement has been issued by, and is the sole

responsibility, of the Company. This Announcement is not an offer

to sell nor a solicitation to buy any securities in any

jurisdiction, nor is it a prospectus for the purposes of Directive

2003/71/EC as amended (including amendments by Directive

2010/73/EU, to the extent implemented in the relevant member state)

(the "Prospectus Directive") and investors should not subscribe for

or purchase any New Ordinary Shares referred to in this

Announcement except solely on the basis of information in the

Prospectus published today.

This Announcement is not an invitation nor is it intended to be

an inducement to engage in investment activity for the purpose of

section 21 of the Financial Services and Markets Act 2000 (as

amended) of the United Kingdom ("FSMA"). To the extent that this

Announcement does constitute an inducement to engage in any

investment activity included within this Announcement, it is

directed at and is only being distributed to: (A) persons in member

states of the European Economic Area who are qualified investors

within the meaning of Article 2(1)(e) of the Prospectus Directive;

(B) if in the United Kingdom, persons who (i) have professional

experience in matters relating to investments who fall within the

definition of "investment professionals" in Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005, as amended (the "Order"), or are high net worth companies,

unincorporated associations or partnerships or trustees of high

value trusts as described in Article 49(2) of the Order; and (ii)

are "qualified investors" as defined in section 86 of FSMA; and (C)

otherwise, to persons to whom it may otherwise be lawful to

communicate it to (each a "Relevant Person"). No other person

should act or rely on this Announcement and persons distributing

this Announcement must satisfy themselves that it is lawful to do

so. By accepting the terms of this Announcement you represent and

agree that you are a Relevant Person.

Jefferies, which is authorised and regulated in the United

Kingdom by the Financial Conduct Authority, is acting exclusively

for the Company as Sponsor, Global Co-Ordinator and Bookrunner and

no-one else in relation to the Fundraising or the admission of the

New Ordinary Shares to the premium listing segment of the Official

List of the FCA and to trading on the London Stock Exchange's main

market for listed securities, ("the Admission"), and, will not

regard any other person (whether or not a recipient of this

Announcement) as a client in relation to the Fundraising or

Admission, and will not be responsible to anyone other than the

Company for providing the protections afforded to clients of

Jefferies nor for providing advice in relation to the Fundraising

or Admission, or any other transaction or arrangement referred to

in this Announcement and, apart from the responsibilities and

liabilities, if any, which may be imposed on Jefferies by FSMA or

the regulatory regime established thereunder, Jefferies accepts no

responsibility whatsoever and makes no representation or warranty,

express or implied, for or in respect of the contents of this

Announcement, including its accuracy, completeness or verification,

nor for any other statement made or purported to be made by, on

behalf of it, the Company, the Directors or any other person, in

connection with the Company, the Fundraising or Admission.

Jefferies and its directors, officers, employees, advisors and

affiliates each accordingly disclaims all and any liability,

whether arising in tort, contract or otherwise, which it might

otherwise be found to have in respect of this Announcement or any

such statement.

WG Partners, which is authorised and regulated in the United

Kingdom by the Financial Conduct Authority, is acting for the

Company as UK Placement Agent and no-one else in relation to the

Fundraising or Admission, and will not regard any other person

(whether or not a recipient of this Announcement) as a client in

relation to the Fundraising or Admission, and will not be

responsible to anyone other than the Company for providing the

protections afforded to clients of WG Partners nor for providing

advice in relation to the Fundraising or Admission or any other

transaction or arrangement referred to in this Announcement and,

apart from the responsibilities and liabilities, if any, which may

be imposed on WG Partners by FSMA or the regulatory regime

established thereunder, WG Partners accepts no responsibility

whatsoever and makes no representation or warranty, express or

implied, for or in respect of the contents of this Announcement,

including its accuracy, completeness or verification, nor for any

other statement made or purported to be made by, on behalf of it,

the Company, the Directors or any other person, in connection with

the Company, the Fundraising or Admission. WG Partners and its

directors, officers, employees, advisors and affiliates each

accordingly disclaims all and any liability, whether arising in

tort, contract or otherwise, which it might otherwise be found to

have in respect of this Announcement or any such statement.

Scott Harris, which is authorised and regulated in the United

Kingdom by the Financial Conduct Authority, is acting for the

Company as UK Placement Agent and no-one else in relation to the

Fundraising or Admission, and will not regard any other person

(whether or not a recipient of this Announcement) as a client in

relation to the Fundraising or Admission, and will not be

responsible to anyone other than the Company for providing the

protections afforded to clients of Scott Harris nor for providing

advice in relation to the Fundraising or Admission or any other

transaction or arrangement referred to in this Announcement and,

apart from the responsibilities and liabilities, if any, which may

be imposed on Scott Harris by FSMA or the regulatory regime

established thereunder, Scott Harris accepts no responsibility

whatsoever and makes no representation or warranty, express or

implied, for or in respect of the contents of this Announcement,

including its accuracy, completeness or verification, nor for any

other statement made or purported to be made by, on behalf of it,

the Company, the Directors or any other person, in connection with

the Company, the Fundraising or Admission. Scott Harris and its

directors, officers, employees, advisors and affiliates each

accordingly disclaims all and any liability, whether arising in

tort, contract or otherwise, which it might otherwise be found to

have in respect of this Announcement or any such statement.

Roth Capital, which is authorised in the US by the Financial

Industry Regulatory Authority ("FINRA"), is acting exclusively for

the Company as US Placement Agent and no-one else in relation to

the Fundraising and Admission, will not regard any other person

(whether or not a recipient of the Announcement) as a client in

relation to the Fundraising or Admission and will not be

responsible to anyone other than the Company for providing the

protections afforded to clients of Roth Capital nor for providing

advice in relation to the Fundraising or any other transaction or

arrangement referred to in the Announcement and, apart from the

responsibilities and liabilities, if any, which may be imposed on

Roth Capital by FINRA or any other US regulatory authority, Roth

Capital accepts no responsibility whatsoever and makes no

representation or warranty, express or implied, for or in respect

of the contents of the Announcement, including its accuracy,

completeness or verification, nor for any other statement made or

purported to be made by, or on behalf of, it, the Company, the

Directors or any other person, in connection with the Company, the

Fundraising or Admission. Roth Capital and its directors, officers,

employees, advisors and affiliates each accordingly disclaims all

and any liability, whether arising in tort, contract or otherwise,

which it might otherwise be found to have in respect of the

Announcement or any such statement.

This Announcement may contain forward-looking statements that

reflect the Group's current expectations regarding future events,

including the clinical development and regulatory clearance of the

Group's product candidates, the Group's ability to find partners

for the development and commercialisation of its product

candidates, the business of the Company, and management plans and

objectives. The Company considers any statements that are not

historical facts as "forward-looking statements". Forward-looking

statements involve risks and uncertainties. Actual events could

differ materially from those projected herein and depend on a

number of factors, including the success of the Group's research

strategies, the applicability of the discoveries made therein, the

successful and timely completion of pre-clinical and clinical

studies with respect to the Group's product candidates, the

uncertainties related to the regulatory process, the ability of the

Group to identify and agree beneficial terms with suitable partners

for the commercialisation and/or development of product candidates,

as well as the achievement of expected synergies from such

transactions, the acceptance of product candidates by consumers and

medical professionals, the successful integration of completed

mergers and acquisitions and achievement of expected synergies from

such transactions and the ability of the Group to identify and

consummate suitable strategic and business combination

transactions, the scaling-up of the Group's bioprocessing

activities and the risks described in the "Risk Factors" set out in

the Prospectus.

When used in this Announcement the words "estimate", "project",

"intend", "aim", "anticipate", "believe", "expect", "should" and

similar expressions, as they relate to the Company or the

management of the Group, are intended to identify such

forward-looking statements. Readers are cautioned not to place

undue reliance on these forward-looking statements which speak only

as at the date of this Announcement. Neither the Company nor any

other member of the Group undertakes any obligation publicly to

update or revise any of the forward-looking statements, whether as

a result of new information, future events or otherwise, save in

respect of any requirement under applicable laws, the Listing

Rules, Prospectus Rules, Disclosure Rules and Transparency Rules

and other regulations.

No statement in this Announcement or incorporation by reference

into this Announcement is intended as a profit forecast or profit

estimate and no statement in the Prospectus should be interpreted

to mean that earnings or earnings per Ordinary Share for the

current or future financial years would necessarily match or exceed

the historical published earnings per Ordinary Share.

Save where expressly stated otherwise, neither the content of

the Company's website nor the content of any website accessible

from hyperlinks on the Company's website is incorporated into, or

forms part of, this Announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

PDIZXLFFQKFBBBZ

(END) Dow Jones Newswires

September 13, 2016 10:07 ET (14:07 GMT)

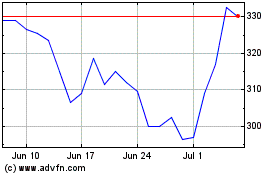

Oxford Biomedica (LSE:OXB)

Historical Stock Chart

From Mar 2024 to Apr 2024

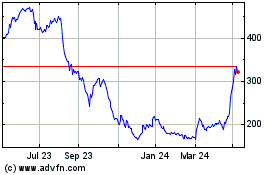

Oxford Biomedica (LSE:OXB)

Historical Stock Chart

From Apr 2023 to Apr 2024